Intel Corporation (NASDAQ:INTC) Battles Challenges with $20 Valuation

With shares down 60% in 2024, Intel's strategic shifts in AI and GPUs aim to revive growth | That's TradingNEWS

Intel Corporation (NASDAQ:INTC): Navigating Challenges Amid a Tumultuous Year

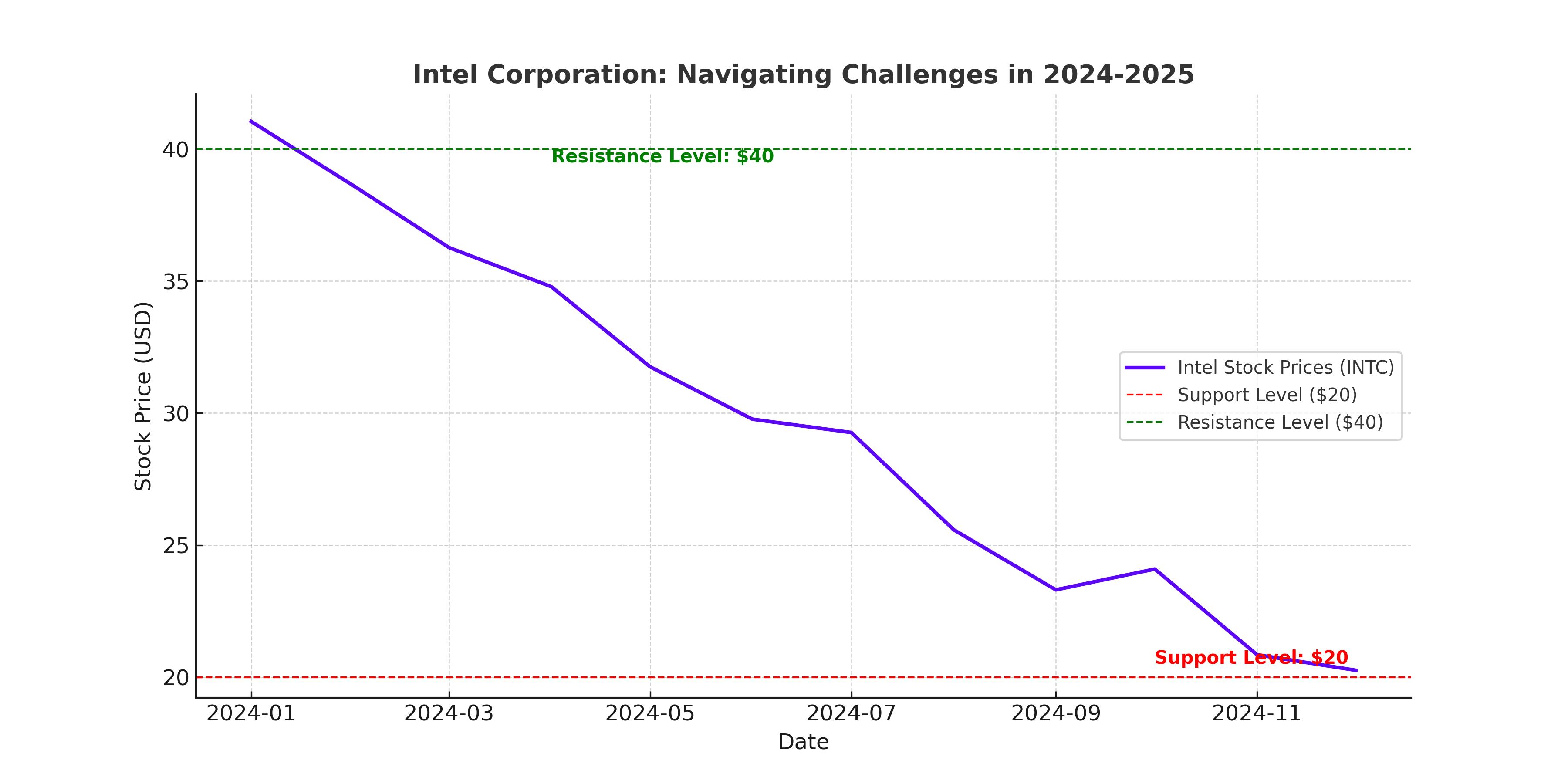

Intel Corporation (NASDAQ:INTC), a cornerstone of the semiconductor industry, enters 2025 grappling with significant headwinds. The company’s stock performance has been bleak, with shares plunging nearly 60% year-to-date, substantially underperforming the broader Nasdaq Composite Index, which rose 29%. This stark decline has been exacerbated by fierce competition, particularly from Nvidia (NVDA), which has soared 173% this year on the back of its AI dominance, and AMD (AMD), down 17%, but still outperforming Intel. Amid this, Intel finds itself at a crossroads, attempting to regain investor trust and strategic footing.

Leadership Changes and Strategic Uncertainty

The abrupt dismissal of Pat Gelsinger as CEO in December 2024 marked a pivotal moment for Intel. Gelsinger, who spearheaded aggressive turnaround strategies including cost reductions, securing CHIPS Act funding, and advancing AI chip initiatives, faced mounting criticism for underwhelming results. During his tenure, Intel struggled to reclaim its leadership in chip innovation, particularly in AI and advanced computing. The interim leadership duo of CFO David Zinsner and former Client Computing head Michelle Johnston Holthaus has been tasked with stabilizing the company during this transitional phase.

Intel's board is reportedly exploring external candidates for the CEO role, with names like Lip-Bu Tan of Cadence Design Systems (CDNS) and Matt Murphy of Marvell Technology (MRVL) circulating as potential successors. Whoever assumes the mantle will face a herculean challenge: restoring Intel’s competitive edge, particularly in its foundry business and AI-focused divisions, while navigating substantial financial hurdles.

Financial Performance: A Mixed Bag

Intel’s financial results underscore the depth of its challenges. The company reported $13.28 billion in Q3 revenue, a 6.2% year-over-year decline, driven by weakness in its core Client Computing Group (CCG), which accounted for $7.33 billion, or 55% of total sales. Desktop revenues plummeted by 25%, while notebook revenues saw a modest 9% gain. Data Center and AI Group (DCAI) revenues increased by 9% to $3.35 billion, but operating profit dipped by 11% to $347 million. Notably, sales of its Gaudi 3 AI accelerator fell short of expectations, casting doubt on Intel's ability to capitalize on the burgeoning AI market.

The company’s foundry business remains a significant drag, with a staggering $5.83 billion operating loss in Q3, underscoring ongoing inefficiencies and low customer adoption. Overall, Intel posted a non-GAAP loss of $0.46 per share, compared to a profit of $0.41 in the same quarter last year. These losses were primarily driven by $18.7 billion in impairment and restructuring charges, reflecting Intel’s aggressive cost-cutting measures aimed at restoring profitability.

Investor Sentiment and Valuation

Investor sentiment toward Intel remains deeply pessimistic, as evidenced by its subdued market valuation. Intel’s market capitalization lags significantly behind rivals AMD and Nvidia, despite its commanding market share in CPUs for PCs and servers. At approximately $20 per share, Intel trades at a price-to-sales ratio of 1.54, compared to AMD’s 8.02, highlighting the market’s skepticism about Intel’s turnaround prospects.

However, this low valuation could present an opportunity for long-term investors. Analysts expect Intel to return to non-GAAP profitability by Q4 2024, with a projected gross margin of 39.5% and earnings per share of $0.12. Moreover, Intel’s strategic cost reductions, coupled with its investments in AI and data center products, could lay the groundwork for a gradual recovery in 2025 and beyond.

Product Roadmap and Competitive Landscape

Intel’s product pipeline offers a glimmer of hope, though execution remains a concern. The recent launch of Arrow Lake and Lunar Lake processors has been met with mixed reviews. While Arrow Lake faced criticism for underwhelming gaming performance, it excelled in productivity tasks, demonstrating Intel’s ability to innovate in key segments. Lunar Lake, designed for mobile applications, has been well-received but suffers from high production costs and low margins due to its reliance on TSMC’s manufacturing nodes.

Looking ahead, Intel’s upcoming Panther Lake processors and 18A fabrication process are expected to address some of these challenges. By shifting production back to its own fabs, Intel aims to regain control over its supply chain and reduce dependency on external foundries. This transition will be critical in determining Intel’s ability to compete with TSMC and other industry leaders.

Opportunities in AI and GPUs

Intel’s foray into the GPU market, led by its Arc series and the newly launched Battlemage B580, has shown promise. The B580’s competitive pricing and robust performance have resonated with consumers, selling out quickly in initial launches. While Intel’s GPU division remains a small contributor to overall revenue, it represents a long-term growth opportunity, particularly as the company aims to challenge Nvidia’s dominance in the discrete GPU market.

In the AI space, Intel’s Falcon Shores and Gaudi processors offer significant potential but face stiff competition. The company’s focus on iterative improvements and integration with its broader product ecosystem could position it as a formidable player in the rapidly expanding AI market.

Strategic Challenges and the Path Forward

Despite its challenges, Intel’s strategic initiatives hold the potential for a turnaround. The company’s IDM 2.0 strategy, which emphasizes vertical integration and foundry expansion, aligns with industry trends favoring localized chip manufacturing. However, execution risks remain high, particularly given the substantial losses incurred by its foundry division.

Intel’s ability to navigate macroeconomic headwinds, including declining PC demand and geopolitical tensions, will be critical. The company’s substantial debt burden of $50.2 billion and its ongoing restructuring efforts add to the complexity of its recovery journey.

Conclusion

Intel Corporation (NASDAQ:INTC) finds itself at a decisive moment in its storied history. Despite significant setbacks, including a 60% year-to-date drop in share price and operational missteps, Intel's position as a market leader in CPU production and its renewed focus on advanced semiconductor technology provide a pathway to recovery. Trading at around $20 per share, the stock is significantly undervalued relative to its historical performance and peers, offering a potentially lucrative opportunity for investors who believe in the company’s ability to stabilize and grow.

Intel's challenges are substantial, from operational losses of $5.83 billion in its foundry division to fierce competition from Nvidia (NVDA) and AMD (AMD). However, its core businesses remain resilient, with a 75% share in the client computing market and a renewed push in AI and GPU segments. Products like Lunar Lake and Battlemage GPUs are promising steps toward diversification and innovation, although execution remains a critical factor.

At its current valuation, Intel offers a price-to-sales ratio of just 1.54, compared to AMD's 8.02, reflecting the market's skepticism about its turnaround efforts. Yet, with significant cost reductions underway and projections of non-GAAP profitability by the end of 2024, Intel could see a resurgence in investor confidence. The imminent announcement of a new CEO is expected to act as a catalyst, potentially sparking a rally as the market reassesses the company's long-term potential.

While the path to recovery is fraught with obstacles, including Intel's $50.2 billion debt load and operational inefficiencies, the company’s strategic investments in AI, advanced fabrication processes, and GPU technology position it for a possible resurgence. For investors willing to navigate these risks, Intel’s low valuation and ongoing transformation efforts present a unique opportunity to capitalize on its potential rebound. With shares hovering near $20, the question remains whether Intel’s new leadership can deliver the stability and growth needed to reclaim its position as a semiconductor powerhouse.

That's TradingNEWS

Read More

-

AMLP ETF (NYSEARCA:AMLP): 8.29% Yield From America’s Midstream Toll Roads

06.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Lift XRPI to $13.12 and XRPR to $18.57 as XRP-USD Price Targets $2.40+

06.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Breaks Down as Henry Hub Spot Hits $2.86 and NG=F Slips Toward $3.00

06.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds 156.70 While Markets Weigh Softer NFP Risk Against a Hawkish BoJ

06.01.2026 · TradingNEWS ArchiveForex