Micron (NASDAQ: MU) Stock: Why This AI-Powered Stock Could Double in 2024

After a sharp decline, Micron (NASDAQ: MU) is positioned for a major comeback fueled by AI demand. Here's why now might be the perfect time to invest | That's TradingNEWS

Micron Technology (NASDAQ: MU): Navigating the Turbulent Market with Resilient AI Prospects

Sharp Decline and Unexpected Buying Opportunity

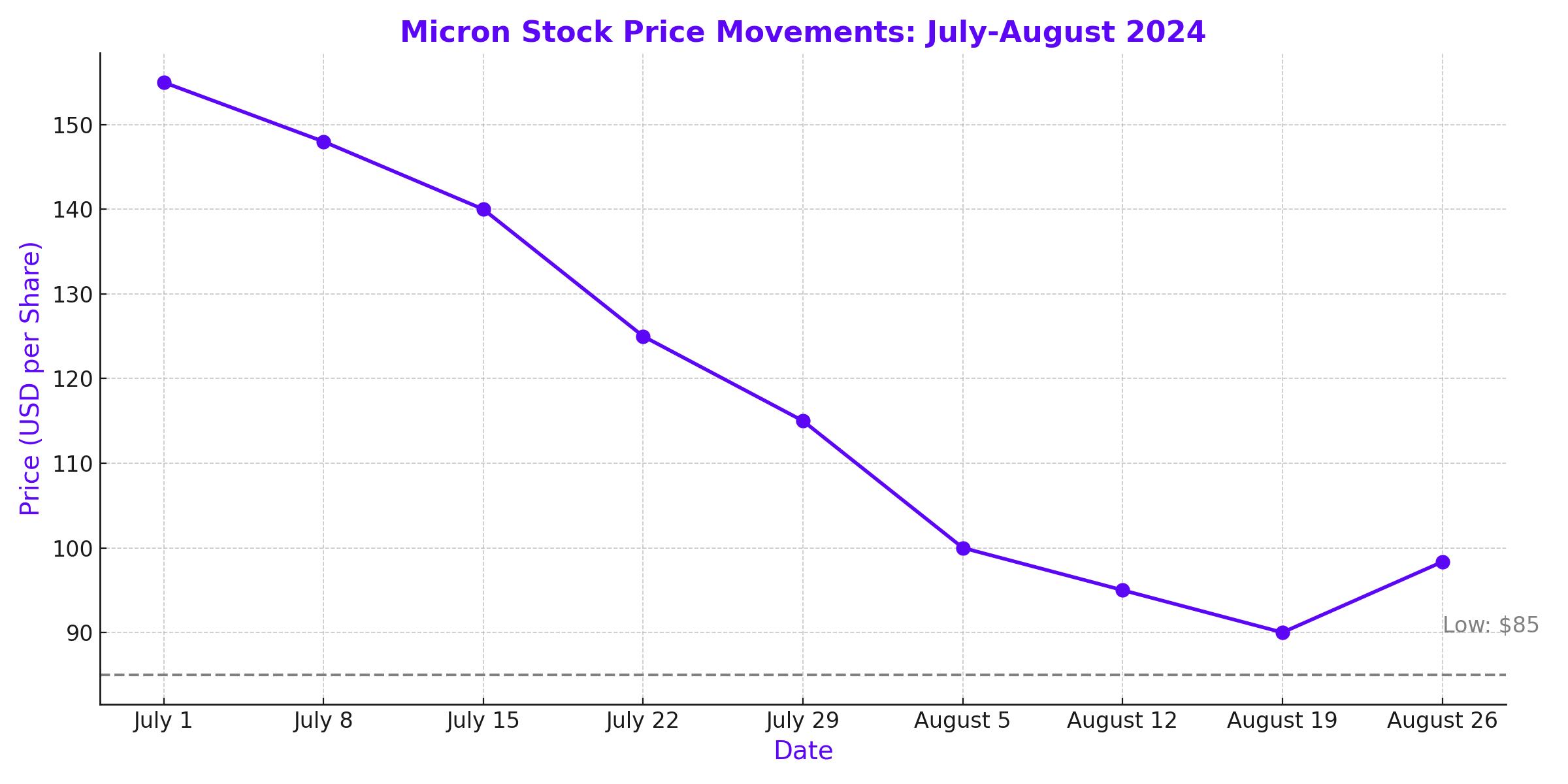

Micron Technology (NASDAQ: MU), a prominent player in the memory chip industry, has recently faced a tumultuous period on the stock market. The stock experienced a dramatic decline, dropping nearly 45% within just six weeks, plummeting from its highs around $155 to lows near $85. This steep drop, which surprised many investors, was marked by panic selling and a significant reset in valuation. At its lowest point, Micron was trading at around 8-9 times its forward earnings, making it an incredibly attractive buy for those with a long-term perspective.

Despite this sharp decline, the fundamentals of Micron remain strong. The company's stock price has been heavily influenced by the volatile sentiment surrounding AI stocks, which soared in popularity late last year but have recently cooled off. The selloff has presented a golden opportunity for investors, as Micron’s core business and growth prospects remain robust, particularly in the AI sector.

Micron’s AI Strength: A Key to Future Growth

Micron's position as a leader in the memory market is closely tied to its AI capabilities. The company’s memory and storage solutions are critical in powering the next generation of AI and machine learning technologies. With AI's increasing demand for high-speed data processing, Micron's products are more vital than ever.

Micron's recent advancements include purpose-built memory solutions for AI training and applications, which are being integrated into various high-demand sectors, such as data centers, smartphones, and PCs. These AI-driven solutions are expected to significantly boost Micron's revenue and earnings in the coming years.

During the company's fiscal Q3 2024 earnings report, Micron announced an EPS of $0.62, beating expectations by 17%. Revenue surged by 81.6% year-over-year to $6.81 billion, highlighting the strong demand for its products. The company also provided a promising outlook for fiscal Q4, projecting revenues of $7.6 billion and EPS of $1.08, further solidifying its growth trajectory.

Wall Street’s Perspective: Is Micron Undervalued?

Despite the recent price cut from analysts like Needham’s Quinn Bolton, who adjusted the price target to $140 from $150, the overall sentiment on Wall Street remains bullish for Micron. The stock’s lowest price target stands at $110, offering a 16% upside from current levels, while the average price target is around $161, suggesting a potential 70% increase. Higher-end estimates even reach $225, which would represent a 135% upside.

Given Micron's strong market position and growth potential, these targets seem justified. The company's AI-driven products are expected to lead to substantial revenue growth, with EPS potentially reaching $10 in fiscal 2025. This growth could propel the stock to significantly higher levels, making Micron an attractive buy for long-term investors.

Micron’s Strategic Position in the AI Revolution

Micron's leadership in the memory chip market is further enhanced by its strategic focus on AI and data center technologies. As AI becomes more integrated into everyday applications, the demand for high-performance memory solutions is expected to skyrocket. Micron's cutting-edge products, including its High Bandwidth Memory (HBM) and advanced SSDs, position the company to capture a significant share of this growing market.

CEO Sanjay Mehrotra has expressed confidence in Micron's ability to deliver record revenues in fiscal 2025, driven by AI demand and the company’s shift towards higher-margin products. This optimism is backed by Micron’s robust technology portfolio and its ongoing investments in R&D to stay ahead in the competitive semiconductor landscape.

The Future of Micron (NASDAQ: MU): A Bullish Outlook

Looking ahead, Micron’s revenue and earnings growth potential remains strong, supported by its leading position in AI memory technology and expanding data center market share. The company's EPS is expected to grow significantly, reaching $12 by fiscal 2026, with further upside possible depending on market conditions and product demand.

Micron’s stock, currently trading around $98.34, still offers considerable upside, with potential targets ranging from $140 to $225 over the next 12 months. As the company continues to innovate and capitalize on AI-driven opportunities, its stock price could see substantial gains, making it a compelling investment for those looking to benefit from the next wave of technological advancements.

For real-time updates on Micron's stock performance, visit Micron Real-Time Chart.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex