Intel (NASDAQ:INTC): Why the Stock a Long-Term Buy Amid Challenges?

Amid leadership changes and strategic challenges, can Intel reclaim its industry dominance and deliver long-term gains for investors? | That's TradingNEWS

Intel Corporation (NASDAQ:INTC): Charting the Path to Recovery Amid Industry Challenges

Intel Corporation, trading under NASDAQ:INTC, is at a pivotal moment in its history, as the company navigates leadership transitions, financial challenges, and evolving industry dynamics. Pat Gelsinger’s recent departure signals an inflection point, but Intel remains a cornerstone in the U.S. technology sector, bolstered by strategic government support, ambitious technological initiatives, and its global role in semiconductor manufacturing. Investors and analysts alike are scrutinizing the company’s every move as it seeks to regain market leadership in the face of formidable competition from Taiwan Semiconductor Manufacturing Company (TSMC), NVIDIA, and AMD.

Leadership Shakeup and Strategic Realignment

The departure of Pat Gelsinger as Intel's CEO raises critical questions about the company's strategic direction. Despite criticisms surrounding his ambitious turnaround plan, Gelsinger’s tenure brought a clear focus on Intel’s manufacturing capabilities and its goal of regaining process node leadership by 2025. The board’s decision to seek new leadership may hinge on financial underperformance, as Intel’s stock has declined over 50% since his appointment in February 2021, but this move carries significant risks, especially as the company embarks on its most transformative years.

Intel’s ambitious “5 nodes in 4 years” roadmap remains intact, with the 18A process node expected to position Intel at the forefront of semiconductor technology. However, questions surrounding defect density and yield rates have created uncertainty. Industry comparisons suggest Intel is on par with TSMC’s historical timelines, but it must meet its aggressive goals for the node to deliver a significant competitive edge.

U.S. Government Support: A Strategic Lifeline

Intel’s role as a strategic asset to the United States cannot be overstated. The CHIPS and Science Act has positioned Intel as a key beneficiary, granting nearly $7.9 billion in direct funding, alongside investment tax credits and contracts such as the $3 billion Secure Exclave program. Intel’s massive investment in domestic manufacturing, exemplified by its $100 billion Ohio facility, underscores its importance in securing U.S. semiconductor independence.

This backing provides a safety net as Intel works to reestablish its competitive position. However, government support alone will not guarantee success—it must be paired with tangible technological advancements and profitability improvements.

The Battle for GPU Supremacy

Intel’s pivot toward GPUs and artificial intelligence (AI) accelerators reflects a strategic shift toward growth markets. The company’s Gaudi 3 accelerator has achieved a price-performance advantage, competing directly with NVIDIA’s H200. The upcoming Falcon Shores GPU, leveraging TSMC’s 3nm process, could mark a turning point.

Falcon Shores is expected to deliver a significant performance leap, matching the same TSMC node as NVIDIA’s next-gen Rubin GPU. This alignment underscores Intel’s commitment to competitiveness, but execution risks remain high. If Falcon Shores succeeds, it could provide Intel with a foothold in a lucrative market, potentially contributing billions in incremental revenue by 2026.

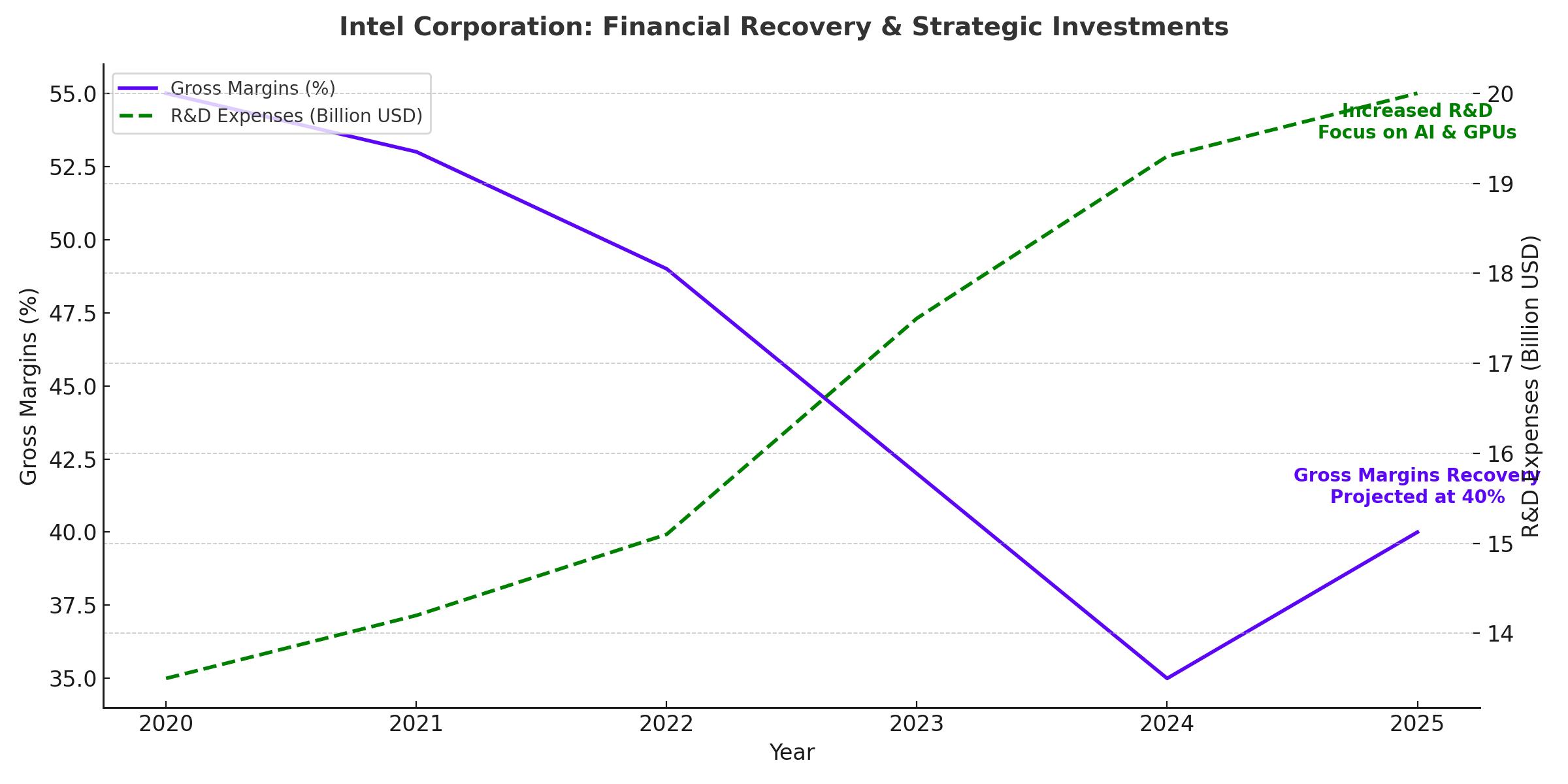

Financial Realignment: Challenges and Opportunities

Intel's financial position remains precarious as it invests heavily in future growth while managing declining revenues. The company’s gross margins have plummeted to 18%, down from over 40%, reflecting the capital-intensive nature of its turnaround.

Cost-cutting measures, including a $10 billion expense reduction plan and layoffs of 15,000 employees, aim to stabilize operations. Partnerships, such as the deal with Apollo Global Management for fab investments, highlight innovative approaches to managing capital needs. However, Intel’s ability to balance these measures while maintaining technological leadership is critical to its long-term viability.

Addressing Process Node Concerns

Intel’s 18A node, touted as the linchpin of its turnaround, has faced scrutiny over defect density and yield rates. Recent reports suggest a defect density of 0.4 defects per cm², comparable to TSMC’s N7 and N5 nodes at similar stages. While this metric shows progress, skepticism remains, particularly after Broadcom reportedly raised concerns over early testing.

If Intel can achieve mass production without significant delays, the 18A node will underpin its competitiveness across both internal and external foundry operations. Success here would also validate Intel’s decision to vertically integrate its manufacturing capabilities, setting the stage for sustained profitability.

Investor Considerations

Despite its challenges, NASDAQ:INTC remains an attractive long-term bet. The stock trades at a steep discount, with a price-to-book ratio below 1. The potential upside from successful execution of its turnaround strategy, combined with strong government support and industry tailwinds in AI and semiconductors, makes Intel a compelling option for patient investors.

Intel’s valuation is supported by its tangible assets and its critical role in the global semiconductor supply chain. However, risks abound, including execution missteps, intensifying competition, and potential delays in its technological roadmap.

Outlook for NASDAQ:INTC

The coming years will be decisive for Intel Corporation. The success of the 18A process node, the rollout of Falcon Shores, and continued support from the U.S. government will define its trajectory. While challenges remain, Intel’s strategic initiatives position it for a potential comeback. Investors must weigh the risks of near-term volatility against the potential for long-term gains as the company seeks to reclaim its industry leadership.

For real-time updates and deeper insights, track NASDAQ:INTC here.

That's TradingNEWS

Read More

-

QDVO ETF: 11% Yield And AI Heavyweights Keep This Fund Near Its $30.40 Peak

26.12.2025 · TradingNEWS ArchiveStocks

-

XRPI at $10.66 and XRPR at $15.13 as XRP ETFs Build $1B+ Exposure Around $1.84 XRP-USD

26.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Near $4.34 Tests How Strong The $4.00 Winter Floor Really Is

26.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: 156 Range Trapped Below 158 as BoJ 0.75% Hike Clashes with Fed Cuts

26.12.2025 · TradingNEWS ArchiveForex