NVIDIA (NASDAQ: NVDA): Stock Split and $10 Trillion Valuation- Buy Opportunity

With a 10-for-1 stock split and leadership in AI technology, NVIDIA presents a major investment opportunity as it targets a $10 trillion valuation by 2030 | That's TradingNEWS

NVIDIA Stock Analysis: Dominating the AI Revolution (NASDAQ: NVDA)

NVIDIA's Stock Split: Boosting Accessibility

In June 2024, NVIDIA (NASDAQ: NVDA) completed a 10-for-1 stock split, dropping its share price to around $120. The split, aimed at making shares more accessible to retail investors, reflects the company’s long-term confidence in its growth. NVIDIA has now joined other tech giants, such as Apple and Amazon, which previously performed stock splits to enhance liquidity. Stock splits have historically led to price increases due to increased accessibility, and NVIDIA’s move aligns with this trend. Despite the stock drop from its highs, NVIDIA continues to be a dominant player in the AI market. With the stock split, NVIDIA is positioning itself for continued demand from both retail investors and institutional buyers who view the AI leader as critical for the next technological wave. NVIDIA's success is largely tied to its role in artificial intelligence, and the stock split increases accessibility for investors seeking exposure to the rapidly growing AI space.

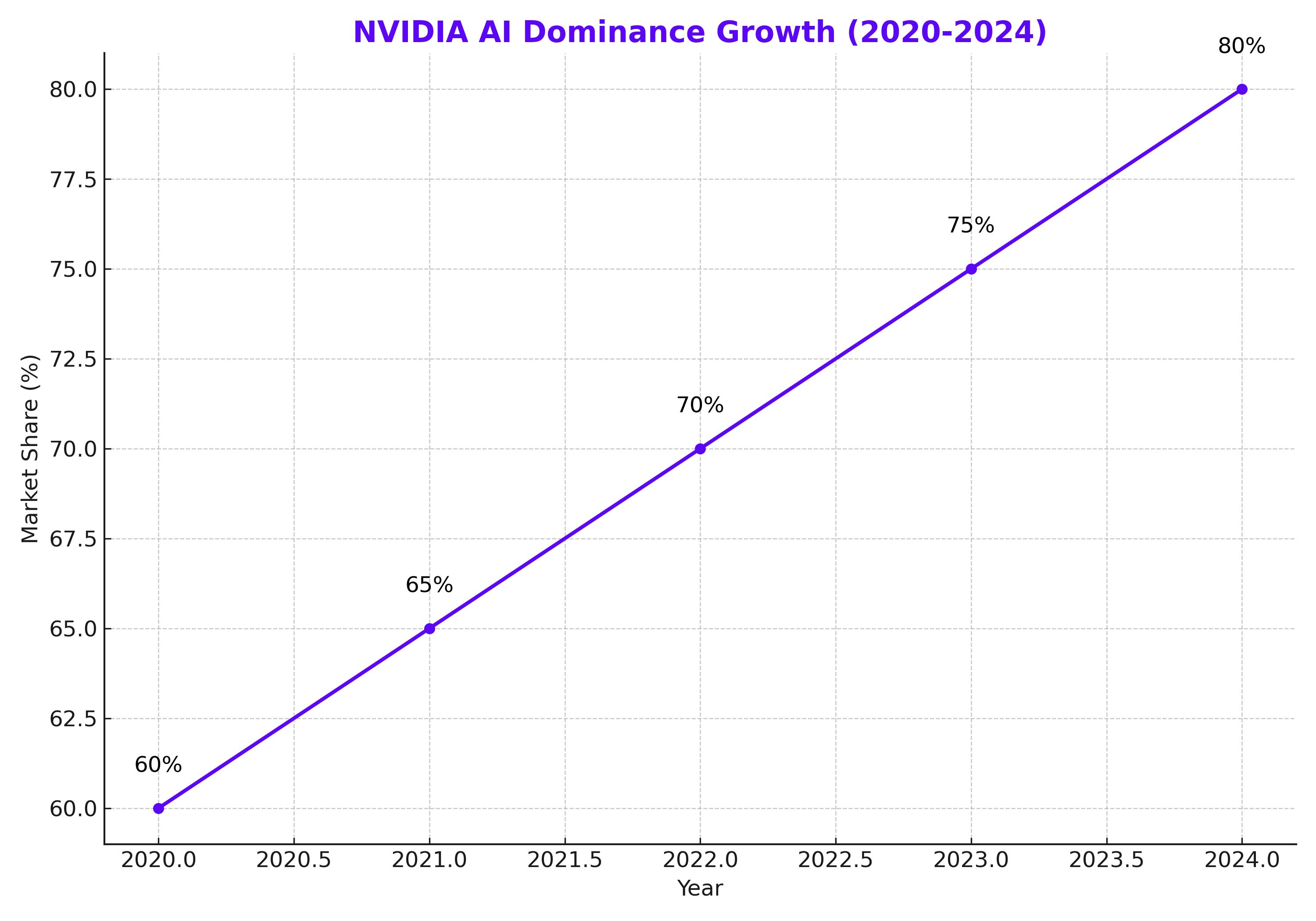

AI Dominance Driving NVIDIA’s Growth

The AI boom continues to propel NVIDIA (NASDAQ: NVDA) to new heights. The company's market leadership is unrivaled, with its graphics processing units (GPUs) accounting for 80% of AI chip sales globally. With OpenAI's ChatGPT as a critical driver, NVIDIA's hardware has become indispensable to AI developments, leading to triple-digit revenue growth for five consecutive quarters. The company’s data center segment alone contributed $30 billion in revenue, reflecting the massive demand for its AI hardware solutions. NVIDIA is not only leading the AI hardware space but is also a pioneer in software development through its proprietary CUDA platform. This comprehensive system includes more than 400 software libraries, facilitating GPU development across multiple industries, further embedding NVIDIA into the AI ecosystem. The company’s influence extends beyond just hardware, positioning it as a full-stack solution provider for AI computing.

NVIDIA’s Efficient R&D Spending and Profit Margins

NVIDIA's research and development (R&D) spending has been notably efficient. While it spent $10.6 billion on R&D in the last 12 months, lower than peers like Microsoft and Alphabet, the company has maximized its returns on these investments. Its key innovations include the launch of CUDA, GPUs, and autonomous driving technologies, demonstrating a long-term strategic focus. Despite lower R&D spending, NVIDIA’s operating margins reached an impressive 62%, showcasing the company's ability to optimize resources and maintain profitability. This efficiency contrasts with peers that have higher R&D expenses but lower returns, reinforcing NVIDIA's unique position in the market. The company's ability to scale without excessive costs positions it well for continued profitability as the AI industry expands.

Blackwell GPUs: The Next Game-Changer

NVIDIA’s upcoming Blackwell architecture is poised to further solidify its dominance in the AI chip market. Expected to launch in the fourth quarter of 2024, Blackwell is predicted to be the company's most successful product to date. CEO Jensen Huang emphasized that Blackwell’s launch will elevate NVIDIA’s offerings, further entrenching its leadership in the AI space. The delay in Blackwell’s launch, due to adjustments aimed at improving production yields, has not dampened expectations. With demand already surpassing supply, NVIDIA anticipates that Blackwell will contribute significantly to its revenue growth in the coming quarters. This launch will keep NVIDIA ahead of competitors like AMD and Intel, ensuring its GPUs remain the gold standard in AI computing.

NVIDIA Stock Outlook: On Track for $10 Trillion?

Both Wall Street analysts and industry experts foresee significant upside for NVIDIA (NASDAQ: NVDA). Predictions from analysts like Beth Kendig suggest the company could reach a $10 trillion market cap by 2030. With a current market value of $2.6 trillion, this ambitious target implies a 285% upside potential, driven by the AI sector's continued expansion. Jim Cramer, a long-time NVIDIA advocate, also projects the company could hit this milestone, emphasizing NVIDIA’s unmatched AI capabilities. The AI market is expected to grow at an annual rate of 36% through 2030, supporting the belief that NVIDIA’s revenue and earnings will continue to surge. However, achieving this target will depend on NVIDIA maintaining its competitive edge in the rapidly evolving AI landscape.

Profit Margins and Future Challenges

NVIDIA’s gross margins have soared to unprecedented levels, hovering around 75%. However, a slight decrease in the second quarter to 75.1%, down from 78.4%, has raised questions about future profitability. While the decline was marginal, it highlights potential risks from rising competition. Should NVIDIA’s margins revert to historical levels of 60%, the company’s earnings could see a significant decline, leading to a potential revaluation of the stock. That said, NVIDIA's margins remain robust due to its market dominance. For now, no competitor has been able to challenge its leadership effectively, meaning the company's profitability may continue to outpace industry norms. But investors should remain vigilant, watching for any further compression in margins as the market evolves.

NVIDIA's Competitive Edge in AI Hardware

NVIDIA’s AI chips are central to its long-term growth prospects, with a dominant market share in AI hardware. The company’s ability to pair cutting-edge hardware with proprietary software gives it a competitive moat that is difficult for rivals to breach. Its innovation in data center GPUs and AI networking equipment positions NVIDIA to benefit from the exponential growth in AI applications across industries. The upcoming Blackwell platform is expected to strengthen this position, ensuring that NVIDIA remains the go-to provider for AI hardware. With AI demand projected to exceed $1 trillion by the end of the decade, NVIDIA is well-placed to capture a significant portion of this market. This positions the company for sustained growth, despite any short-term fluctuations in stock performance.

Final Thoughts on NVIDIA’s Stock Performance

While NVIDIA (NASDAQ: NVDA) has seen a 20% drop from its highs, its long-term outlook remains positive. The company’s strategic position at the heart of the AI revolution, combined with its efficient R&D spending and robust profitability, makes it a strong contender for future growth. With the Blackwell platform set to launch and AI demand showing no signs of slowing, NVIDIA remains a key player in the tech space. Investors should monitor the company’s profit margins and competitive landscape, but for now, NVIDIA’s leadership in AI seems secure. The stock’s current price may offer a buying opportunity for those seeking exposure to the AI-driven future.

That's TradingNEWS

Read More

-

Broadcom Stock Price Forecast - AVGO at $340 — $19.3B Record Revenue and AI Chips Up 106% to $8.4B

06.03.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast — $2.45 XRP-USD Base, Why $1.57 Is the Only Level That Matters Right Now

06.03.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast — Brent at $90.08, WTI at $87.89, Qatar Warns $150 as Force Majeure Declared and 200 Tankers Remain Stranded

06.03.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today — Dow Loses 903 Points, S&P 500 Cracks 6,734 and Breaks December Support, Nasdaq Hits 22,458 as February NFP Sheds 92,000 Jobs

06.03.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound at 1.3362 — NFP Misses by 150K Jobs But Sterling Can't Catch a Bid

06.03.2026 · TradingNEWS ArchiveForex