Is Coca-Cola NYSE:KO a Good Investment in 2024?

Analyzing Coca-Cola's Market Dominance, Financial Health, and Strategic Growth Initiatives | That's TradingNEWS

Comprehensive Analysis of The Coca-Cola Company (NYSE:KO)

Market Position and Financial Overview

Coca-Cola, one of the most iconic brands in the beverage sector, continues to hold significant market sway with a current stock price of $63.26, reflecting a modest daily increase. As observed in the trading performance on the New York Stock Exchange, Coca-Cola boasts a robust market capitalization of approximately $272.52 billion, emphasizing its substantial footprint in the global market. Detailed performance metrics can be tracked via Coca-Cola's Real-Time Stock Chart.

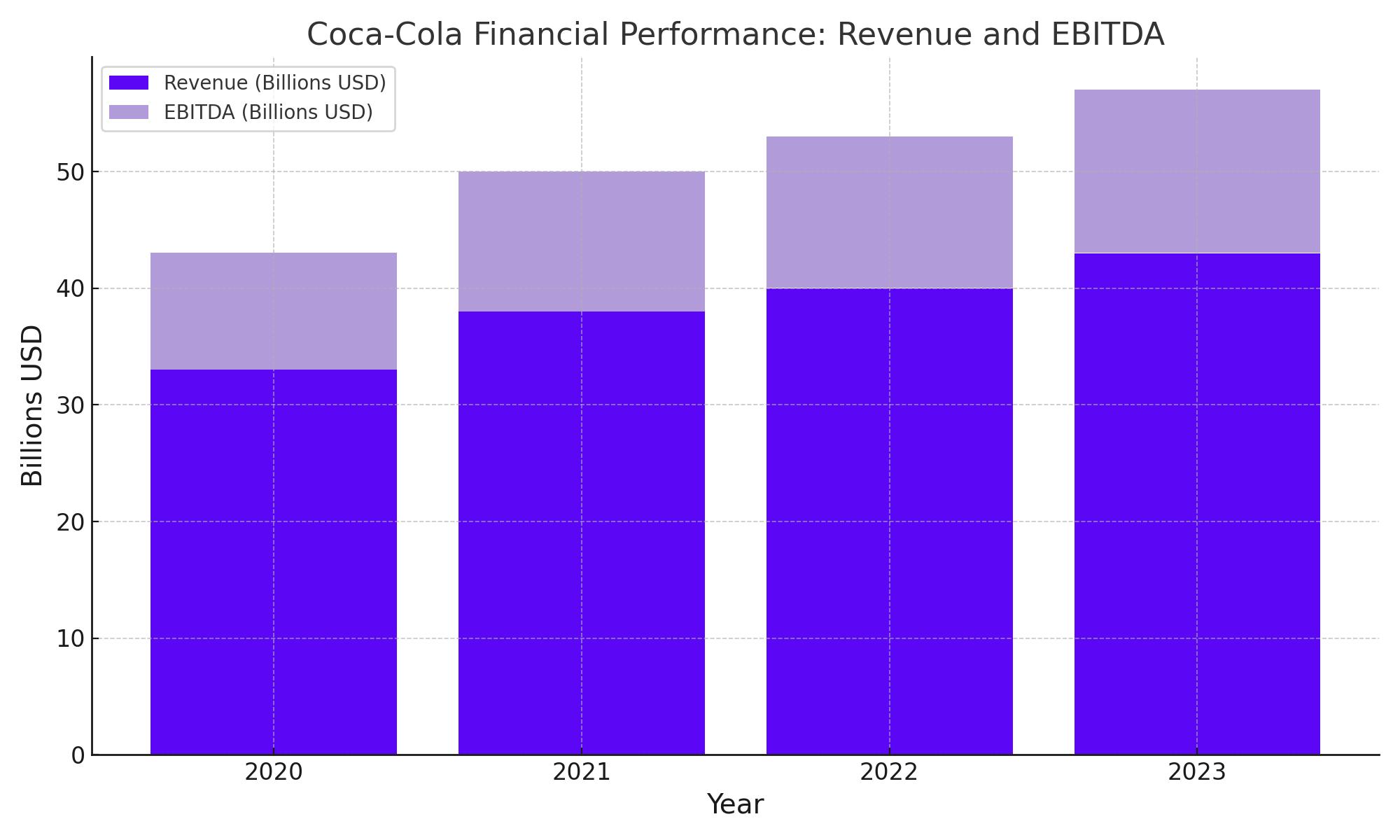

Recent Financial Performance

In the latest fiscal quarter, Coca-Cola reported a revenue increment to $10.84 billion, a 7.2% year-over-year increase, highlighting strong consumer demand despite price adjustments. This revenue growth is supported by a 2% increase in global unit case volumes, a testament to the brand's enduring appeal. The company's ability to manage operational costs effectively is evidenced by an EBITDA ratio improvement, showcasing strategic financial stewardship.

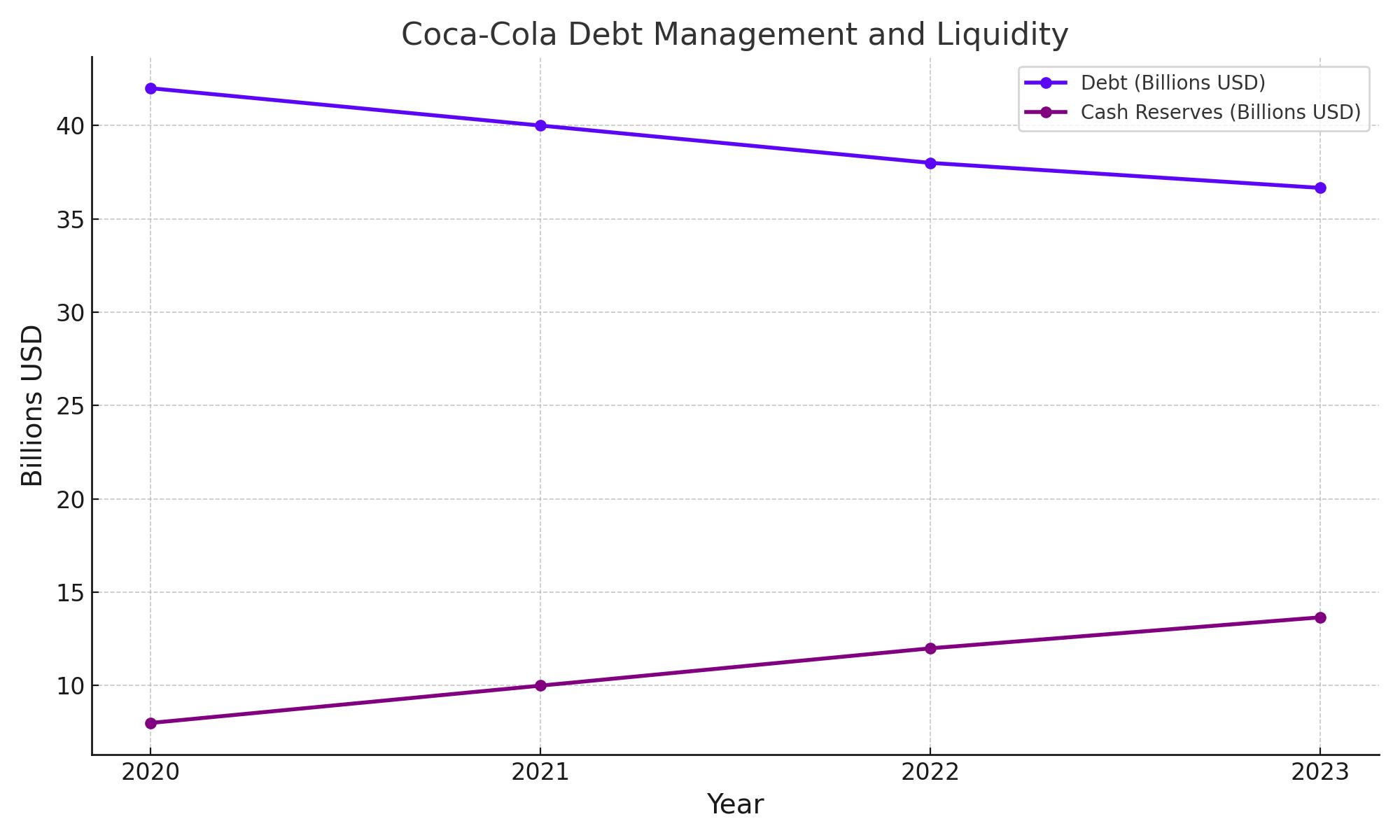

Debt Management and Liquidity

Coca-Cola has effectively managed its debt levels, with a reported decrease to $36.66 billion, marking a significant reduction from previous fiscal years. This prudent financial management is crucial in maintaining the company's creditworthiness and investment appeal. Additionally, Coca-Cola's liquidity is robust, with cash reserves of $13.66 billion, facilitating strategic investments and operational flexibility.

Product Diversification

In response to evolving consumer preferences, Coca-Cola has expanded its product lineup to include healthier alternatives such as BODYARMOR, POWERADE, and various tea and water products. This diversification strategy not only broadens its market base but also aligns with global health trends, potentially mitigating risks associated with regulatory changes targeting sugary beverages.

Growth Projections and Strategic Initiatives

Looking forward, Coca-Cola anticipates continued revenue growth with projections suggesting a 7.5% increase in 2024. These expectations are underpinned by ongoing product innovation and market expansion strategies. Additionally, the company's increased capital expenditures, forecasted at $2.2 billion for the upcoming year, indicate a commitment to long-term growth through infrastructure and technology enhancements.

Investor Returns and Dividend Stability

Coca-Cola remains committed to delivering shareholder value, as evidenced by its consistent dividend payments and a forward yield of 3.07%. The company's strategic financial management supports a sustainable payout ratio, ensuring dividend reliability and attractiveness to income-focused investors.

Market Risks and Challenges

The company faces several market challenges, including fluctuating commodity prices such as sugar, which could impact cost structures and profitability. Moreover, global economic fluctuations and regulatory changes in the beverage industry pose potential risks that require ongoing strategic adjustments.

While Coca-Cola holds a dominant position, it faces competition from other major players like PepsiCo and Keurig Dr Pepper. The competitive dynamics within the beverage industry require continuous innovation and marketing prowess to maintain consumer preference and market share. Additionally, global economic instability, including currency fluctuations, could impact profitability and operational costs.

Valuation and Market Sentiment

Coca-Cola's current P/E ratio stands at 25.41, reflecting investor confidence and a valuation that aligns with its financial stability and growth prospects. The company's strategic initiatives and robust market presence support a positive long-term outlook, making it an appealing option for investors seeking both growth and stability in the consumer staples sector.

Why Coca-Cola (KO) Stock is a Buy ?

That's TradingNEWS

Read More

-

MAGS ETF Price Near $69 High: Mag 7 EPS Surge And AI Cash Flows Drive The $67.55 ETF

29.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI at $10.69 and XRPR at $15.15 Lead $1B Inflow Wave While Bitcoin ETFs Bleed $782M

29.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Jumps Above $4.60 as Storage Flips to Deficit and LNG Exports Hit Records

29.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Slips Toward 156 As BoJ Hawkish Turn Collides With Fed Cut Outlook

29.12.2025 · TradingNEWS ArchiveForex