NASDAQ:GRRR – Is Gorilla Technology a Breakout AI Play or a High-Risk Bet?

Gorilla Technology’s Ambitious 2025 Growth Targets – Can It Deliver?

Gorilla Technology Group (NASDAQ:GRRR) has set aggressive financial targets for 2025, aiming for $90-$100 million in revenue and EBITDA margins between 20-25%. This marks a major step forward for the AI-driven company, which has built a niche in smart city development and security intelligence. The company’s backlog stands at an impressive $93 million, providing a clear runway for revenue realization. Additionally, Gorilla is targeting a pipeline worth over $2 billion, suggesting that its market reach is expanding rapidly.

The key question is whether Gorilla can successfully convert these opportunities into sustained profitability. The company has shown strong revenue growth, but concerns remain around its ability to efficiently manage cash flow and working capital. Government contracts, a core component of Gorilla’s business, often come with delayed payments, raising concerns about liquidity and receivables turnover. Despite these risks, Gorilla’s ability to secure large-scale deals in North America, the MENA region, and beyond positions it as a serious contender in the AI-driven security and infrastructure market.

A $93 Million Backlog and Multi-Billion Dollar Pipeline – A Sign of Strength?

Gorilla Technology’s backlog of $93 million gives the company strong revenue visibility heading into 2025. This backlog represents already-secured contracts that should translate into revenue in the coming quarters. On top of this, the company has reported a $2 billion pipeline, indicating an aggressive push into new markets. This expansion has been largely driven by AI-powered security solutions for governments and enterprises, which have gained increasing demand as digital transformation accelerates globally.

However, backlog alone does not guarantee profitability. The key issue is execution—can Gorilla successfully convert backlog into actual revenue while keeping costs under control? The company has also opened a new office in Seattle, a strategic move to gain more U.S. government and enterprise contracts. If Gorilla can successfully execute its backlog and win a significant portion of its pipeline opportunities, its stock could see major upside. But execution risks remain, particularly with its history of SPAC-related volatility.

AI-Powered Smart Cities – The Future or an Overhyped Market?

Gorilla’s core business revolves around AI-powered smart city solutions, integrating advanced security, big data, and IoT technologies to create more efficient urban environments. Governments and enterprises are investing heavily in AI-driven security infrastructure, and Gorilla is well-positioned to benefit from this trend. According to the OECD, the global smart city market is expected to grow at a 15% CAGR, reaching over $1 trillion by 2027.

Gorilla’s AI-driven security solutions have been a key selling point, allowing cities to enhance surveillance, cybersecurity, and operational efficiency. The company’s partnerships in the Middle East and North America show increasing demand for these solutions. However, while the smart city industry is growing, it remains highly competitive, with companies like Palantir (NYSE:PLTR) and other AI players also vying for dominance. Gorilla’s ability to scale its solutions and differentiate itself will be crucial in determining whether it can capture a meaningful share of this booming industry.

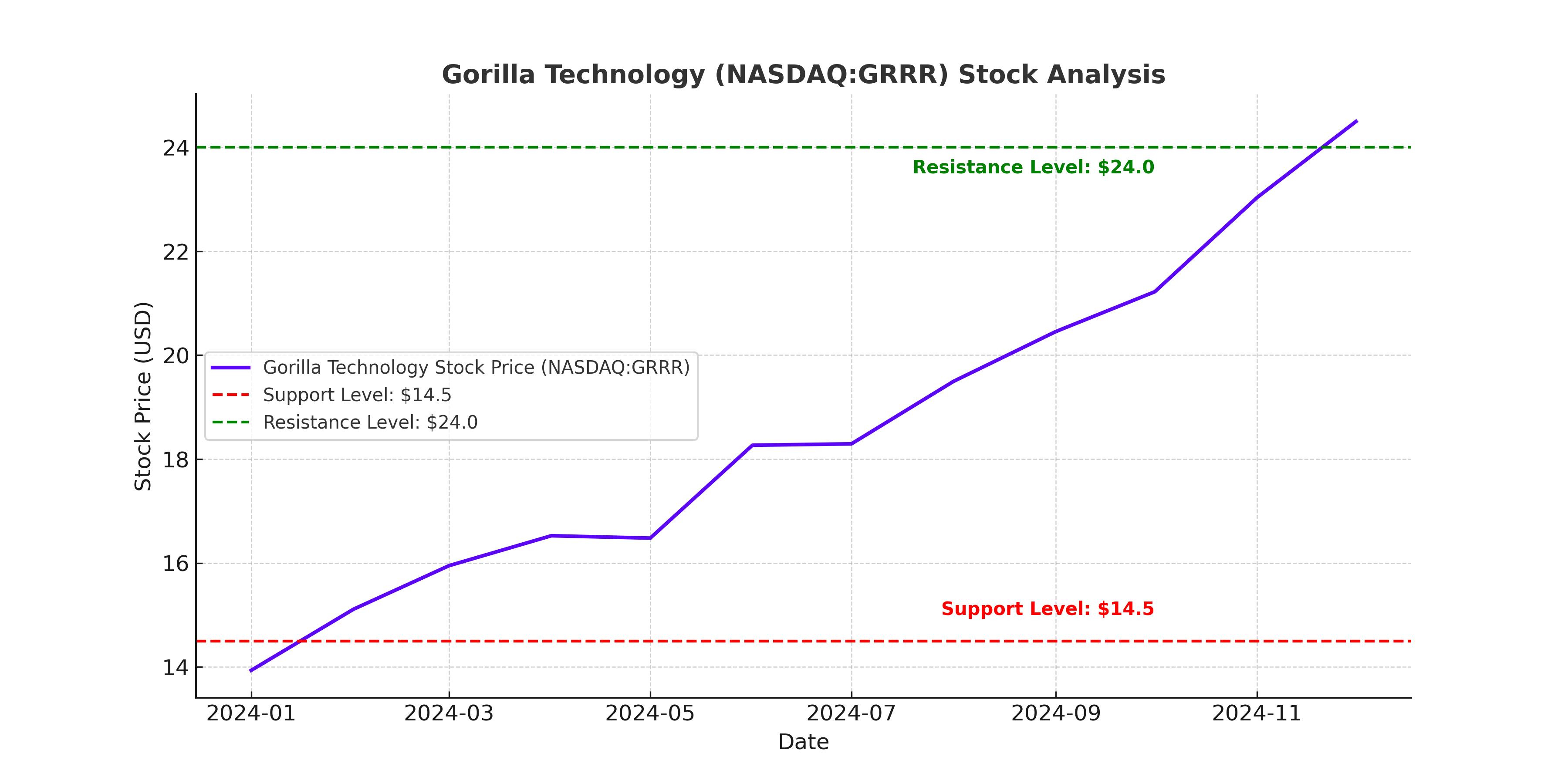

Why Did NASDAQ:GRRR Drop 40% After Hitting $24?

After surging to $24 per share, Gorilla Technology’s stock has pulled back nearly 40%, raising concerns among investors. This drop can be attributed to several factors, including profit-taking, concerns about government contract delays, and broader market volatility in AI-related stocks. The company has attempted to address these concerns by emphasizing its improving fundamentals, including strong revenue growth and a healthier balance sheet.

One key issue that has pressured GRRR’s stock is its cash flow conversion problem. The company’s receivables have grown significantly, meaning that while it is recognizing revenue on paper, it is not necessarily receiving cash at the same rate. This is particularly concerning given that a large portion of its business comes from government contracts, which historically have longer payment cycles. High receivables mean the company may face liquidity challenges despite strong reported revenue numbers.

Cash Flow Concerns – Can Gorilla Improve Liquidity?

One of the biggest red flags in Gorilla’s financials is its cash flow conversion issue. The company’s working capital days on revenue stands at 150 days, meaning it takes nearly five months to convert revenue into actual cash. This is primarily due to delayed payments from government contracts, a common issue for companies heavily reliant on public sector deals.

This delay in cash flow raises concerns about Gorilla’s ability to scale efficiently. While the company has a $93 million backlog, if it struggles to collect cash in a timely manner, it may need external funding to sustain operations. Investors should monitor how Gorilla manages its receivables and whether it improves cash conversion rates in the coming quarters.

Valuation – Is NASDAQ:GRRR Undervalued or a Trap?

At its current price of $14.50 per share, Gorilla Technology is trading at a forward P/E of 21.19x, a 31.5% discount to the software sector median of 30.92x. On a revenue basis, GRRR trades at roughly 1.5x forward sales, which is significantly lower than AI-driven software peers that typically trade at 5x-10x revenue multiples.

If Gorilla can achieve its $90-$100 million revenue target and maintain 20-25% EBITDA margins, the stock could see significant upside. A conservative 5x revenue multiple would imply a valuation of $450-$500 million, or a potential price target of $30+ per share. However, execution risks, cash flow concerns, and potential dilution from future funding rounds must be considered.

Buy, Sell, or Hold – Is GRRR a High-Risk AI Play Worth the Bet?

Gorilla Technology (NASDAQ:GRRR) presents a compelling growth story with its AI-powered smart city expansion, strong backlog, and growing presence in North America. However, concerns around cash flow conversion, government contract delays, and overall market volatility cannot be ignored. If the company successfully executes its $93 million backlog and captures a portion of its $2 billion pipeline, the stock could easily trade at $20-$25+ per share. However, if cash flow issues persist and growth slows, the stock could struggle to hold its current levels.

Given the balance of high reward but significant risk, NASDAQ:GRRR is a high-risk, high-reward investment that is best suited for aggressive investors willing to endure volatility. If Gorilla improves cash flow management and executes on its growth plans, it could emerge as a major AI player in smart city technology. However, investors should remain cautious and track execution closely before making a long-term commitment.