Lululemon’s Resurgence and Key Market Dynamics: Analyzing NASDAQ:LULU's Growth and Challenges

Lululemon Athletica Inc. (NASDAQ:LULU) has captured investor attention with its dynamic performance across international and domestic markets. Following the release of Q3 earnings, which surpassed expectations, LULU stock saw a significant 16% surge. Despite these gains, the company faces a nuanced landscape marked by regional growth disparities, evolving consumer preferences, and fierce competition. Let’s dissect the critical elements shaping LULU’s trajectory while evaluating its current valuation and market potential.

Q3 Earnings Performance: Robust Growth but Lingering Challenges

Lululemon posted Q3 revenue of $2.4 billion, a 9% increase from $2.2 billion a year earlier, beating analyst expectations of $2.36 billion. Earnings per share also exceeded projections, rising to $2.87 from $2.53 the prior year. Gross margins improved sequentially by 150 basis points, reaching 58.5%. However, the North American market saw same-store sales drop by 2%, contrasting with a 25% increase internationally.

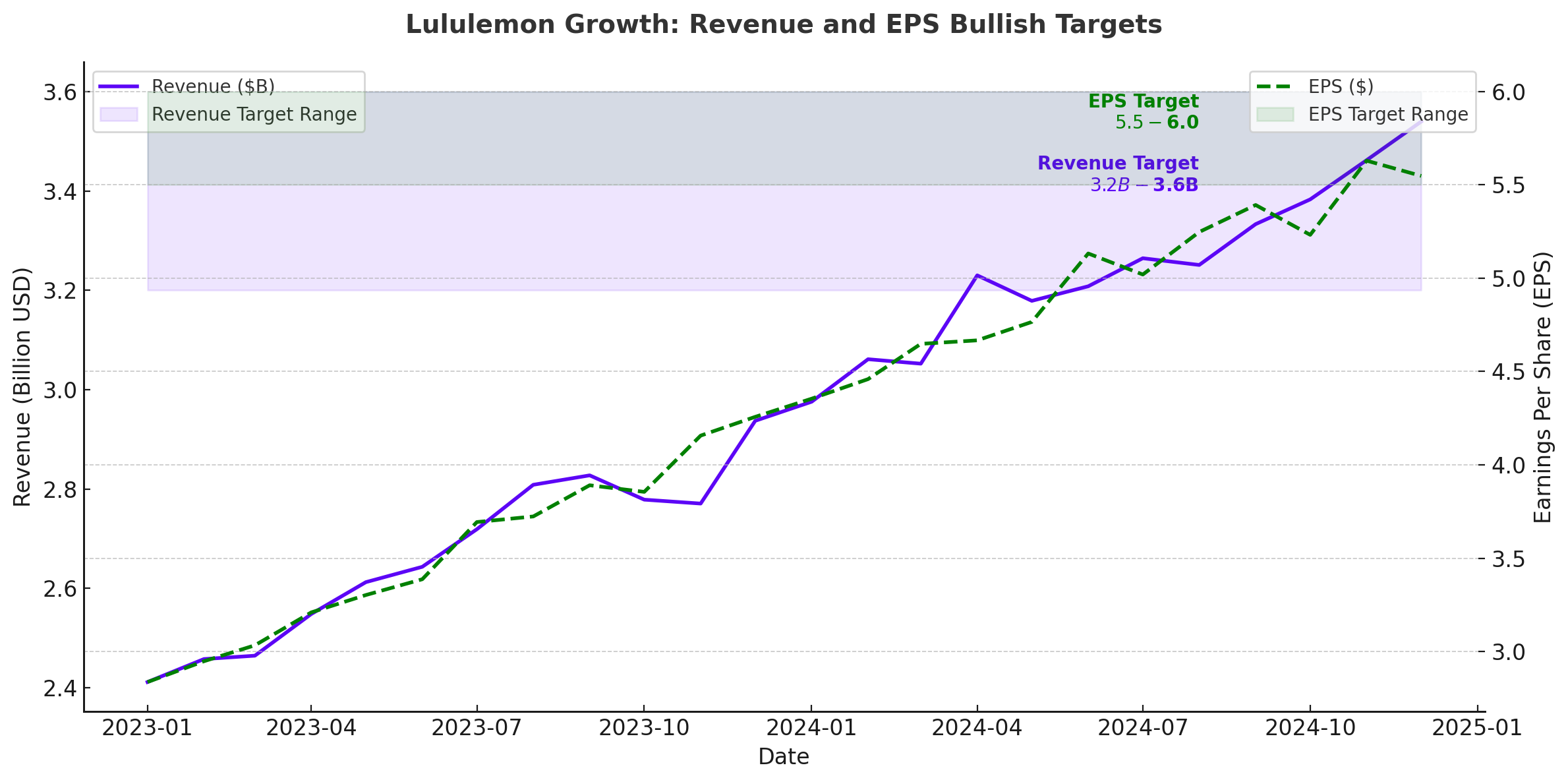

For the fourth quarter, Lululemon provided guidance of $3.48 billion to $3.51 billion in revenue, aligning with the anticipated 9% growth. Earnings per share for Q4 are expected between $5.56 and $5.64, slightly below the $5.70 consensus. The company also raised its full-year revenue guidance to a range of $10.45 billion to $10.49 billion, projecting EPS between $14.08 and $14.16.

North America: A Stagnant Market in Transition

North America remains Lululemon’s largest revenue driver, accounting for approximately 60% of total sales. However, this market has been increasingly challenged, with same-store sales falling 2% during Q3, reflecting a continued softness in consumer demand and heightened competition. Over the past year, Lululemon has struggled with product missteps in the women’s category, contributing to slower growth.

CEO Calvin McDonald has expressed optimism about regaining momentum in North America, emphasizing improvements in inventory management and product "newness." The company aims to address these challenges through a revamped product pipeline, including innovations in the women’s category and a strategic push in menswear, which grew 11% in Q3.

International Markets: The Bright Spot for Growth

Lululemon’s international markets, led by China, have been the primary drivers of growth. In Q3, international revenue grew by 33%, with the China Mainland segment recording a remarkable 25% sales increase. This strong performance is underpinned by localized marketing efforts, brand collaborations, and an expanding store footprint.

China remains a relatively untapped market for Lululemon, with 132 stores compared to 400+ in the United States. The company plans to open 25–35 additional stores in China in 2024, signaling confidence in the region’s long-term potential. However, challenges such as declining consumer confidence and high return rates during sales events like "Double 11" indicate potential headwinds.

Evolving Consumer Preferences and Competitive Pressure

The athleisure market is becoming increasingly crowded, with brands like Vuori and Alo Yoga gaining traction. Legacy players such as Nike and Adidas have also intensified competition. Lululemon’s ability to differentiate itself lies in its strong brand identity and focus on innovation.

In the women's category, which represents 62% of Lululemon’s revenue, the company has introduced updates to its iconic Wunder Under leggings and Chargefeel footwear to reinvigorate consumer interest. Meanwhile, the men's category continues to show promise, with plans to double revenue in this segment by 2026.

Profitability and Shareholder Value

Lululemon has demonstrated strong profitability metrics, with Q3 operating income growing 12% year-over-year to $540 million. Free cash flow remains robust at $13.50 per share over the past 12 months, enabling the company to fund strategic initiatives and shareholder returns.

The company approved a $1 billion increase to its stock buyback program in December, bringing the total remaining authorization to $1.8 billion. This move reflects confidence in its financial position and commitment to enhancing shareholder value.

Valuation: Assessing Upside Potential

LULU currently trades at a forward P/E of 24.35, below its 5-year average of 30x. This discount reflects tempered expectations due to slower growth in North America and macroeconomic uncertainties. The stock appears undervalued, especially given its strong international momentum and profitability metrics.

Assuming FY26 EPS of $17.47, discounted to $14.98 at an 8% rate, and applying a 25x P/E multiple, the fair value for LULU stock is approximately $381, representing a 20% upside from current levels near $320.

Hidden Upside: Unlocking International and Digital Growth

Lululemon’s untapped potential in international markets and digital channels presents a significant opportunity for growth. The company aims to quadruple its international revenue by 2026 as part of its "Power of Three x 2" strategy. Digital sales, which currently contribute 38% to total revenue, are expected to double during the same period.

This dual-pronged approach could add over $2 billion in incremental revenue, translating to approximately 15% annualized growth in these segments. Such expansion would help offset challenges in North America while diversifying the company’s revenue base.

Conclusion

Lululemon’s stock presents a compelling opportunity despite its challenges in North America. The company’s strong international growth, product innovation, and profitability metrics position it for sustained success. While competition remains a key risk, Lululemon’s focus on differentiation and execution provides a clear path to achieving its FY26 revenue target of $12.5 billion. With a fair value estimate of $381, LULU offers meaningful upside potential for investors willing to navigate near-term volatility.