Introduction to Mobileye's Trajectory

Mobileye Global Inc., trading under NASDAQ:MBLY, emerged strongly from its IPO in late 2022, navigating a turbulent market environment. The company, a pioneer in autonomous driving technology, was acquired by Intel Corporation for $15 billion in 2017. This acquisition aimed to amplify Mobileye's growth and market penetration. Despite robust progress, including partnerships with over 50 manufacturers and a presence in nearly a thousand car models, concerns linger regarding its valuation and profitability.

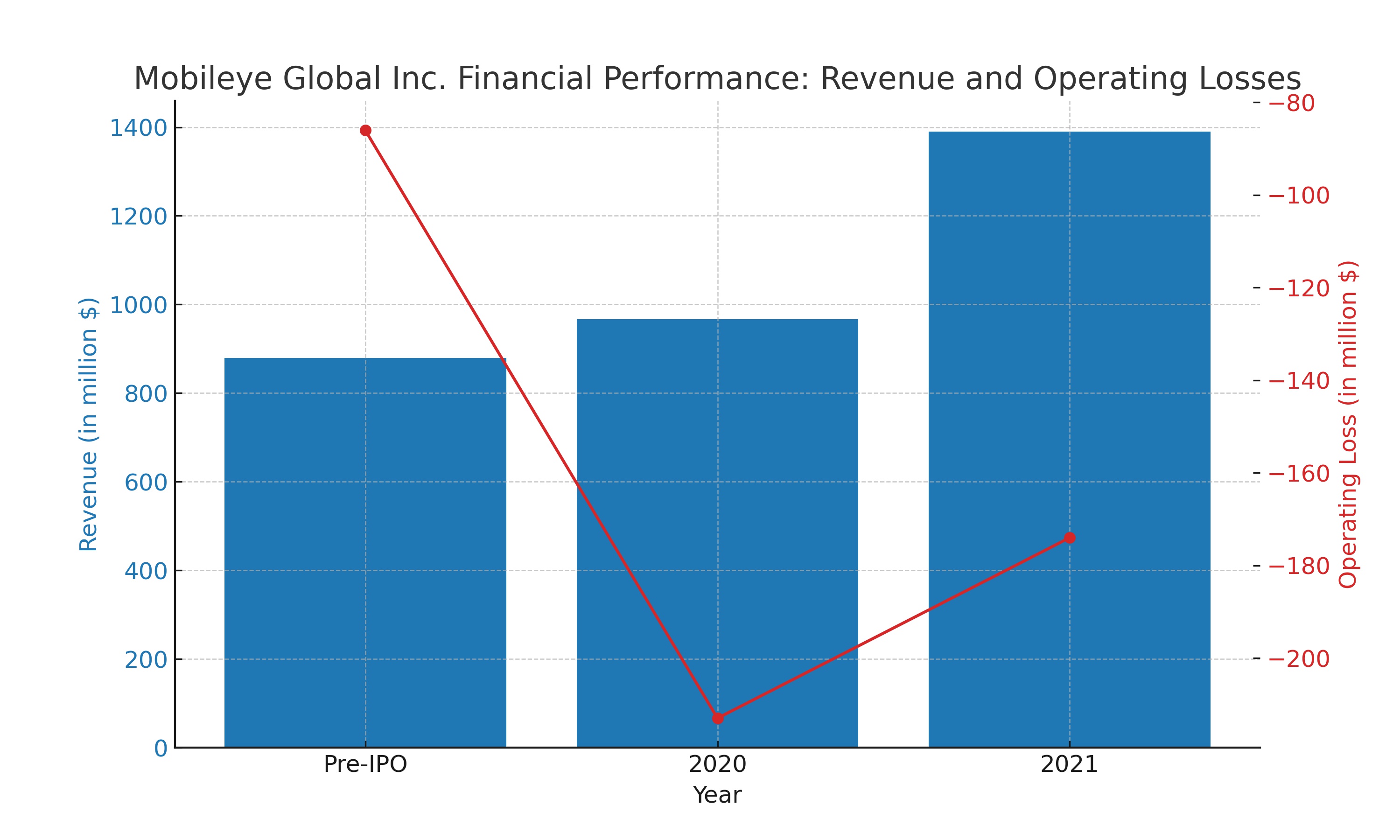

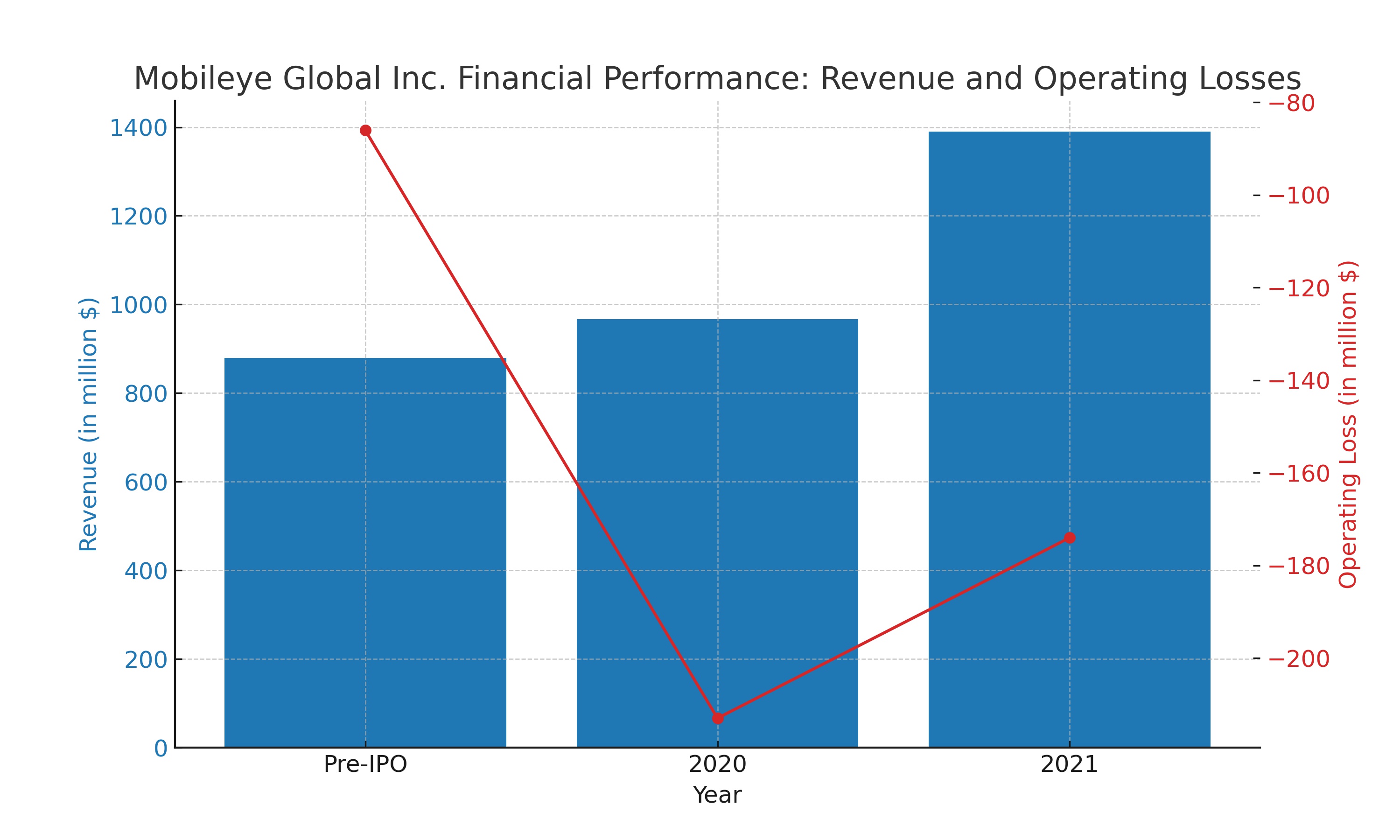

IPO Performance and Financial Growth

Mobileye's IPO, priced at $21 per share, was ambitious, given the challenging conditions in the technology sector during that period. The first trading day saw a rise to $27 per share, valuing the company at $21 billion. Despite this promising start, the valuation, when adjusted for time and additional investments, suggested modest returns. Pre-pandemic revenue stood at $879 million, but operating losses were a concern, escalating to $213 million in 2020. However, a revenue spike to $1.39 billion in 2021, along with reduced operating losses, indicated potential growth trajectories.

2023 Performance: A Mixed Bag

The company's stock has fluctuated between $35 and $45 throughout 2023. A 59% surge in fourth-quarter sales ($565 million) was notable, yet the full-year sales growth was projected at a moderate 20%. Challenges in the Chinese market and subsequent adjustments to the sales forecast underscored the volatile nature of the business. The divestment of Intel's stake in June and a surprising dip in Q2 sales further complicated the company's financial landscape.

The 2024 Outlook: Caution Ahead

As 2024 dawned, Mobileye faced significant challenges. Preliminary results for 2022 were aligned with prior forecasts, but the revelation of a substantial inventory surplus among customers was alarming. This surplus, totaling 6-7 million units, prompted a drastic revision of Q1 2024 sales projections, expecting a 50% decline. While a recovery is anticipated later in the year, the overall revenue outlook is muted, coupled with flat operating profits.

Market Valuation and Investment Considerations

As of early 2024, Mobileye's shares hover around $30, valuing the company at approximately $24.3 billion. This valuation, despite a net cash position of $1.2 billion, places the company in a challenging position regarding sales multiples and profitability. Investors remain cautious, especially given the substantial profit warning and the prospect of a "lost year" in terms of financial growth.

CES 2024 Presentation and Future Prospects

Mobileye's upcoming presentation at CES 2024 is anticipated to shed light on its technology roadmap and product portfolio. This event could be pivotal in reassessing the company's long-term prospects, especially in light of the recent financial uncertainties.

Conclusion

Mobileye's journey post-IPO has been a mix of promising advancements and significant challenges. While the company has demonstrated its capability in the autonomous driving space, its financial performance, particularly in light of the recent profit warnings and inventory issues, warrants a cautious approach from investors. The year 2024 will be crucial in determining whether Mobileye can navigate these challenges and realize its potential in a rapidly evolving industry.

For real-time stock information and further details, please visit Mobileye's Stock Profile and for insider transactions information, refer to Insider Transactions or Stock Profile for broader insights.