In-Depth Analysis of MercadoLibre, Inc. (NASDAQ: MELI)

NASDAQ: MELI - A Financial Deep Dive into MercadoLibre, Inc.

The E-Commerce Giant in Latin America: MercadoLibre's Growth Trajectory and Market Dominance

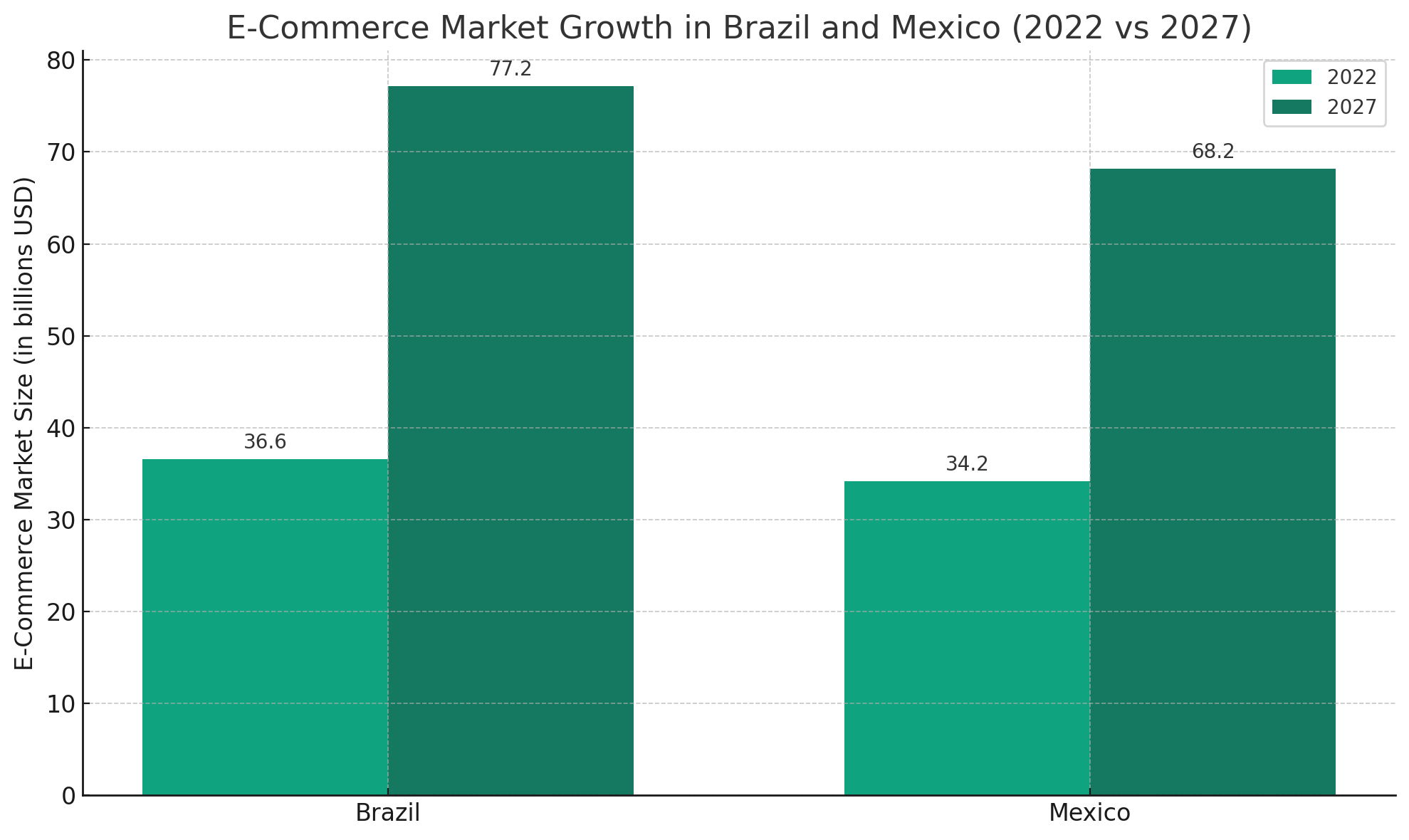

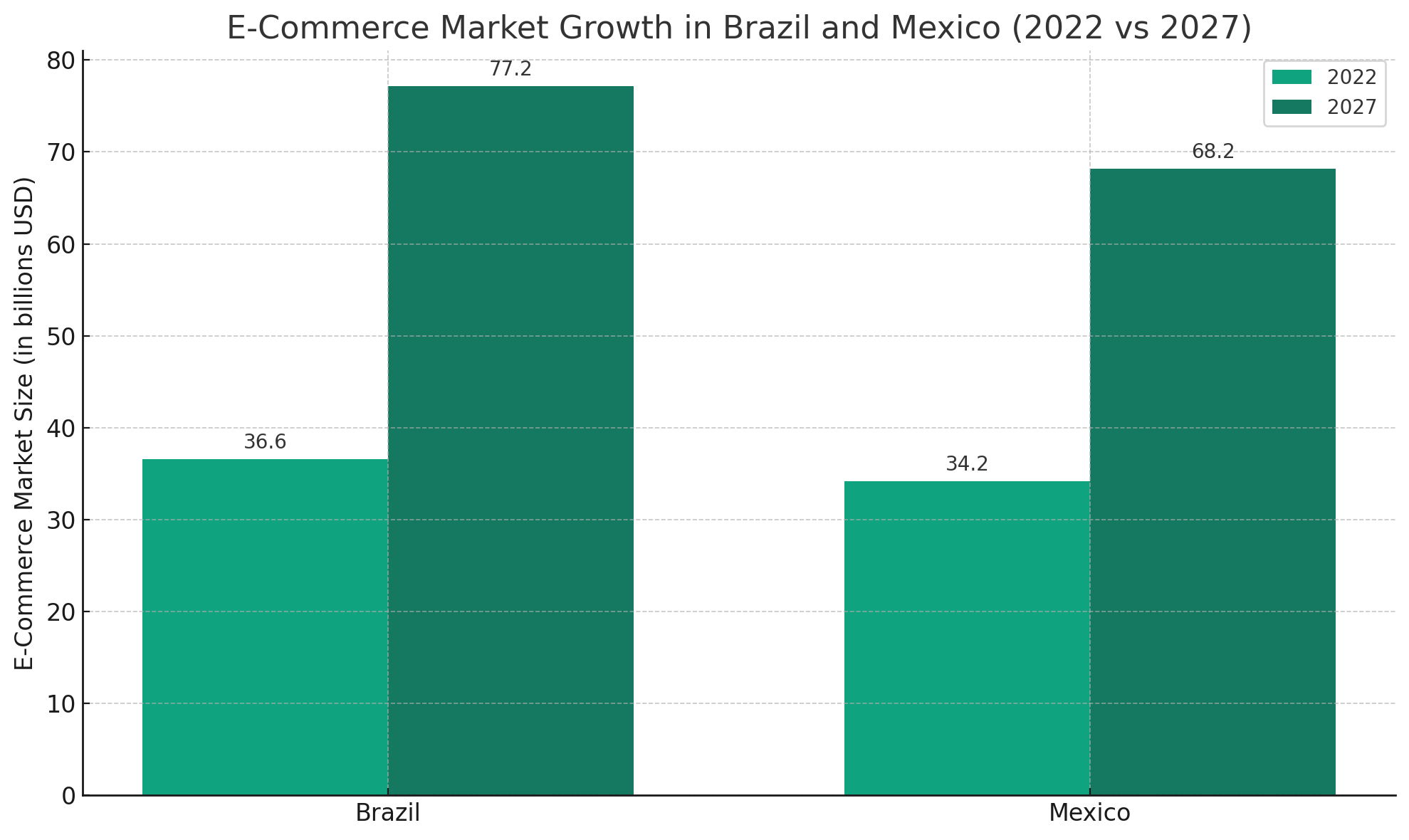

MercadoLibre, Inc. (NASDAQ: MELI), often hailed as the Amazon of Latin America, has witnessed a significant transformation in its market presence and financial performance. As a leading e-commerce platform, MercadoLibre has expanded its footprint in key Latin American markets, including Brazil, Mexico, and Argentina. These regions, forming the crux of MercadoLibre's revenue, are expected to see exponential growth in e-commerce sales. For instance, Brazil's e-commerce market is projected to grow from $36.6 billion in 2022 to $77.2 billion by 2027, a 111% increase. Mexico's market is anticipated to nearly double from $34.2 billion to $68.2 billion in the same period.

Strategic Business Segments and Their Integration

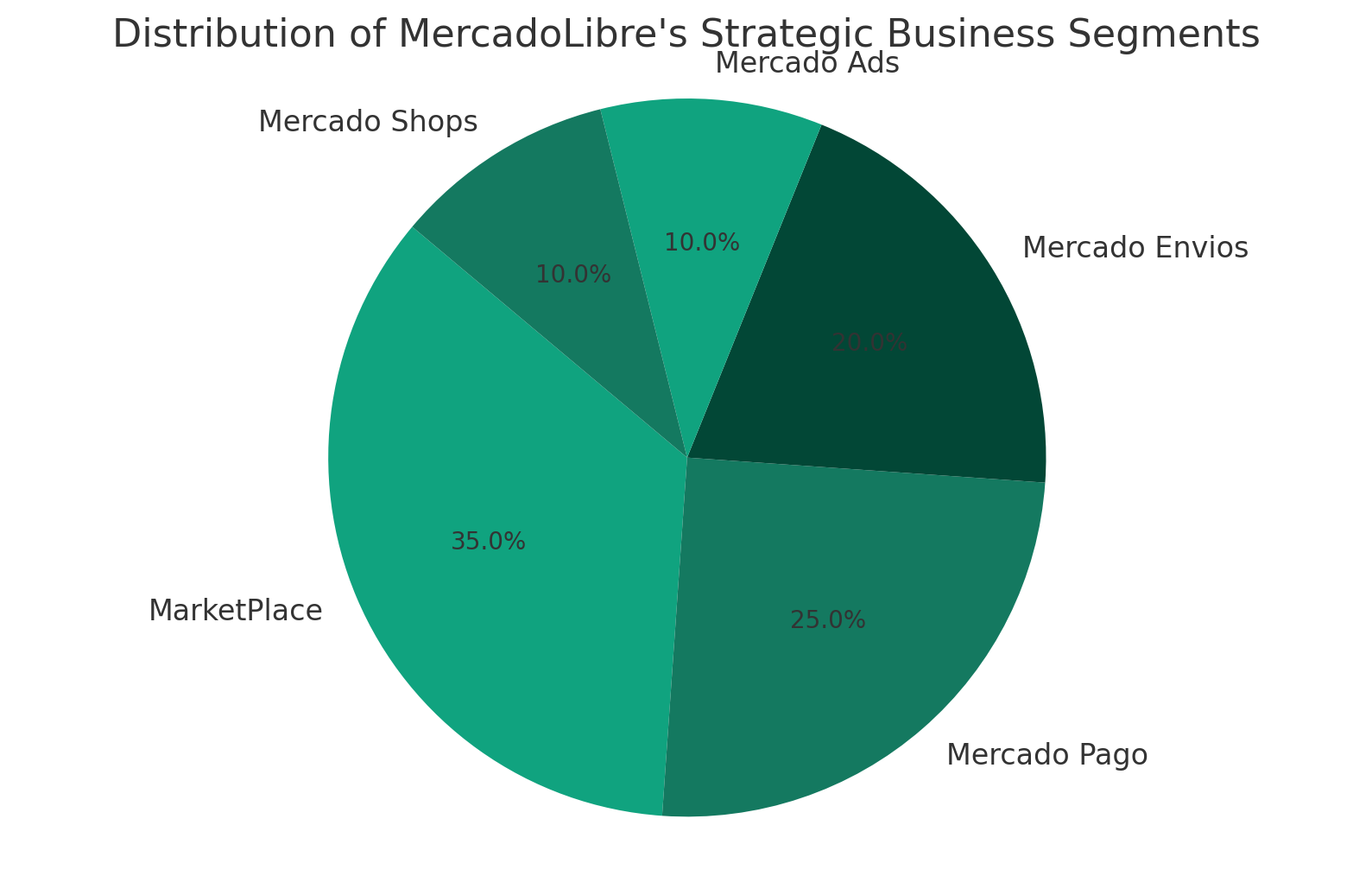

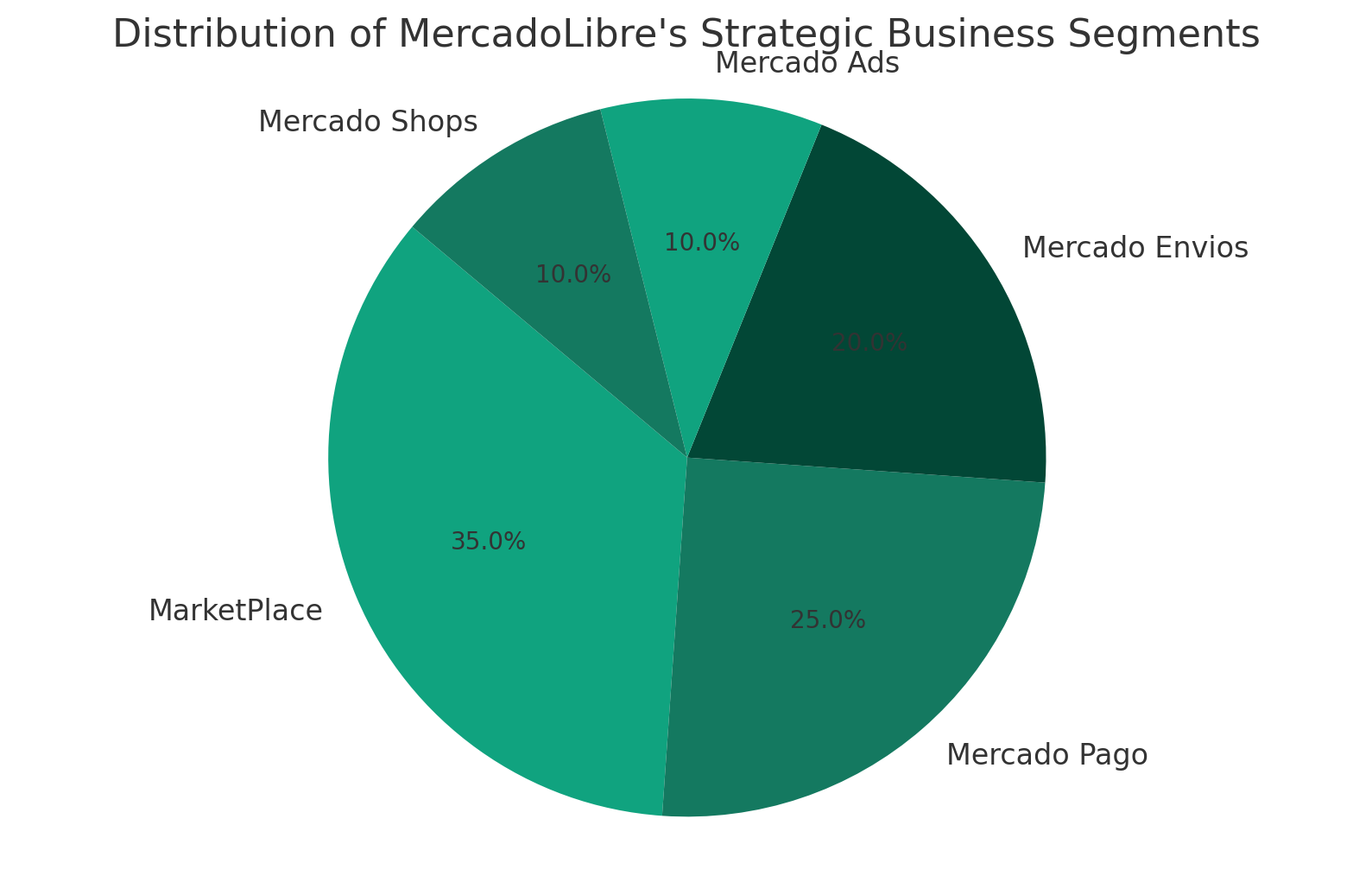

MercadoLibre's business model is multifaceted, comprising the MercadoLibre MarketPlace, Mercado Pago (digital payment platform), Mercado Envios logistics, Mercado Ads, and Mercado Shops. Each segment plays a pivotal role in creating a cohesive ecosystem that attracts and retains customers, thereby boosting revenue and profitability. The company's logistics network, Mercado Envios, has been particularly effective, accounting for 48% of all shipments within its operational zones.

Financial Health and Performance

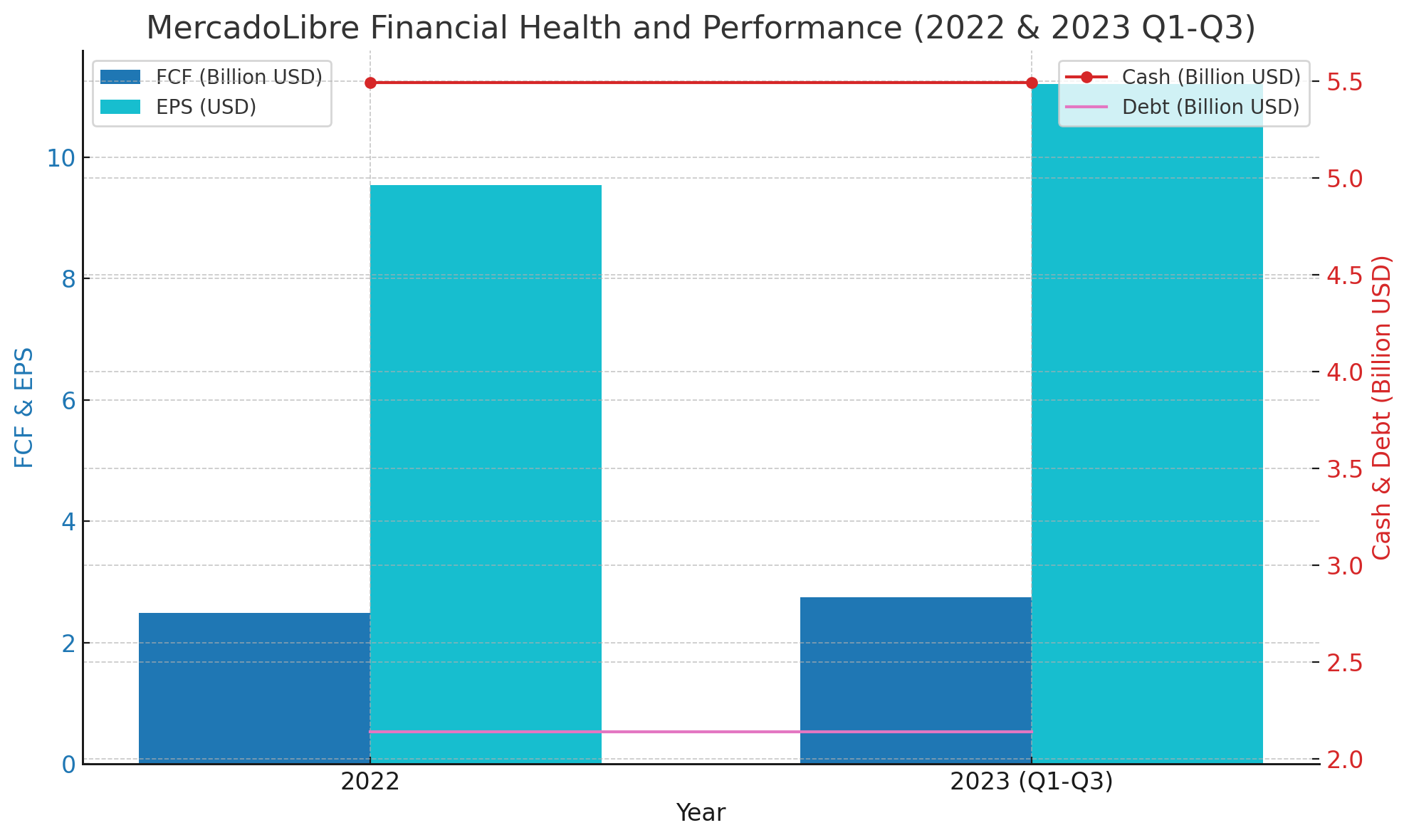

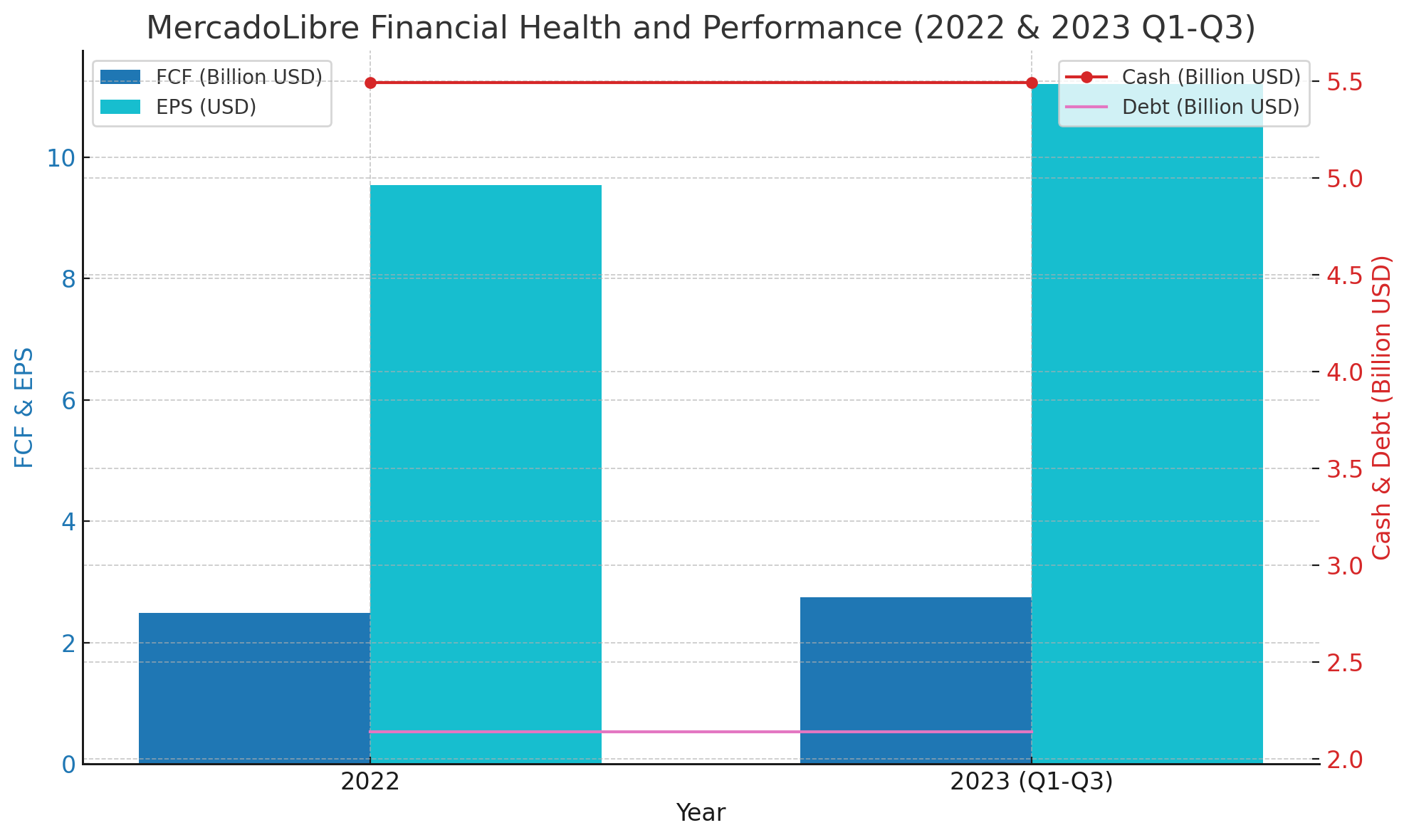

MercadoLibre's financial stability is noteworthy, with significant free cash flow (FCF) and earnings per share (EPS). The company reported over $2.49 billion in FCF and $9.54 in EPS for the full year 2022, surpassing these figures in just the first three quarters of 2023. With a robust balance sheet featuring $5.49 billion in cash and $2.14 billion in long-term debt, MercadoLibre is well-positioned to manage its financial obligations and pursue growth opportunities.

Investment Activity and Institutional Interest

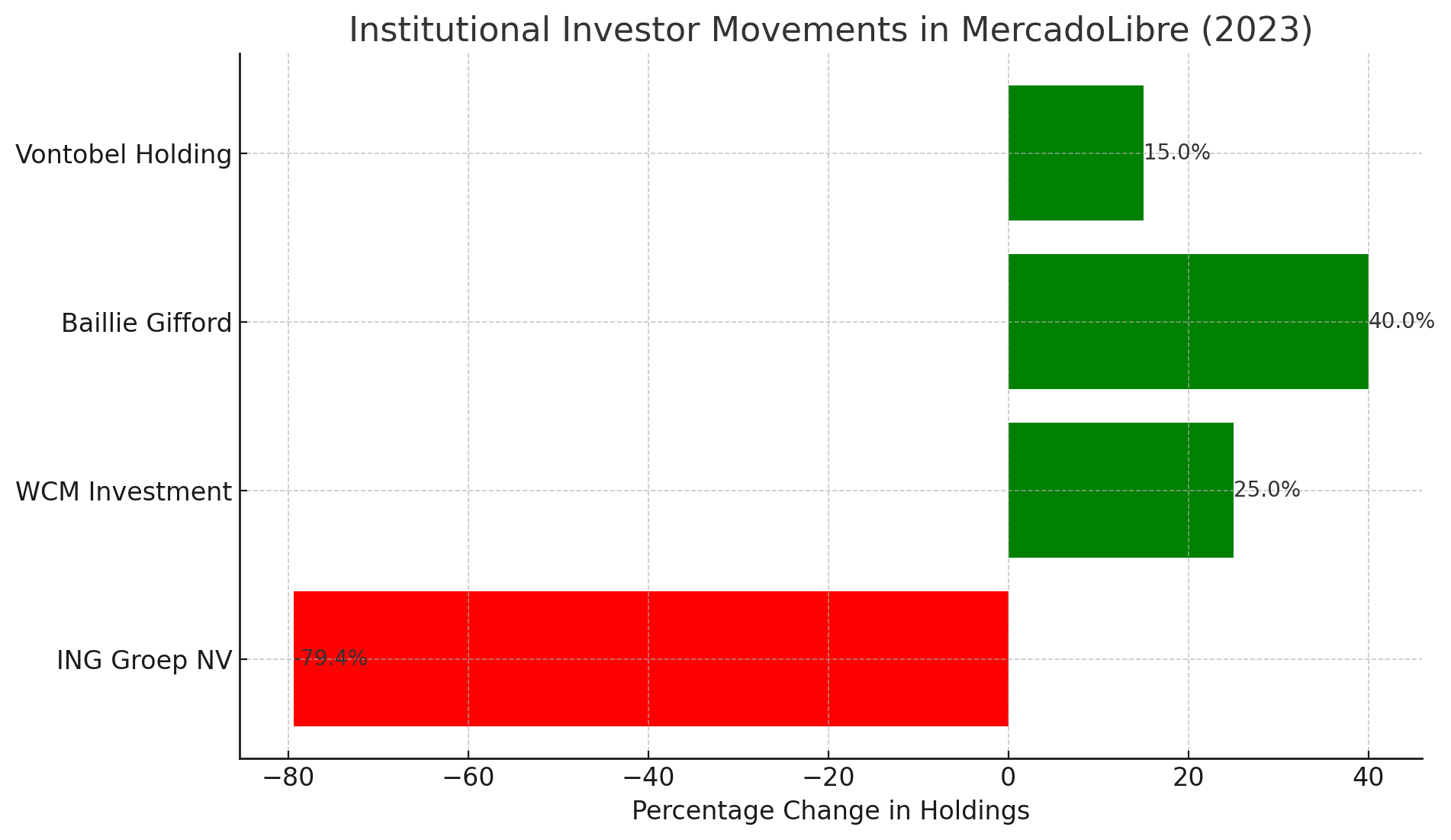

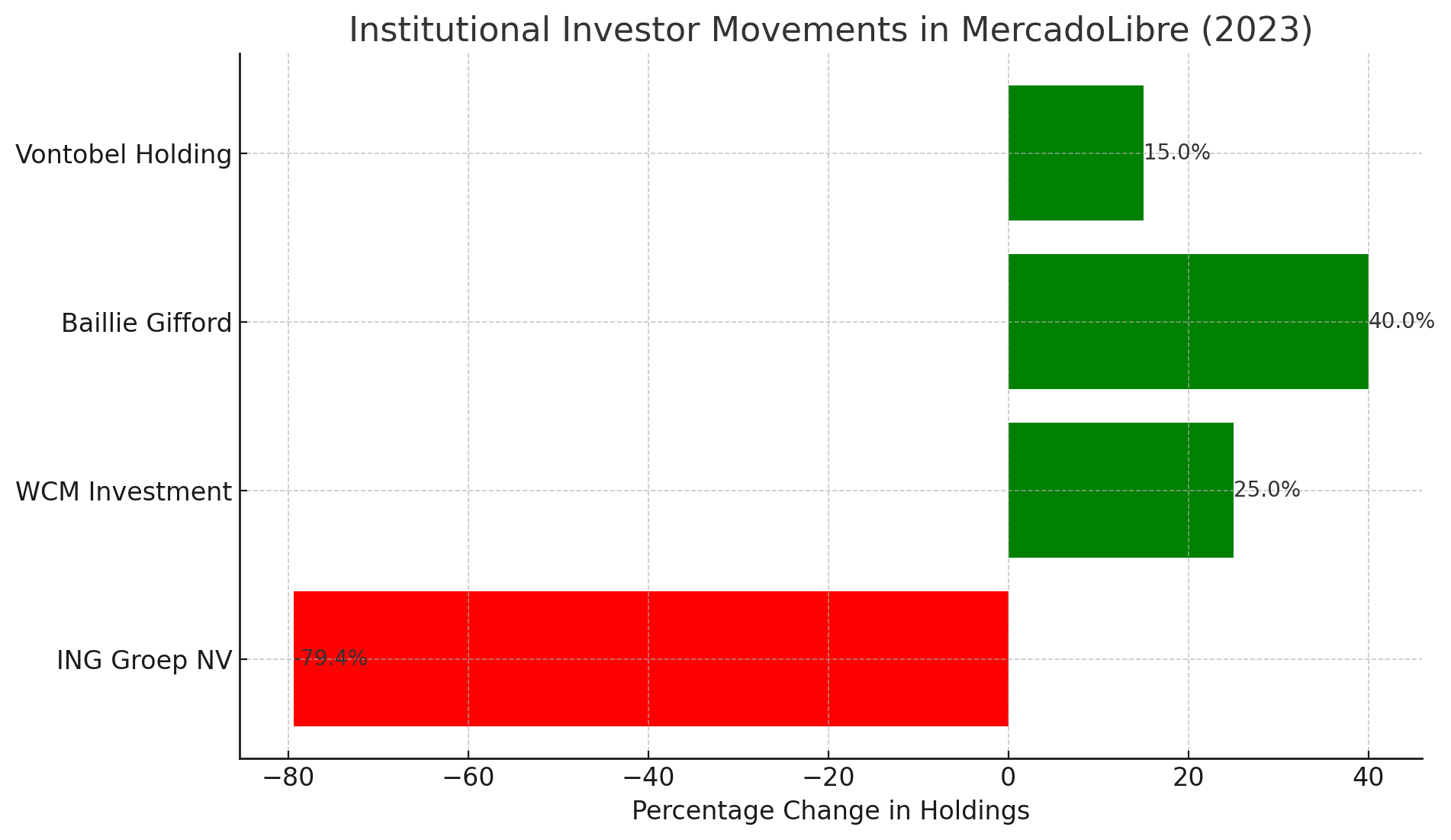

MercadoLibre has caught the attention of major institutional investors and hedge funds. Notable movements include ING Groep NV's reduction of its stake by 79.4% in the third quarter, whereas WCM Investment Management LLC, Baillie Gifford & Co., and Vontobel Holding Ltd. have significantly increased their holdings. Such varied investment activity underscores the diverse perceptions and strategies of institutional players regarding MercadoLibre's potential and risks.

Equity Analysts' Perspectives and Stock Performance

MercadoLibre's stock performance has been a subject of interest among equity analysts. Several firms, including Wedbush, Citigroup, and Bank of America, have provided optimistic price targets and ratings, reflecting confidence in the company's growth trajectory and market potential. The stock's performance, characterized by a P/E ratio of 81.46 and a PEG ratio of 0.82, indicates strong investor sentiment and expectations of continued growth.

MercadoLibre's Market Outlook and Potential Risks

MercadoLibre operates in a highly competitive e-commerce and fintech landscape, with potential challenges from global giants like Alibaba and Amazon. Additionally, the company's performance is subject to economic fluctuations and political or regulatory changes in Latin America. However, MercadoLibre's comprehensive business model and strong market position in key Latin American countries present a compelling case for its continued growth and market dominance.