Morgan Stanley Cuts Oil Price Forecast to $75 as Global Demand Weakens

Weakening Demand from China and Rising U.S. Shale Output Pressures Oil Prices | That's TradingNEWS

U.S. and Global Oil Price Forecasts See Revisions Amid Weakened Demand

The oil market is facing significant volatility as both global demand forecasts and oil prices have been revised downward by major institutions, including Morgan Stanley and Goldman Sachs. In recent weeks, Brent crude has dropped to just above $71 per barrel—its lowest level since June 2023, driven by reduced demand from key economies such as China and an oversupply risk stemming from U.S. shale production.

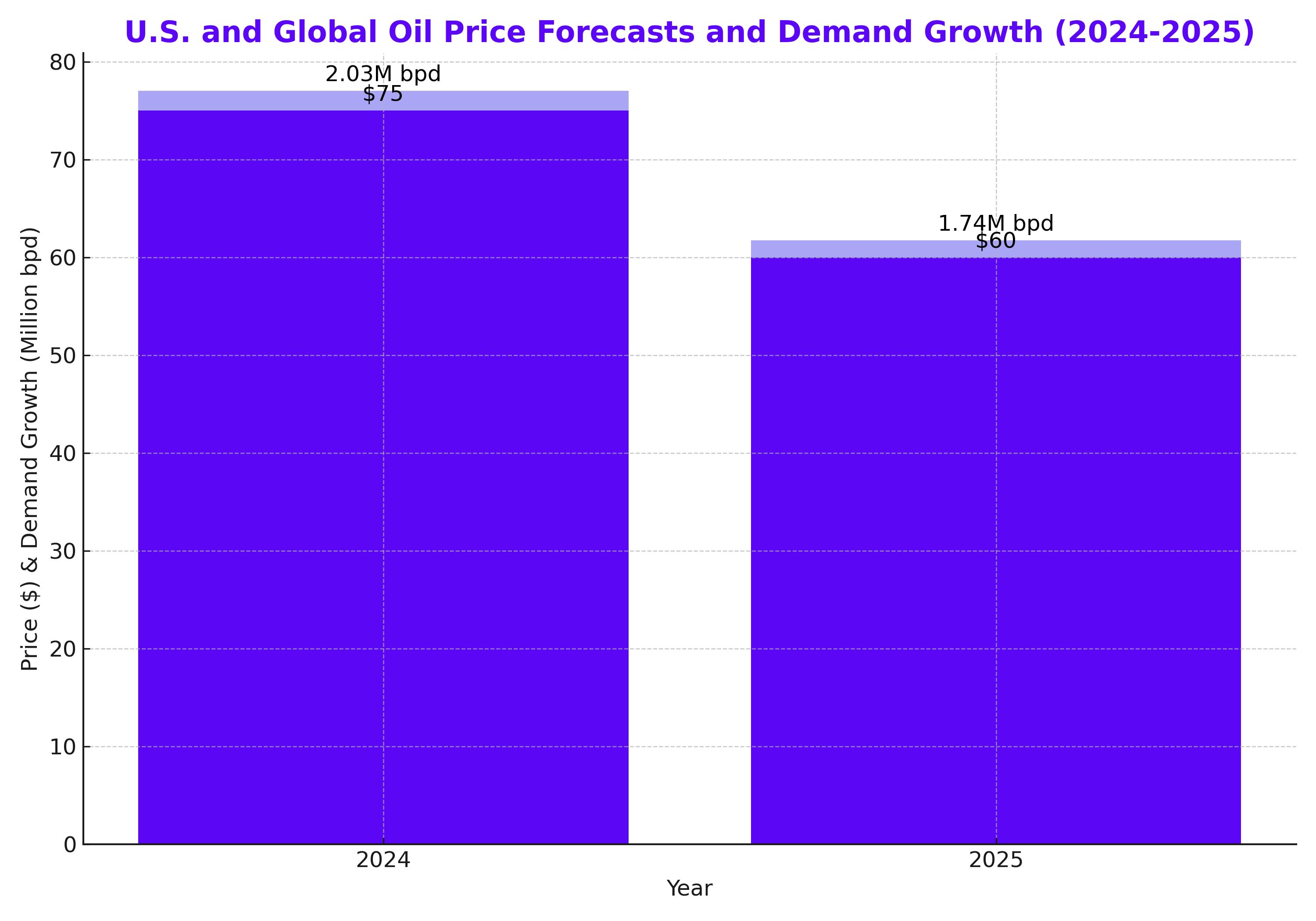

Morgan Stanley recently cut its oil price forecast for Q4 2024 to $75 per barrel, down from an earlier estimate of $80. This comes just two weeks after their initial downward revision from $85 per barrel, with the investment bank citing headwinds on the demand side as the primary reason. In parallel, Goldman Sachs lowered its range for Brent crude prices to $70-$85 per barrel, also attributing the adjustment to weaker Chinese demand and higher U.S. shale production. Citi took an even more bearish stance, forecasting oil prices to potentially fall to $60 per barrel next year if OPEC+ doesn’t introduce more substantial production cuts.

OPEC Adjusts Growth Forecasts as Production Cuts Persist

The Organization of the Petroleum Exporting Countries (OPEC) has responded to this downward pressure by delaying its planned production increases and slightly reducing its growth forecast for global oil demand in 2024. In its latest report, OPEC projects demand growth at 2.03 million barrels per day (bpd), down from a previous forecast of 2.11 million bpd. For 2025, the cartel reduced its estimate to 1.74 million bpd, down from 1.78 million.

Despite these cuts, OPEC remains optimistic about long-term demand growth, estimating global oil consumption to reach 106 million barrels per day by 2025. This outlook is buoyed by sustained industrial activity and road mobility in non-OECD countries, as well as strong demand from air travel. However, weaker-than-expected economic data from China has caused many to question whether this level of demand growth is realistic, given the world's largest oil importer’s recent struggles with consumer inflation and a slowing economy.

Oil Supply Disruptions in the U.S. Give Temporary Price Support

While global demand pressures persist, U.S. domestic factors are providing some temporary price stability. Tropical Storm Francine forced a halt in operations at several key Texas ports, including Exxon Mobil's offshore platforms, Shell’s drilling platforms, and Chevron's oil and gas operations. This disruption provided a temporary floor for oil prices, which briefly saw a 1% rise on Monday. However, the longer-term outlook remains bleak, as oversupply from U.S. shale oil and faltering global demand could continue to weigh heavily on prices.

In a report by the U.S. National Hurricane Center, the tropical storm was expected to strengthen into a hurricane, potentially exacerbating U.S. supply disruptions. However, unless these disruptions persist or escalate, they are unlikely to significantly alter the broader downward trajectory of oil prices.

Technical Outlook for Oil Prices: Downside Risks Continue to Grow

The technical outlook for oil prices remains decidedly bearish. In a recent analysis, West Texas Intermediate (WTI) crude broke below key support levels, plunging 13.4% off its highs. It is now trading near its December lows, with the next support level seen at $65.62-$66.57 per barrel. A breach below this region could see further declines, potentially reaching $60 per barrel.

Resistance is currently pegged at $71.33, with any rallies likely to be capped at this level. The overall trend indicates a continuation of the bearish trajectory, particularly if WTI fails to break through these technical barriers. Analysts are closely watching the 2023 consolidation pattern, with many expecting continued downward pressure if demand doesn’t pick up soon.

OPEC+ Faces Dilemma: Support Prices or Risk Losing Market Share?

OPEC+ has been in a difficult position as it tries to balance oil prices with maintaining its market share. While the cartel's production cuts have helped prevent a sharper decline in oil prices, concerns are mounting that extended cuts could erode OPEC's influence over the global market, particularly as non-OPEC producers like the U.S. continue to ramp up output.

Saudi Arabia and Russia, the de facto leaders of OPEC+, require higher oil prices to balance their national budgets. However, with Brent crude trading around $71 per barrel, well below the fiscal breakeven levels for these nations, market watchers are wondering how long the group can sustain its output curbs before facing more severe economic repercussions.

Iraq Faces Budgetary Concerns Amid Oil Price Decline

Iraq, OPEC’s second-largest producer, has also been impacted by the falling oil prices, as it heavily relies on crude revenues to finance its budget. Despite increasing its budget in 2024 to 211 trillion dinars ($161 billion), Iraq could face a budget crunch in 2025 if oil prices remain low. According to Mudher Saleh, an economic adviser to the Prime Minister, stricter financial discipline will be required to avoid a financial crisis.

The Iraqi government has already committed over 90 trillion dinars ($69 billion) to salaries and pensions, accounting for more than 40% of its national budget. Infrastructure projects may need to be scaled back if oil prices don’t recover, potentially stalling key development efforts in the country.

Outlook: The Battle Between Supply and Demand

The oil market's future remains precarious as demand struggles to keep pace with rising supply. China, the world’s largest importer, continues to show signs of economic weakness, which is exacerbating global oversupply concerns. With major financial institutions lowering their price forecasts and OPEC signaling continued production cuts, the market appears headed for a period of prolonged volatility.

Investors should prepare for further declines in oil prices, particularly if OPEC+ fails to implement more aggressive supply curbs. While there is some potential for short-term price increases driven by U.S. supply disruptions or a recovery in Chinese demand, the overarching trends suggest that oil may continue to face headwinds for the foreseeable future. The next critical juncture will be the release of key U.S. inflation data and the upcoming Federal Open Market Committee (FOMC) interest rate decision, both of which could provide further insight into oil’s price direction.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex