NASDAQ:TSM Reports Strong Q1 2024 Earnings and Strategic Growth Initiatives

Q1 2024 EPS of $1.38 and $18.32 Billion Revenue Beat Forecasts; Strategic Investments in New Fabs and Advanced Technologies Position TSM for Continued Growth in AI and Semiconductor Markets | That's TradingNEWS

Q1 2024 Earnings and Market Impact

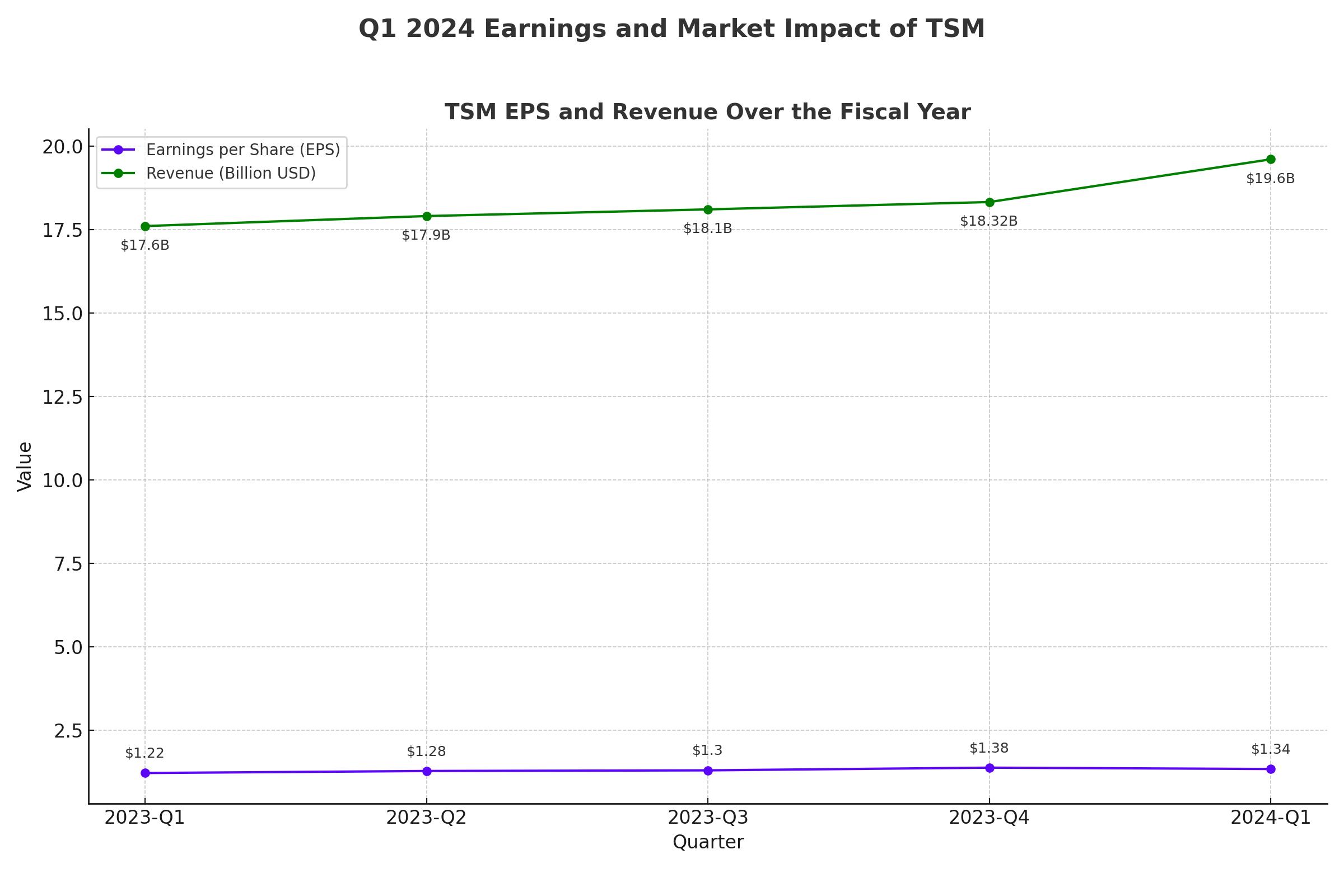

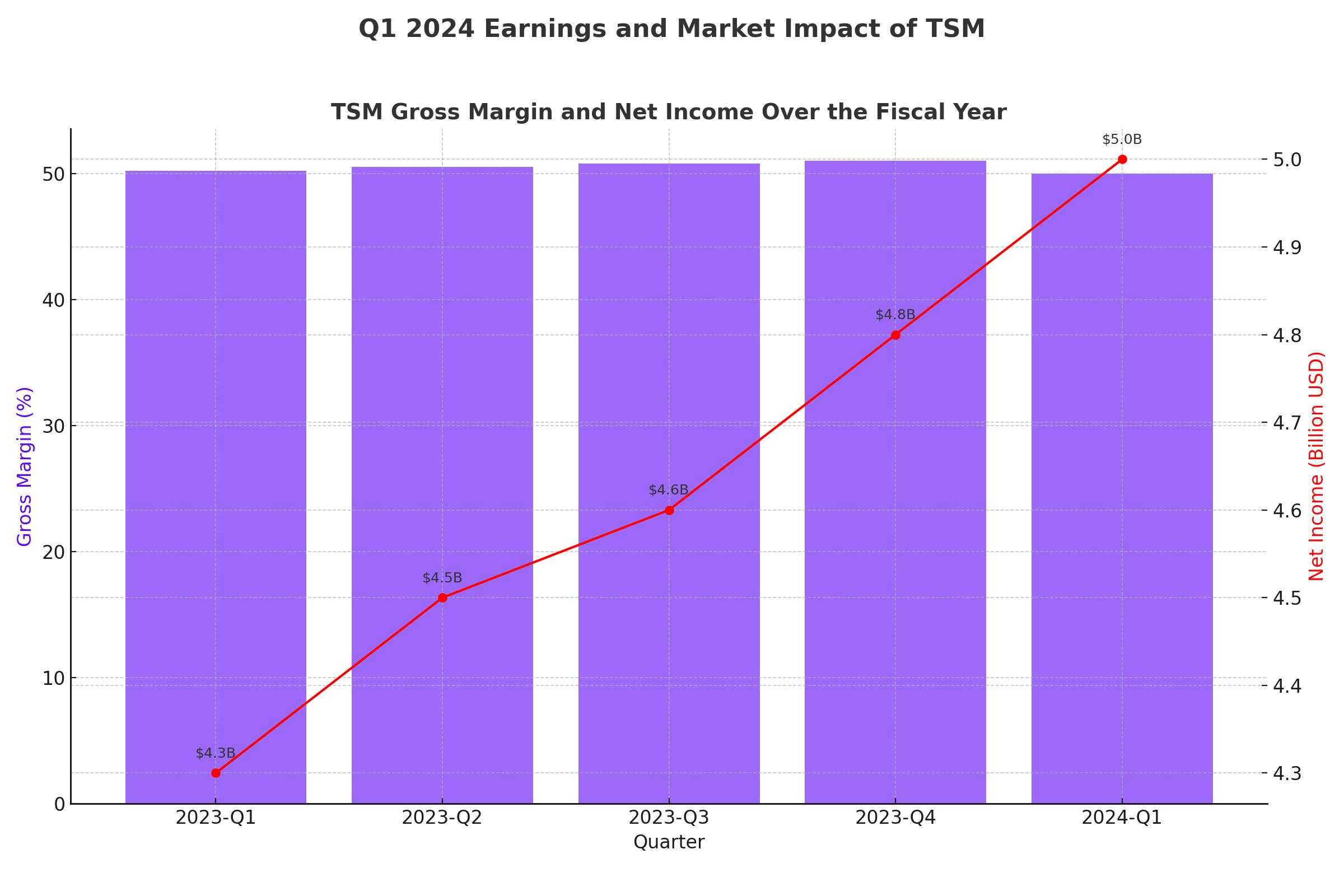

Taiwan Semiconductor Manufacturing Co. (NASDAQ: TSM) reported Q1 2024 earnings that exceeded expectations. The company achieved an EPS of $1.38, surpassing the consensus estimate by $0.06, and generated revenue of $18.32 billion, beating forecasts by nearly $225 million. This represented a year-over-year net revenue increase of 16.5% and an 8.9% rise in net profit.

Despite these strong results, TSM's stock initially dipped due to a revised growth outlook for the overall semiconductor industry, which was lowered to 10% from a previously optimistic forecast. However, the stock rebounded, climbing over 30% since bottoming just below $128 a share post-earnings report.

Q2 Forecast and Growth Projections

For Q2 2024, TSM management forecasts revenue between $19.6 billion and $20.4 billion. Analysts expect an EPS of $1.34, a significant increase from the $1.14 reported in Q1 of the previous year, with revenue projected to reach $20.08 billion, marking a 28% year-over-year growth.

Earlier projections indicated at least a 20% revenue growth for FY 2024, which is more than double the industry's outlook. The demand for TSM's advanced chips, particularly in the 3-nanometer and 5-nanometer technologies, is expected to drive this robust growth.

Strategic Investments and Capital Injections

TSM received approval to inject an additional $10.26 billion to finance the construction of new fabs in Kumamoto, Japan, and Arizona, USA. This includes $5.26 billion for its Japanese venture and $5 billion for its Arizona fab, which will upgrade to 2-nanometer process technology to meet the growing AI demand.

The second Kumamoto fab will produce chips for automotive, industrial, and high-performance computing applications, while the first fab is set to begin production in Q4 of this year. TSM's aggressive expansion strategy underscores its commitment to maintaining its leadership in advanced semiconductor manufacturing.

Revenue Growth and Market Leadership

TSM's revenue trajectory has seen a significant slowdown since Q1 FY2023, with a notable drop to 3.6% YoY growth in Q1 FY2024 from 43% in Q4 FY2022. Despite this, the company's revenue is showing signs of a strong rebound, driven by the GenAI boom. In April and May, TSM reported a 59.6% and 30.1% YoY increase in revenue, respectively, indicating a potential beat of its Q2 FY2024 revenue guidance.

TSM's dominance in the advanced semiconductor market is evident, holding 70-80% of the global 5nm market and over 90% of the 3nm market. The company's leadership in AI computing and advanced packaging positions it well for continued growth.

Margin Expansion and Valuation

TSM's margins have been under pressure, with expectations of a 100bps decline in gross and EBIT margins in Q2 FY2024 compared to the previous quarter. However, the anticipated price hikes and increased demand for advanced chips are expected to drive margin expansion starting in Q1 FY2025.

Currently trading at a forward P/E of 27.36x, TSM's valuation reflects its growth potential. Despite a higher multiple compared to its historical average, the stock's valuation is justified by the strong demand for AI and advanced semiconductor technologies. The stock's forward PEG ratio stands at 2.05x, indicating reasonable growth prospects.

Dividend and Financial Health

TSM's solid financial health is highlighted by its investment-grade debt ratings and substantial cash reserves of $64.4 billion. The company maintains a low payout ratio, ensuring the sustainability of its dividend, which has grown at an average rate of 9.83% over the past five years.

Technological Advancements and AI Integration

TSM's focus on technological advancements, particularly in AI and semiconductor manufacturing, is a key driver of its growth. The company's N2 process technology, expected to be widely available in the second half of FY2025, will offer significant improvements in performance and power efficiency. The N2 node will boost performance by 10-15% and reduce power consumption by 25-30%, making it highly attractive for AI computing and other advanced applications.

The integration of AI capabilities into semiconductor processes is expected to drive significant demand for TSM's advanced chips. As AI becomes more pervasive across various industries, the need for high-performance, energy-efficient semiconductors will continue to grow. TSM's leadership in AI integration positions it well to capitalize on this trend and drive future revenue growth.

Customer and Revenue Diversification

TSM's customer base is heavily concentrated, with its top ten customers accounting for 91% of its revenue, and Apple alone contributing 25%. While this concentration poses a risk, it also highlights the company's importance to some of the world's leading tech companies. TSM's ability to secure long-term contracts and prepayments from these key customers underscores its critical role in the global tech supply chain.

To mitigate the risks associated with customer concentration, TSM is working to diversify its revenue streams. The company's investments in new fabs and advanced technologies aim to attract a broader range of customers across different industries, including automotive, industrial, and high-performance computing. This diversification strategy will help to reduce dependency on a few key customers and enhance revenue stability.

Financial Health and Investment Grade Rating

TSM's strong financial health is a significant advantage, providing the company with the flexibility to invest in growth initiatives and weather economic downturns. The company's investment-grade debt ratings (AA-/stable by Standard & Poor's and Aa3/stable by Moody's) reflect its robust financial position. With $64.4 billion in cash and cash equivalents and a manageable debt load of $30 billion, TSM is well-positioned to finance its ambitious expansion plans.

The company's disciplined approach to capital allocation, including significant investments in R&D and capacity expansion, ensures that it remains at the forefront of technological innovation. TSM's strong cash flow generation capabilities also support its ongoing dividend payments and share repurchase programs, providing attractive returns to shareholders.

Market Sentiment and Analyst Views

Market sentiment towards TSM remains positive, driven by the company's strong financial performance, leadership in advanced semiconductor technologies, and strategic growth initiatives. Analysts are generally bullish on TSM, with the average 12-month price target of $176.39, reflecting confidence in the company's growth prospects. Eight analysts rate TSM as a strong buy, and four rate the stock as a buy.

The recent rally in TSM's stock price, up over 70% in the past 12 months, underscores the market's optimism about the company's future. While the stock's valuation has expanded, the potential for continued growth in AI and advanced semiconductor technologies justifies the higher multiple. Investors are advised to monitor TSM's execution on its strategic initiatives and its ability to navigate industry challenges to assess the sustainability of its growth trajectory.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex