Q4 Financial Performance: A Mixed Bag

Nike (NYSE:NKE) reported a mixed set of results for its fourth quarter, highlighting both challenges and opportunities. The company delivered an earnings per share (EPS) of $1.01, surpassing the analyst consensus of $0.84 by $0.17. This positive EPS surprise, however, was overshadowed by a revenue miss, with the company reporting $12.6 billion against an expected $12.89 billion. This 2% year-over-year decline in revenue underscores the hurdles Nike faces in sustaining its growth momentum.

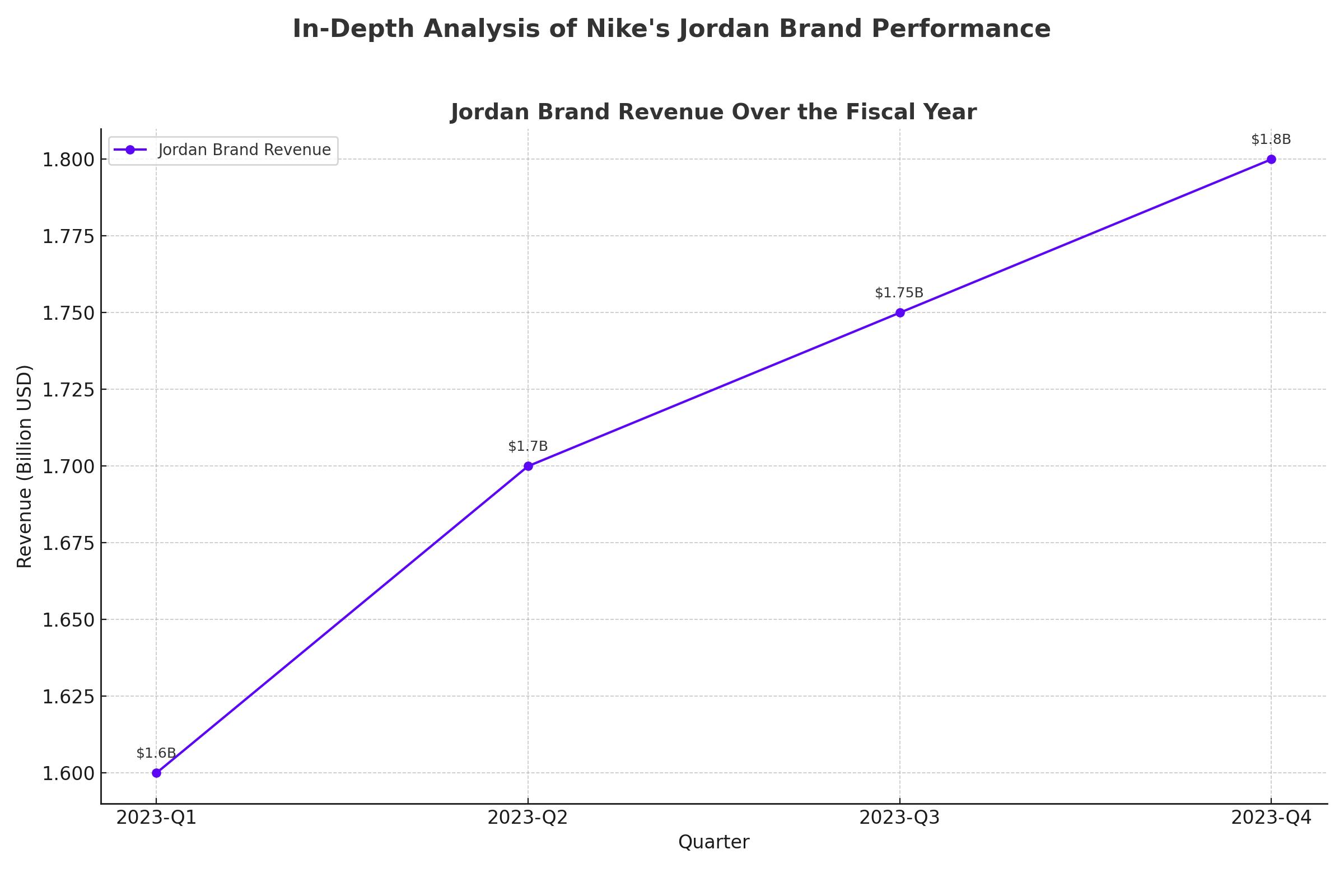

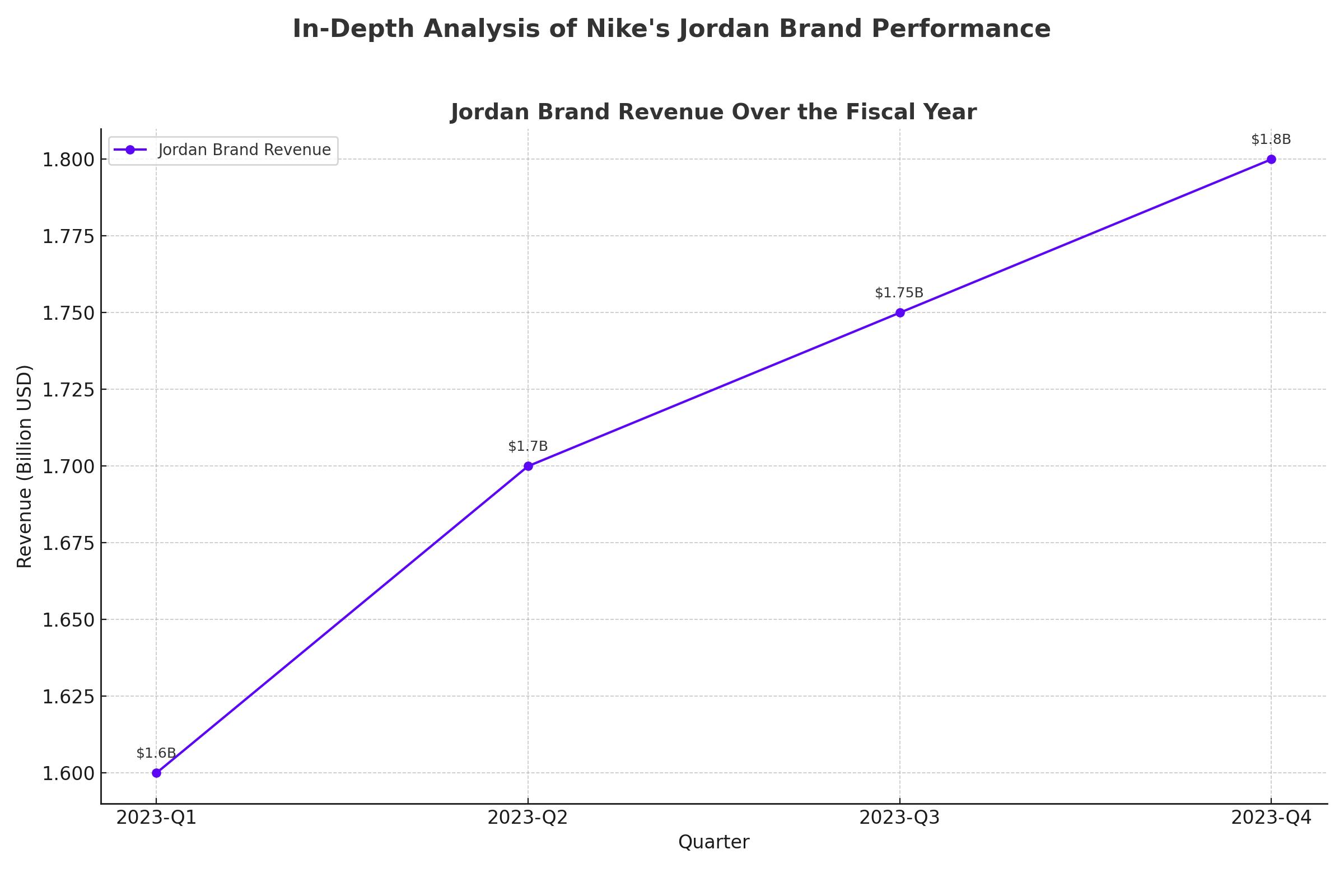

Annual Performance and Jordan Brand Strength

For the fiscal year, Nike's revenue stood at $51.4 billion, reflecting a meager 0.3% growth from the previous year. This marks one of the lowest growth rates in two decades, highlighting the need for strategic shifts to reignite growth. Notably, the Jordan brand emerged as a significant bright spot, posting a 6% sales increase to $7 billion. This performance underscores the brand's strong market positioning and its ability to resonate with consumers beyond its basketball roots, expanding into women’s gear and lifestyle products.

Insider Transactions and Shareholder Returns

Nike has consistently demonstrated a commitment to shareholder returns, with significant buybacks and dividend increases. In fiscal 2024, the company returned approximately $6.4 billion to shareholders through dividends and share repurchases. Specifically, dividends amounted to $2.2 billion, up 8% from the prior year, and share repurchases totaled $4.3 billion. This financial strategy highlights Nike's robust cash flow generation capabilities and its confidence in long-term business prospects. For detailed insider transactions, visit Nike's Insider Transactions.

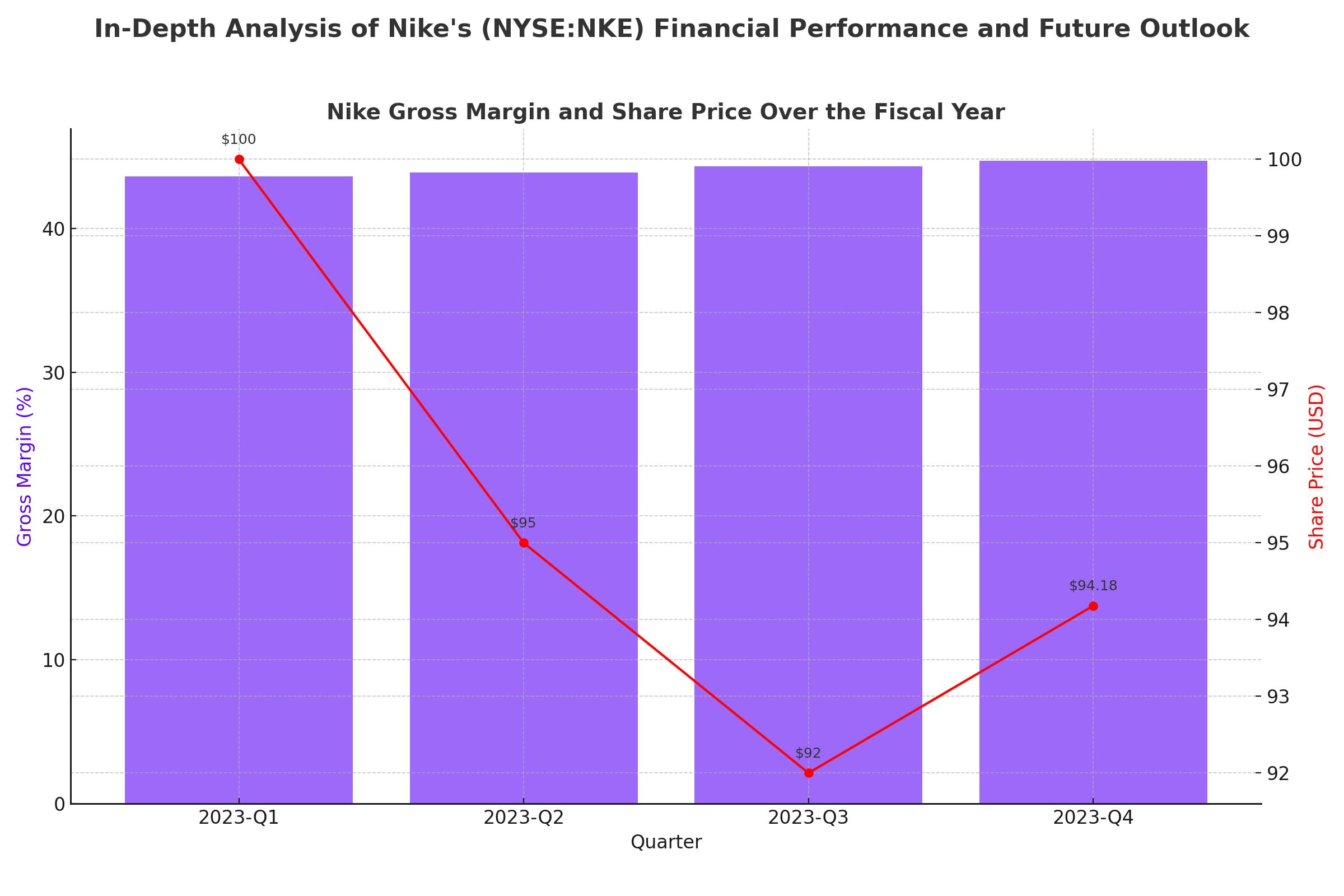

Market Reactions and Analyst Sentiment

Nike's stock has been under pressure, closing at $94.18, down 13% year-to-date. The post-earnings reaction was negative, with an additional 11% decline in after-hours trading, reflecting investor concerns about the near-term outlook. Analysts are divided, with Oppenheimer upgrading the stock to "outperform" and raising the price target to $120, citing a potential turnaround. In contrast, JPMorgan lowered its price target to $116, pointing to mixed signals from market fieldwork and ongoing challenges in key regions like North America and Greater China.

Revenue and Margin Dynamics

Nike's revenue dynamics reveal a complex picture. The company's gross margin improved by 110 basis points to 44.7% in Q4, driven by strategic pricing actions and lower logistics costs. However, Nike Direct revenues fell 8%, with declines in both digital and physical store sales. This indicates the need for a more integrated omnichannel strategy to drive consumer engagement and sales.

Key Financial Metrics:

- Gross Margin: Increased to 44.7% from 43.6% in the prior year.

- Operating Expenses: Total selling and administrative expenses decreased by 7% to $4.1 billion.

- Net Income: Rose by 45% to $1.5 billion, reflecting operational efficiencies and cost management.

Regional Performance: Strengths and Weaknesses

Greater China and EMEA: Both regions reported currency-neutral revenue growth, highlighting Nike's ability to leverage its brand strength in international markets. However, North America saw a decline, underscoring the competitive pressures and changing consumer dynamics in its home market.

Converse Brand: The performance of Converse was disappointing, with revenues down 18% on a reported basis. This decline was primarily driven by weaker demand in North America and Western Europe, indicating a need for revitalization of the brand's appeal in these markets.

Strategic Initiatives and Future Outlook

Nike has outlined several strategic initiatives aimed at repositioning the company for sustainable growth. These include:

- Innovation in Product Lines: Continued investment in product innovation, particularly within the Jordan brand and performance wear, to meet evolving consumer preferences.

- Enhanced Omnichannel Presence: Strengthening the integration of digital and physical retail experiences to drive higher engagement and sales.

- Operational Efficiencies: Ongoing efforts to streamline operations, reduce costs, and improve supply chain efficiencies.

Fiscal 2025 Outlook:

Nike's updated outlook for fiscal 2025 anticipates mid-single-digit revenue declines, including a 10% drop in Q1. Despite these near-term challenges, the company's long-term growth strategy focuses on innovation and market responsiveness.

Technical Analysis and Key Levels

Technical Patterns: Nike's stock is currently trading near its support levels. The 50-day and 200-day moving averages are critical technical indicators to watch. A sustained break above these levels could indicate a bullish trend, while a failure to hold support may lead to further downside.

Key Resistance and Support Levels:

- Resistance: $100, $110

- Support: $90, $85

Conclusion

Nike NYSE:NKE is navigating a challenging landscape marked by macroeconomic headwinds, competitive pressures, and evolving consumer behaviors. The company's strong brand equity, particularly in segments like Jordan, and strategic focus on innovation provide a foundation for future growth. However, investors should closely monitor how effectively Nike addresses its near-term challenges and executes its strategic initiatives. The mixed sentiment from analysts reflects the uncertainty and potential volatility in the stock's performance. For real-time updates and detailed financial insights, visit Nike Real-Time Chart.

Nike's ability to adapt and innovate will be crucial in determining its trajectory in the coming quarters. Investors should stay informed and vigilant, considering both the opportunities and risks associated with this iconic brand.

That's TradingNEWS