Microsoft (NASDAQ: MSFT) Closing in on $500: AI, Cloud, and Explosive Growth Potential!

As Microsoft’s stock rockets past $468, AI and cloud leadership set the stage for new highs. Will it hit $500? Here's why investors are buzzing | That's TradingNEWS

Microsoft (NASDAQ:MSFT): Analyzing the Giant's Performance and Future Potential

Current State of (NASDAQ:MSFT)

Microsoft Corporation (NASDAQ:MSFT) is a dominant force in the tech world, posting solid earnings across its divisions. At present, MSFT's stock is trading at a relatively high valuation, which has led to mixed feelings among investors. In 2024, the stock is up around 27% year-to-date, yet it underperformed the broader S&P 500 index by 12%, indicating a slower pace of growth.

MSFT Stock Price and Performance

After hitting an all-time high of $468 per share earlier this year, Microsoft saw a 12.5% pullback, with current prices hovering around $410–$420. This dip presents an opportunity to review whether the stock is now in more reasonable territory for investment.

Microsoft’s blend of solid business performance, AI innovation, and acquisitions has maintained investor interest. However, the high price-to-earnings ratio of nearly 40x at its peak raised concerns about overvaluation, particularly when compared to the sector's average. Yet, Microsoft has shown resilience, bouncing back from market corrections thanks to its robust fundamentals and growth across multiple sectors.

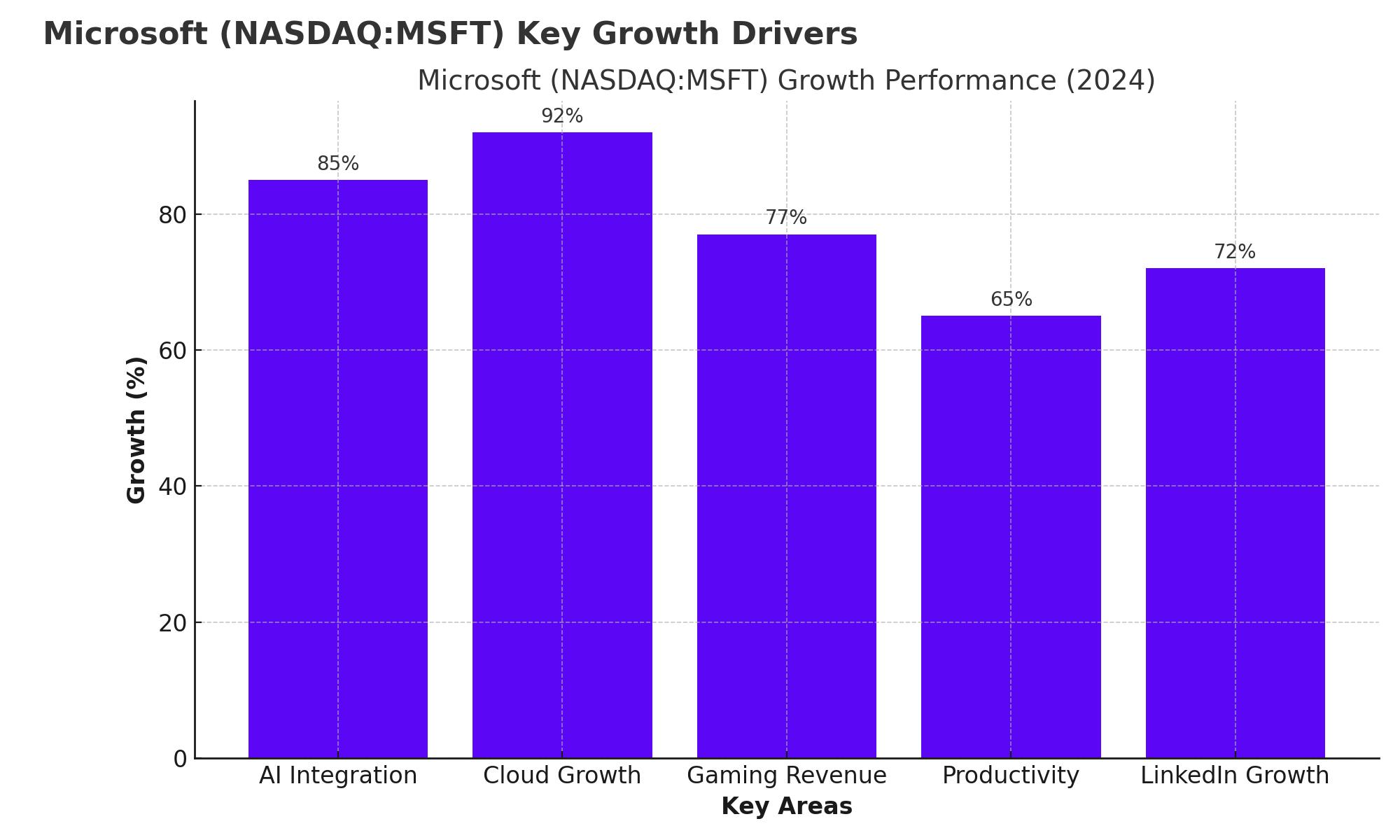

AI Driving Microsoft's Future Growth

Microsoft and OpenAI Partnership

One of the biggest drivers behind Microsoft’s growth is its deep partnership with OpenAI, which gives it perpetual access to OpenAI's intellectual property, a significant differentiator in the crowded AI space. OpenAI's GPT-4 model, widely recognized as one of the top-performing AI tools, is fully integrated into Microsoft’s software suite, most notably in Bing and Microsoft 365 Copilot. This integration allows Microsoft to monetize AI in both consumer and enterprise sectors.

Microsoft 365 Copilot, for example, is set to revolutionize productivity software by embedding AI capabilities directly into tools like Excel, PowerPoint, and Outlook. With over 345 million users worldwide, this move has the potential to significantly increase Microsoft's revenue, particularly with enterprise clients paying an additional $30 per user for AI-powered functionalities.

Azure's Performance in the AI Era

In the cloud sector, Microsoft's Azure has been the key growth driver. Azure revenue surged by 29% YoY in the latest quarter, benefiting from a notable increase in AI services, which contributed an impressive 8 percentage points to this growth. This AI focus is expected to maintain momentum as more companies adopt cloud-based AI solutions.

Azure’s AI customers grew by 60% YoY, reflecting the explosive demand for AI-enabled infrastructure. The company remains capacity-constrained due to this demand, which, while initially limiting growth rates to the lower end of forecasts, underscores the enormous potential of Azure in the AI landscape. This cloud platform is second only to Amazon Web Services (AWS), which grew by 19% during the same period, placing Azure in a competitive position.

Microsoft's Q4 Financial Summary: Strong Performance Across the Board

Microsoft exceeded analysts’ expectations in Q4 2024, delivering revenue growth of 15% to $64.7 billion, with operating income climbing 15% to $27.9 billion. The company’s robust earnings were driven by strong growth in all three business segments:

- Productivity and Business Processes: Revenue increased by 11% to $20.3 billion, led by 12% growth in Office 365 and 10% in LinkedIn.

- Intelligent Cloud: Revenue surged by 19% to $28.5 billion, primarily due to growth in Azure and AI services.

- More Personal Computing: Revenue rose 14% to $15.9 billion, supported by the acquisition of Activision Blizzard and an increase in Xbox content and services.

These numbers reflect the company’s execution of its long-term growth strategy, driven by cloud and AI investments.

Microsoft's Strategic Acquisitions: Activision Blizzard

Microsoft’s acquisition of Activision Blizzard was a strategic move to strengthen its gaming segment, adding synergies between its Xbox ecosystem and subscription-based gaming services. Xbox’s content and services revenue jumped 61% YoY, indicating strong growth potential in this space. However, hardware revenue dropped by 42%, suggesting a shift toward a content-driven strategy.

This acquisition also strengthens Microsoft’s position in cloud gaming, with expectations of further efficiency gains as the company integrates Activision’s gaming portfolio into its Xbox Game Pass.

AI-Driven Cloud Growth and The Path Forward

Microsoft's cloud growth is strongly anchored in AI. Its cloud revenue hit $28.5 billion, with Azure contributing the bulk of this growth. As more businesses adopt AI-driven processes, the demand for cloud infrastructure like Azure will continue to expand. Microsoft’s long-term investment in cloud and AI technology positions it as a leader in this space, potentially setting up the company for continued revenue growth well into FY2025 and beyond.

FY2025 Outlook and AI-Related Capital Expenditures

For fiscal year 2025, Microsoft projects double-digit revenue growth across its segments, driven primarily by AI demand. However, the company’s announcement of increased capital expenditure (CAPEX), particularly in building out AI infrastructure, has raised some eyebrows. In FY2024, Microsoft spent $55.7 billion on CAPEX, and this number is expected to rise in FY2025. Investors will need to see the results of these investments to maintain confidence in Microsoft's ability to generate returns on such significant spending.

Insider Transactions: A Closer Look at NASDAQ:MSFT's Insider Activity

Insider activity can often provide insights into a company’s internal sentiment. Microsoft's recent insider transactions can be viewed here, showing the key trades made by executives, reflecting confidence in the stock's future.

Microsoft's Valuation: A Premium Price Worth Paying?

Despite the correction from its all-time high, Microsoft still trades at a high forward P/E ratio of 31.5x for FY2025. With EPS expected to grow by 12% in FY25, 16% in FY26, and 17% in FY27, some investors may question whether the current valuation is justified. Over the next two years, Microsoft’s valuation is expected to come down to a more reasonable level, with a forward P/E of 23.1x by FY2027, based on its earnings projections.

However, given Microsoft’s dominance in multiple sectors and its leadership in AI, a premium valuation might be justifiable. Microsoft’s growth is not only steady but is also accelerating in key areas like AI and cloud services, which offer long-term revenue potential.

Potential Risks and Challenges for Microsoft

While Microsoft’s outlook is positive, it faces several risks. Global economic uncertainty could weigh on enterprise spending, particularly in ad-sensitive areas like LinkedIn and Bing. Additionally, the company is facing antitrust scrutiny over its cloud dominance and partnership with OpenAI. Microsoft’s reliance on cloud growth, coupled with the significant capital expenditure in AI infrastructure, could expose the company to downside risks if adoption fails to meet expectations.

Moreover, competition from other hyperscalers like Amazon and Google remains intense. Google Cloud, for instance, grew by 29% YoY, matching Azure’s growth, while Amazon's AWS still holds a commanding 32% market share. Any further pressure on cloud margins could dampen Microsoft’s profitability, particularly with AI infrastructure costs expected to rise.

Microsoft’s Future Growth: Buy, Sell, or Hold?

Given its current valuation, recent performance, and future outlook, Microsoft (NASDAQ:MSFT) appears to be a Buy for long-term investors, especially those with a focus on AI and cloud infrastructure. Despite the premium price, Microsoft’s ability to integrate AI into its core products and services, coupled with strong cloud growth, positions it well for future earnings expansion.

Final Thoughts

Microsoft's stock is not cheap, but its fundamentals are strong. With Azure leading cloud adoption and AI integration becoming a core aspect of its future growth strategy, Microsoft is poised for continued success. For investors looking to capitalize on the AI revolution, MSFT presents a compelling opportunity, especially as the stock has corrected from its recent highs. For those considering an entry, the real-time chart shows current pricing dynamics.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex