Is TeraWulf Stock (NASDAQ:WULF) the Future of Digital Infrastructure a Buy at $5.81?

Shifting from Bitcoin mining to AI hosting, TeraWulf repositions itself for sustainable growth. Explore the data behind its potential trajectory to a $9.30 high | That's TradingNEWS

TeraWulf (NASDAQ:WULF) Expands Horizons: From Bitcoin Mining to AI-Driven High-Performance Computing

TeraWulf (NASDAQ:WULF) has emerged as a transformative player in the digital infrastructure and Bitcoin mining sector, leveraging its vertically integrated operations powered predominantly by zero-carbon energy. The company, trading at $5.81 per share as of its most recent market close, has captured attention with its aggressive expansion into high-performance computing (HPC) infrastructure and its ability to adapt to rapidly shifting market dynamics.

Bitcoin Production Highlights and Operational Efficiency

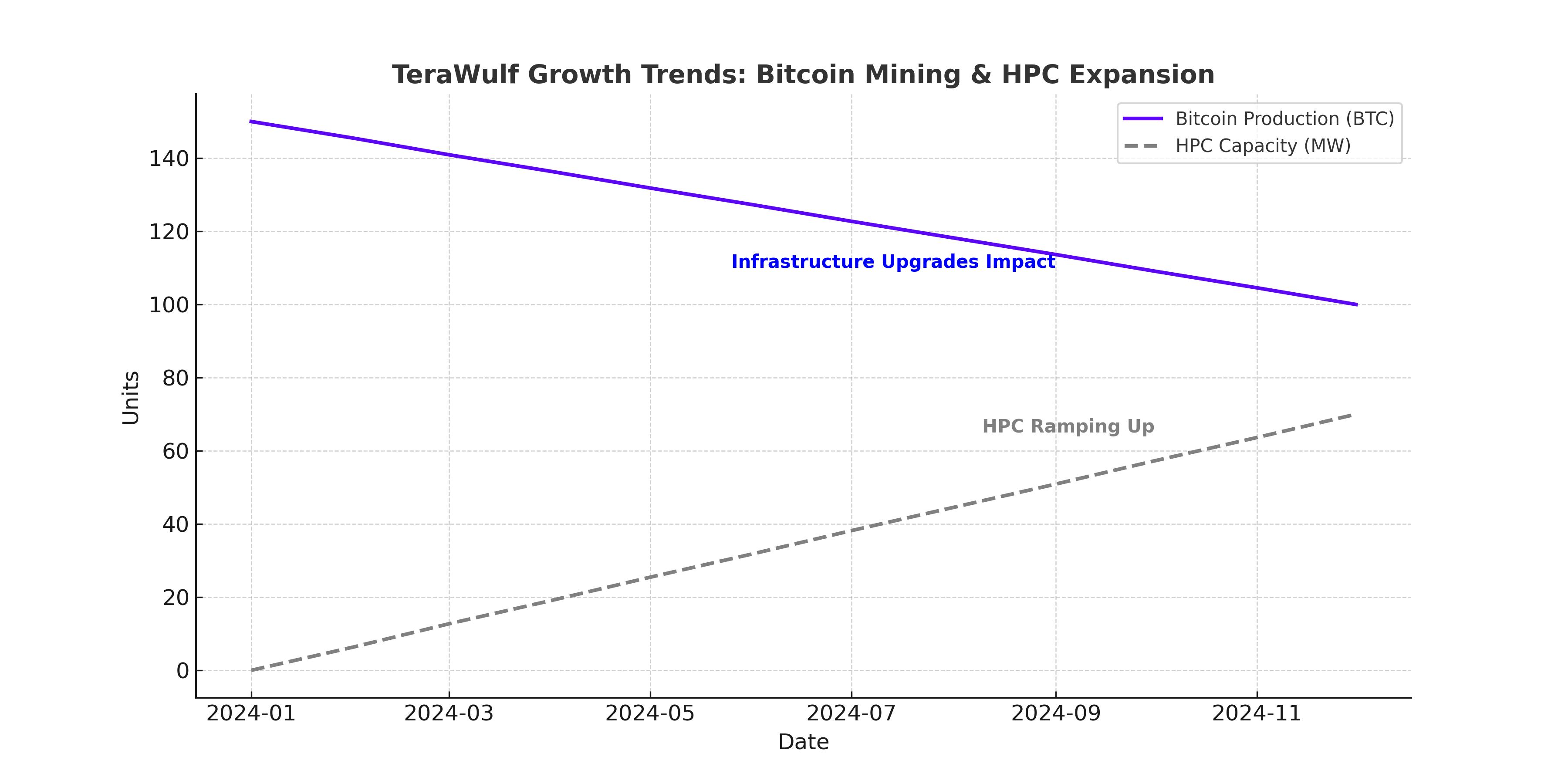

In November, TeraWulf self-mined 115 Bitcoin, marking a decline from October's 150 Bitcoin due to planned outages aimed at upgrading its infrastructure. The average value per Bitcoin mined soared to $83,947, a significant increase from $65,427 in October, highlighting the favorable pricing environment. However, the company’s daily production rate fell to 3.8 Bitcoin, reflecting temporary disruptions in its mining capacity of 5.9 exahashes per second (EH/s).

The power cost per Bitcoin mined rose to $41,190, up from $36,789 in October, corresponding to $0.051 per kilowatt-hour (kWh). Despite these higher costs, TeraWulf continues to position itself as one of the most efficient miners in the sector, achieving a rate of 19.49 Bitcoin per EH/s, second only to Marathon Digital Holdings (NASDAQ:MARA).

Strategic Transition into AI and HPC Hosting

In a bold strategic pivot, TeraWulf announced a partnership with Core42, a subsidiary of G42, to deliver over 70 megawatts (MW) of turn-key data center infrastructure at its Lake Mariner facility in Upstate New York. This infrastructure, tailored for AI-driven applications, will feature advanced Dell Integrated Rack Scalable Solutions, including liquid-cooled Dell PowerEdge XE9680L GPU servers. Production is expected to commence in phases from Q1 to Q3 2025.

The partnership aligns with TeraWulf’s diversification strategy, transitioning from a pure-play Bitcoin miner to a provider of scalable, sustainable infrastructure for AI and HPC. The deal not only secures long-term, high-margin revenue streams but also includes provisions for expanding Core42’s hosting capacity by an additional 135 MW gross, underscoring the scalability potential of this venture.

Financial Strength and Strategic Capital Allocation

TeraWulf's financial position remains robust, supported by a $500 million senior note offering at 2.75% due in 2030. The company has effectively utilized $115 million from this offering for share buybacks, acquiring 18 million shares as part of a broader $200 million repurchase program. With $387 million in unallocated cash projected for 2025, TeraWulf has the flexibility to accelerate its growth initiatives in HPC and AI compute.

The recent sale of its 25% stake in the Nautilus joint venture for $92 million further highlights the company’s focus on streamlining operations and reallocating resources toward higher-margin opportunities. This transaction underscores management’s commitment to creating shareholder value while maintaining operational agility.

Institutional Interest and Analyst Sentiment

Institutional investors have taken notice of TeraWulf’s strategic pivot. Hedge funds, including Stanley Druckenmiller’s Duquesne Family Office, increased their holdings from 2.1 million shares to 2.9 million in Q3, reflecting growing confidence in the company’s long-term prospects. Analysts have echoed this optimism, with firms like Northland Capital Markets and Cantor Fitzgerald assigning price targets as high as $11 per share. The average 12-month price target stands at $9.06, representing a potential upside of 56% from current levels.

Challenges in Bitcoin Mining and Future Outlook

While TeraWulf continues to mine Bitcoin efficiently, the sector faces headwinds from rising network difficulty and increasing energy costs. The global Bitcoin network hash rate recently reached 800 EH/s, pushing hash prices to a three-month high of $60 per terahash per second (TH/s). Despite these challenges, TeraWulf’s ability to mine at a cost below $42,000 per Bitcoin provides a competitive edge.

Management has also signaled a cautious approach to Bitcoin mining post-2025, aligning with the next Bitcoin halving. CFO Patrick Fleury emphasized the company’s focus on HPC and AI, positioning these segments as future growth drivers. With plans to increase its self-mining capacity to 13.2 EH/s in Q1 2025, TeraWulf aims to solidify its position as a leader in both Bitcoin mining and digital infrastructure.

Valuation and Investment Potential

TeraWulf’s current market capitalization of $2.6 billion reflects a forward price-to-sales ratio of 8.7x based on a Bitcoin price of $100,000. This valuation, while elevated, is supported by the company’s strong growth trajectory and strategic diversification. Analysts project revenue growth of 117% in 2024, with profitability expected to follow as the company scales its HPC operations.

The stock’s recent rally—up 140% since August—has been fueled by both rising Bitcoin prices and enthusiasm for its HPC initiatives. However, this rapid appreciation also raises questions about valuation sustainability. Investors should monitor key milestones, including the announcement of TeraWulf’s first HPC client by year-end and the operational ramp-up of its AI-focused infrastructure.

Conclusion: A Strategic Shift with Long-Term Promise

TeraWulf’s transition from a Bitcoin-focused miner to a diversified leader in digital infrastructure represents a significant strategic pivot with far-reaching implications. Despite ongoing volatility in Bitcoin mining, the company’s deliberate expansion into AI-driven high-performance computing (HPC) hosting signals a move toward a more sustainable and scalable business model. With its recent partnership with Core42, plans to deliver over 70 megawatts of AI computing infrastructure, and a competitive average power cost of $41,190 per Bitcoin mined, TeraWulf demonstrates a commitment to leveraging its predominantly zero-carbon energy advantage to create diversified revenue streams. Backed by institutional confidence, as evidenced by increased hedge fund stakes, and armed with nearly $387 million in unallocated capital projected for 2025, TeraWulf’s trajectory points toward long-term financial and operational strength. At a current price of $5.81 and a 52-week high of $9.30, TeraWulf presents both a speculative opportunity and a glimpse into the future of sustainable digital infrastructure.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex