NASDAQ:TXN Future Growth Through Strategic Investments

Delving into TXN's dividend history, new manufacturing initiatives, and the impact of recent capital expenditures on its financial trajectory | That's TradingNEWS

Texas Instruments: A Deep Dive into NASDAQ:TXN

Performance and Prospects

For over a decade, Texas Instruments (NASDAQ:TXN)has been a stalwart in the investment portfolios of dividend growth investors. Known for its impressive starting yield, significant dividend growth, and market-beating returns, TXN has delivered a remarkable 253% return over the past ten years. It’s also a key holding in the Schwab U.S. Dividend Equity ETF (SCHD). However, recent announcements about substantial investments in new manufacturing facilities have sparked concerns among investors regarding the company’s ability to sustain its impressive track record.

Capital Allocation: A Long-Term Strategy

Free Cash Flow and Shareholder Rewards

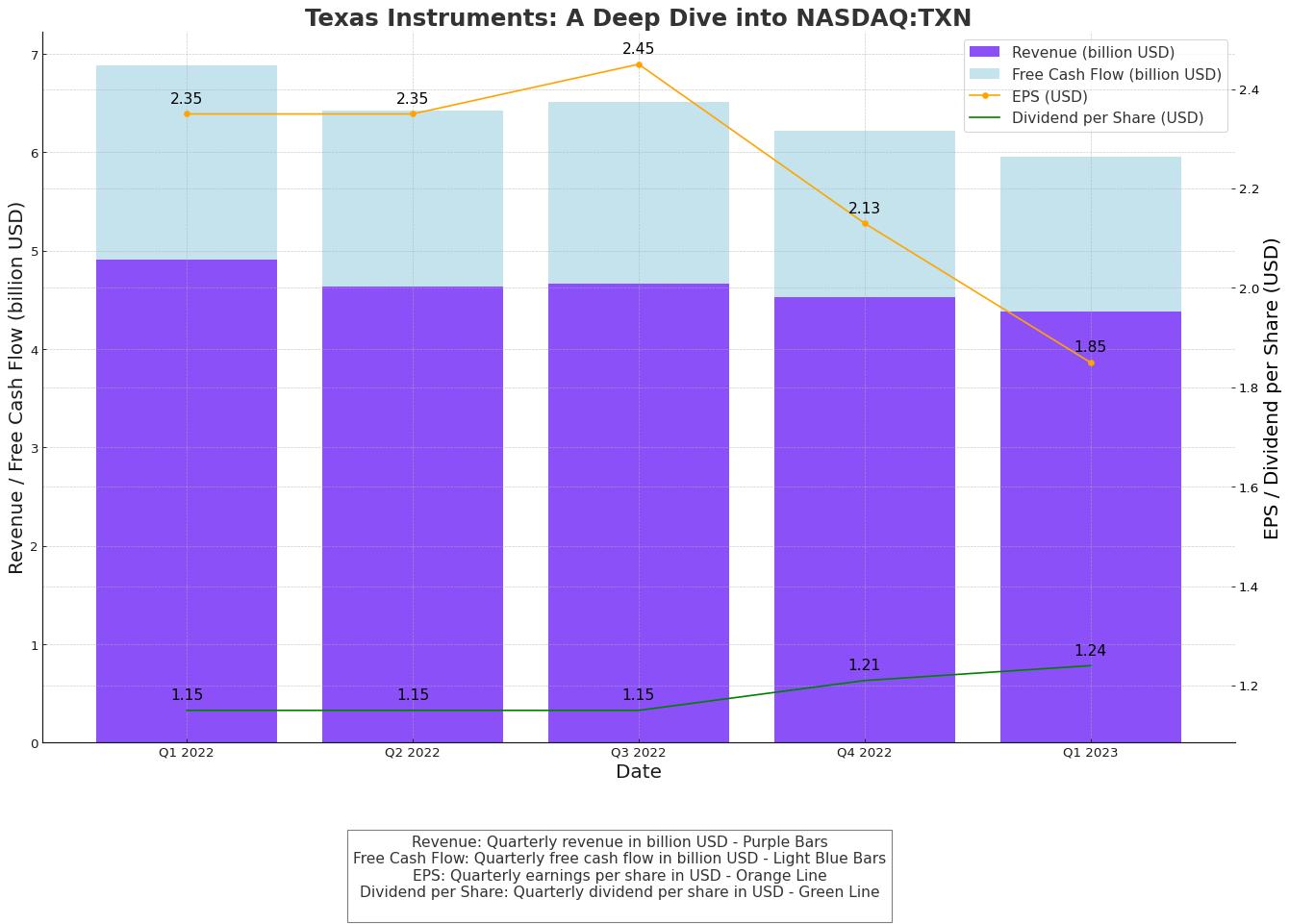

Texas Instruments has demonstrated a steadfast commitment to increasing free cash flow per share and utilizing that cash flow to reward shareholders through dividend growth and share buybacks. From 2004 to 2022, the company saw an annual growth rate of over 11% in free cash flow per share, which allowed TXN to boost its dividend payments from $0.09 to $4.69 per share.

Additionally, TXN reduced its share count by 47% between 2004 and 2023, significantly enhancing per-share value.

Dividend Breakdown and Financial Metrics

Current Dividend Metrics

The current starting yield for TXN stands at 3.26%. While the company has exhibited impressive dividend growth over the past decade, there has been a noticeable slowdown in the last five years. The most pressing concern is that, for the first time in a decade, TXN’s free cash flow did not cover its dividend in 2023, resulting in a free cash flow payout ratio of 337%.

Short-Term Concerns: Capital Expenditures and Free Cash Flow

Investment in New Manufacturing Facilities

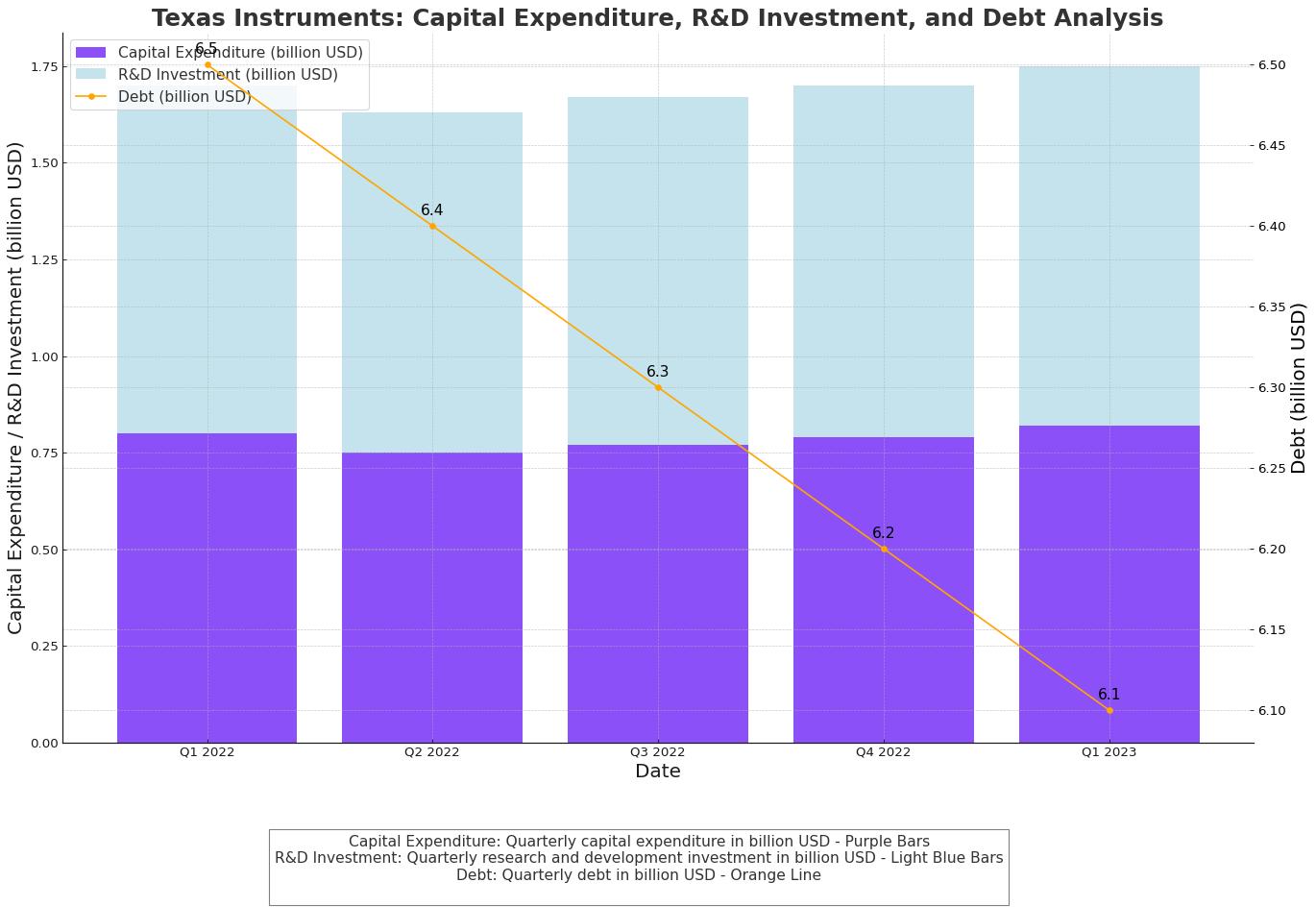

TXN has announced plans to build new manufacturing facilities, a move that, while beneficial in the long term, is expected to significantly impact free cash flow per share in the near future. Free cash flow per share has already seen a substantial drop in 2023, with no significant improvement anticipated until these facilities are completed. According to Vice President Dave Pahl, capital expenditures are projected to reach $5 billion annually through 2026. This heavy investment is expected to cause a dip in earnings per share and a decrease in dividend growth rates, impacting investor sentiment.

Long-Term Payoff: Potential Benefits of New Facilities

Reduction in Chip Production Costs

Despite the short-term outlook appearing bleak due to reduced free cash flow per share, the long-term potential for TXN looks promising. The new manufacturing facilities are expected to reduce chip production costs by 40%, which could significantly boost profit margins and drive long-term growth.

Government Incentives and Strategic Capital Management

The U.S. government's Chips Act, which incentivizes domestic chip production, is likely to benefit TXN by offering tax credits. The company’s management team has a proven track record of strategic capital management that rewards shareholders while achieving free cash flow per share growth.

Valuation: Assessing TXN's Financial Health

Discounted Cash Flow and Dividend Discount Models

The discounted cash flow valuation for TXN is unique, as free cash flow is expected to remain low through 2026, followed by a spike to previous highs with solid growth expectations. My discounted cash flow analysis indicates an intrinsic value of $145.89, close to the current trading price. The dividend discount model suggests a fair value of $156.00, assuming a 5% dividend growth rate and an 8.5% discount rate.

Investment Perspectives

For Long-Term Investors

Investing in TXN is essentially a bet on a company with a proven track record of growing free cash flow per share and a strong management team capable of navigating substantial investments in manufacturing facilities. The short-term increase in capital expenditures is viewed as an investment in the company’s future.

For Income-Focused Investors

For those seeking immediate dividend income, TXN may not be the best option in the short term due to its planned capital expenditures through 2026, which could negatively impact dividend growth and free cash flow per share.

Risks: Factors Investors Should Consider

Economic and Geopolitical Risks

TXN is susceptible to economic downturns, trade wars, and geopolitical instability, which could disrupt its supply chain. The highly competitive semiconductor industry poses a threat from both established and emerging companies, including foreign-based manufacturers with lower production costs.

Technological Advancements

Rapid technological advancements could render TXN’s products obsolete if the company fails to innovate and adapt. Continuous investment in research and development is crucial for maintaining its competitive edge.

Intellectual Property

TXN relies heavily on its intellectual property (IP) to protect its technology and designs. Infringement or loss of key IP could significantly harm its business.

Recent Performance and Analyst Ratings

Q1 Financial Results and Market Response

In Q1, Texas Instruments reported EPS of $1.20, surpassing Wall Street forecasts of $1.07 per share. Revenue came in at $3.66 billion, topping analyst estimates of $3.60 billion. This earnings beat has driven TXN stock higher, with the company forecasting Q2 revenue of $3.65 billion to $3.95 billion and profits of $1.05 to $1.25 per share. TXN stock is up 16% over the past 12 months and has nearly doubled over the last five years.

Analyst Opinions

Several research analysts have issued reports on TXN. Evercore ISI raised their price target to $225.00, while Morgan Stanley lifted their target price to $146.00. Despite these positive ratings, the consensus price target is $182.48, reflecting a mixed outlook among analysts.

Conclusion

Texas Instruments remains a compelling investment for long-term growth, backed by a strong track record of shareholder returns and strategic investments. While short-term challenges related to high capital expenditures and free cash flow constraints exist, the company’s future potential in cost reduction and profit margin enhancement positions it well for sustained growth. Investors should closely monitor TXN’s progress in executing its strategic plans and navigating market dynamics.

That's TradingNEWS

Read More

-

FTEC ETF Climbs to $226.76 as Tech Bid Targets $240 High

22.12.2025 · TradingNEWS ArchiveStocks

-

XRPI at $10.97, XRPR Near $15.8: XRP-USD Stalls at $1.94 as $82M XRP ETF Inflows Hit the $2 Wall

22.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Stays Pinned Near $4 as LNG Pull Beats Warm Weather

22.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Pulls Back to 156.95 After 157.75 Spike as BoJ Hike Triggers Intervention Alarm

22.12.2025 · TradingNEWS ArchiveForex