Robust Q3 Revenue Growth and Margin Expansion Netflix (NASDAQ:NFLX) reported a stellar third quarter, achieving 15% year-over-year revenue growth, reaching $9.83 billion, slightly surpassing analyst expectations of $9.76 billion. This growth stemmed from a surge in paid memberships globally, particularly in APAC, where membership grew 24% year-over-year. Despite challenges in LATAM, the overall subscriber count reached 283 million by the quarter's end. The company also demonstrated a significant improvement in operating margin, which expanded to 30%, showcasing the effectiveness of recent pricing strategies and cost optimizations.

However, it’s noteworthy that APAC and LATAM experienced declining average revenue per member (ARM) due to users transitioning to ad-supported tiers. ARM declined by 4% in APAC and 5% in LATAM. Yet, the 30% sequential growth in Netflix's ad-supported memberships in Q3’24 highlights the ad tier's potential to drive growth in these regions. Management aims to double ad revenues in 2025, which is projected to scale NFLX’s ad-supported tier into a more substantial revenue driver.

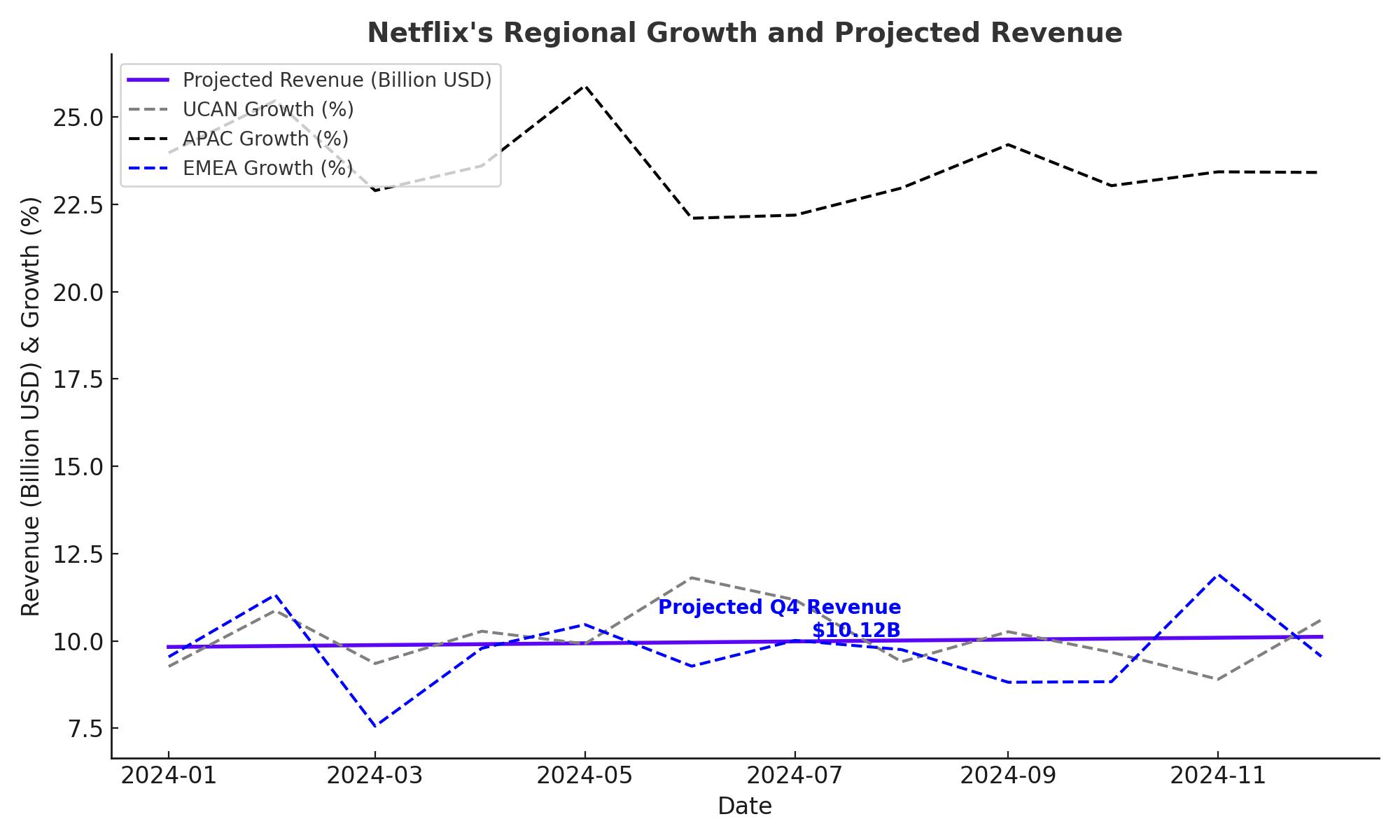

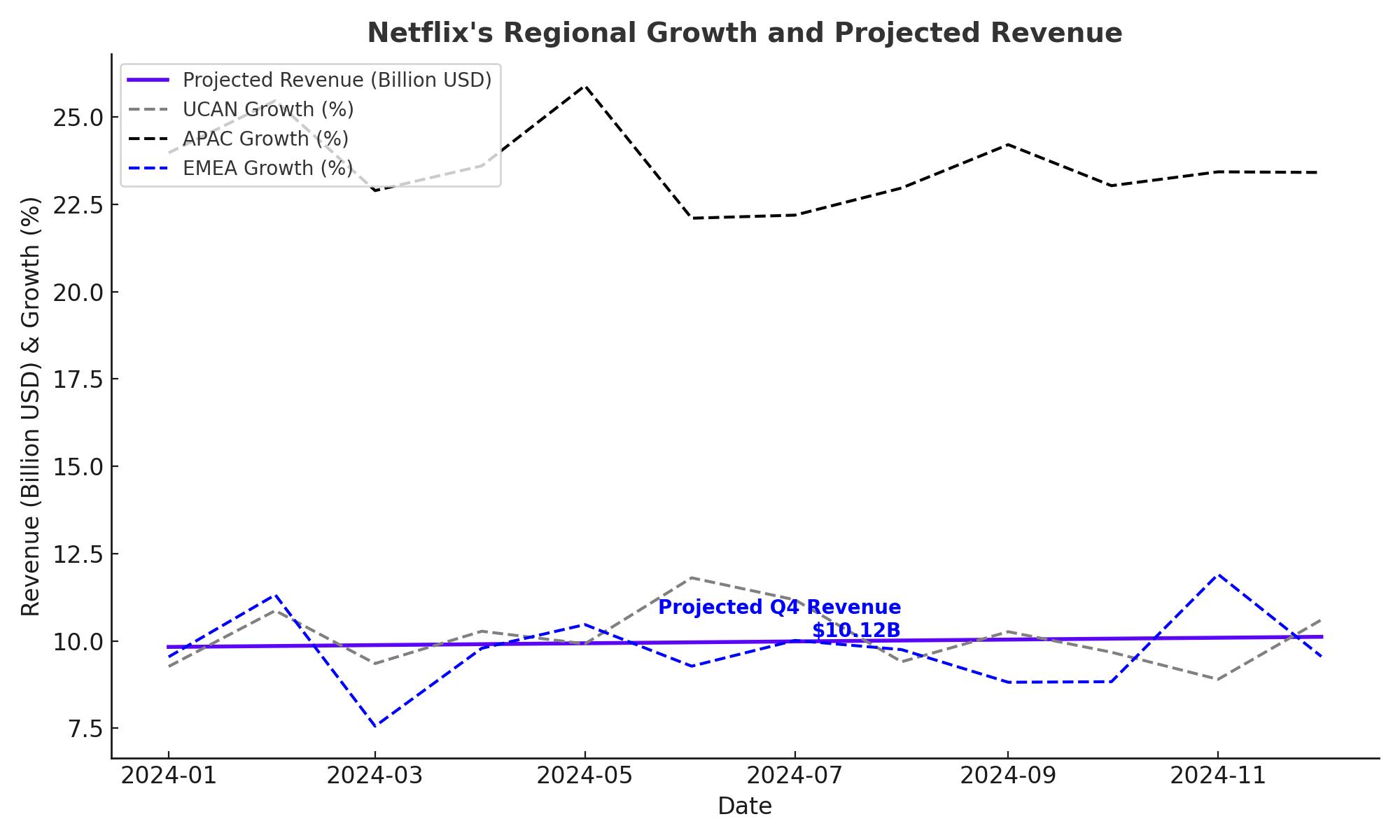

Projected Revenue for Q4 and 2025 Looking forward, Netflix has set an ambitious Q4 revenue target of $10.12 billion, indicating consistent mid-teens growth. For FY2025, Netflix forecasts revenue in the range of $43-44 billion, representing an 11-13% year-over-year growth. This projection aligns with Wall Street’s consensus revenue forecast of $43.73 billion, a 12% annual increase, showcasing Netflix’s commitment to maintaining its revenue trajectory even in a maturing market.

Expanding Growth Catalysts: Live Events and Advertising Push

Live Sports as a Strategic Growth Driver NFLX has aggressively entered the live entertainment space, with notable upcoming events, including two NFL games on Christmas Day, a high-profile Jake Paul vs. Mike Tyson fight on November 15, 2024, and weekly WWE programming starting in January 2025. These ventures are poised to attract dedicated audiences and significantly boost Netflix’s ad-supported tier revenue. WWE alone has an average weekly viewership of 1.7 million, which, if leveraged effectively, could contribute significantly to Netflix’s ad revenue potential. NFL games, traditionally high in advertising expenditure, present a lucrative opportunity for Netflix to establish itself as a premier streaming destination for live sports.

As evidenced by the $4.5 billion generated from NFL advertising in the 2023 season, NFLX’s Christmas Day games offer substantial revenue potential. Additionally, with live events, Netflix can attract a new audience segment, enhancing customer acquisition and retention across all tiers.

Advertising Strategy and First-Party Ad Server Implementation The advertising model is another vital growth driver. NFLX’s ad-supported tier, launched in November 2022, has grown rapidly to reach 15 million active users, appealing to price-sensitive customers. This tier, which was introduced in major markets such as the US, UK, France, and Japan, has performed well, and management anticipates ad revenue to double in 2025. Netflix also plans to launch a first-party ad server in Canada by the end of 2024 and expand to other markets in 2025. This shift to first-party ad technology is expected to improve ad personalization and revenue by leveraging viewer data to enhance targeting capabilities and increase CPMs (Cost per Mille).

Partnerships with platforms like The Trade Desk, Microsoft, and Google will further streamline programmatic advertising capabilities, giving Netflix access to a broader advertiser base and refining ad performance metrics. These advancements solidify Netflix’s potential to grow ad revenue while maintaining low operational costs, making advertising a cornerstone of Netflix’s growth strategy.

Q3 Subscriber Trends and Regional Performance

Subscriber Growth by Region Netflix’s Q3 report highlighted its regional growth dynamics. The APAC region led the way with 24% year-over-year growth, while UCAN (U.S. and Canada) posted a modest 9.67% growth, reflective of market saturation in North America. However, despite slowing net adds in the U.S., APAC’s average ARM remains below UCAN, at $7.31. Europe, the Middle East, and Africa (EMEA) also contributed significantly with robust subscriber growth, although the region faces pressure from recent price hikes in Spain and Italy.

In the US, Netflix eliminated its Basic plan, compelling users to upgrade or switch to the ad-supported tier, leading to a 61% decrease in net adds. Yet, this approach potentially drives up ARM, despite a gradual rise in customer churn. For Q4, Netflix has projected net adds of 6.57 million subscribers, with expected growth in UCAN and improving ARM in other markets.

Content Diversification and Engagement Engagement has also been healthy, with users averaging two hours daily on the platform. Netflix’s strategy of diversifying content, including new gaming titles, popular series, and live events, has resonated well with users. CEO Greg Peters emphasized that live events like the Tyson-Paul fight and NFL games represent a strategic push into high-engagement content that Netflix believes will help maintain or increase ARM in the long term.

Financial Position and Cash Flow Dynamics

Improved Cash Flow and Financial Flexibility In terms of cash flow, Netflix’s trailing 12-month cash flow from operations (CFO) stood at $7.49 billion, translating to a CFO margin of 19.92%. The free cash flow (FCF) was $7.125 billion, bolstered by reduced content expenditure due to the writers' strike. Netflix spent approximately $13 billion on content in 2023, with plans to increase spending to $17 billion in 2024. Nonetheless, the company’s high FCF margin, combined with its minimal capital expenditures of $362.5 million, enables NFLX to channel surplus cash into content, stock buybacks, and other strategic investments.

Debt Position and Credit Rating Netflix’s debt management has been prudent. It raised $1.8 billion in investment-grade bonds in Q3 to address maturing debt. As of Q3, NFLX’s total debt reached $16 billion, with a net debt-to-EBITDA ratio of 0.27, underscoring the company’s ability to service its debt comfortably. With a debt-to-equity ratio of 0.70 and an interest coverage ratio of 14.05, NFLX maintains a stable financial position that allows for aggressive content spending and new growth initiatives without compromising financial health.

Valuation and Investment Decision

Rich Valuation but Strong Growth Prospects NFLX trades at a forward P/E of 32x, in line with other large-cap tech stocks. Despite concerns about high valuation, the company’s forward PEG ratio of 1.59 suggests room for upside, with analysts predicting potential growth up to a $988 target based on a 34.56x FY2025 EV/EBITDA. While growth in subscriptions and ARM may slow slightly as global market saturation increases, advertising and live sports represent new avenues for substantial revenue generation.

Bull and Bear Case Considerations The bull case for NFLX hinges on its ability to maintain subscriber engagement through a diversified content portfolio, increase ARM through strategic pricing, and capitalize on live events for ad revenue growth. However, the bear case points to challenges in sustaining margin expansion if consumer spending tightens, or if subscriber growth in the ad-supported tier impacts overall margins.

Conclusion: Is (NASDAQ: NFLX) a Buy, Hold, or Sell?

In conclusion, while Netflix’s (NASDAQ:NFLX) stock has had an impressive run in 2024, macroeconomic headwinds and the premium valuation warrant caution. The company’s current strategies in live entertainment and advertising are promising, yet execution risks persist. For investors with a high-risk tolerance, NFLX presents a Buy opportunity on dips, especially if future earnings underscore further ad-supported tier growth. Otherwise, a Hold recommendation is prudent until NFLX’s Q4 results reveal more about the trajectory of its strategic pivots.

For real-time tracking of Netflix stock, check the (NASDAQ: NFLX) chart.

That's TradingNEWS