Libya’s Oil Crisis and Iraq’s Cuts Ignite Global Price Surge

Geopolitical Tensions and Strategic Moves Propel Oil Prices Amid Fears of Supply Shortages | That's TradingNEWS

Libya's Oil Production Disruption: Impact and Implications

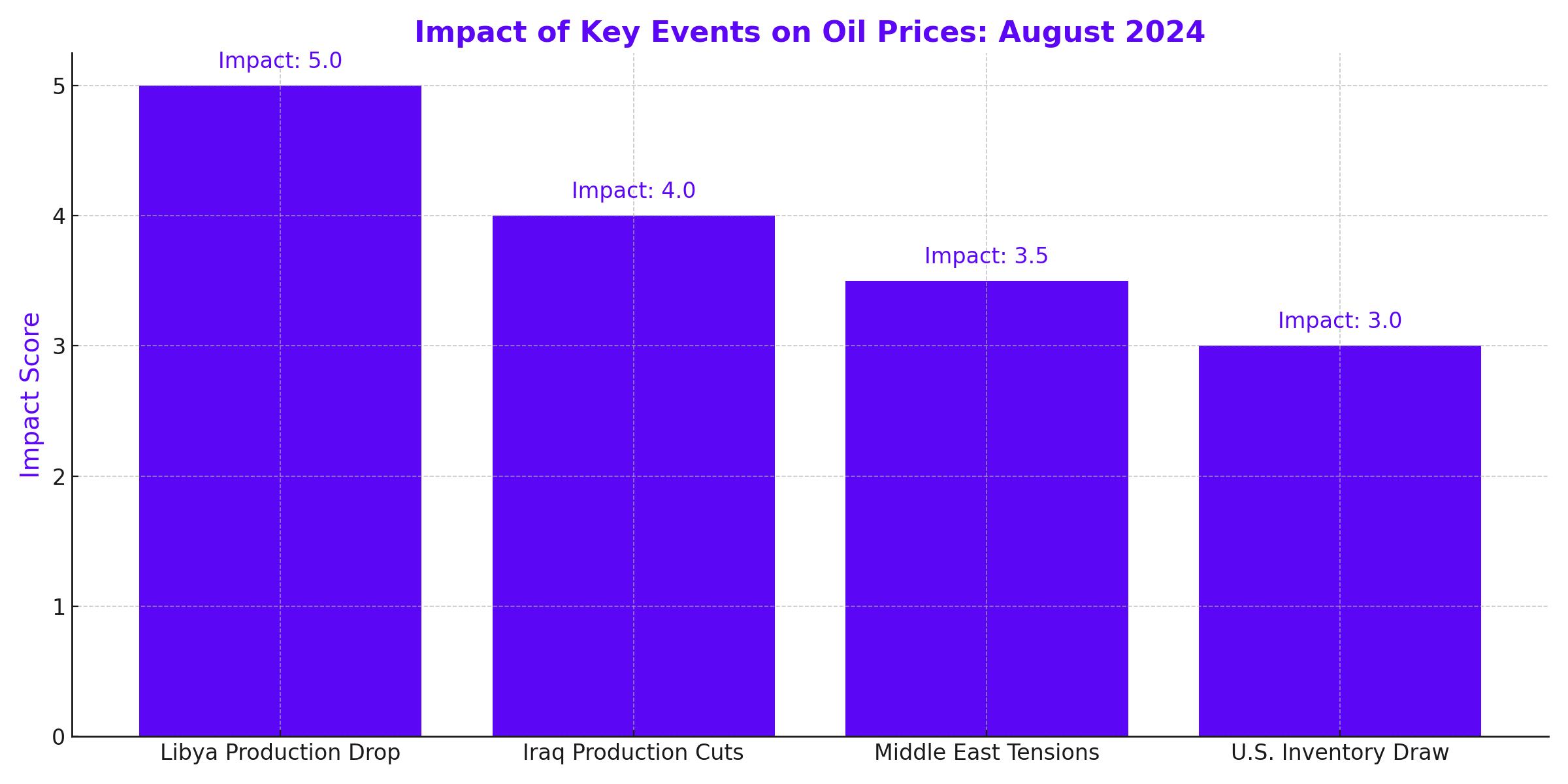

Oil prices experienced a modest uptick on Friday, driven by concerns over global supply disruptions, particularly due to the shutdown of key oil fields in Libya. The Libyan National Oil Corp. reported that the abrupt halt in production, ordered by the eastern government, has resulted in significant losses exceeding $120 million within just three days. As of Wednesday, oil production in Libya plummeted from nearly 1.3 million barrels per day to a mere 591,024 barrels. The political standoff that triggered this crisis underscores the fragility of Libya's oil sector, a crucial member of the Organization of the Petroleum Exporting Countries (OPEC), which had produced 1.18 million barrels per day in July.

Iraq's Strategic Production Cuts and Their Effect on Global Markets

In a parallel development, Iraq has announced plans to reduce its oil production starting in September, aligning with OPEC's broader strategy to manage global supply. Iraq's output is set to decrease to between 3.85 million and 3.9 million barrels per day, a significant reduction from the 4.25 million barrels per day reported in July. This decision is expected to tighten global supply further, especially as the market grapples with the ongoing disruptions in Libya.

Geopolitical Tensions in the Middle East and Their Influence on Oil Prices

The oil market's volatility has been further exacerbated by geopolitical tensions in the Middle East, particularly following the recent conflicts involving Yemen's Houthi group targeting oil tankers in the Red Sea. The UN has welcomed reports of rescue operations for the Greek-flagged oil tanker MV Sounion, which was stranded due to these hostilities. The Red Sea, a critical corridor for global oil shipments, remains under threat from these conflicts, adding another layer of uncertainty to the global oil supply chain.

Market Response and Price Movements

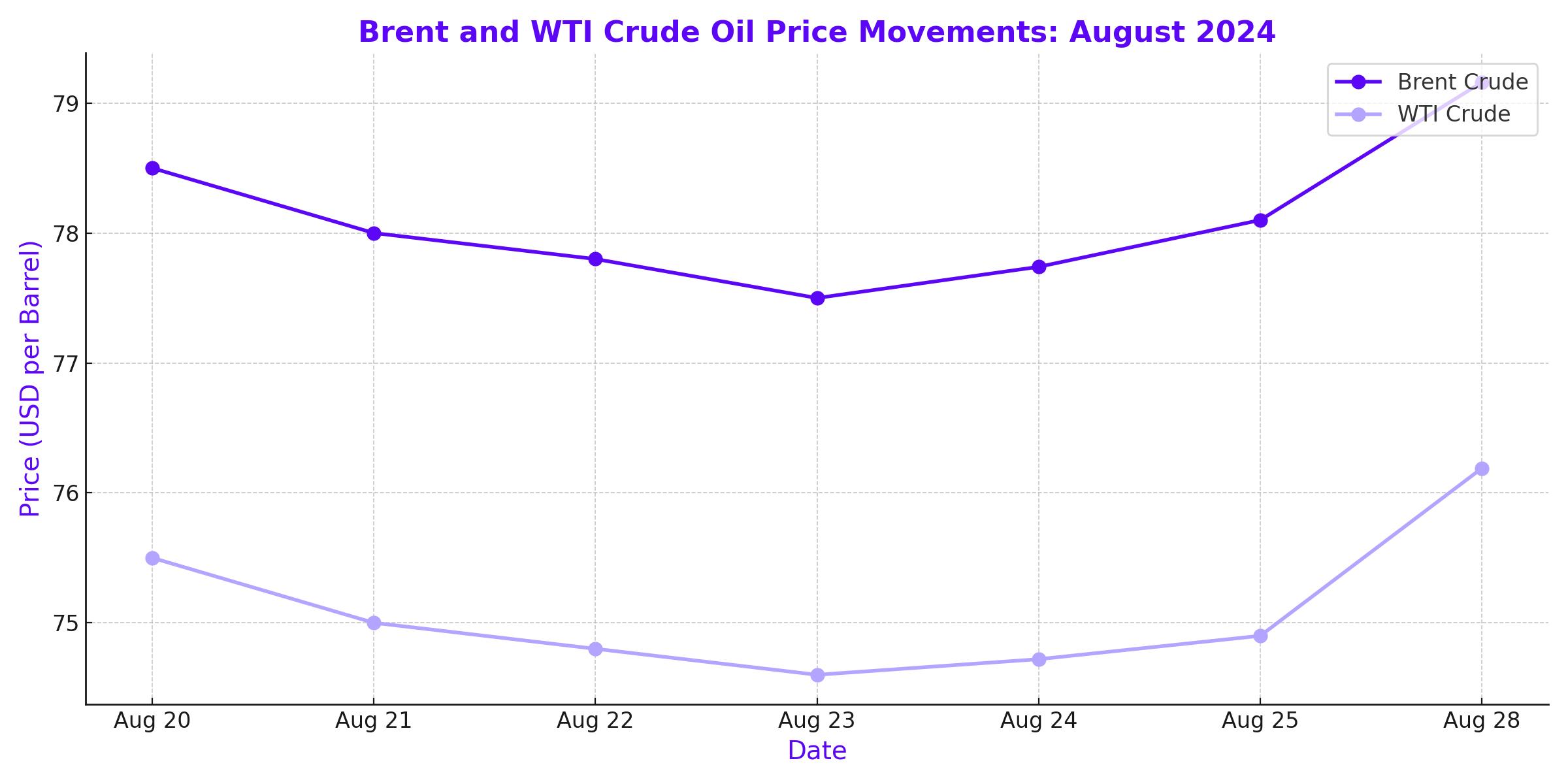

Following these developments, Brent crude rose by 0.43% to $79.16 per barrel, while West Texas Intermediate (WTI) increased by 0.37% to $76.19 per barrel. These price movements reflect the market's sensitivity to supply-side disruptions, particularly from OPEC members like Libya and Iraq. However, the broader market sentiment remains cautious as analysts continue to weigh the impact of these disruptions against ongoing concerns over weak demand, particularly from China and Europe.

U.S. Economic Data and Oil Inventory Dynamics

U.S. crude inventories also played a role in shaping the week's oil market dynamics. The latest data revealed a drawdown of 846,000 barrels, bringing total stockpiles to 425.2 million barrels. While this was smaller than the anticipated 2.3 million barrel reduction, it nonetheless supported prices amidst the backdrop of supply concerns. Yet, the overall effect on the market has been tempered by persistent worries over global demand, especially given weak economic indicators from China, the world's largest oil importer.

Analysts' Outlook: Balancing Supply Disruptions and Demand Concerns

Looking ahead, analysts have adjusted their 2024 oil price forecasts downward, citing weaker-than-expected demand and rising inventory levels. A Reuters poll of 37 analysts and economists now projects Brent crude to average $82.86 per barrel in 2024, down from previous estimates. Similarly, U.S. crude is expected to average $78.82 per barrel. Despite the current supply disruptions, the overarching narrative in the oil market is one of caution, as the potential for a slowdown in global economic activity looms large.

Future Market Trajectory: Strategic Considerations for Investors

As the market continues to navigate these turbulent waters, investors must consider the delicate balance between supply-side risks and demand-side weaknesses. While geopolitical events in Libya and Iraq are likely to keep oil prices supported in the near term, the longer-term outlook remains clouded by uncertainties, particularly surrounding global economic growth and energy demand. For those invested in the oil sector, staying attuned to these developments will be crucial in making informed decisions about future positioning.

This evolving scenario in the oil markets, shaped by a complex interplay of geopolitical risks and economic factors, underscores the importance of a strategic and well-informed approach to investing in this volatile sector. Investors should closely monitor ongoing developments, particularly in key OPEC member states like Libya and Iraq, as well as broader macroeconomic indicators that could signal shifts in global demand dynamics.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex