ITB vs. XHB: Unpacking the Better Homebuilder ETF for Your Portfolio

Strategic Choices in the Housing Market: A Detailed Comparison of ITB and XHB ETFs for Targeted Investment Returns | That's TradingNEWS

Comparative Analysis: ITB vs. XHB - Which Homebuilder ETF is the Better Bet?

As the U.S. housing market continues to navigate post-pandemic dynamics, investors are keen to identify the best avenues for capitalizing on this sector's potential. Two exchange-traded funds (ETFs) that often come to the forefront of this discussion are the iShares U.S. Home Construction ETF (BATS: ITB) and the SPDR S&P Homebuilders ETF (NYSEARCA: XHB). Although both ETFs provide substantial exposure to the U.S. homebuilding industry, they diverge in their composition, focus, and subsequent performance outcomes. Below is a thorough comparative analysis to help you determine which ETF is better aligned with your investment strategy.

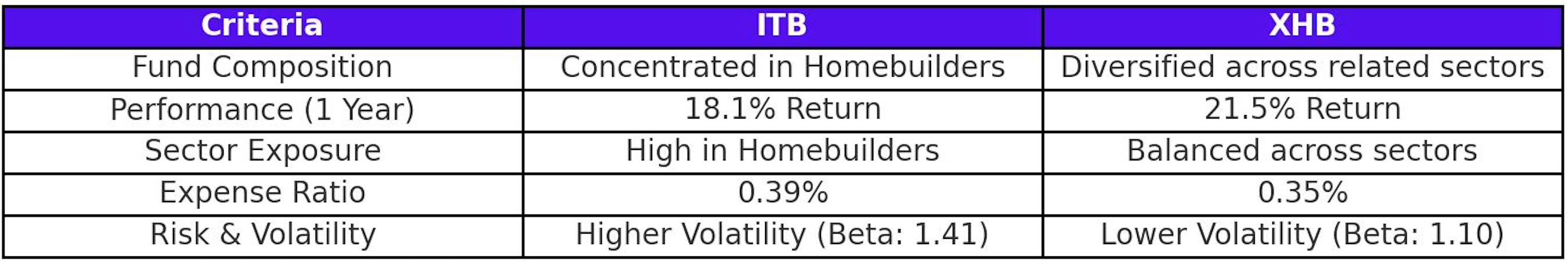

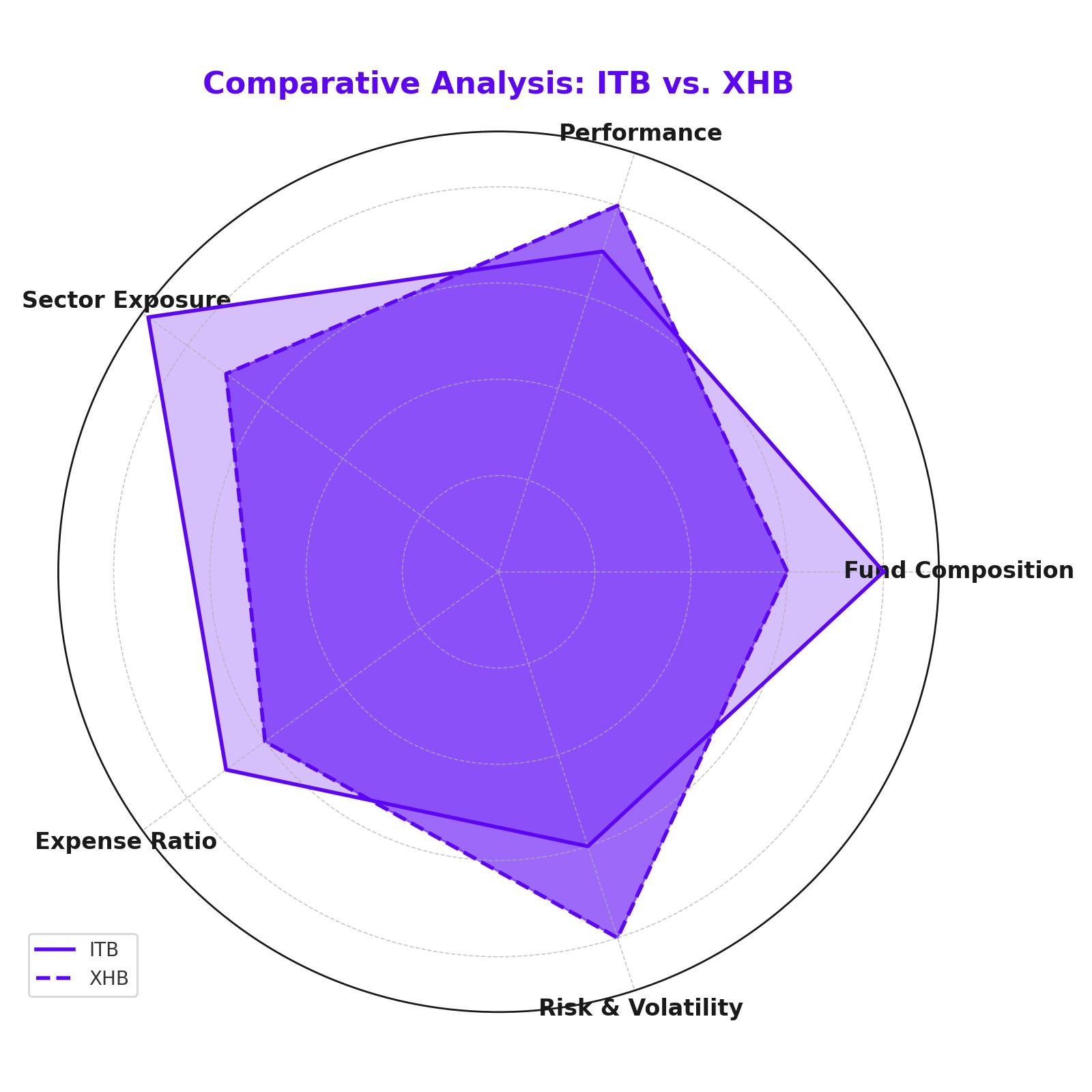

Fund Composition and Focus ITB vs XHB

ITB: Targeted Homebuilder Exposure

The iShares U.S. Home Construction ETF (BATS: ITB) offers investors concentrated exposure to the homebuilding sector, with over 65% of its total assets invested in residential construction companies. This ETF tracks the Dow Jones U.S. Select Home Construction Index, primarily featuring heavyweights like D.R. Horton (DHI), Lennar Corporation (LEN), and NVR, Inc. (NVR). These companies are industry leaders with robust market shares, which positions ITB as a compelling option for investors seeking targeted exposure to the homebuilding industry. For instance, D.R. Horton, with a market cap of $34.5 billion, is a significant component of ITB’s holdings, underscoring its influence on the fund’s overall performance.

XHB: Diversified Construction and Homebuilding Exposure

Conversely, the SPDR S&P Homebuilders ETF (XHB) adopts a more diversified investment strategy. While homebuilders form a core part of its portfolio, XHB also allocates substantial assets to related sectors, including building products, home improvement retailers, and household durables. This broader approach means that companies like The Home Depot, Inc. (HD), which is not a homebuilder but a leading home improvement retailer, play a critical role in XHB's portfolio. As of the latest reports, Home Depot, with a market cap of $320 billion, is a significant holding within XHB, illustrating the ETF's diversified exposure. This diversification reduces the risk typically associated with the cyclical nature of the homebuilding industry but might dilute the ETF's direct correlation with housing market trends.

Performance Analysis: ITB vs. XHB

ITB: Strong Performance Tied to Homebuilding Growth

The performance of iShares U.S. Home Construction ETF (BATS: ITB) is closely tied to the success of the homebuilding sector. Given its concentrated exposure to major homebuilders, ITB often experiences more pronounced gains during periods of strong housing demand. Over the past year, ITB has returned approximately 18.1%, reflecting the robust performance of the homebuilding sector as demand for new homes surged amid low-interest rates and a shortage of housing inventory. For example, Lennar Corporation (LEN), a key holding in ITB, saw its stock price increase by 20% in the same period, driven by strong quarterly earnings and optimistic forward guidance.

However, this focused exposure also means that ITB is more vulnerable during downturns in the housing market. For instance, when mortgage rates increased in late 2023, causing a slowdown in housing starts, ITB experienced a temporary dip, reflecting the sector's sensitivity to economic cycles.

XHB: Balanced Performance with Reduced Volatility

On the other hand, the SPDR S&P Homebuilders ETF (XHB) tends to exhibit more stable performance due to its diversified holdings. In the past year, XHB delivered a 21.5% return, slightly outperforming ITB. This outperformance can be attributed to the broader exposure to sectors beyond homebuilding, such as home improvement retailers and building product manufacturers, which provided a cushion during periods of volatility in the housing market.

For instance, The Home Depot, Inc. (HD), which constitutes a significant portion of XHB's portfolio, posted a 15% gain over the past year, benefiting from strong consumer demand for home improvement products despite fluctuations in the homebuilding sector. This diversification strategy helps mitigate the risks associated with the cyclical nature of homebuilding, making XHB a potentially more resilient option for investors looking for steady returns.

Sector and Industry Exposure

ITB: High Concentration in Leading Homebuilders

On the other hand, the SPDR S&P Homebuilders ETF (XHB) tends to exhibit more stable performance due to its diversified holdings. In the past year, XHB delivered a 21.5% return, slightly outperforming ITB. This outperformance can be attributed to the broader exposure to sectors beyond homebuilding, such as home improvement retailers and building product manufacturers, which provided a cushion during periods of volatility in the housing market.

For instance, The Home Depot, Inc. (HD), which constitutes a significant portion of XHB's portfolio, posted a 15% gain over the past year, benefiting from strong consumer demand for home improvement products despite fluctuations in the homebuilding sector. This diversification strategy helps mitigate the risks associated with the cyclical nature of homebuilding, making XHB a potentially more resilient option for investors looking for steady returns.

Expense Ratios and Liquidity

ITB: Competitive Costs with Strong Liquidity

ITB comes with an expense ratio of 0.39%, making it relatively cost-effective given its targeted exposure. It also boasts strong liquidity, with a high average daily trading volume, ensuring that investors can enter and exit positions without significant price impact.

XHB: Slightly Higher Expense, Broader Coverage

The SPDR S&P Homebuilders ETF (XHB), while offering broader market exposure, comes with a slightly higher expense ratio of 0.35%. This modest difference in fees reflects the broader diversification within the ETF, which includes a wider range of industries and companies. Although the expense ratio is slightly higher than ITB, XHB's diversified approach may justify the additional cost for investors seeking reduced volatility and broader exposure to the housing market and related sectors.

Risk and Volatility Considerations: ITB vs. XHB

ITB: Higher Volatility with Sector-Specific Risks

Given its concentrated focus on the homebuilding sector, ITB is subject to higher volatility, particularly in response to changes in interest rates, economic conditions, and consumer sentiment. The fund's beta, a measure of its volatility relative to the broader market, stands at 1.41, indicating that it is significantly more volatile than the overall market. This heightened volatility can lead to larger price swings, both positive and negative, depending on the economic environment.

For example, during the interest rate hikes in 2023, ITB experienced a more significant decline compared to XHB, as higher borrowing costs directly impacted the affordability of new homes and, consequently, the profitability of homebuilders like PulteGroup, Inc. (PHM) and NVR, Inc. (NVR). Investors in ITB should be prepared for this type of sector-specific risk, especially during periods of economic uncertainty.

XHB: Lower Volatility with Broader Market Exposure

In contrast, XHB tends to exhibit lower volatility due to its diversified approach. The fund's beta is closer to 1.10, suggesting that it moves more in line with the broader market, with less pronounced fluctuations. This makes XHB a more stable option for investors who prefer to avoid the sector-specific risks associated with pure-play homebuilder investments.

For instance, during the same period of interest rate hikes in 2023, XHB's broader exposure to companies in less cyclical industries, such as household durables and building products, helped to buffer the ETF against some of the downturns experienced by ITB. This reduced volatility makes XHB an attractive choice for more conservative investors looking to participate in the housing market's growth without taking on excessive risk.

Conclusion: Which ETF Should You Choose?

Your choice between ITB and XHB should be guided by your investment goals and risk tolerance. If you are looking for concentrated exposure to the homebuilding sector with the potential for higher returns, ITB may be the better option. However, if you prefer a diversified approach with lower volatility, XHB might be more suitable for your portfolio.

In a rapidly changing housing market, both ETFs offer compelling opportunities, but your selection should align with your broader investment strategy.

That's TradingNEWS

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex