Monarch Casino & Resort - Why to Buy NASDAQ:MCRI Stock ?

Unlocking the Potential of Monarch Casino & Resort (NASDAQ:MCRI): A Comprehensive Investment Analysis | That's TradingNEWS

Why to Buy Monarch Casino & Resort (NASDAQ:MCRI) Stock?

Solid Financial Performance

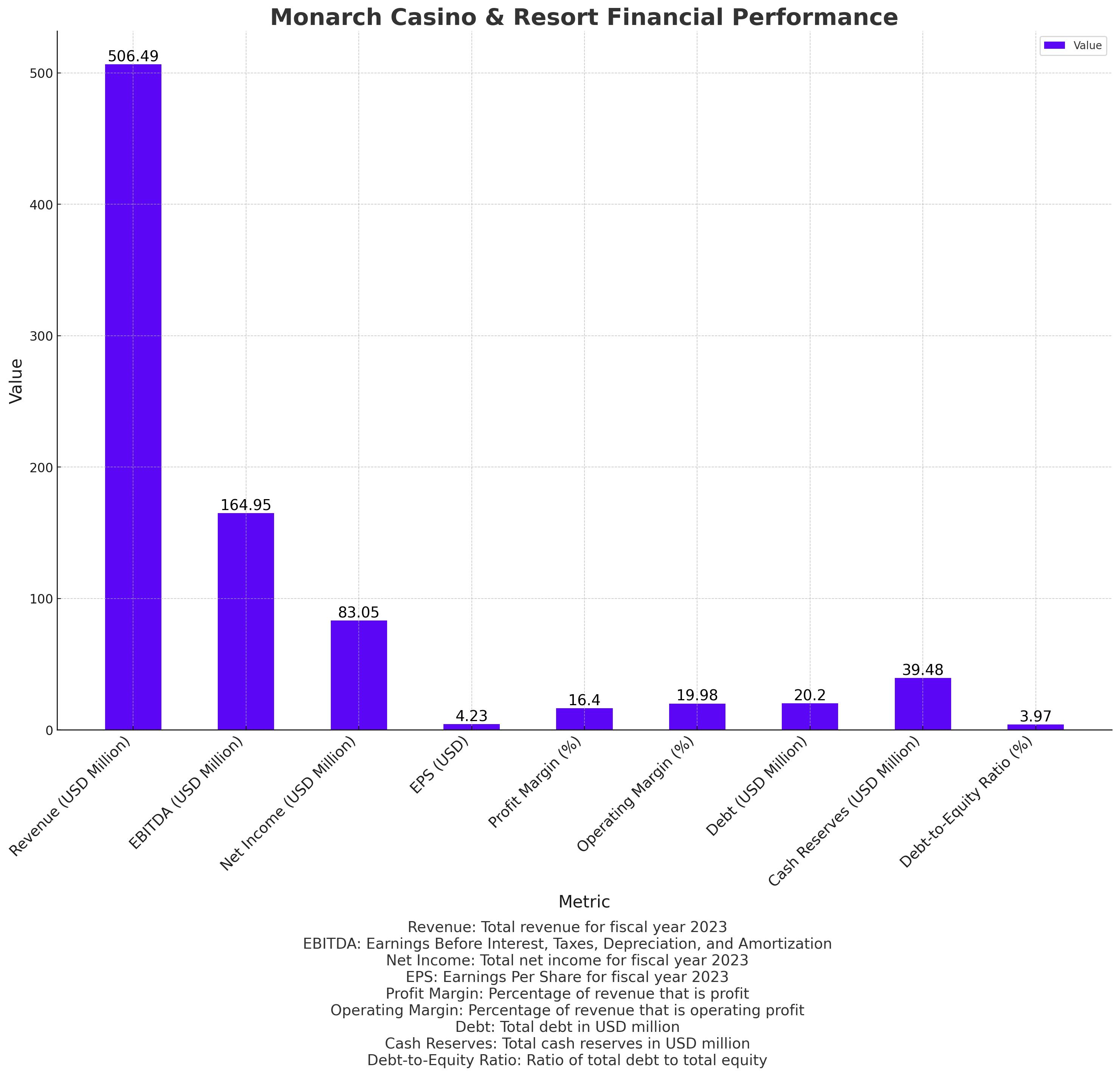

Monarch Casino & Resort (NASDAQ:MCRI) has consistently demonstrated robust financial performance, establishing itself as a lucrative investment. For the fiscal year 2023, the company reported revenue of $506.49 million, reflecting its strong market presence and effective business strategy. EBITDA stood at an impressive $164.95 million, indicating high operational efficiency and profitability. Additionally, Monarch's net income of $83.05 million and EPS of $4.23 underscore its ability to generate substantial earnings. The company's profitability is further highlighted by a profit margin of 16.40% and an operating margin of 19.98%, showcasing effective cost management and revenue generation capabilities. This consistent financial performance makes Monarch a compelling choice for investors seeking stable and growing returns.

Prudent Debt Management

Monarch maintains a commendable balance sheet, characterized by prudent debt management. The company has $39.48 million in cash reserves and a relatively low total debt of $20.2 million. This results in a debt-to-equity ratio of just 3.97%, indicating a conservative approach to leveraging. Such a low level of indebtedness reduces financial risk and enhances the company’s stability and creditworthiness. Furthermore, Monarch's ability to cover interest expenses multiple times over with operating profits (interest coverage ratio of 72 times in 2023) demonstrates strong financial health and liquidity. This prudent debt management strategy ensures that Monarch can sustain its operations and pursue growth opportunities without the burden of excessive debt.

Strong Profit Margins

Monarch's strong profit margins are a testament to its operational efficiency and effective cost control measures. The company boasts a profit margin of 16.40%, which is well above the industry average, indicating that a significant portion of its revenue translates into net income. The operating margin of 19.98% further highlights Monarch's ability to manage its operational costs effectively while generating substantial revenue. These robust margins are a clear indicator of the company’s competitive advantage and its ability to sustain profitability even in a competitive market. Monarch's consistent margin performance, even during economic downturns, reflects its resilience and efficient management practices.

Strategic Market Positioning

Monarch's strategic positioning in high-growth markets such as Reno, Nevada, and Black Hawk, Colorado, offers significant growth potential. These regions are experiencing increasing population and income levels, which drive demand for gaming and hospitality services. Monarch's properties, including the Atlantis Casino Resort Spa in Reno and the Monarch Casino Resort Spa in Black Hawk, are well-positioned to capitalize on these trends. The company’s focus on upscale properties with extensive amenities, such as state-of-the-art spas and expanded casino spaces, caters to the affluent demographic in these areas. This strategic market positioning not only enhances Monarch's revenue potential but also solidifies its brand presence in key growth markets.

Dividend and Shareholder Returns

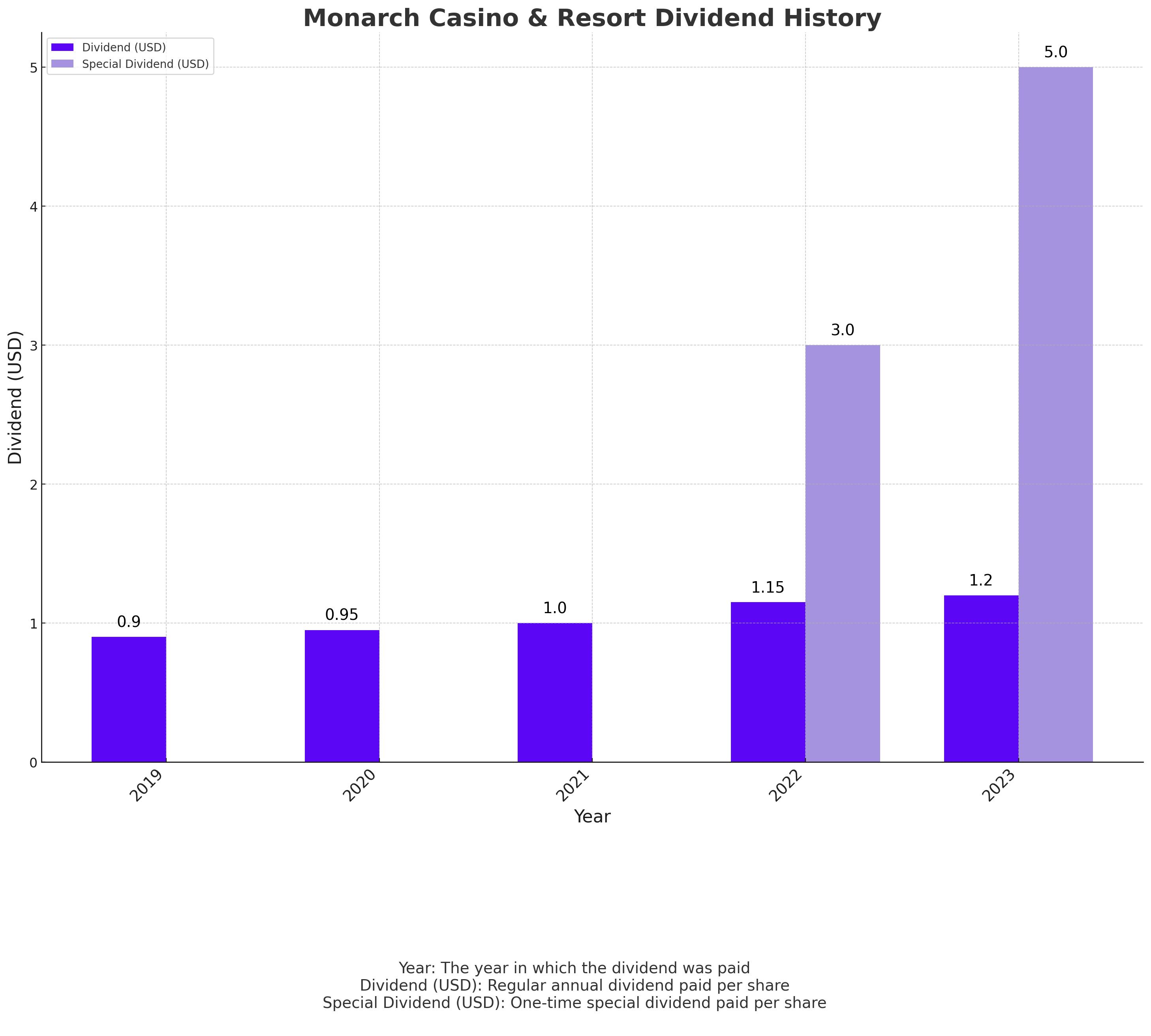

Monarch is committed to rewarding its shareholders, as evidenced by its consistent dividend policy. The company offers a forward annual dividend rate of $1.20, yielding 1.79%, which provides a steady income stream for investors. In addition to regular dividends, Monarch declared a one-time cash dividend of $5.00 per share in 2023, reflecting its strong financial performance and cash flow generation. This shareholder-friendly approach underscores the management’s confidence in the company’s future prospects and its dedication to enhancing shareholder value. Monarch's ability to generate substantial free cash flow and its strategic dividend policy make it an attractive option for income-focused investors.

Insider and Institutional Confidence

Monarch enjoys significant insider and institutional ownership, which indicates strong confidence in the company's future prospects. Insiders hold 30.51% of the shares, while institutions own 66.37%, reflecting a high level of trust and investment from those closely associated with or analyzing the company. This substantial insider ownership aligns management’s interests with those of shareholders, ensuring that decisions are made with a long-term perspective. Moreover, the strong institutional presence provides additional validation of Monarch’s business model and growth potential. High insider and institutional confidence is a positive signal to potential investors, suggesting that those with the most knowledge of the company believe in its continued success.

Efficient Capital Structure

Monarch’s conservative capital structure is a key strength, characterized by a predominant use of equity capital over debt. This approach minimizes financial risk and enhances the company’s ability to generate higher returns on equity. Monarch's total debt is $20.2 million, significantly lower than many of its competitors, which underscores the company’s strategic prudence. The company's strong cash flow, evidenced by an operating cash flow of $149.8 million, is strategically used to finance operations and growth initiatives, minimizing reliance on external borrowing.

This conservative approach to capital management ensures financial stability and reduces the cost of capital. Monarch's debt-to-equity ratio stands at a low 3.97%, highlighting its robust balance sheet and minimal financial leverage. This strategy benefits shareholders by maintaining a stable financial foundation while pursuing growth opportunities, such as the expansion of their Black Hawk property and potential new developments. Monarch's ability to sustain a strong balance sheet while exploring growth prospects demonstrates its financial prudence and strategic foresight, making it an attractive investment for risk-averse investors seeking long-term value.

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex