Blackwell GPUs: A Game-Changer in AI Computing

The recent launch of NVIDIA’s Blackwell GPU series marks a pivotal moment for the company. These GPUs, featuring 25 times the performance capabilities of previous generations, are engineered to support the most complex AI workloads. With a price range of $30,000 to $40,000 per unit, and server racks scaling up to $3 million, NVIDIA’s technology caters to hyperscalers like Amazon (AMZN), Meta, and Google (GOOGL), which have already integrated these GPUs into their AI operations.

Despite some concerns over potential overheating issues with Blackwell chips in server racks, demand has been staggering. Over 13,000 units have already been shipped to customers, with supply struggling to keep pace with demand. NVIDIA expects Blackwell revenue to exceed several billion dollars in FY2025, further cementing its dominance in the AI space.

Cloud Partnerships and Expanding Revenue Streams

NVIDIA’s partnerships with cloud giants such as Amazon AWS, Google Cloud, and Microsoft Azure remain integral to its success. Cloud service providers (CSPs) contribute nearly half of NVIDIA’s data center revenue. Beyond the U.S., international CSPs like India’s Tata Communications and Yotta Data Services are significantly ramping up NVIDIA GPU deployments, indicating a diverse and expanding customer base.

Moreover, NVIDIA’s AI Enterprise platform, which includes NeMo and NIM microservices, has seen widespread adoption across industries, supporting applications like Salesforce’s (CRM) agentic AI services and Meta’s Llama series. With nearly 1,000 companies leveraging these tools, NVIDIA's software ecosystem is generating substantial recurring revenue streams.

Emerging Threats: In-House ASIC Development

A notable challenge for NVIDIA is the emergence of in-house ASIC (application-specific integrated circuit) development by hyperscalers such as Amazon, Meta, and Google. These custom chips, tailored for specific AI workloads, could segment the market, particularly for low-complexity inferencing tasks. However, high-end workloads are expected to remain dominated by NVIDIA’s cutting-edge GPUs, including older-generation models like the H100.

This segmentation underscores NVIDIA’s resilience and strategic foresight. The company’s robust ecosystem, encompassing software, hardware, and integrated supercomputing systems, offers a value proposition unmatched by custom ASIC solutions.

Financial Performance and Valuation

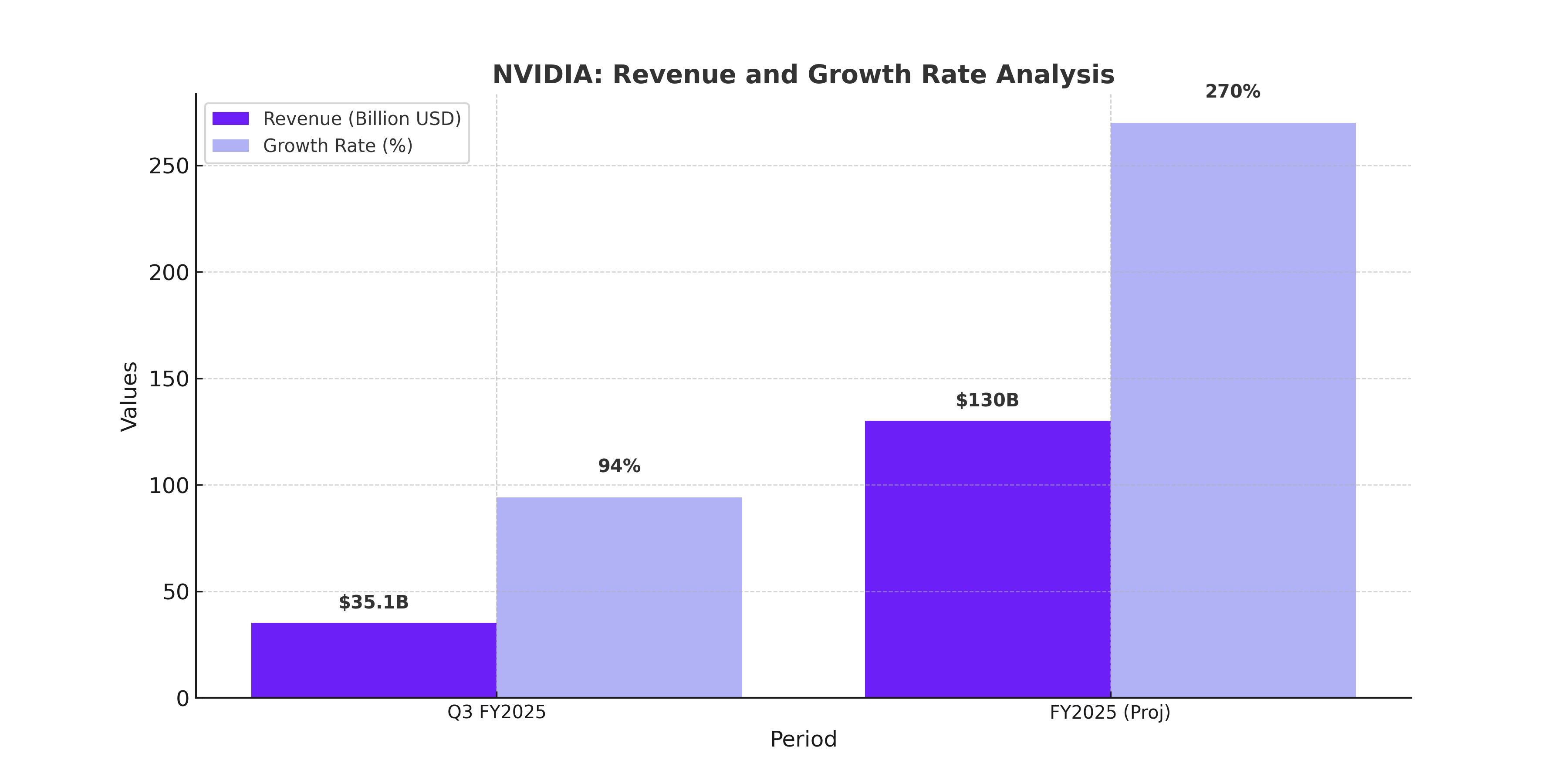

NVIDIA’s financials reflect its unparalleled market position. For Q3 FY2025, revenue surged 94% year-over-year to $35.1 billion, driven by record data center sales. Despite a deceleration in growth rates compared to prior quarters, the company maintains a formidable trajectory, with Blackwell demand expected to drive FY2025 revenue above $130 billion.

NVIDIA’s valuation remains a topic of debate. Trading at a forward P/E of 35.08 and a forward PEG ratio of 1.24, the stock appears reasonably priced relative to its growth prospects. Analysts project a 38.16% EPS CAGR over the next five years, outpacing peers like Broadcom (21.70%) and Marvell Technologies (MRVL) (37.02%). Wall Street remains overwhelmingly bullish, with a median price target of $165, suggesting a potential upside of 22%.

Strategic Focus on On-Premises Solutions

While CSPs’ custom silicon initiatives present a potential risk, NVIDIA has diversified its revenue streams through on-premises AI solutions. Collaborations with partners like Dell Technologies (DELL) and Hewlett Packard Enterprises (HPE) enable enterprises to deploy NVIDIA’s technology within their own data centers, catering to industries with specific data protection and regulatory requirements.

In Q1 FY2025 alone, NVIDIA worked with over 100 customers on AI factory projects, ranging from hundreds to tens of thousands of GPUs. This strategy not only mitigates reliance on CSPs but also taps into a broader market of enterprise clients.

Outlook and Recommendation

Despite the challenges posed by custom silicon and overheating concerns, NVIDIA’s strategic investments and technological leadership position it well for sustained growth. The Blackwell GPUs, coupled with an expanding software ecosystem and diversified customer base, are expected to drive robust financial performance in the coming quarters.

With a strong pipeline of innovation and an improving risk/reward profile, NVIDIA Corporation (NASDAQ:NVDA) remains a compelling investment. Trading at $135, the stock offers an attractive entry point for long-term investors seeking exposure to the AI revolution. While near-term risks exist, NVIDIA’s dominant market position and strategic foresight make it a "buy" as it continues to shape the future of computing. For live stock data and updates, visit NVIDIA Stock Real-Time Chart.

That's TradingNEWS