Is NASDAQ:RDVI ETF Positioned for Growth at $59.63? A Deep Dive Into Performance and Dividend Potential

Why NASDAQ:RDVI Outshines SCHD and VTV with Rising Dividends and Strategic Sector Allocation | That's TradingNEWS

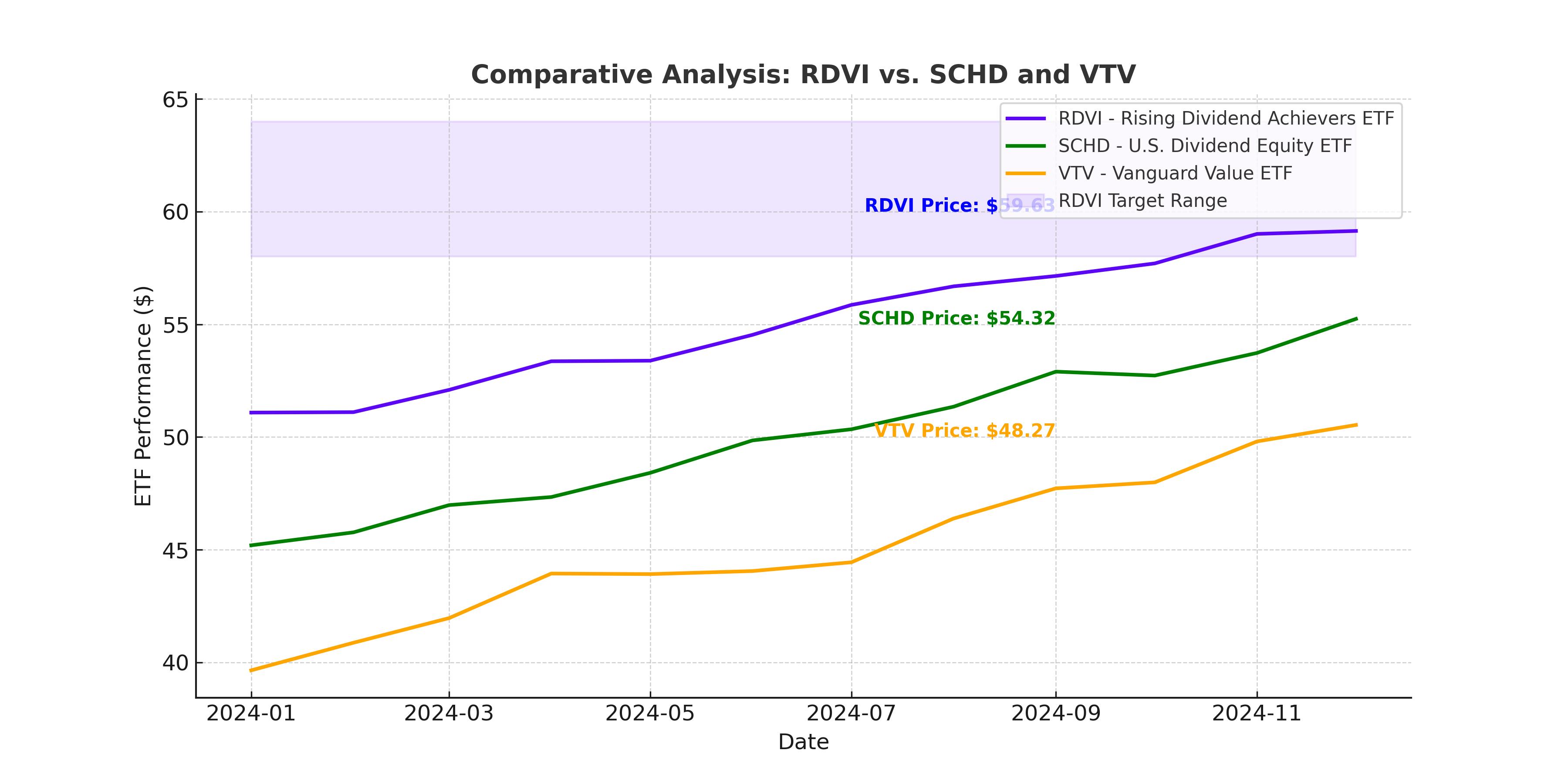

Comparative Analysis: RDVI vs. SCHD and VTV

When evaluating the First Trust Rising Dividend Achievers ETF (NASDAQ:RDVI) against its closest peers, the Schwab U.S. Dividend Equity ETF (SCHD) and the Vanguard Value ETF (VTV), several differentiators emerge that highlight RDVI's distinctive value proposition. While SCHD and VTV are stalwarts in the dividend-focused and value-investing ETF space, RDVI carves out a niche by emphasizing dividend growth and a sector allocation strategy tailored for long-term income and capital appreciation.

Sector Allocation as a Competitive Edge

RDVI allocates a substantial 42% of its portfolio to financials, a sector that has historically demonstrated resilience and steady income generation through dividends. This sector allocation not only differentiates RDVI from SCHD and VTV but also aligns with the ETF's objective of targeting companies with a proven history of dividend growth. By contrast, SCHD and VTV offer more balanced sector exposure, with SCHD leaning towards technology and consumer staples, and VTV reflecting broader value-oriented diversification.

Additionally, RDVI's portfolio includes 20% exposure to information technology and 10.3% to energy, sectors that provide both growth potential and robust cash flow to sustain rising dividends. This contrasts with the heavier weight on utilities and consumer discretionary sectors in SCHD and VTV, which may limit growth opportunities in dynamic market conditions.

Expense Ratios and Cost-Benefit Analysis

SCHD and VTV boast ultra-low expense ratios of 0.06% and 0.04%, respectively, making them cost-effective choices for expense-conscious investors. RDVI’s expense ratio of 0.49%, while higher, is a reflection of its tailored approach to dividend growth investing, rigorous stock selection criteria, and consistent historical outperformance. The added cost is justified by the fund’s ability to identify and track companies that exhibit strong financial metrics, sustainable payout ratios, and a commitment to increasing dividends over time.

For investors seeking a focused approach to dividend growth with the potential for capital gains, RDVI's higher expense ratio represents a premium worth paying. The ETF's superior year-to-date return of 20.76% (as of November 2024) further underscores its capacity to deliver above-average results in its category.

Performance and Volatility Comparison

RDVI’s robust one-year return of 32.58% places it ahead of many competitors in the Large Cap Value segment, showcasing its ability to capture market upside while maintaining a disciplined approach to risk. In comparison, SCHD and VTV delivered solid but slightly lower returns, partly due to their broader sector diversification and lower weighting in high-growth sectors like technology and energy.

From a volatility perspective, RDVI exhibits a beta of 1.10 and a standard deviation of 19.97%, placing it in the medium-risk category. SCHD and VTV, known for their steadier performance profiles, exhibit slightly lower betas and standard deviations, making them attractive for conservative investors prioritizing stability over aggressive growth.

Dividend Growth and Yield Dynamics

A key differentiator for RDVI is its explicit focus on rising dividends, which resonates strongly with income-seeking investors. The ETF features a 12-month trailing dividend yield of 1.63%, marginally higher than SCHD and on par with VTV. However, RDVI's stock selection methodology—prioritizing companies with a history of sustained dividend increases—adds a layer of reliability and future growth potential to its yield profile.

RDVI’s dividend-focused strategy has been bolstered by recent market trends, with dividend-paying stocks experiencing renewed investor interest amid a volatile interest rate environment. The ETF’s exposure to financials and energy sectors positions it well to capitalize on rising cash flows in industries benefiting from higher interest rates and stable commodity prices.

Unique Value Proposition

RDVI’s distinguishing factors lie in its commitment to identifying companies with a track record of consistent dividend increases, robust earnings growth, and manageable payout ratios. The ETF’s strict inclusion criteria and quarterly rebalancing ensure that only the strongest performers remain in the portfolio, enhancing its appeal to investors seeking both income and capital appreciation.

In contrast, SCHD and VTV, while excellent options for broad market exposure, lack the concentrated emphasis on dividend growth that defines RDVI. For investors prioritizing steady income growth alongside potential market upside, RDVI stands out as a focused and effective investment vehicle.

Conclusion: A Compelling Case for RDVI

The First Trust Rising Dividend Achievers ETF (NASDAQ:RDVI) represents a compelling investment opportunity for those seeking a blend of income, growth, and value. Its robust sector allocation, emphasis on rising dividends, and consistent outperformance make it a standout choice in the Large Cap Value category. While SCHD and VTV provide low-cost, diversified alternatives, RDVI’s targeted strategy and proven track record justify its higher expense ratio, offering a unique value proposition for investors with a long-term focus.

With its current price at $59.63, RDVI remains attractively positioned within its 52-week range of $47.16 to $64.63. For value-driven investors looking to capitalize on strong dividend growth and sector-specific tailwinds, RDVI’s outlook suggests further growth potential and continued resilience in volatile market conditions.

To stay updated on real-time movements and insights for NASDAQ:RDVI, visit this link.

That's TradingNEWS

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex