Invesco NYSEarca:QQQ Trust ETF in 2024 - An In-Depth Analysis

From Tech Giants to Healthcare Innovators: Exploring the Forces Driving QQQ's Performance and the Economic Signals Investors Must Watch | That's TradingNEWS

The Strategic Dynamics of Invesco QQQ Trust: An Analytical Deep Dive into Its Performance and Future Outlook

Invesco QQQ Trust (NASDAQ:QQQ), a prominent Nasdaq tracker fund, remains at the forefront of the investment landscape, encapsulating the pulse of the technology sector and broader market trends. With its performance closely tied to the "Magnificent 7" tech giants, QQQ offers investors a unique vantage point into the high-flying technology sector, which has led the equity markets to new zeniths in early 2024. This analysis explores the fund's recent journey, the economic undercurrents influencing its trajectory, and a speculative glance at what lies ahead.

Performance Review: Navigating Through Market Highs and Lows

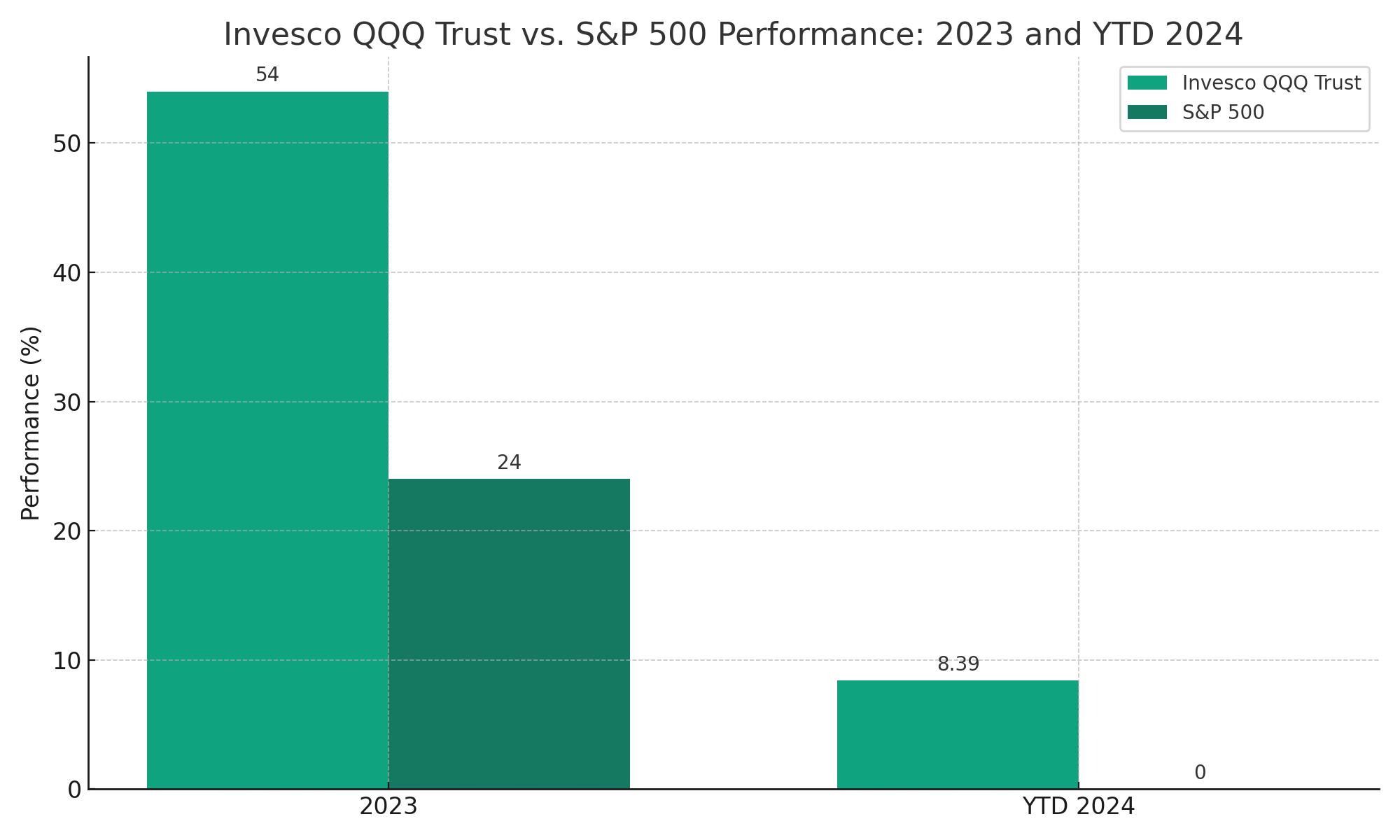

Current Market Positioning: As of the latest close, QQQ stood at $444.83, marking a modest year-to-date (YTD) gain of 8.39%. Despite this growth, it has slightly lagged behind the S&P 500, signaling a nuanced shift in its market dominance amidst persistent macroeconomic risks and valuation concerns.

Historical Performance Insight: Reflecting on its 2023 performance, QQQ surged by 54%, outpacing the S&P 500's 24% increase. This was during a time when the technology sector, buoyed by AI advancements, was seen as a beacon for growth within the investment community.

Economic Indicators and Their Impact

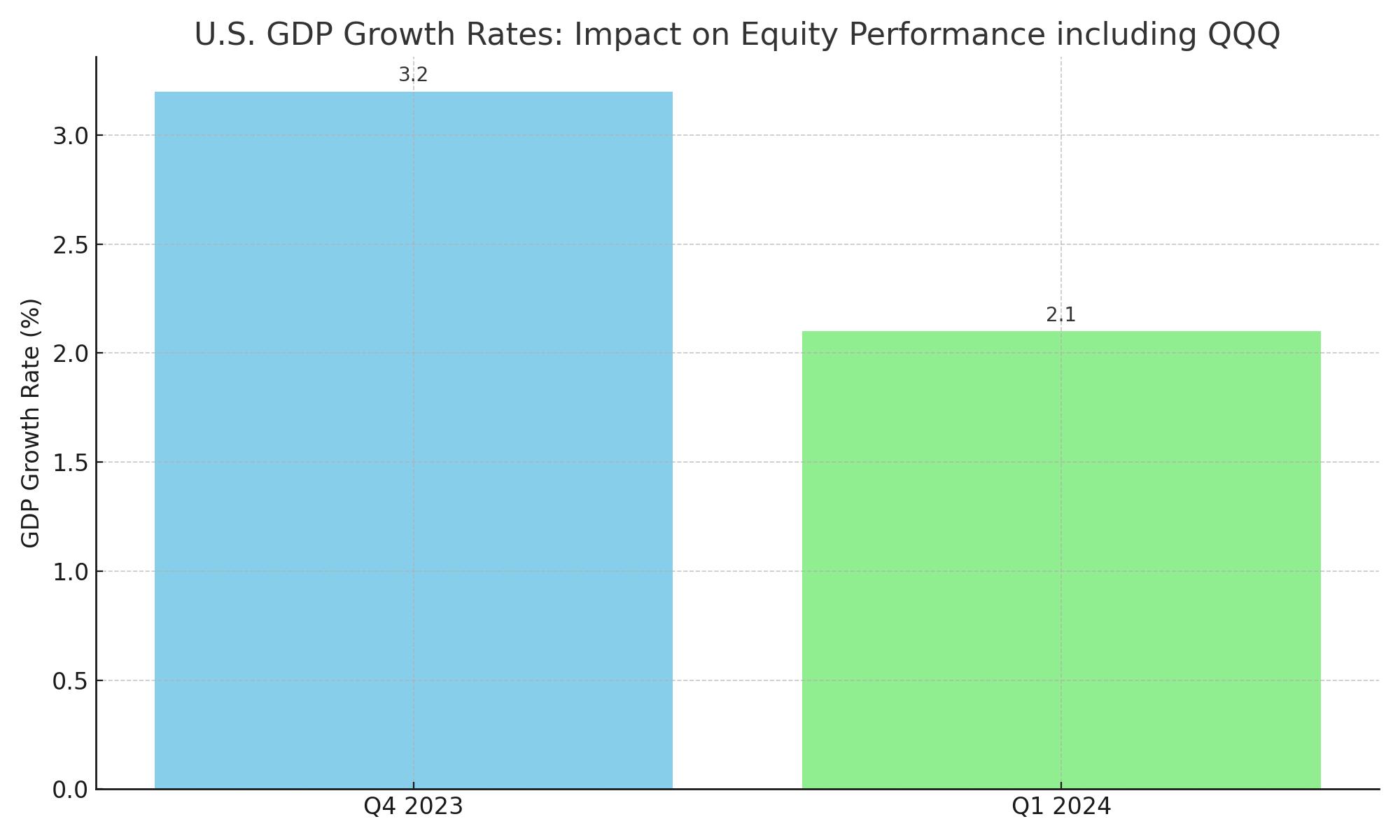

GDP Growth Trends: The U.S. economy's resilience, with a 3.2% annual growth rate in Q4 2023, has been a bedrock for equity performance. However, projections for Q1 2024 indicate a potential slowdown to 2.1%, raising caution about future equity performance, including QQQ.

Inflation and Interest Rate Dynamics: With inflation showing signs of moderation and expectations of interest rate cuts, there's a silver lining for net margins across the board. This could potentially support QQQ's holdings, especially as the cost pressures, particularly interest expenses, decelerate.

QQQ's Holdings: A Closer Look at the "Magnificent 7" and Beyond

Valuation Perspective: The average weighted price-to-earnings (P/E) ratio of QQQ's top holdings has seen a slight decline to 33.8x from 37.3x, suggesting a more tempered valuation landscape. This adjustment in valuations, especially among its top constituents like Microsoft, NVIDIA, and Amazon, provides a mixed bag of investment potential and risk.

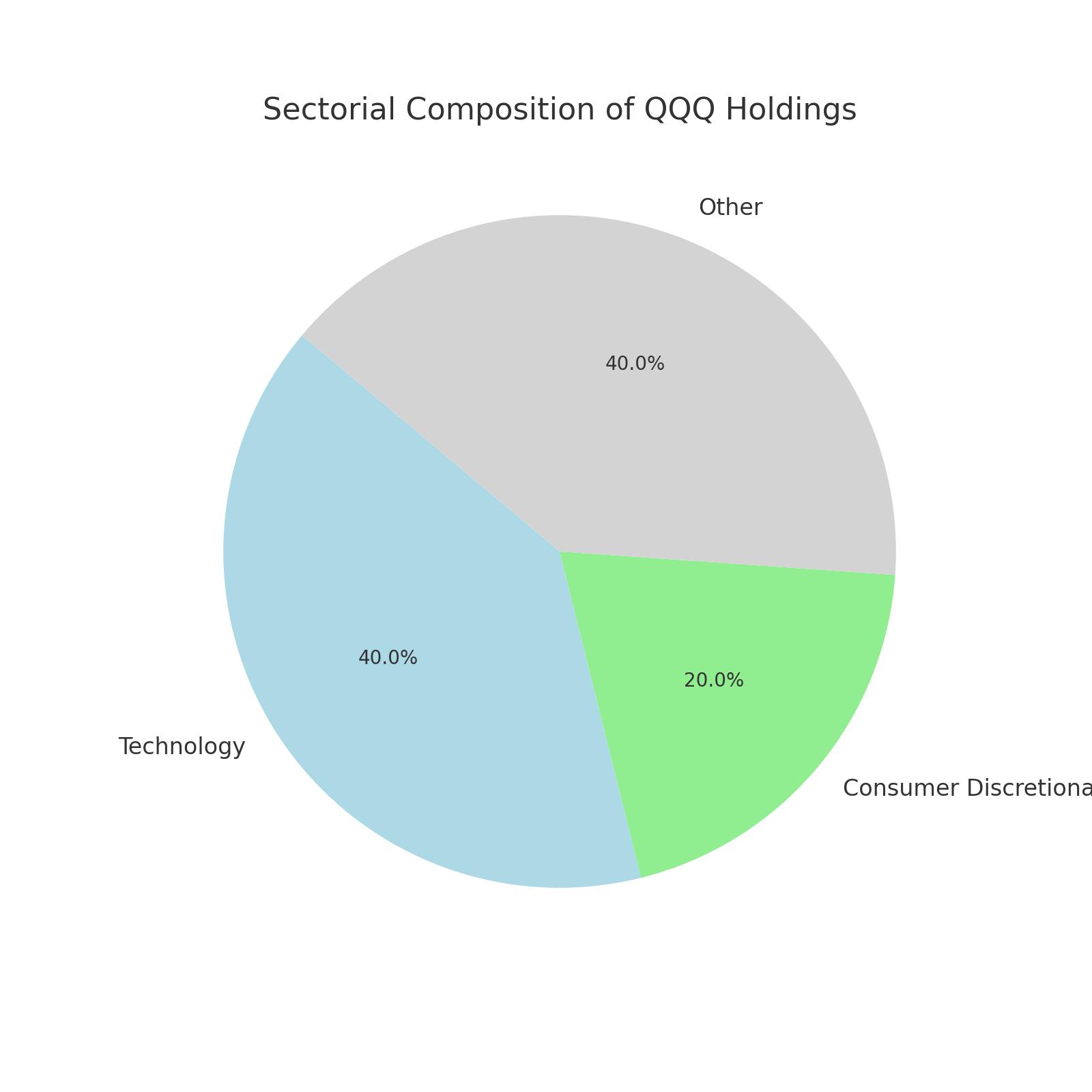

Sectorial Insights: Beyond the tech dominion, QQQ's exposure to consumer discretionary and other sectors has been a mixed influence on its overall performance. The lag in consumer discretionary, despite being the ETF’s second-largest sector holding, indicates potential vulnerabilities in QQQ’s portfolio against broader market movements.

Liquidity, Market Sentiment, and the Road Ahead

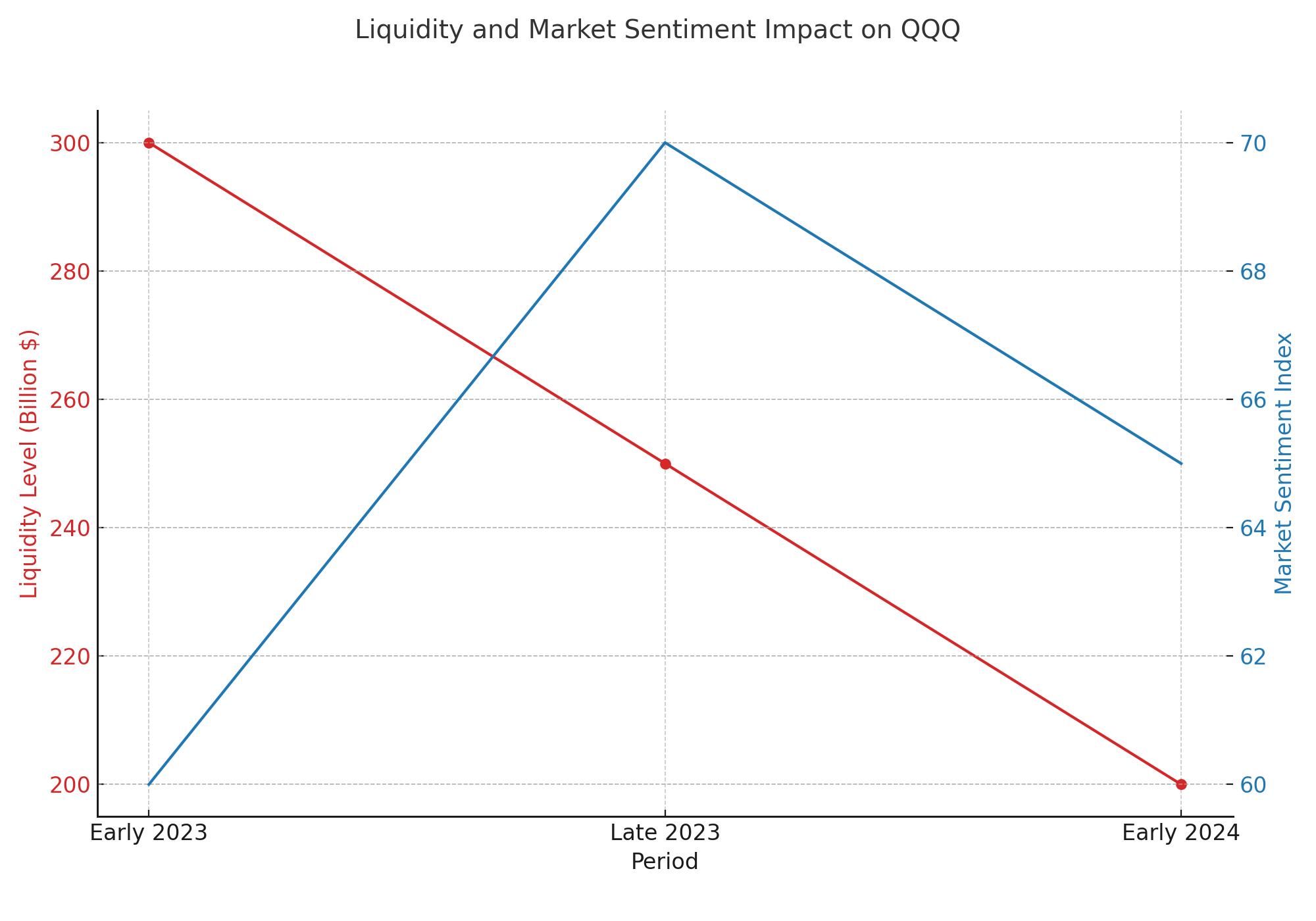

The Liquidity Conundrum: Despite the Federal Reserve's quantitative tightening, the financial system has witnessed net liquidity injections, buoying the markets. However, with the Reverse Repo (RRP) facility's balances diminishing, the impending liquidity withdrawal could introduce volatility and pressure on asset valuations, including QQQ.

Technological Innovations vs. Market Speculation: The juxtaposition of groundbreaking AI advancements against speculative market rallies, such as those seen in cryptocurrencies and certain speculative stocks, underscores the complex liquidity dynamics at play. This dual narrative poses both opportunities and challenges for QQQ, as it navigates through these speculative waters buoyed by technological innovation.

Navigating the Future: Investment Considerations for QQQ

Anticipating Market Adjustments: With potential shifts in monetary policy on the horizon and the U.S. economy's consumption patterns at a pivot, QQQ investors must tread cautiously. The balance between embracing technological growth stories and hedging against economic cooling and sectorial drags will be crucial.

Strategic Positioning: For long-term investors, QQQ presents a nuanced opportunity to capitalize on the tech sector's dynamism, albeit with a vigilant eye on broader economic indicators and liquidity conditions. The ETF’s historical performance, underpinned by its heavyweight holdings, suggests a promising outlook, contingent on navigating the impending economic and liquidity shifts.

Conclusion: In sum, Invesco QQQ Trust stands at a critical juncture, reflecting the broader complexities of the current investment climate. While its core holdings in the technology sector remain a source of strength, evolving economic conditions and market dynamics warrant a strategic and measured investment approach. As we look ahead, the balance between leveraging growth opportunities and mitigating risks will be paramount for investors aiming to harness QQQ's potential in their portfolios.

That's TradingNEWS

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex