Comprehensive Analysis of JPMorgan Chase & Co. (NYSE:JPM): A Financial Powerhouse in 2024

Overview of JPMorgan's Market Position and Strategic Adaptations

NYSE:JPM stands as a beacon of robust financial strategy and innovation in the banking sector. With its recent quarterly performance for the first quarter of 2024, JPMorgan Chase & Co. has not only demonstrated resilience but also an aggressive posture towards capturing market opportunities and enhancing operational efficiencies. The company's strong results reflect its strategic foresight in navigating a complex economic landscape marked by fluctuating interest rates and evolving regulatory environments.

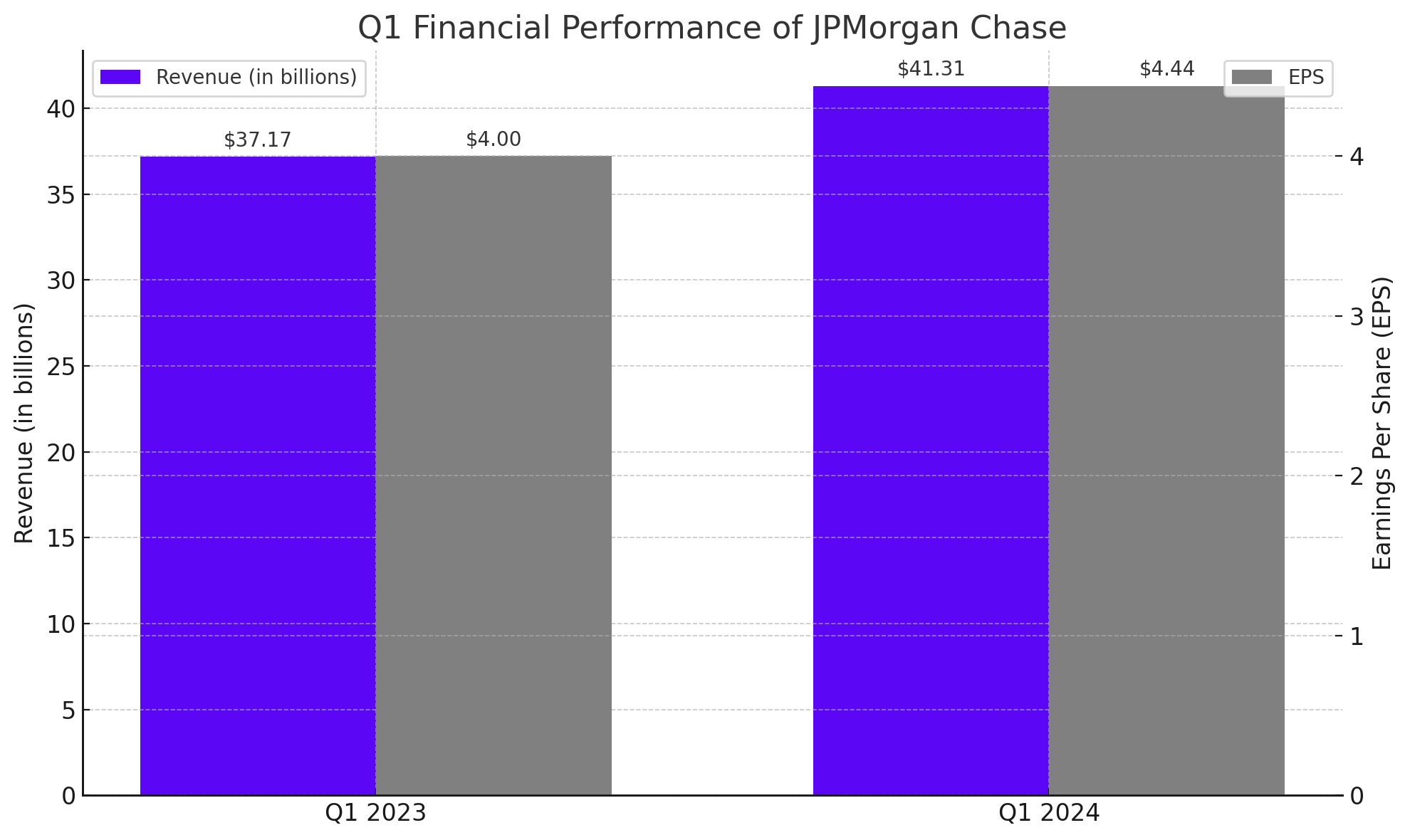

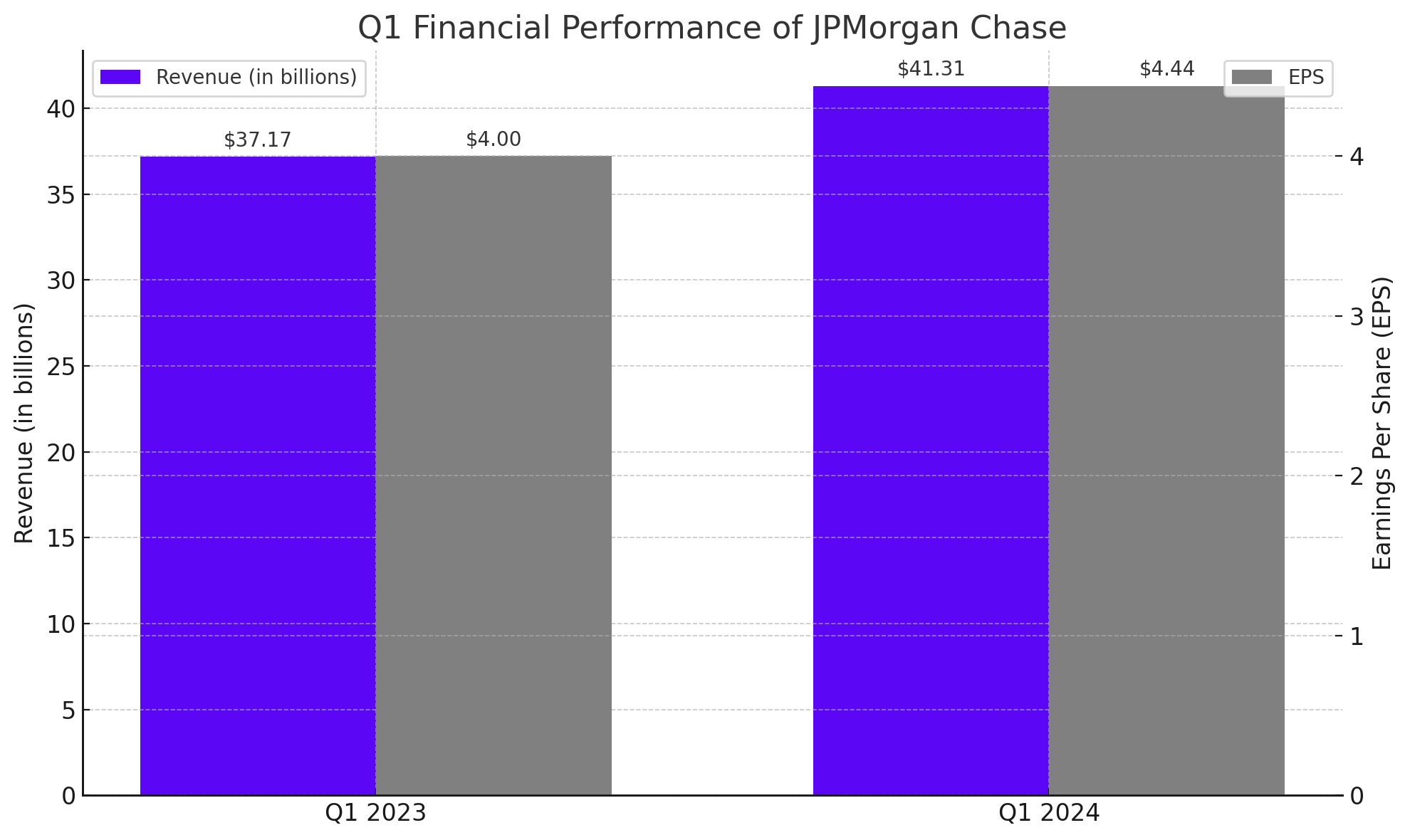

Q1 2024 Financial Performance

In the first quarter of 2024, JPMorgan reported stellar financial results with net revenues reaching $41.31 billion, showcasing an 11% year-over-year growth. The earnings per share (EPS) stood impressively at $4.44, significantly surpassing the market expectations. This financial uplift was driven by a diversified portfolio, including substantial growth in investment banking and asset management sectors, despite the broader challenges of credit quality pressures and interest rate uncertainties.

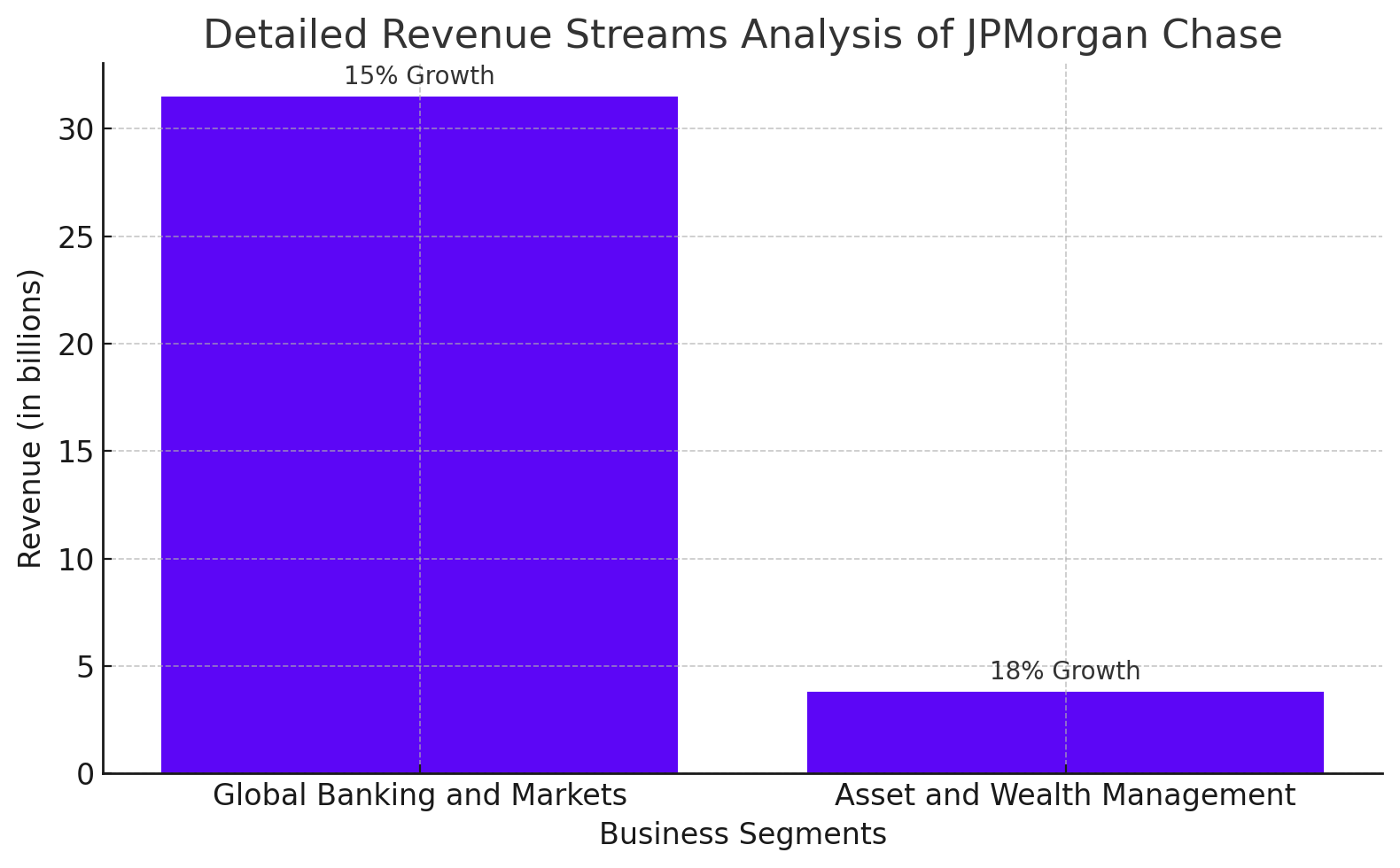

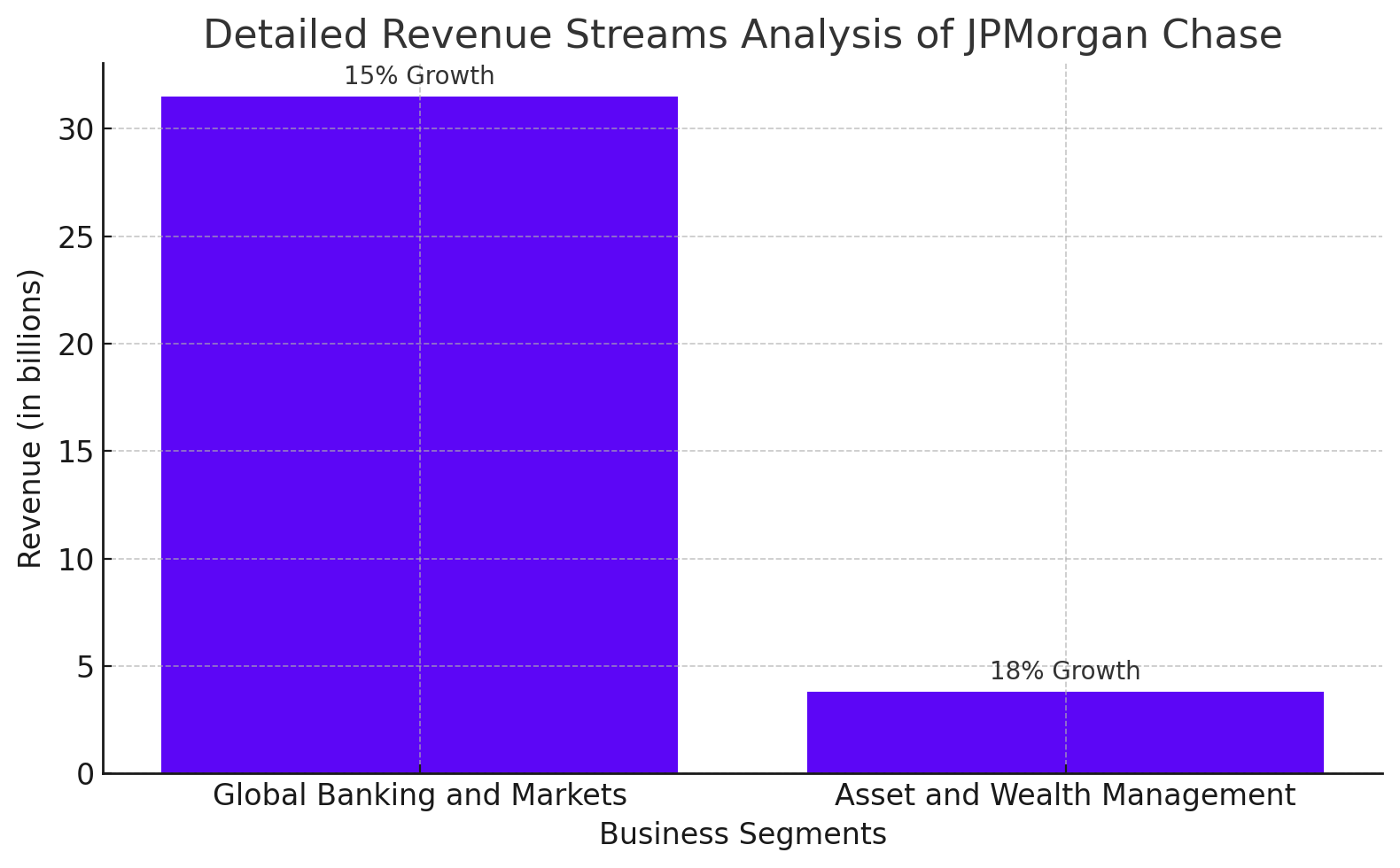

Detailed Revenue Streams Analysis

Global Banking and Markets

JPMorgan's Global Banking and Markets segment exhibited a robust performance, contributing heavily to the total revenue with an increase of 15% from the previous year. This rise was notably propelled by a 24% surge in advisory services, thanks to a vibrant M&A landscape. Moreover, equity and debt underwriting revenues experienced remarkable growth, evidencing the bank's strong positioning and client trust in its financial structuring capabilities.

Asset and Wealth Management

The Asset and Wealth Management arm reported a revenue of $3.8 billion, marking an 18% increase year-over-year. This segment benefited from high management and service fees, indicating successful asset retention and acquisition in a challenging market. The strategic decision to expand into private credit and alternative investments has been fruitful, with assets in these categories expected to grow substantially in the coming years.

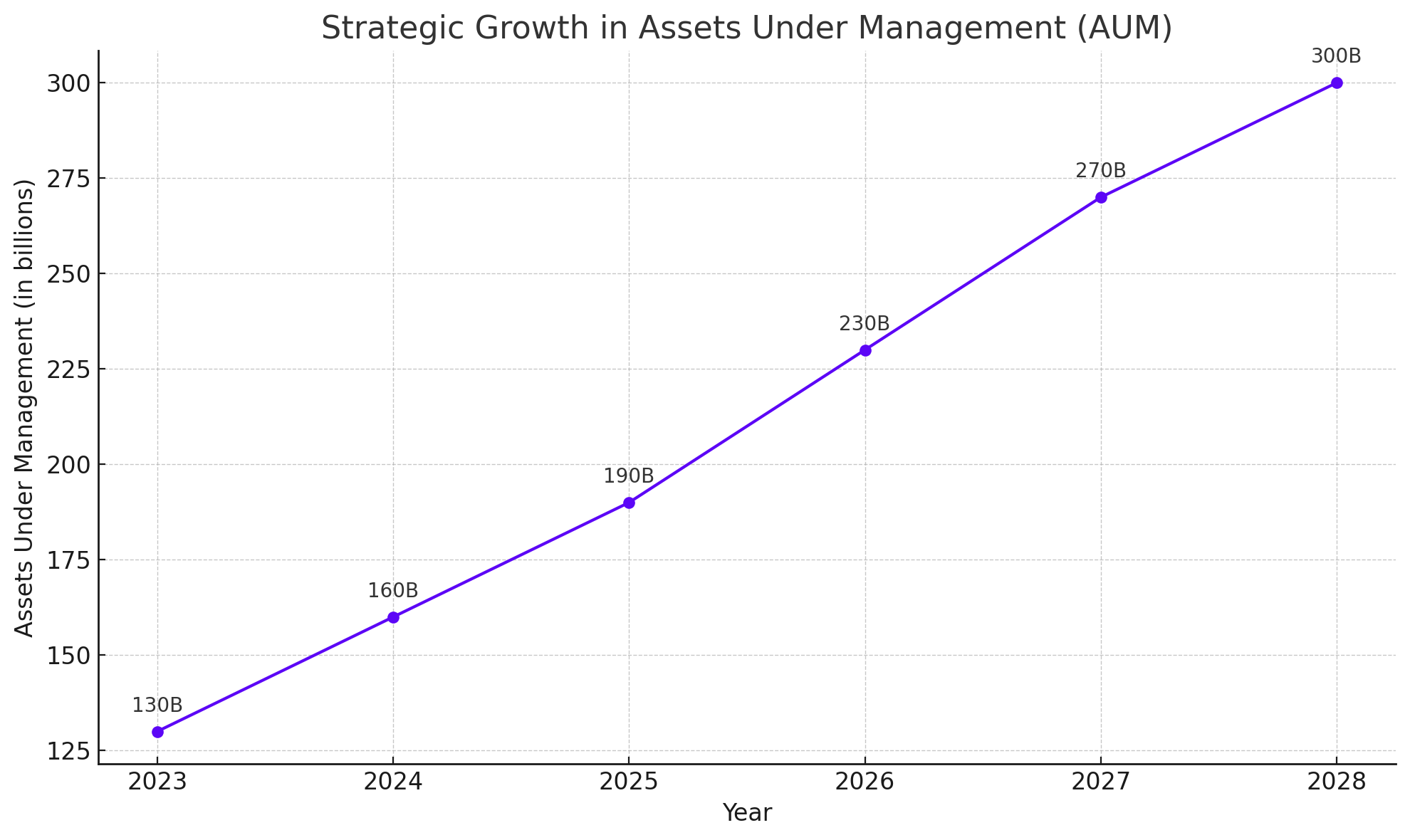

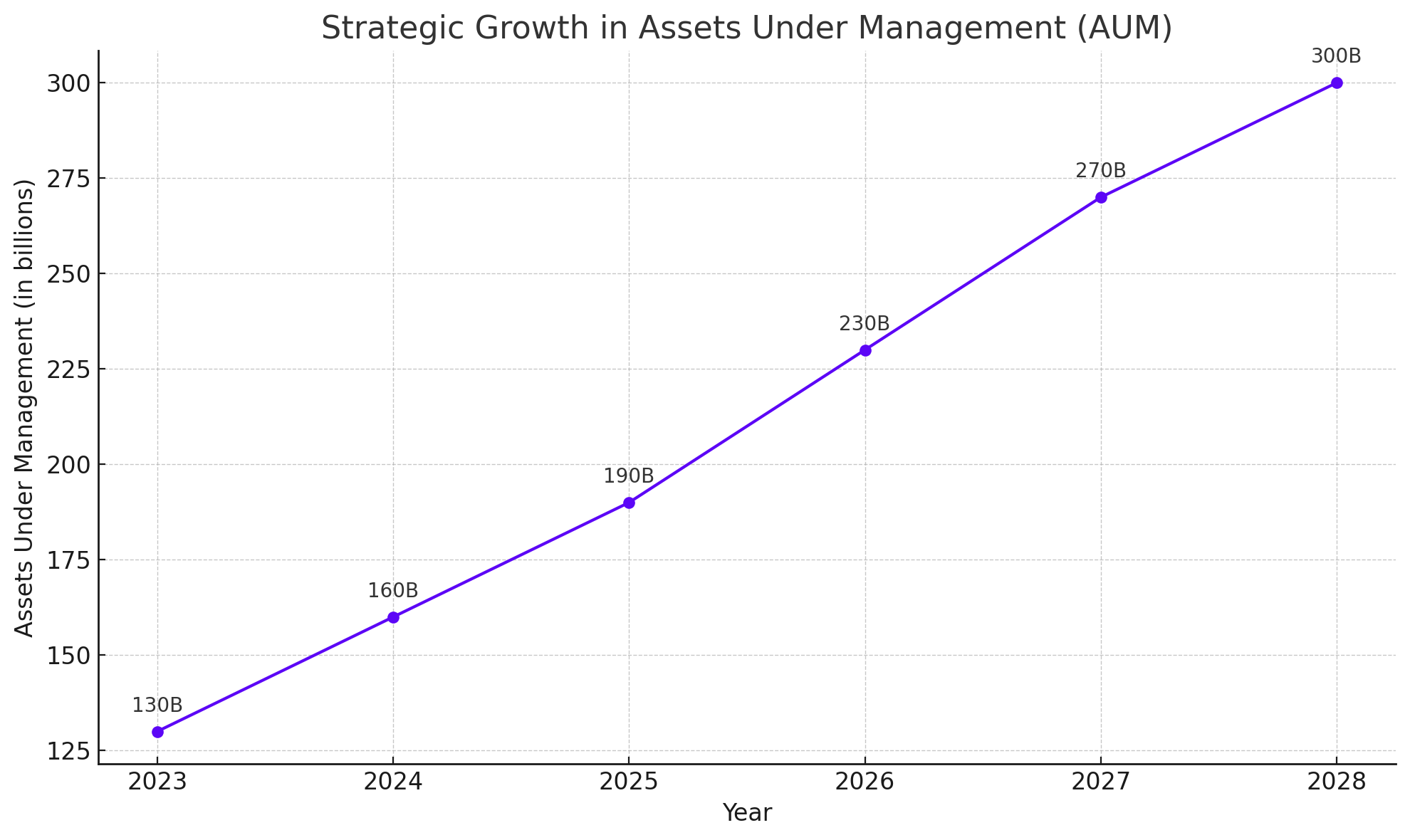

Strategic Growth and Market Adaptability

JPMorgan has been proactive in transcending traditional banking boundaries by venturing into high-growth areas such as alternative investments and private credit. The acquisition of a significant stake in Kennedy Lewis Investment Management is a testament to this strategy, enhancing the bank’s capabilities in private credit and setting a growth trajectory from $130 billion to $300 billion in assets under management over the next five years.

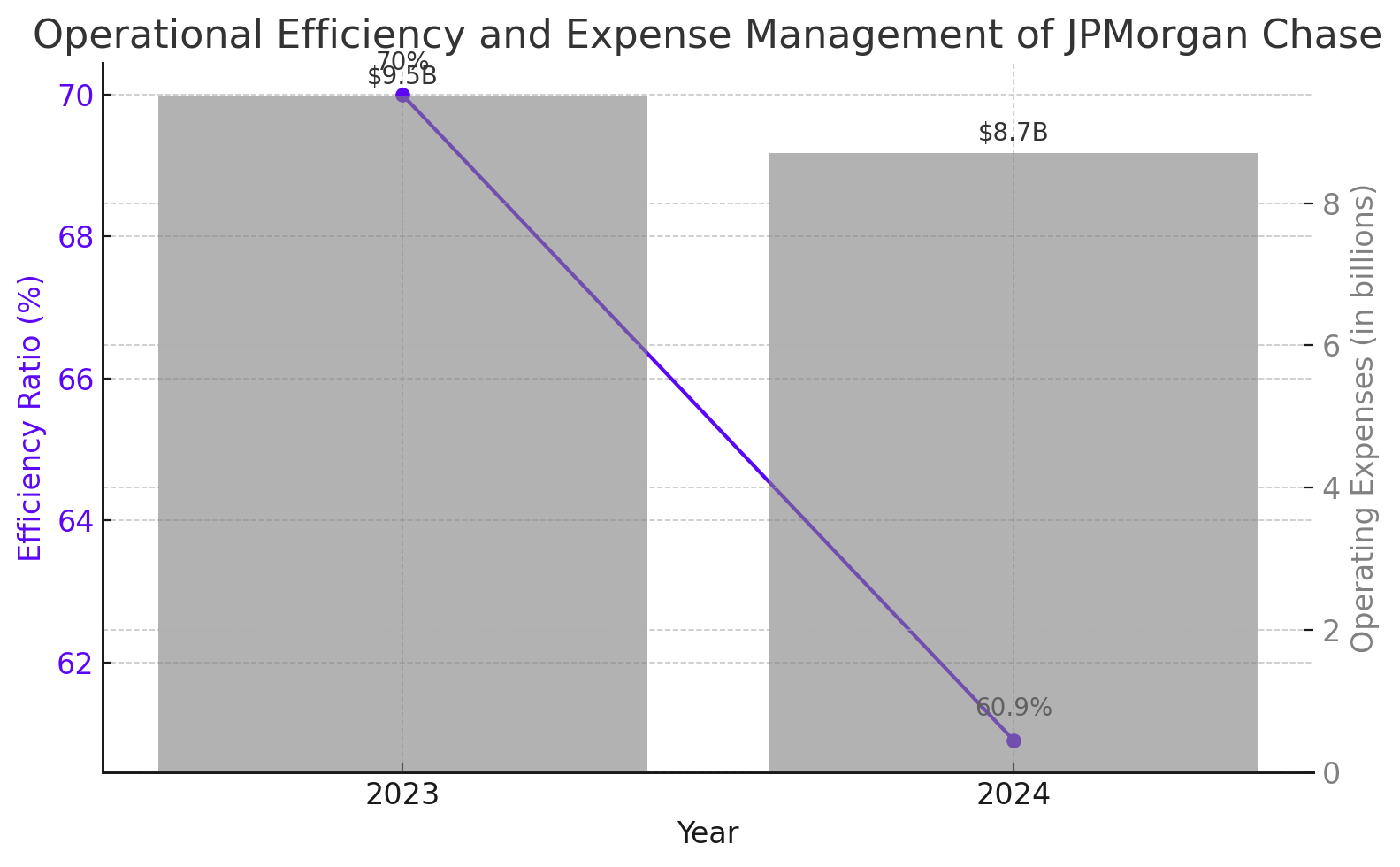

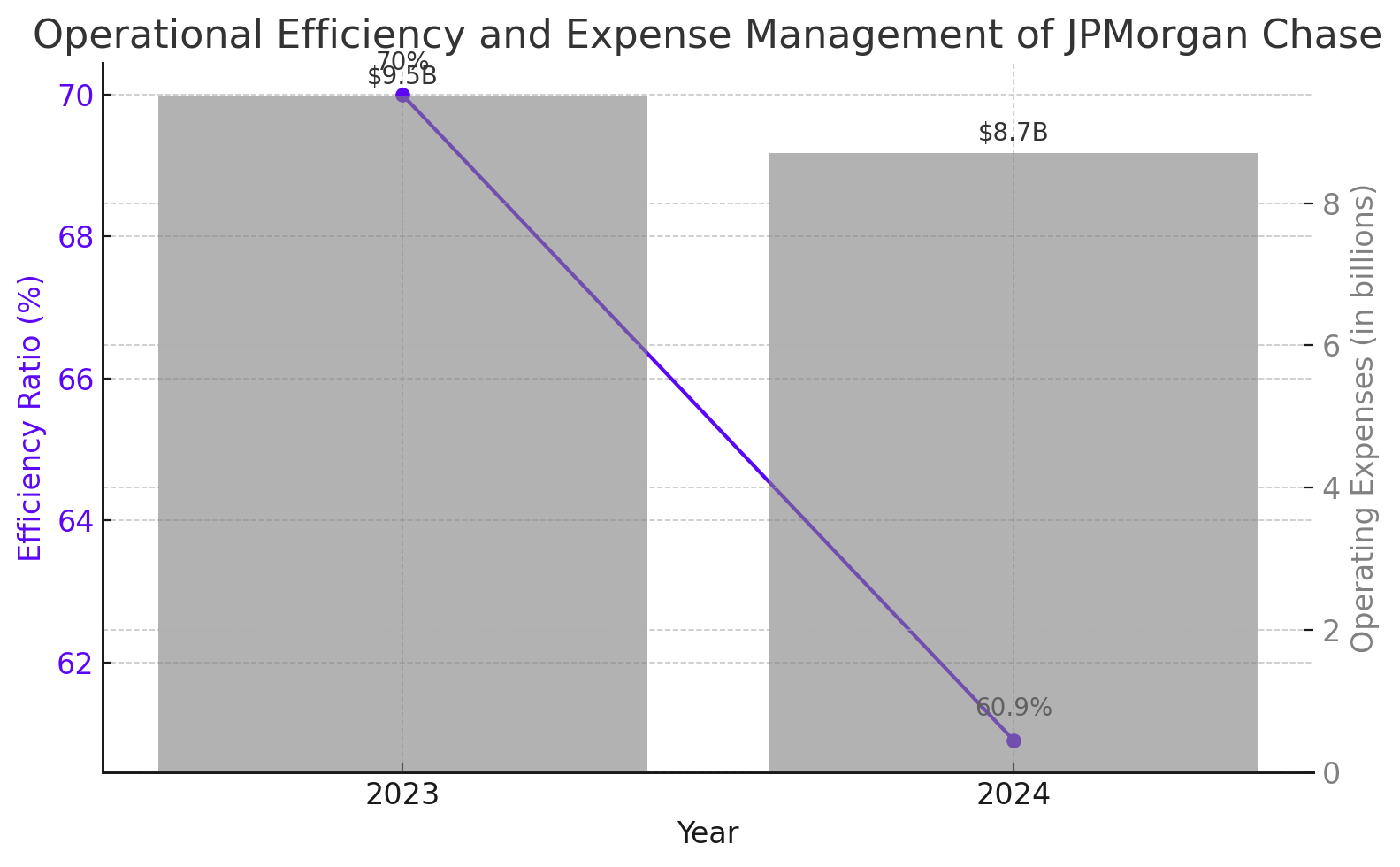

Operational Efficiency and Expense Management

The bank's operational efficiency has seen a notable improvement, with total operating expenses recorded at $8.7 billion for the quarter. The efficiency ratio improved to 60.9%, down from nearly 70% in the previous year, highlighting effective cost management and operational streamlining.

Future Outlook and Opportunities

Looking ahead, JPMorgan is well-positioned to capitalize on the reopening of capital markets, with expected increases in market activity and investor appetite. The exploration of artificial intelligence (AI) to boost productivity and operational efficiencies presents another strategic avenue for growth.

Investment Consideration for JPMorgan Chase & Co. (NYSE:JPM)

Financial Performance Review

JPMorgan has consistently shown strong financial results, and Q1 2024 is no exception. The bank reported an 11% increase in revenue year-over-year, reaching $41.31 billion, with earnings per share at an impressive $4.44. This outperformance is notable especially given the broader banking sector's challenges with fluctuating interest rates and regulatory changes.

Strategic Growth Initiatives

A key aspect of JPMorgan's strategy is its diversification into high-growth areas like alternative investments and private credit, with ambitions to expand assets under management significantly. This forward-thinking approach is designed to cushion the bank against downturns in traditional banking sectors and capitalize on emerging financial trends.

Operational Efficiency

JPMorgan's operational efficiency has seen significant improvements, demonstrated by a reduction in its efficiency ratio to 60.9%, down from nearly 70% in previous years. This indicates more effective cost management and profitability from operations, a critical factor when assessing a bank's long-term viability.

Market Position and Valuation

JPMorgan's stock is trading at a P/E ratio of 11.21, which is slightly above historical norms but still reasonable given the bank's robust earnings growth and strategic market positioning. With a market cap of approximately $533.63 billion, JPMorgan is a leading figure in the financial sector, reflecting stability and strength.

Dividend Yield and Growth Prospects

The bank offers a forward dividend yield of 2.48%, underpinning a commitment to returning value to shareholders. This yield, combined with a strong history of dividend growth, makes it an attractive option for income-focused investors.

Investment Recommendation: Buy (Bullish Outlook)

Rationale:

Given JPMorgan's impressive quarterly performance, strategic diversification, and enhanced operational efficiencies, the recommendation is a buy. The bank's proactive strategy in expanding into less cyclical, high-growth financial sectors positions it well to capitalize on new market opportunities. Additionally, its strong fundamentals, consistent dividend growth, and reasonable valuation relative to its earnings growth potential suggest that JPMorgan offers a promising investment opportunity.

Investors should consider JPMorgan not only as a stable dividend-paying stock but also as a growth-oriented investment, thanks to its ventures into innovative financial services and technologies like AI and blockchain. These initiatives are likely to drive significant value over the long term, making JPMorgan a solid choice for those looking to benefit from both capital appreciation and dividends.

Final Thoughts:

Investors bullish on the financial sector and seeking a mix of growth and stability in a still-volatile economic environment will find JPMorgan an attractive buy. The bank's robust financial health, strategic innovation, and strong market presence provide a buffer against potential downturns and position it for further growth as global financial markets evolve. For real-time stock analysis and updates, investors are encouraged to keep an eye on JPMorgan’s profile on platforms like Trading News.