Is NASDAQ:MSTR Stock Undervalued at $421? Bitcoin Strategy - Microstrategy Price Forecast

Is MSTR stock underpriced at $421, or is the $480 forecast too conservative for its Bitcoin-driven growth? | That's TradingNEWS

Navigating the Potential of MicroStrategy’s (NASDAQ: MSTR) Bitcoin Strategy and Stock Performance

MicroStrategy’s Shift Toward Bitcoin and its Impressive Stock Performance

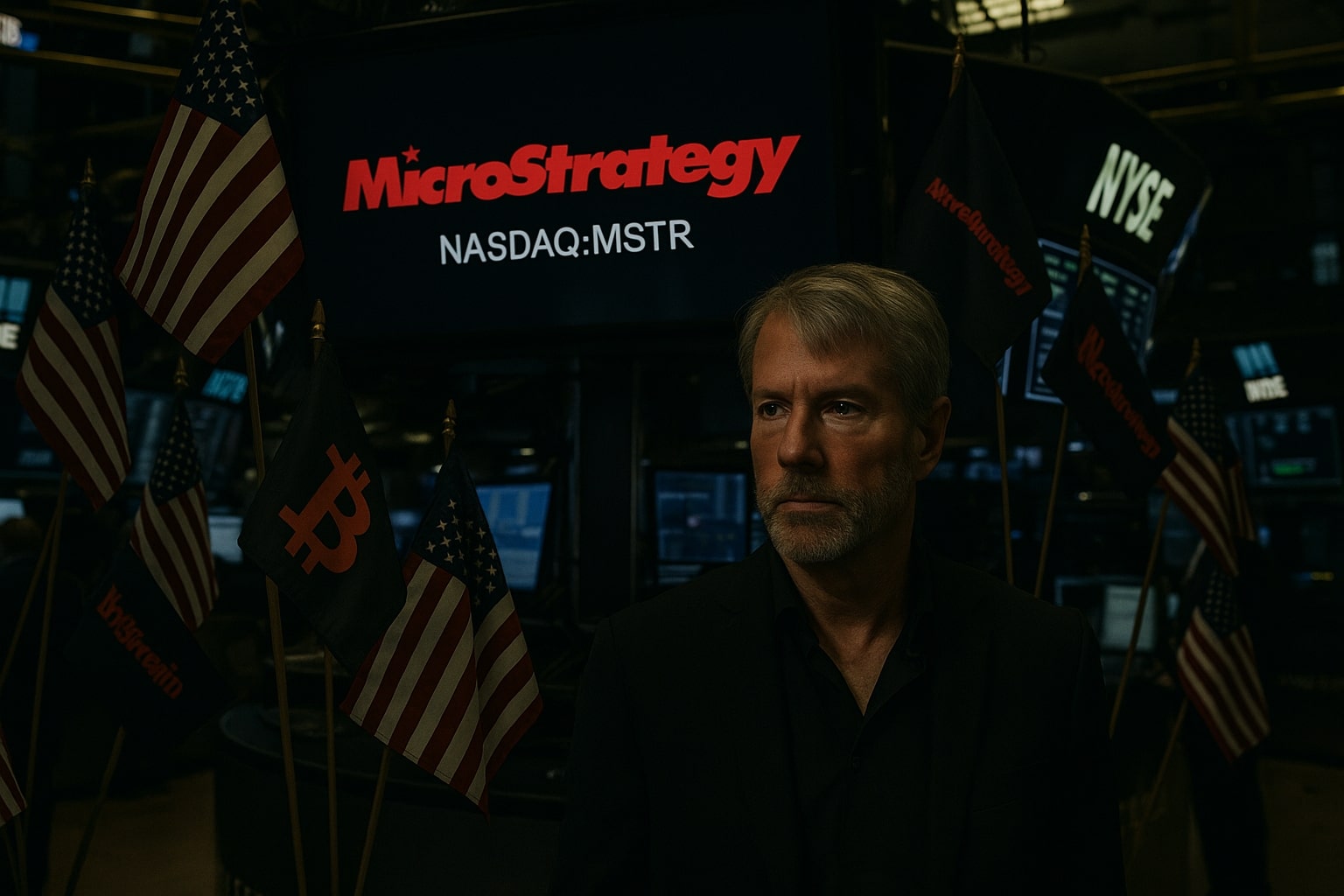

MicroStrategy, now officially known as Strategy (NASDAQ: MSTR), has evolved into a major player in the cryptocurrency space, transforming from an enterprise software company to one of the world’s largest holders of Bitcoin. This shift has garnered significant attention, especially as the firm’s founder, Michael Saylor, continues to make headlines with aggressive Bitcoin purchases. On May 12, 2025, MSTR announced the acquisition of 13,390 BTC for approximately $1.34 billion, solidifying its position as the largest corporate holder of Bitcoin with 568,840 BTC worth an estimated $59 billion at current prices. The latest acquisition, purchased at an average price of $99,856 per Bitcoin, marks another major step in the company’s ongoing Bitcoin accumulation strategy.

The market responded positively, with MSTR’s stock surging to $423.8 in pre-market hours following the announcement. This increase is part of a broader trend for MSTR, which has risen by over 10% in the past week alone. Investors have largely embraced the company’s strategic approach, seeing potential in its substantial Bitcoin holdings. As of May 11, MSTR has accumulated over 568,000 BTC for a total cost of $39.4 billion. This aggressive strategy has not only positioned the company as a key player in the Bitcoin space but also sparked interest from other corporations, including Metaplanet and Semler Scientific, who have followed suit by adding BTC to their balance sheets.

The Market’s Reaction to MicroStrategy’s Bitcoin Exposure

The strong performance of MSTR's stock is directly tied to the value of Bitcoin, as the company’s core assets are largely in cryptocurrency. With Bitcoin’s price hovering around $104,014, a 10% increase in the past week, MSTR is benefiting from Bitcoin’s surge, which has bolstered its market cap. MSTR’s stock price has outperformed even Bitcoin, with an impressive 43% increase year-to-date. Despite Bitcoin’s recent slight dip of nearly 5% from its all-time high of $108,786 in January, MSTR has continued to demonstrate impressive growth. In fact, MSTR's stock has surged by over 670% since 2023, far outperforming many of its tech and crypto peers.

The company’s approach is not without risks, however. Critics, including well-known Bitcoin skeptic Peter Schiff, have voiced concerns over MSTR’s Bitcoin acquisition strategy, warning that further Bitcoin price corrections could lead to significant losses. With the firm’s Bitcoin holdings now worth over $59 billion, the price of Bitcoin must remain robust to justify MSTR’s current valuation. Nonetheless, MSTR’s strategy of using “intelligent leverage” by issuing new equity and convertible debt to fund its Bitcoin purchases has worked remarkably well so far, as evidenced by its substantial stock price rise.

**Financial Engineering and Future Prospects for MSTR

What sets MSTR apart is its innovative approach to financial engineering, utilizing leverage to expand its Bitcoin holdings. In simple terms, MSTR raises capital through equity and debt offerings to finance its Bitcoin acquisitions. This strategy, akin to using “intelligent leverage,” has been successful, but it also comes with significant risks. If Bitcoin’s price were to suffer a prolonged downturn, MSTR could face serious financial challenges, especially with the increasing debt load and dilution from new stock issuances.

Despite the risks, MSTR has maintained strong operational performance, with Bitcoin exposure providing significant upside potential. As of now, MSTR holds 568,840 BTC, purchased for a total of $39.4 billion, representing more than half of the company’s market cap. Bitcoin’s continued price appreciation has driven MSTR's market value to a staggering $113 billion, making it one of the most valuable crypto-related companies. The company’s financial statements show a robust performance, with a year-to-date BTC yield of 15.5%. This yield, calculated by comparing changes in Bitcoin holdings to the number of diluted shares, highlights the company’s ability to leverage its Bitcoin assets effectively.

However, the market remains cautious. While the stock’s price has surged by 43% year-to-date, there are concerns about the company’s growing debt load. If Bitcoin prices were to collapse, MSTR’s leverage could exacerbate losses, potentially leading to significant volatility in its stock price. Nevertheless, analysts are still bullish on the company, with a consensus price target of $480 per share, suggesting a potential upside of 13.85% from the current price of $421.61.

**BTC Yield and the Role of “Intelligent Leverage” in MSTR’s Success

MSTR has consistently added Bitcoin to its balance sheet, demonstrating a clear commitment to the cryptocurrency as a primary treasury reserve asset. The company’s BTC yield, currently at 13.7%, reflects the success of this strategy. The goal is to maintain a yield between 15% and 25%, which could significantly enhance the company’s value if Bitcoin prices continue to rise. This innovative approach has earned MSTR a spot as one of the leading companies in the digital asset space, with investors eager to participate in the company’s leveraged Bitcoin strategy.

However, MSTR’s exposure to Bitcoin comes with inherent risks, particularly due to the volatility of cryptocurrency prices. If Bitcoin’s price were to experience a significant decline, MSTR could face substantial financial strain. The company’s capital-raising activities, including its plan to raise $84 billion in new equity and convertible debt, provide a cushion for future Bitcoin acquisitions, but they also increase the risk of dilution for existing shareholders.

**Insider Transactions and Analyst Sentiment on MSTR

In recent insider activity, MSTR's Director Jarrod Patten sold 1,100 shares of the company, totaling $469,700. This sale reflects a broader sentiment in the market that while MSTR has seen impressive growth, there are concerns about the sustainability of its Bitcoin acquisition strategy, particularly if the market enters a downtrend. As of now, MSTR’s stock is a popular choice among analysts, with a consensus “Strong Buy” rating and a target price of $480. However, this sentiment is tempered by the risks associated with the company’s leverage and Bitcoin’s inherent volatility.

Should Investors Buy, Sell, or Hold MSTR Stock?

The current market conditions for MSTR suggest a bullish outlook for the stock, but with caution. While the company’s Bitcoin strategy has been successful so far, the risk of a market correction or significant decline in Bitcoin’s price remains a concern. The company’s aggressive capital raising strategy and reliance on Bitcoin as its primary asset expose it to greater risk in the event of a crypto market downturn. Nevertheless, for investors willing to accept this risk, MSTR presents a compelling investment opportunity, especially with Bitcoin continuing to show strong growth and analysts projecting further upside.

MSTR's ability to leverage its Bitcoin holdings while maintaining a strong financial position has made it one of the most interesting stocks in the market today. Investors should continue to monitor Bitcoin’s price movements, as well as MSTR's capital-raising activities, to gauge the stock’s long-term potential. For more detailed insider transactions and financial data, investors can visit MSTR’s insider transactions page at insider transactions and stock profile at MSTR stock profile.

In conclusion, while MSTR shows strong potential due to its innovative Bitcoin strategy, it also faces substantial risks that could impact its stock performance, particularly if Bitcoin’s price experiences a significant downturn. Investors should weigh these risks carefully before making any decisions on buying, selling, or holding MSTR stock.

That's TradingNEWS

Read More

-

BITQ ETF Soars 66.55% as Bitcoin Blasts Past $124,000 — Crypto Equities Lead 2025 Rally

13.10.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPR, XRPI Slip as Ripple XRP-USD Holds $2.62 — SEC Fast-Track Could Ignite $20B

13.10.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Steadies at $3.00 as U.S. Export Boom Tests Old Fields

13.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen Climbs to ¥152.28 as Japan’s Political Shakeup

13.10.2025 · TradingNEWS ArchiveForex