Nvidia (NASDAQ:NVDA): AI's Powerhouse or Overpriced Hype?

With AI spending set to exceed $274 billion and major technological breakthroughs ahead, can Nvidia maintain its dominance, or is its stock overextended? | That's TradingNEWS

Nvidia (NASDAQ:NVDA) Stock Battles Market Volatility Amid AI Growth

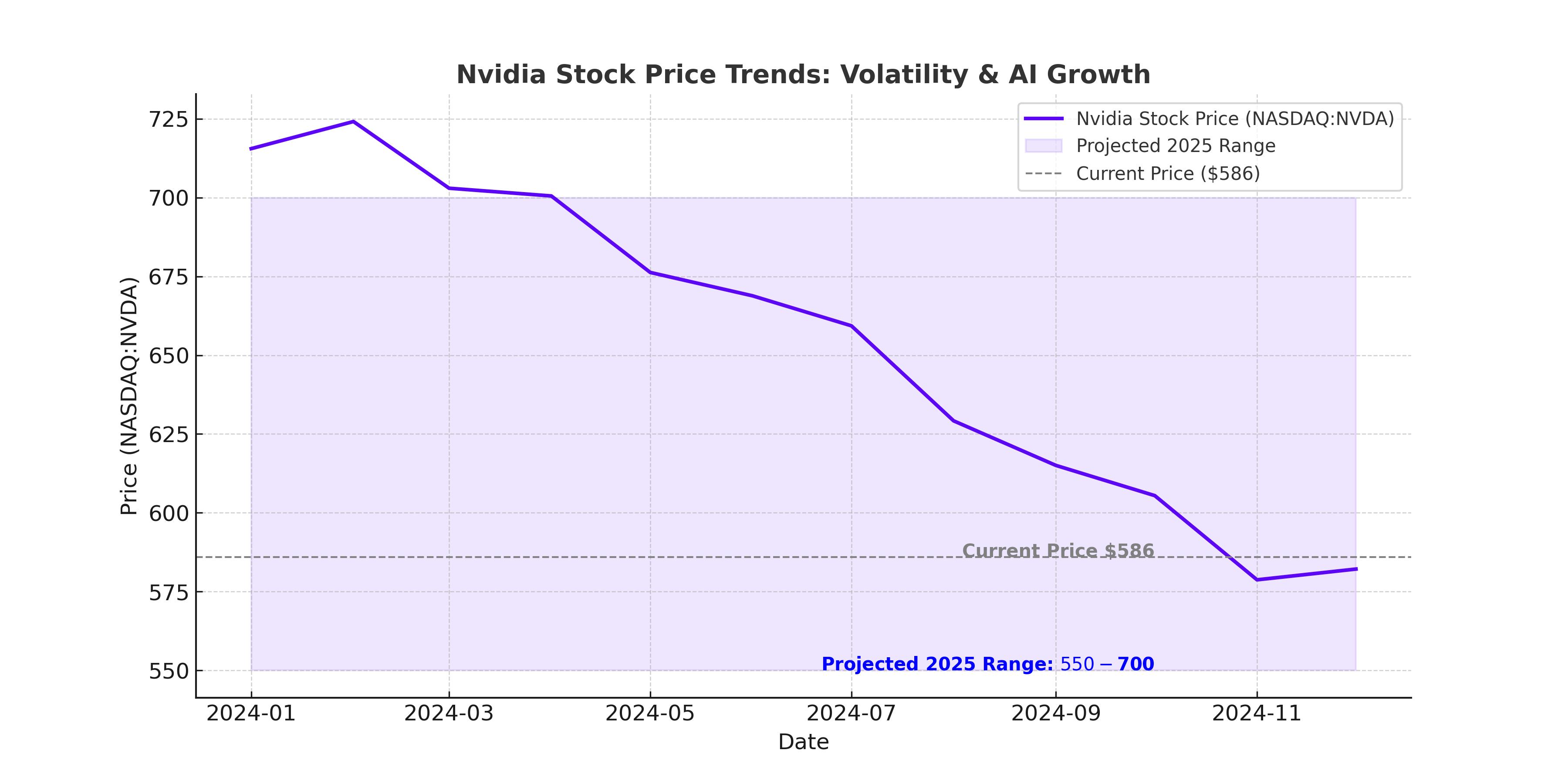

Nvidia Corporation (NASDAQ:NVDA) has dominated the artificial intelligence (AI) revolution, but the stock has recently faced turbulence, dropping over 20% in response to DeepSeek's AI efficiency breakthroughs. Investors are now questioning whether Nvidia can sustain its current market share or if this is the beginning of increased competition eating into its dominance. Shares of NVDA currently trade around $586, down from a recent high of $723. The question remains: is this dip a buying opportunity or a warning sign?

AI Spending to Surpass $274 Billion – What It Means for Nvidia

The AI sector is on track to see spending exceed $274 billion, marking a 22.8% increase year-over-year. Nvidia remains a key beneficiary, supplying the high-powered GPUs necessary for machine learning and AI applications. While some argue that cost-efficient models like DeepSeek could reduce the need for Nvidia’s hardware, the reality is that AI is still in its infancy. Demand for more complex AI models continues to rise, requiring greater computational power, and Nvidia remains the undisputed leader in this space.

OpenAI’s upcoming o3 model reinforces Nvidia’s critical role in AI development. Unlike DeepSeek’s cost-efficient models, OpenAI prioritizes performance, with models requiring weeks of high-intensity GPU computation. This demand underscores Nvidia's advantage, as no competitor currently offers a GPU stack that matches its efficiency and scalability.

Nvidia (NASDAQ:NVDA) and Military AI: A $1.4 Trillion Opportunity

The U.S. military budget for 2025 is set at $895 billion, with NATO's total spending surpassing $1.4 trillion. AI’s integration into military applications is only beginning, and Nvidia is in a prime position to capitalize. The Department of Defense is already investing $21 billion in AI-related projects, but this number is expected to grow exponentially as governments worldwide race to enhance AI-driven defense capabilities.

Nvidia’s long-standing government partnerships and proven track record in AI infrastructure make it a logical choice for defense-related AI expansion. As AI military budgets increase, Nvidia could secure multi-billion-dollar government contracts, providing a stable revenue stream outside of the volatile consumer and enterprise markets.

DeepSeek’s Impact on Nvidia (NASDAQ:NVDA): Overblown Fears or Real Threat?

The DeepSeek panic sell-off that led to NVDA’s 20% drop has left many investors worried. The Chinese AI company’s cost-efficient training model triggered fears that demand for Nvidia’s high-priced GPUs would decline. However, historical trends suggest that lower AI costs do not reduce GPU demand—instead, they increase AI adoption.

Microsoft’s CEO, Satya Nadella, recently stated that more efficient AI models will drive further enterprise adoption, a sentiment echoed by OpenAI’s Sam Altman and Anthropic’s Dario Amodei. Nvidia’s ecosystem remains unmatched, integrating GPUs with software like CUDA, networking solutions, and AI computing infrastructure. Even as competitors emerge, no company currently matches Nvidia’s complete AI stack.

Financial Performance: Can Nvidia (NASDAQ:NVDA) Justify Its Valuation?

Nvidia’s revenue over the past 12 months exceeded $113 billion, a staggering increase from $27 billion just two years ago. Gross profit margins remain at an incredible 75%, highlighting Nvidia’s pricing power and demand strength. Wall Street expects revenue to continue growing at 30%+ annually, fueled by AI, gaming, and data center expansion.

However, concerns remain about valuation risk. Nvidia currently trades at a forward P/E ratio of 43.6, which is elevated relative to the broader market and its historical averages. The stock’s price-to-sales (P/S) ratio of 27.6x mirrors levels last seen during the dot-com bubble, raising concerns about sustainability.

That said, Nvidia’s leadership in AI infrastructure and strong earnings growth continue to justify a premium valuation. With companies like BlackRock, Fidelity, and major hedge funds accumulating shares, institutional confidence in Nvidia remains strong.

Insider Transactions: What Are Nvidia’s Executives Doing?

Investors should always track insider transactions to gauge confidence in the company’s future. Recent filings reveal that Nvidia insiders have sold over $280 million in stock over the past six months. While this might indicate that some executives believe the stock is fully valued, it’s also common for insiders to take profits after a massive rally.

For detailed insider transaction data, visit Nvidia’s insider transaction page. Tracking executive activity can provide valuable insights into management sentiment.

Nvidia’s Expansion Beyond AI: The Future of Robotics and AI PCs

Beyond AI chips, Nvidia is aggressively expanding into robotics, autonomous driving, and AI-powered PCs. The launch of Project DIGITS signals its ambitions in disrupting the PC and laptop market, an area currently dominated by Intel and AMD.

Nvidia’s AI-powered PC initiative aims to integrate AI models into consumer devices, unlocking new revenue streams beyond its traditional data center and gaming divisions. If successful, this could add billions to Nvidia’s valuation in the coming years.

Nvidia’s (NASDAQ:NVDA) Growth Projections: Can It Sustain This Pace?

Wall Street analysts remain bullish on Nvidia, with price targets ranging from $700 to $1,000 per share. If AI adoption continues accelerating, Nvidia’s revenue could surpass $150 billion annually by 2026. However, any slowdown in AI infrastructure spending or competition from AMD and Intel could limit upside potential.

Nvidia’s leadership position is undeniable, but investors must consider valuation risks. At current levels, Nvidia is priced for perfection, meaning any negative earnings surprise could trigger further declines.

Is Nvidia (NASDAQ:NVDA) a Buy, Sell, or Hold?

Given Nvidia’s unmatched AI dominance, expanding government contracts, and strong financial performance, long-term investors could see further gains. However, the stock’s rich valuation and insider selling warrant caution.

At current levels of $586 per share, Nvidia appears to be in a consolidation phase. Investors looking to buy should watch for a breakout above $620 or a pullback toward $550 for a better risk-reward entry.

For real-time stock movements, visit Nvidia’s live price chart.

The final verdict? Nvidia remains a dominant force in AI, but the stock is priced aggressively. If you believe in AI’s long-term growth, holding NVDA makes sense. However, new buyers should wait for a better entry point before jumping in.

That's TradingNEWS

Read More

-

GPIQ ETF Rises on 10% Yield and AI Boom as Investors Brace for Tech Volatility

14.10.2025 · TradingNEWS ArchiveStocks

-

Ripple (XRP-USD) Stabilizes at $2.51 as Whales Buy $5.5B and ETF Outflows Shake Crypto

14.10.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Falls to $3.07 as Supply Glut and Weak Heating Outlook Hit Demand

14.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen Slides to 151.80 as Trade Tensions Boost Yen Strength

14.10.2025 · TradingNEWS ArchiveForex