Labour Party's Election Victory Sparks Concerns for UK Oil Industry Amid Global Market Dynamics

As the Labour Party proposes stricter regulations on oil and gas profits, the global market sees steady oil prices driven by summer demand and geopolitical influences | That's TradingNEWS

UK Oil Industry Faces Uncertainty Amid Labour Party Victory

Impact of Labour Party's Landslide Win

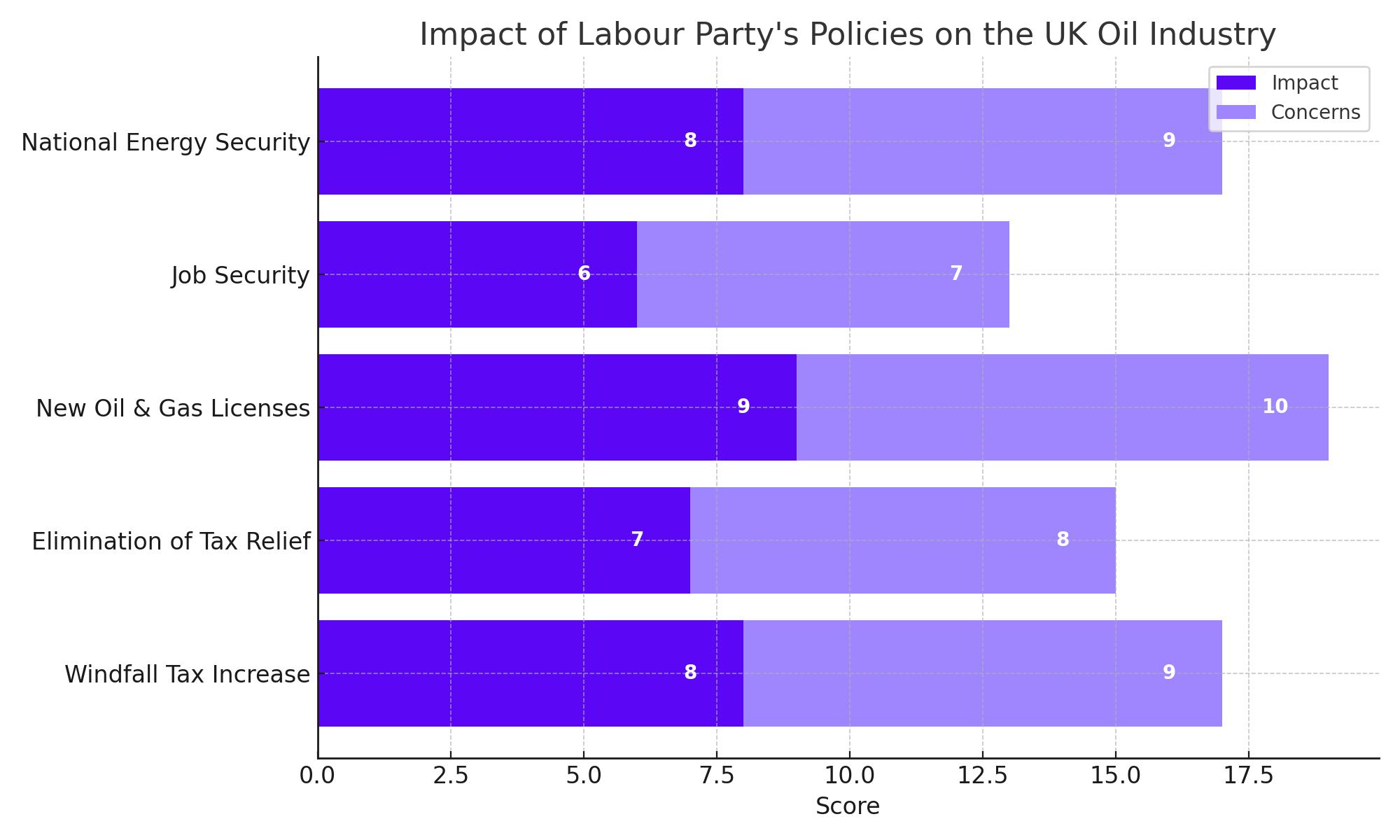

The Labour Party’s landslide victory in the UK election has sent shockwaves through the oil and gas industry. Winning more than 400 seats in Parliament, Labour’s triumph ends 14 years of Conservative rule and raises significant concerns for the UK oil and gas sector. The party has pledged to raise the already high windfall tax on oil and gas profits in the North Sea and eliminate tax relief for investments in oil and gas assets. These proposed changes could disrupt operations and employment within the industry.

David Whitehouse, CEO of Offshore Energies UK (OEUK), emphasized the importance of government engagement with the energy sector to ensure a smooth energy transition. He highlighted that poorly managed Labour policies could lead to job losses and economic instability. Last month, Whitehouse expressed concerns over Labour’s proposal to end new oil and gas licenses, stressing the need for continued investment and new licenses to secure energy jobs and national energy security.

Current Oil Price Trends and Influencing Factors

Oil prices have steadied near their highest levels since late April, driven by strong summer fuel demand and supply concerns. Brent crude futures rose to $87.51 per barrel, while U.S. West Texas Intermediate (WTI) crude futures reached $83.98. This price stability is attributed to strong U.S. summer demand and a significant draw in U.S. crude inventories, reported at 12.2 million barrels, far exceeding analyst expectations of a 700,000-barrel draw.

Additionally, geopolitical factors are influencing oil prices. Russian oil producers Rosneft and Lukoil are expected to make sharp cuts to oil exports from the Black Sea port of Novorossiisk in July. This potential reduction in supply is seen as a positive signal for the forecasted supply deficit in the third quarter, though analysts remain cautious about Russia's adherence to production quotas.

Brent Oil Price Forecasts and Market Dynamics

Analysts at BMI, a unit of Fitch Solutions, project that the Brent oil price will average $85 per barrel this year, with a slight decrease to $82 per barrel in 2025. These projections reflect expectations of strong summer demand offsetting softer price performance earlier in the year. However, the analysts also anticipate a potential supply surplus in the coming quarters, which could lead to downward revisions of these forecasts.

A Bloomberg Consensus included in the report aligns closely with these projections, forecasting Brent prices at $84 per barrel for this year and gradually decreasing to $72 per barrel by 2028. This consensus underscores a cautious market outlook, influenced by global economic growth concerns and the potential return of OPEC+ production to the market.

Challenges in the UK and Global Oil Markets

In the UK, energy executives are challenging the Ministry of Energy's proposed amendments to control oil prices, arguing that it could lead to long-term oil shortages and increased fossil fuel consumption. The proposed regulatory changes aim to reduce energy costs for households and businesses but have raised concerns about market disruptions and potential losses for retailers.

Globally, Saudi Aramco has cut prices for its flagship Arab Light crude to Asia, reflecting ongoing demand softness in the region. Conversely, prices for Northwest Europe and the Mediterranean have been raised, indicating regional demand variations.

Brent Price Dynamics and Future Projections

The Brent price has rebounded from a low of $77.5 per barrel in early June to around $86 per barrel, driven by firmer fundamentals and improved market sentiment. Seasonal increases in global oil demand and reduced exports from key exporters like OPEC+ countries are contributing to this rebound. Analysts at Standard Chartered project that Brent prices could sustain well past $90 per barrel, given the anticipated supply deficits in the third and fourth quarters.

Technical Indicators and Market Sentiment

Technical indicators suggest that the recent rally in Brent prices may continue. The term structure has strengthened, with backwardation deepening at the front end of the futures curve. This indicates a tightening physical supply and demand balance. Data from the Commodity Futures Trading Commission shows an increase in long positions held by managed money in Brent, although the overall ratio remains low historically.

Market sentiment remains cautious due to a lackluster global economic growth outlook and the expected return of cut OPEC+ barrels to the market in October. Despite this, the recent improvement in fundamentals and technical indicators supports a bullish outlook for Brent prices in the short term.

Conclusion

The UK oil industry is navigating significant challenges amid the Labour Party's election victory and proposed regulatory changes. Globally, oil prices are supported by strong summer demand and geopolitical supply concerns, with Brent prices showing potential for further gains. Analysts project a cautious but generally positive outlook for Brent prices, tempered by economic growth concerns and potential supply increases. Investors and industry stakeholders should closely monitor these developments to navigate the evolving market landscape effectively.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex