Natural Gas (NG=F) Sinks Below $3.10 as Record Production and Weather Shift Undercut Bulls

NG=F Faces $2.75 Test After Losing Key Technical Zone and Storage Surplus Grows | That's TradingNEWS

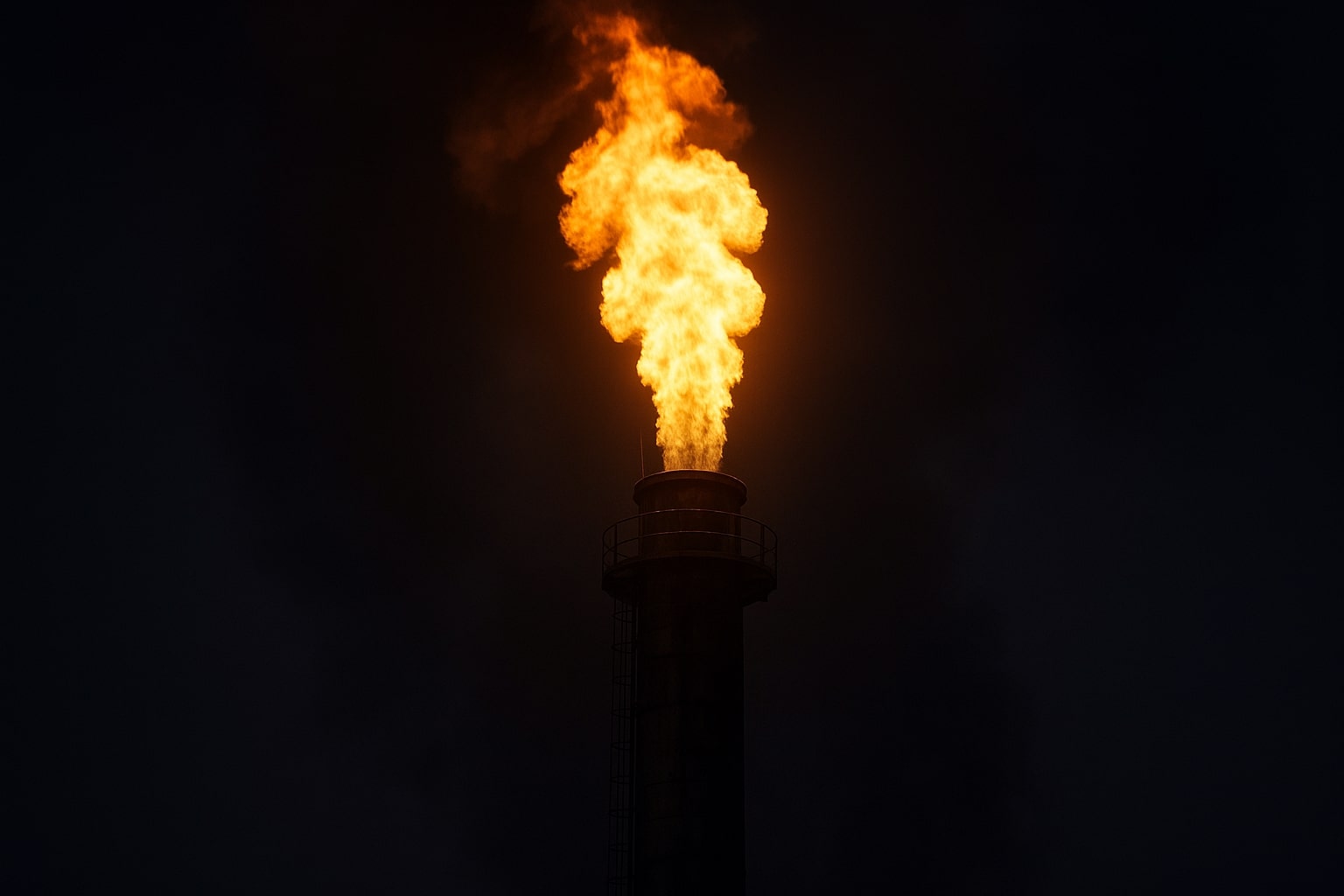

Natural Gas Faces Renewed Bearish Momentum as Supply Surges and Weather Softens

Price Break Below $3.10 Triggers Technical Breakdown Across Key Averages

Natural gas futures have decisively breached the $3.10 threshold, printing $3.096 as of July 24. This violation marks the lowest close since April and dismantles a multi-month technical base that had supported bullish narratives since Q4 2023. Notably, price action sliced beneath the 20-, 50-, 100-, and 200-day EMAs—all clustered tightly between $3.38 and $3.50—invalidating prior breakout structures and reinforcing near-term bearish sentiment.

The breakdown followed the collapse of an ascending triangle formation, with the Relative Strength Index (RSI 14) now down at 36.99, signaling mounting downside pressure. Unless bulls swiftly reclaim the $3.30–$3.35 area, rallies are likely to be sold into. Meanwhile, the next critical floor lies between $2.95 and $3.05—a zone that previously attracted dip buyers. If broken, the market risks acceleration toward $2.75 or even $2.60.

Record Output at 107.2 bcfd Swamps Market Despite Firm LNG Export Flows

U.S. Lower 48 output reached a new record of 107.2 billion cubic feet per day in July, eclipsing the June high of 106.4 bcfd. This production glut has saturated the domestic market, especially with mild weather forecasts slashing cooling demand expectations. Despite robust LNG exports holding near 15.8 bcfd, excess supply continues to dominate, overwhelming export capacity and undermining near-term upside.

Storage levels have climbed to 6% above the five-year seasonal norm. This removes any urgency from physical buyers and adds to bearish pressure. Traders are essentially fighting upstream against a structural surplus—a dynamic that only a major weather disruption or production slowdown could resolve.

Cooling Demand Outlook Weakens as Heatwaves Fizzle into August

The latest meteorological models suggest a pullback in expected U.S. heat into early August. While above-average temperatures are still forecasted, intensity has moderated. This reduces power burn demand for natural gas, especially during peak daytime hours, and further contributes to weakening spot pricing.

The Henry Hub benchmark fell $0.135 on the day, while major regional hubs showed even steeper drops. Northwest Sumas plummeted $0.47, SoCal Border slid $0.345, and Stanfield collapsed $1.435. These spot trends confirm deteriorating local fundamentals, particularly in the Pacific and Mountain West, where excess pipeline flows have nowhere to go amid tepid power demand.

Historical Volatility Retreats as Injection Surge Calms Market Jitters

After a volatile winter and early spring, natural gas markets are settling into more traditional summer patterns. Annualized front-month volatility dropped to 69% by mid-year, down from 81% in Q4 2024, according to Bloomberg data. This decline reflects a more balanced inventory situation, with the market recovering from extreme swings in 2022–2023 that saw both record draws and chaotic injections.

From late April through June, weekly net injections exceeded 100 Bcf per week for seven straight weeks—the longest streak since 2014. By the end of Q2, storage levels were 6% or 173 Bcf above the five-year average, easing supply shock concerns and reducing speculative risk premiums in futures pricing. Lower volatility implies tighter bid-ask spreads and calmer institutional flows, favoring rangebound trading strategies over high-leverage directional bets.

Waha and Permian Markets at Crossroads as Data Center Demand Enters Picture

In-basin pricing at Waha remains deeply discounted relative to Henry Hub, though regional demand shifts could begin to alter that imbalance. The explosive growth in data center construction across Texas is generating new electricity load profiles, increasing long-term gas demand from generators.

Yet, this demand hasn't translated into short-term price premiums. Waha continues to print at a discount of over $0.30 relative to Henry Hub, with many producers prioritizing oil output and dumping associated gas at index rates. The prevailing mindset remains “get the gas out of the way to pump oil,” which limits negotiated uplift in regional contracts.

Law firm Bracewell LLP suggests that only structural offtake deals with utilities or AI hyperscalers could re-rate Waha pricing over the long term. For now, Permian gas remains a liability rather than an asset.

AI-Driven Power Demand Adds Long-Term Bullish Tailwind, But Timing Uncertain

There’s growing chatter that AI and compute-driven power loads could become a major structural demand driver for U.S. gas in the next 12–36 months. While current weather and production data dominate the immediate tape, long-only funds and utilities are starting to position around a thesis where data centers anchor new baseload demand.

This narrative, however, lacks near-term catalysts. The market needs to see actual signed offtake deals and confirmed plant openings before rerating expectations higher. Until then, power burn remains cyclical and weather-dependent—leaving NG=F highly vulnerable to shoulder-season weakness and bearish overhang from excessive supply.

Buy, Sell, or Hold Verdict for NG=F (Natural Gas Futures): SELL

The technical, fundamental, and structural picture all currently lean bearish. With NG=F trading below $3.10 and beneath all key moving averages, and no short-term demand surge in sight, rallies are likely to be sold. Storage overhangs remain elevated, production is at record highs, and volatility has collapsed—offering little reason to chase long exposure until $3.35 is reclaimed. A retest of $2.75 appears more probable than a breakout above $3.50 in the near term.

That's TradingNEWS

Read More

-

Broadcom Stock Price Forecast: AVGO at $325 Ahead of AI-Driven Earnings

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: Ripple XRP-USD Climbs Back to $1.47 but $1.80 Wall and Sub-$1 Risk Still Dominate

14.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Prices Forecast - Oil Hold WTI at $63 and Brent at $68 While New Supply and IEA Surplus Weigh on the Market

14.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Weekly Recap: S&P 500 Stalls, Nasdaq Leads the Decline, Dow Eases as AMZN, NVDA, AAPL Sell Off

14.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Stuck at 1.36 as Fed Cut Hopes Clash With UK Weakness

14.02.2026 · TradingNEWS ArchiveForex