Nvidia NASDAQ:NVDA AI Stock Comprehensive Financial Review

Unpacking NVIDIA's Latest Earnings, Stock Performance, and Strategic Initiatives Poised to Drive Future Expansion | That's TradingNEWS

Detailed Financial Review and Future Outlook for NVIDIA Corporation (NASDAQ:NVDA)

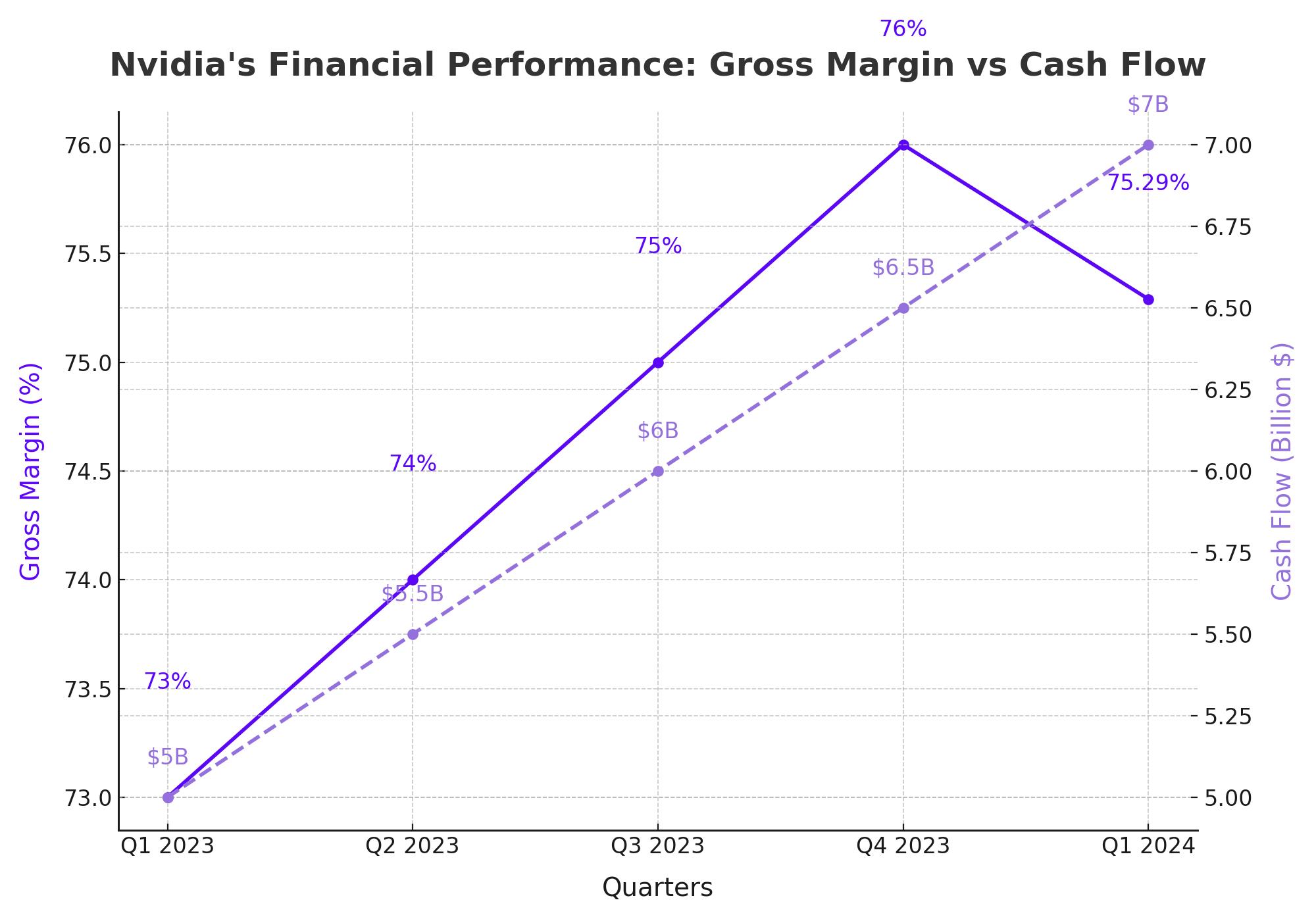

Comprehensive Financial Performance Analysis

NASDAQ:NVDA recently concluded its trading session at $830.41, marking a decrease of 3.89% from the previous close of $864.02. Despite this day-to-day volatility, NVIDIA's performance over the last year is nothing short of impressive, with the stock price maintaining a position significantly above its 52-week low of $272.40. This robust performance underscores a persistent bullish trend and underscores investor confidence in NVIDIA's strategic direction and market potential. With a formidable market capitalization of approximately $2.076 trillion, NVIDIA exemplifies a titan in the tech industry, buoyed by strong investor sentiment and market confidence.

Diving deeper into NVIDIA’s financial health, the company reported an earnings per share (EPS) of $11.92 on a trailing twelve-month basis, an indicator of robust profitability and efficient management execution. The price-to-earnings (P/E) ratio currently stands at 69.67, reflecting a premium valuation that investors are willing to pay for NVIDIA's future growth prospects, driven by groundbreaking innovations and market leadership in high-demand sectors such as AI and GPU technology. For real-time insights into NVIDIA’s stock performance, interested parties can visit NVIDIA Real-Time Chart.

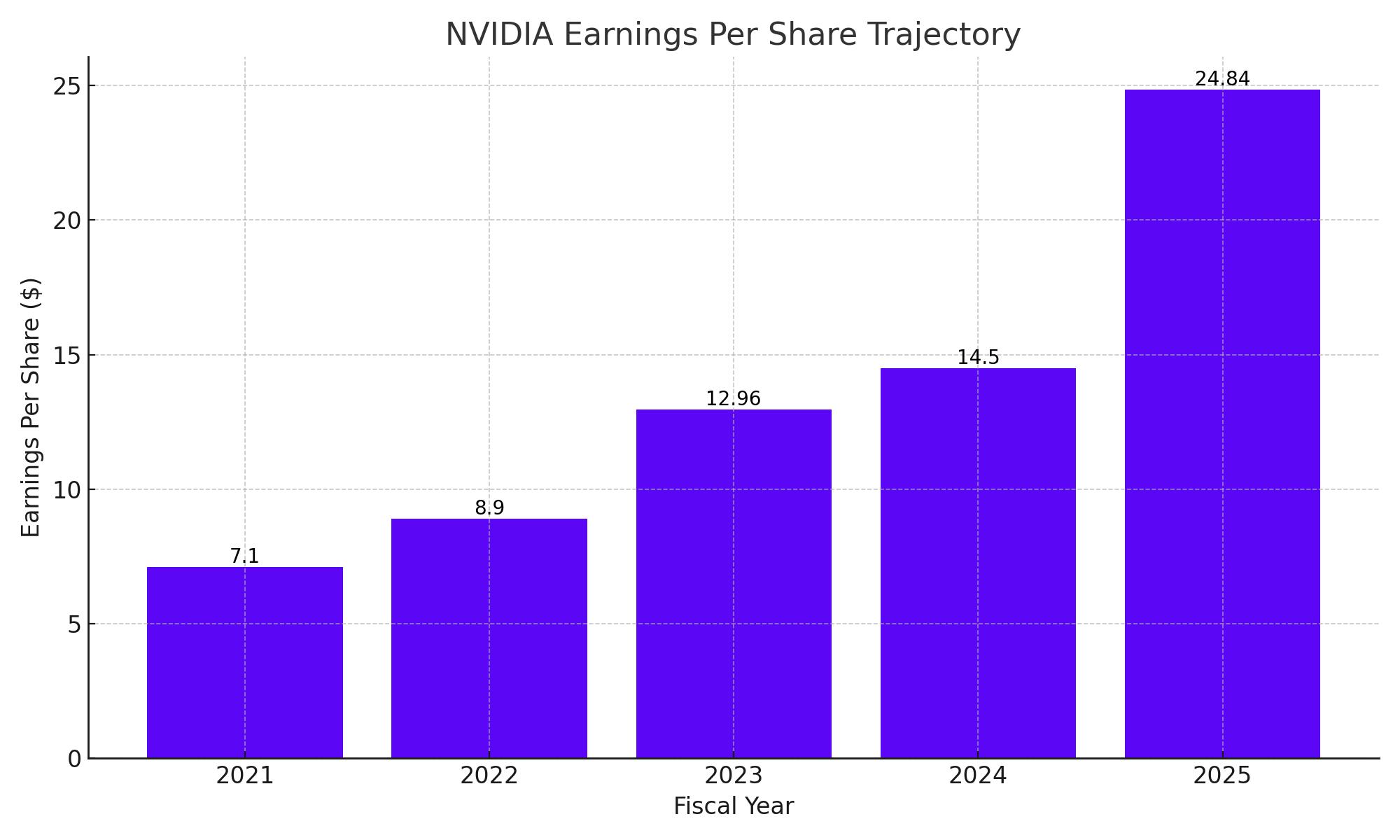

Earnings and Revenue Trajectory

NVIDIA has showcased exceptional growth in earnings and revenue, setting a strong forecast for the upcoming fiscal periods. For fiscal year 2025, financial analysts have projected a remarkable average earnings estimate of $24.84 per share, a sharp increase from $12.96 reported the previous year. This projection implies a significant anticipated year-over-year growth rate of 91.70%. This leap in earnings highlights NVIDIA's capacity to scale its operations and enhance its profitability markedly.

On the revenue front, NVIDIA is projected to reach a monumental $111.92 billion for the current fiscal year, rising from $60.92 billion in the preceding year, which translates to an 83.70% increase. This exponential growth in revenue is a testament to NVIDIA’s dominant market position and its successful penetration and expansion in high-growth markets, particularly those driven by advances in AI and machine learning technologies.

Market Leadership and Segment Analysis

NASDAQ:NVDA continues to lead the GPU market, pivotal for powering AI applications and managing extensive data processing tasks required in modern data centers. NVIDIA's GPUs, which are critical for AI technologies, accounted for nearly 80% of the company’s revenue streams in the last fiscal period. This segment dominance is a clear indicator of NVIDIA’s competitive edge, significantly outpacing rivals like Intel (INTC) and AMD in this high-stakes market. The company’s relentless innovation and consistent product advancement are expected to secure its market leadership position well into the future.

Stock Performance and Technical Outlook

NVIDIA’s stock has shown substantial volatility, which is highlighted by its significant 52-week price range. Despite this, the overarching market sentiment remains highly bullish. Technical analysis of the daily and hourly stock charts indicates a consistent pattern of strong growth, punctuated by normal market retracements. Notably, a Bull Flag pattern was identified, suggesting a potential continuation of the upward trend and implying that there may be substantial room for further price appreciation.

Future Growth Potential and Analyst Perspectives

Looking ahead, NVIDIA is exceptionally well-positioned to capitalize on continuous advancements in AI technology and to expand its global market presence. Analysts are optimistic about NVIDIA’s trajectory, with future price target estimates reaching as high as $1,008.90 for the next year. This target reflects a consensus view of substantial growth potential, rooted in NVIDIA’s ongoing innovations and expanding market influence. For a more detailed breakdown of financial forecasts and analyst opinions, interested parties can review the comprehensive NVIDIA Stock Profile.

Expanding Market Share in Emerging Technologies

NASDAQ:NVDA is not only maintaining but significantly expanding its market share in emerging tech sectors, particularly in AI and machine learning applications. With a strategy heavily focused on research and development, NVIDIA has launched several state-of-the-art products that have been crucial in AI advancements. The company's recent introduction of its latest GPU architectures has fortified its position as an indispensable resource in tech industries, ranging from autonomous vehicles to complex data analytics systems.

For example, the growth in the AI sector, with an emphasis on deep learning and neural networks, has exponentially increased the demand for NVIDIA's GPUs. This segment alone has pushed the company's growth trajectory significantly higher than anticipated, with a revenue forecast of $26.53 billion for the next fiscal quarter, a noticeable increase from the current $24.49 billion. This represents not only a sequential growth but a year-on-year expansion that underscores NVIDIA’s critical role in AI advancements.

Innovation and R&D Impact

NVIDIA’s commitment to innovation is evident from its substantial investment in research and development. In the last fiscal year, NVIDIA invested approximately 18% of its revenue back into R&D, totaling around $11 billion. This investment is aimed at advancing GPU technologies and pioneering new areas like AI-driven healthcare applications and autonomous machine capabilities. Such heavy investment in R&D not only fuels future revenue streams through innovation but also solidifies NVIDIA's competitive advantage in a rapidly evolving tech landscape.

Global Expansion and Strategic Partnerships

NVIDIA's global expansion strategy has been marked by strategic partnerships and acquisitions. The company has formed alliances across different regions and sectors, enhancing its global footprint and access to new markets. One of the key strategic moves includes partnerships with leading cloud service providers and automotive companies, which leverage NVIDIA's technology for cloud computing and self-driving car solutions, respectively.

These partnerships are not just growth avenues but also help NVIDIA in diversifying its revenue base and reducing dependency on the volatile gaming sector. For instance, the collaboration with automotive giants is projected to yield a compounded annual growth rate (CAGR) of 45% in the automotive AI sector, adding substantial revenue streams in the coming years.

Financial Health and Stock Liquidity

A closer look at NVIDIA’s balance sheet reveals a strong financial structure, with significant liquidity and manageable debt levels. As of the latest fiscal quarter, NVIDIA reported cash reserves of over $16 billion, providing ample financial flexibility to support ongoing operations, fund aggressive expansion plans, and pursue strategic acquisitions without jeopardizing financial stability.

The stock's liquidity is evidenced by its average trading volume of 55 million shares, which reflects high investor interest and facilitates ease of entry and exit for stockholders. Such liquidity is crucial during periods of market volatility, as it allows for better price discovery and stability in stock valuation.

Long-Term Growth Outlook and Investment Potential

NVIDIA's strategic initiatives and robust financial health present a compelling case for long-term growth potential. Analysts remain bullish, projecting an average price target of $1,008.90, with more optimistic forecasts suggesting even higher valuations based on NVIDIA's growth trajectory and market expansion strategies.

Given the company's leading position in AI and GPU markets, its innovative product pipeline, and strong financial fundamentals, NVIDIA is positioned to deliver substantial returns to investors. The ongoing demand for AI technologies and the expansion into new market sectors further solidify NVIDIA's role as a key player in the global tech arena, making it an attractive option for growth-focused investors.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex