Morgan Stanley NYSE:MS Wealth Management and Financial Stability

Analyzing Morgan Stanley's Growth Trajectory: From AI Integration to Robust Dividend Expansion and CEO Leadership Change | That's TradingNEWS

Morgan Stanley (NYSE: MS): In-Depth Financial Analysis and Forecast

Overview of Morgan Stanley

Morgan Stanley, a stalwart in the financial sector, has been a significant player since the 1930s. Based in New York City and listed on the NYSE, the firm has made notable strides in the financial landscape, particularly with its strategic acquisition of E-Trade in 2020. This move not only diversified its offerings but also marked its foray into retail brokerage. The firm's extensive portfolio now spans across wealth management, investment banking, trading, research, and investment management.

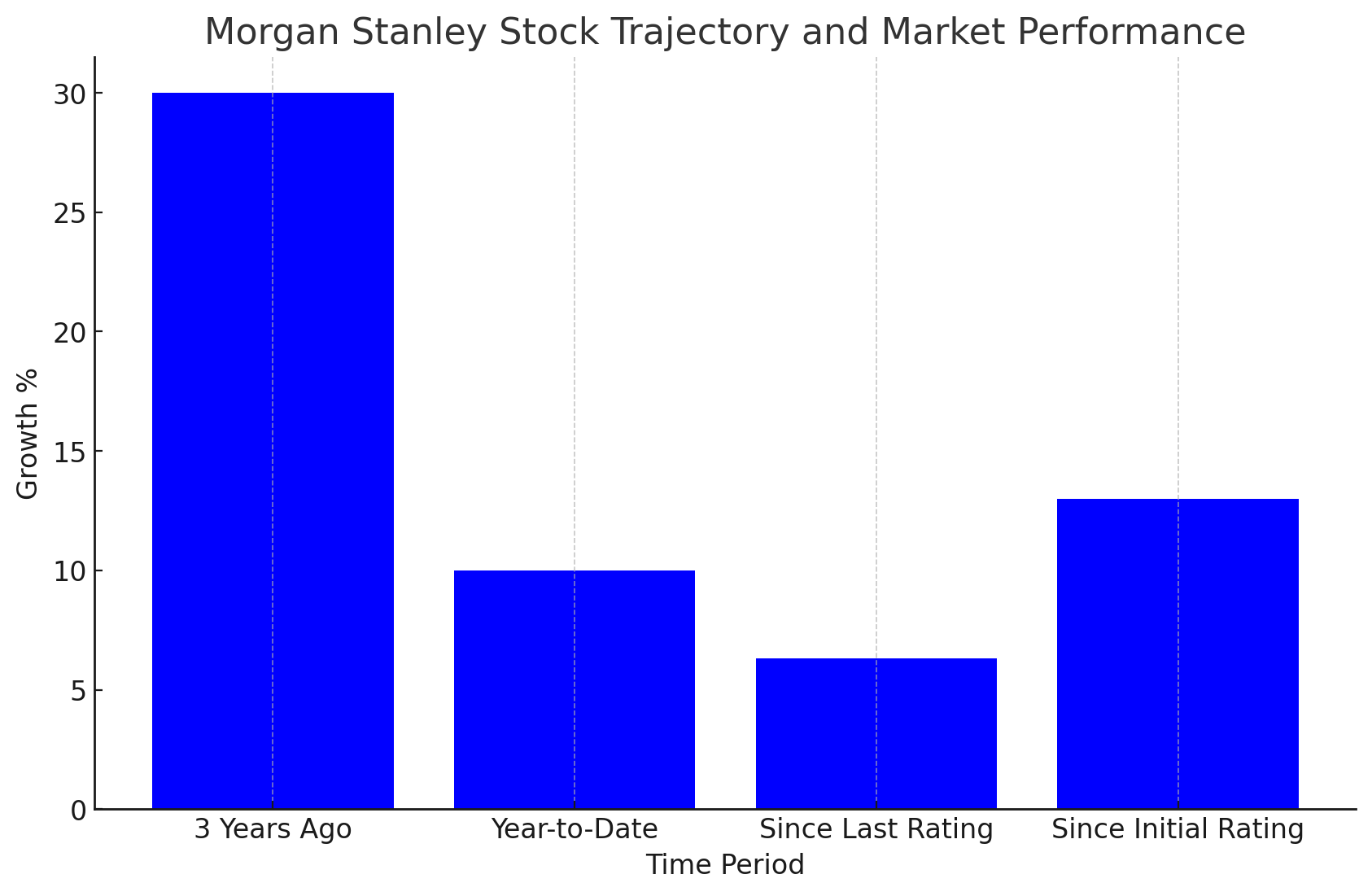

Stock Trajectory and Market Performance

The stock of Morgan Stanley has shown a positive trajectory over recent periods. A key observation is the stock's appreciation by over 6.3% since a previous analysis, underlining its consistent market performance. Additionally, the broader financial sector has seen a near 30% growth over the past three years, with an impressive year-to-date advancement of about 10%. These figures underscore the sector's overall bullishness, potentially influencing Morgan Stanley's stock momentum.

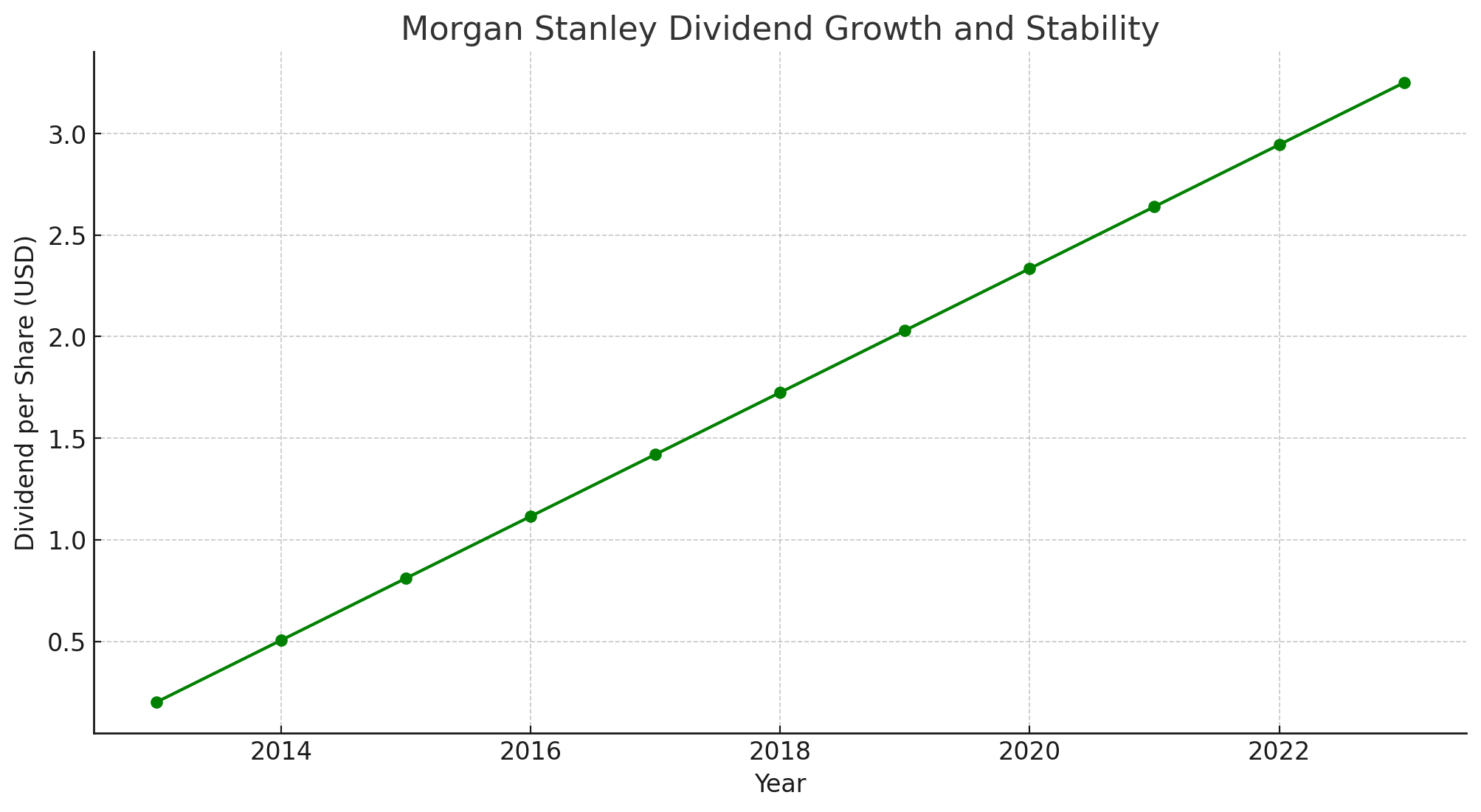

Dividend Growth and Stability

Morgan Stanley has demonstrated remarkable growth in its dividend payouts, soaring from $0.20 per share in 2013 to $3.25 per share in 2023. This increase not only reflects the company's commitment to shareholder value but also its resilience, maintaining dividend payouts through various economic challenges, including the 2008/2009 financial crisis and the 2020/2021 pandemic. The consistent profitability, evident in its quarterly earnings surpassing $2 billion, indicates a strong potential for continued dividend growth.

Dividend Yield Comparative Analysis

A comparative analysis of dividend yields places Morgan Stanley in a favorable position within its peer group. The company's trailing dividend yield stands at 3.47%, surpassing that of other major players in the sector. This yield, however, must be contextualized within the current high-rate investment landscape, offering insights into the relative attractiveness of Morgan Stanley’s stock.

Revenue Dynamics and Growth Potential

Morgan Stanley's revenue growth, particularly in wealth management and investment management segments, has been notable. The increase in average asset levels and positive fee-based flows have been significant drivers of this growth. However, the high-interest-rate environment has posed challenges, as evidenced by the increased interest expenses impacting net interest income growth. Looking ahead, the firm's revenue growth is expected to face continued pressure from net interest margins, though potential tailwinds from improved equity markets and a resurgence in M&A activity may bolster revenue performance in the upcoming year.

Earnings Analysis and Future Outlook

The company witnessed an 8.7% YoY decline in earnings in Q3, with total operating expenses witnessing a rise. Despite these challenges, the improving macroeconomic factors, such as decreasing inflation rates, could potentially alleviate some of the pressure on business costs in 2024. Therefore, the stock holds a 'hold' status in this category, balancing the challenges of flat revenue growth and rising expenses with positive macroeconomic forecasts.

Equity Growth and Financial Stability

Morgan Stanley's equity position remains robust, with total equity at $100.15B as of Q3. Despite a slight YoY decline, the company's strong capital ratios and regulatory compliance position it well in terms of financial stability and resilience against potential market shocks.

Share Price Analysis

The current share price of Morgan Stanley, standing at $93.55, represents an 11% increase above its 200-day simple moving average. While this indicates a bullish trend, the price is still below its January highs, suggesting a potential for further growth. The stock is recommended as a 'hold' at its current level, considering the market trends and the company's financial performance.

Valuation Metrics

The forward P/E ratio of Morgan Stanley, at 16.94, is significantly higher than the sector average, suggesting a potential overvaluation. Conversely, the forward P/B ratio at 1.69, while above the sector average, does not indicate an overvaluation in the context of the company's high book value and equity growth.

Risk Considerations and Leadership Transition

The impending leadership transition with Ted Pick as the new CEO introduces a variable in the company's strategic direction. However, his extensive experience and proven track record within the firm suggest a continued emphasis on stability and core banking fundamentals.

AI Integration and Strategic Growth

Morgan Stanley's strategic integration of AI in wealth management marks a significant shift, contributing to a substantial increase in net revenue and new client assets. This technological advancement positions the firm favorably in the evolving wealth management landscape, potentially redefining its valuation metrics in line with software companies.

Valuation in Context of AI Advancements

While Morgan Stanley trades at a forward sales multiple slightly above the sector average, this does not fully account for the transformative impact of AI on its business efficiency and profitability. The firm's valuation, when compared to software providers in the space, suggests potential for a significant upside, reflecting the high retention margins and stable cash flows akin to software companies.

Final Remarks and Investment Outlook

In conclusion, Morgan Stanley presents a nuanced investment case. While certain aspects like dividend growth and AI integration are highly favorable, challenges in revenue growth and potential overvaluation in certain metrics necessitate a balanced view. The stock is recommended as a 'hold' with a keen eye on future developments, particularly in AI-driven growth and the evolving macroeconomic landscape. As we step into 2024, Morgan Stanley remains a key player to watch in the financial sector.

For real-time stock information and insights on Morgan Stanley (NYSE: MS), visit Trading News. For details on insider transactions and stock profile, explore Morgan Stanley Insider Transactions and Morgan Stanley Stock Profile.

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex