Marvell Technology (NASDAQ:MRVL): AI Boom Fuels 98% Data Center Revenue Growth

Trading at $112, Marvell's AI and data center strategy positions shares for a $159 price target, supported by a 19% revenue jump and expanding partnerships with hyperscalers like AWS | That's TradingNEWS

Marvell Technology (NASDAQ:MRVL): Positioned for AI Growth Amid High Expectations

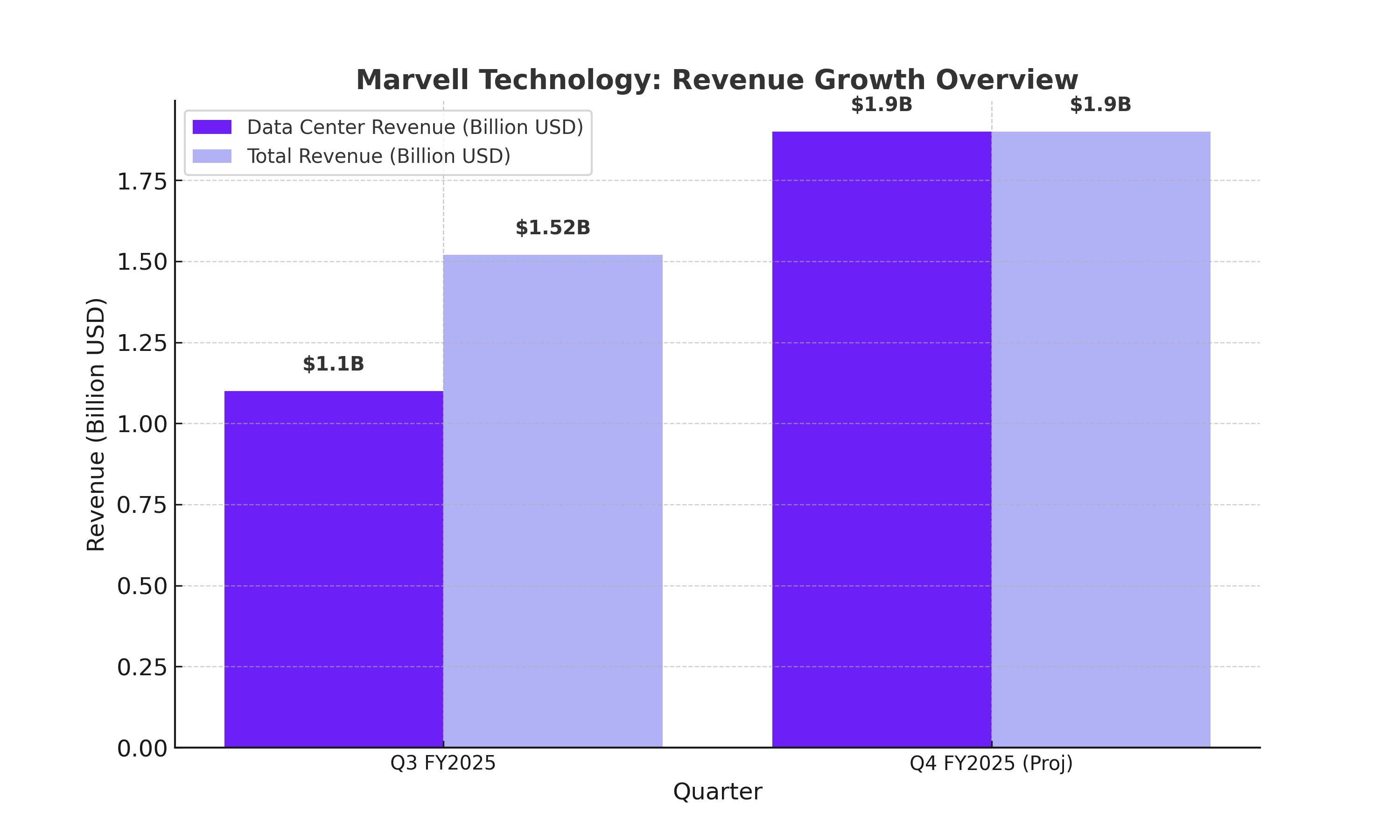

Marvell Technology (NASDAQ:MRVL), trading at approximately $112 per share, has emerged as a critical player in the AI-driven semiconductor space. In Q3 FY2025, the company reported data center revenues surging by 98% year-over-year to $1.1 billion, driven by strong demand for AI custom silicon and networking solutions. Marvell's alignment with the AI growth trajectory and its deepening ties with major hyperscalers solidify its leadership in this transformative industry.

AI-Custom Silicon Leads Revenue Surge

Marvell's strategic focus on custom application-specific integrated circuits (ASICs) has propelled its AI segment. These custom-built chips for AI workloads are increasingly sought after by hyperscalers such as Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Google (NASDAQ:GOOGL). Marvell's expanded partnership with Amazon Web Services (AWS), announced as a five-year, multi-generational agreement, underscores its strong positioning in this market. This collaboration not only ensures Marvell’s foothold in the data center ecosystem but also advances its silicon design capabilities through AWS’s cloud-based tools.

In Q3, Marvell’s total revenue reached $1.52 billion, up 19% quarter-over-quarter. The data center segment accounted for the bulk of this growth, with custom ASIC programs and optical networking products driving demand. For Q4 FY2025, management forecasts revenues to grow by another 19% quarter-over-quarter to $1.9 billion, with data center sales projected to increase by 20-25%. This performance has exceeded consensus expectations and positions Marvell as a dominant force in AI infrastructure.

Broader Market Recovery Supports Growth

Beyond data centers, Marvell is experiencing sequential improvements across its enterprise networking and carrier infrastructure segments. While enterprise networking revenues remained flat quarter-over-quarter, carrier infrastructure grew 12% sequentially in Q3 FY2025. Management expects continued recovery in these markets into Q4 FY2025, further supporting the company’s growth trajectory. Automotive and industrial markets are also showing signs of stabilization, with modest sequential growth expected in the near term. However, consumer-related sales remain weak, declining by 15% quarter-over-quarter due to seasonal gaming demand softness.

Strong Product Pipeline Enhances Market Position

Marvell's investments in advanced silicon technologies continue to bear fruit. The company has ramped up production of its 800G PAM DSPs, launched its first 1.6T PAM DSP based on 5nm technology, and announced plans for a 3nm 1.6T DSP offering 20% greater power efficiency. These innovations are set to capture a larger share of the high-performance networking and AI markets. Marvell’s custom AI silicon and networking chips, designed to meet the needs of hyperscalers, position the company for significant market share gains in 2025 and beyond.

Valuation and Market Sentiment

Despite its growth prospects, Marvell’s valuation reflects high expectations. The stock trades at a forward P/E of 43.71x and EV/Sales of 18.71x, above the semiconductor industry average. However, this premium is consistent with its exposure to the AI growth cycle. Compared to Broadcom (NASDAQ:AVGO), which trades at an EV/Sales multiple of 22.88x, Marvell remains relatively attractively priced given its AI-related opportunities.

Analysts are overwhelmingly bullish on Marvell, with 34 out of 36 rating the stock as a buy. Price targets range from $118 to $125, implying a 5-11% upside from current levels. Wall Street’s optimism is fueled by Marvell’s ability to exceed revenue and AI growth targets for FY2025.

Restructuring to Drive Long-Term Profitability

In Q3 FY2025, Marvell recorded a $715.1 million restructuring charge as it sharpened its focus on high-growth markets such as data centers and AI. These non-cash charges primarily related to impairments in its enterprise and carrier portfolios. Management has emphasized that this strategic realignment will enhance operational leverage and scalability, with GAAP profitability expected to resume in Q4 FY2025.

Marvell also aims to reduce stock-based compensation as a percentage of revenue, reflecting its commitment to cost discipline. The firm ended Q3 FY2025 with $868 million in cash and $4.1 billion in total debt, resulting in a net debt-to-adjusted EBITDA ratio of 1.76x, a slight improvement from the prior quarter.

Challenges and Risks

While Marvell’s custom AI silicon programs offer substantial growth potential, they come with higher production costs, which could compress gross margins. Additionally, the consumer market remains a weak spot, and broader macroeconomic uncertainties could weigh on recovery in automotive and industrial markets. Competition from Broadcom, Nvidia (NASDAQ:NVDA), and other semiconductor giants remains intense, requiring flawless execution from Marvell.

Outlook and Recommendations

Looking ahead, Marvell is poised for continued outperformance, with data center revenues driving growth in FY2026. Management’s projections for mid-20% sequential growth in Q4 FY2025, along with the ramp-up of AI-related products, reflect strong demand trends. Valuation models suggest a price target of $159 per share, based on a 40.36x FY2026 EV/EBITDA multiple, aligning Marvell with premium players like Nvidia.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex