Is Marvell NASDAQ:MRVL a Buy ? Future Trends with Innovations

A Closer Look at Marvell's Financial Dynamics, Market Position, and Prospects for Growth Amid Evolving Tech Demands | That's TradingNEWS

Strategic Analysis of Marvell Technology (NASDAQ:MRVL): Pivoting Towards a Promising Future

NASDAQ:MRVL Market Position and Financial Overview

Marvell Technology (NASDAQ:MRVL), a prominent player in the semiconductor sector, recently reported notable financial dynamics and stock performance, as detailed on Marvell's real-time stock chart. The company's current stock price stands robustly at $66.60, marking a substantial increase of $2.78 from the previous close of $63.82. This performance is set against a background of a 52-week trading range of $38.63 to $85.76, highlighting the volatility and opportunity within the tech sector.

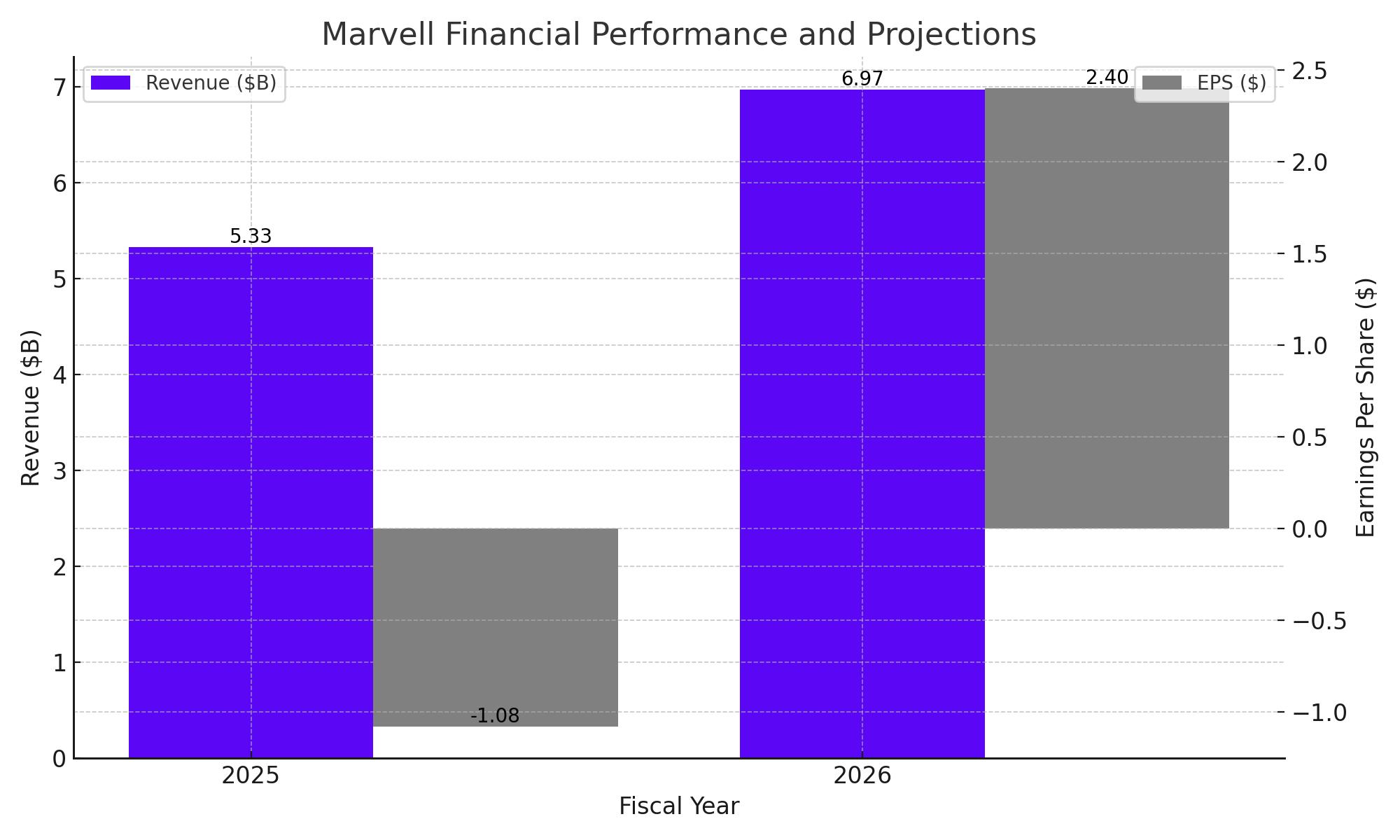

Financial Performance and Projections

Marvell's current market capitalization is $57.684 billion, with an average trading volume reflecting significant investor interest. Despite a negative EPS (Earnings Per Share) of $1.08 TTM (Trailing Twelve Months), forward-looking projections are markedly positive, suggesting a rebound with an anticipated EPS growth to $2.40 by 2026. This forecast is supported by a detailed earnings estimate analysis, which also indicates expected revenue growth from $5.33 billion in 2025 to $6.97 billion in 2026.

Impact of Federal Reserve Policies on NASDAQ:MRVL

The broader economic context, particularly the Federal Reserve's monetary policies, plays a significant role in shaping the market environment for tech stocks like Marvell. The Fed's recent decisions to adjust interest rates and alter its quantitative tightening program have had ripple effects on investment strategies across the board. For Marvell, this means navigating through market reactions with a strategic focus on long-term growth in its core sectors of AI and cloud computing infrastructure.

NASDAQ:MRVL's Technological Advancements and Market Adaptation

Marvell has consistently demonstrated resilience and innovation, particularly through its advancements in data center technologies and AI solutions. The introduction of products like the Spica Gen2-T, the industry's first 5nm 800 Gbps transmit-only PAM4 optical DSP, underscores Marvell's commitment to maintaining its competitive edge. This technological leadership is critical as the company capitalizes on increasing demand for faster data processing and more efficient power consumption in data centers globally.

Insider Transactions and Market Sentiment

The sentiment around Marvell's stock and its future trajectory can also be gauged by analyzing insider transactions, which provide insights into the confidence levels of those who are closest to the company's operations. Detailed records of these transactions are available on Marvell's insider transactions page, indicating recent buying and selling trends among company executives and large shareholders.

Strategic Initiatives and Growth Prospects of Marvell Technology

As Marvell Technology (NASDAQ:MRVL) gears up for the future, the company is strategically positioned to capitalize on numerous growth opportunities that could reshape its trajectory. Focused primarily on enhancing its data center solutions, Marvell is aligning its R&D and product offerings to address the escalating demands of cloud computing and AI technologies. This shift is timely, as the global data center market is expected to reach approximately $69 billion by 2025, growing at a CAGR of over 4% from 2020.

Expanding Data Center Capabilities

Marvell is intensifying its efforts to innovate within the data center space, an area where it has historically excelled. The introduction of the Spica Gen2-T, an advanced 5nm 800 Gbps PAM4 optical DSP, exemplifies Marvell's commitment to pushing the boundaries of data transmission technologies. This product is designed to significantly reduce power consumption in data centers by over 40%, a critical factor given the increasing scrutiny on the environmental impact of tech operations.

Revitalizing Enterprise and Carrier Segments

In addition to data centers, Marvell is poised for a rebound in its enterprise and carrier segments, which have faced downturns but are expected to recover by the second half of FY25. This recovery is anticipated to be bolstered by increased investments in 5G deployment and the expansion of enterprise networking solutions. Marvell projects a robust resurgence in these areas, underpinned by improvements in economic conditions and enterprise spending.

Investment Outlook and Recommendations

Bullish Market Position

The investment outlook for Marvell remains decidedly bullish, underscored by its proactive strategies to leverage core growth areas. Financial analysts maintain a positive stance on MRVL, with a consensus 1-year target estimate of $88.15, reflecting a potential upside from the current trading price of $66.60. This optimism is rooted in Marvell's solid fundamentals, strategic market positioning, and its ability to innovate consistently.

Considerations for Investors

Investors considering Marvell should focus on the company’s long-term potential to capitalize on the burgeoning demands of AI and cloud computing infrastructures. The firm's ability to adapt to and lead in a rapidly evolving technology landscape bodes well for its growth prospects. Additionally, Marvell's financial health, highlighted by a robust balance sheet with substantial cash reserves of $950.8 million and a manageable debt-to-equity ratio of 29.68%, offers a buffer against market volatilities.

Long-Term Growth Potential

The long-term growth trajectory for Marvell is supported by its strategic expansions and expected recovery in key business segments. As global dependency on high-speed data and AI-driven solutions intensifies, Marvell’s forward-thinking product developments and market strategies position it well to benefit from these trends.

Accessing Detailed Financial Insights

For those looking to dive deeper into Marvell's financial specifics and stock performance, comprehensive information is available through Marvell's stock profile on TradingNews. This resource provides detailed insights into the company's earnings forecasts, stock movements, and market sentiments, essential for making informed investment decisions.

That's TradingNEWS

Read More

-

GPIQ ETF: High-Yield Nasdaq-100 Income Engine Near Its Highs

08.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs: XRP Near $2.13 While XRPI and XRPR Ride $1.3B Post-SEC Inflows

08.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Clings to $3.40 Support After 119 Bcf Storage Hit

08.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds 156.70 as Markets Brace for NFP Shock and Tariff Ruling

08.01.2026 · TradingNEWS ArchiveForex