Moody's Q1 2024 Financials Exceeding Expectations with Growth

Insights into Moody's robust earnings performance and strategic directions in Q1 2024, highlighting significant revenue growth and future market prospects | That's TradingNEWS

Analyzing Moody’s (NYSE:MCO) Robust Q1 2024 Financial Performance

Financial Highlights and Market Adaptation

Moody's Corporation (NYSE:MCO) delivered a robust performance in the first quarter of 2024, showcasing a solid rise in earnings and revenue. The company reported earnings per share (EPS) of $3.37, surpassing the consensus estimate of $3.04 by a notable margin. This figure represents a significant year-over-year improvement, up from $2.99 in Q1 2023 and even higher than the previous quarter’s $2.19. This surge reflects not only improved operational efficiency but also Moody's ability to adapt and thrive in fluctuating market conditions.

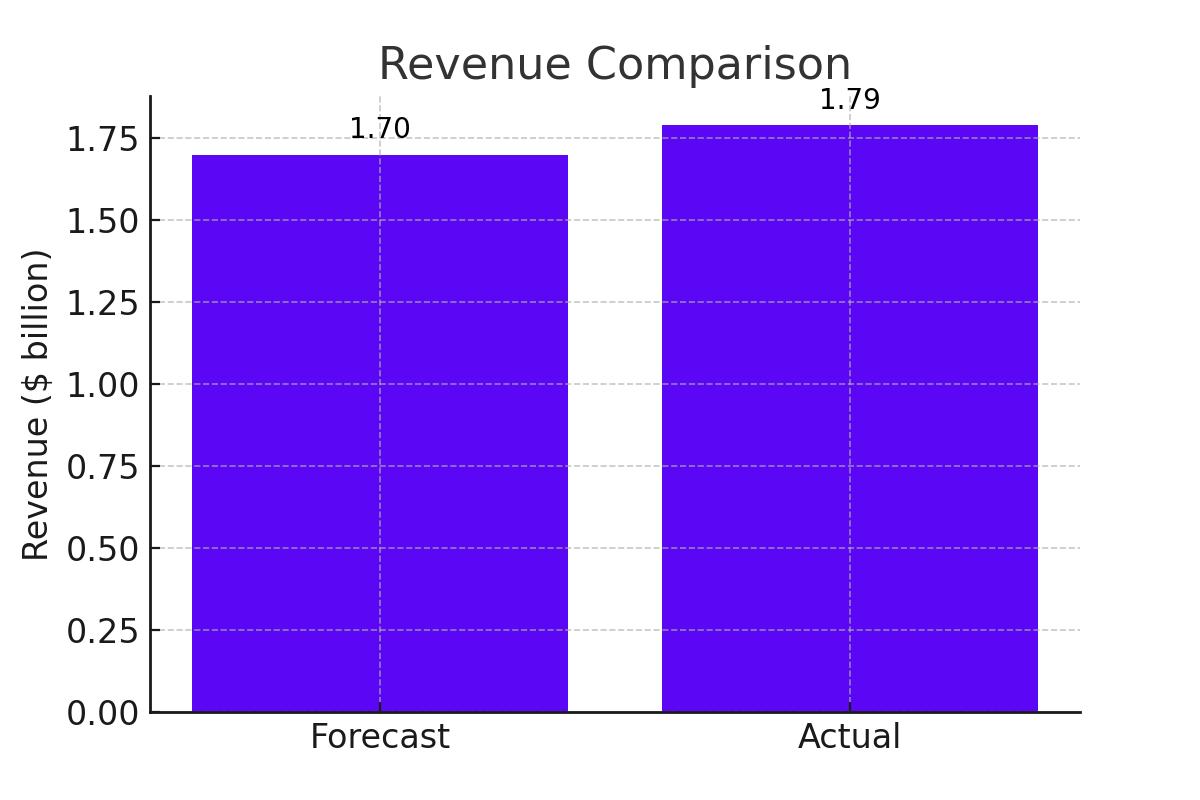

Revenue for the quarter stood at an impressive $1.79 billion, exceeding expectations by 5.06% against the forecasted $1.70 billion. This increase is a testament to the robust demand for Moody’s diversified financial analytics and credit rating services, underpinned by a dynamic economic environment that fosters strong issuance across multiple asset classes.

Segment Performance: Analytics and Investors Service

Moody’s operates through two main business segments: Moody's Analytics (MA) and Moody's Investors Service (MIS). This quarter, MA reported a revenue of $799 million, marking an 8% increase year-over-year. This growth was driven by a 10% rise in annual recurring revenue, fueled by high demand for the company’s sophisticated know-your-customer solutions and comprehensive data services.

Conversely, MIS experienced a more dramatic surge, with revenues climbing 35% year-over-year to $987 million. This significant increase was primarily fueled by favorable market conditions and a proactive approach to capturing opportunities in vibrant asset classes, demonstrating the segment’s agility and strategic market positioning.

Operating Expenses and Margins

Operating expenses for the quarter amounted to $985 million, a slight increase from both the previous quarter and the same period last year. Despite this rise, Moody’s managed to improve its adjusted operating margin impressively to 50.7%, up from 44.6% in Q1 2023. This margin enhancement is indicative of effective cost management and operational optimization.

Market Response and Forward Outlook

Despite these strong results, Moody’s stock experienced a 2.5% decline in early trading, possibly due to the company’s revised EPS guidance for 2024, which, while improved at the lower end, still fell short of average analyst expectations of $10.74. The company now anticipates an adjusted EPS range of $10.40 to $11.00. Moreover, Moody's has reaffirmed its commitment to maintaining robust free cash flow, projecting it to be between $1.9 billion and $2.1 billion for the year.

Strategic Investments and Technological Advancements

Looking ahead, Moody’s is poised to continue its trajectory of growth, with strategic investments in generative AI and enhanced digital finance products. These initiatives are expected to streamline operations and enhance service delivery, further embedding Moody’s at the forefront of financial analytics and credit ratings.

Investment Outlook and Rating

Given the comprehensive performance and strategic positioning of Moody’s, coupled with its consistent revenue growth and operational efficiency, the stock presents a compelling case for investors. However, given the current valuation and market expectations, a cautious approach might be advisable. For more detailed insider transactions and stock performance, you can access Moody's stock profile on Trading News for real-time charts here and insider transactions here.

Conclusion

In summary, Moody’s has demonstrated a strong start to 2024 with its Q1 performance. The company is well-positioned to leverage market opportunities and technological advancements to sustain growth. Investors are encouraged to monitor upcoming financial disclosures and market conditions closely, as these will provide further insights into Moody’s capacity to maintain its market-leading position and deliver on its financial commitments.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex