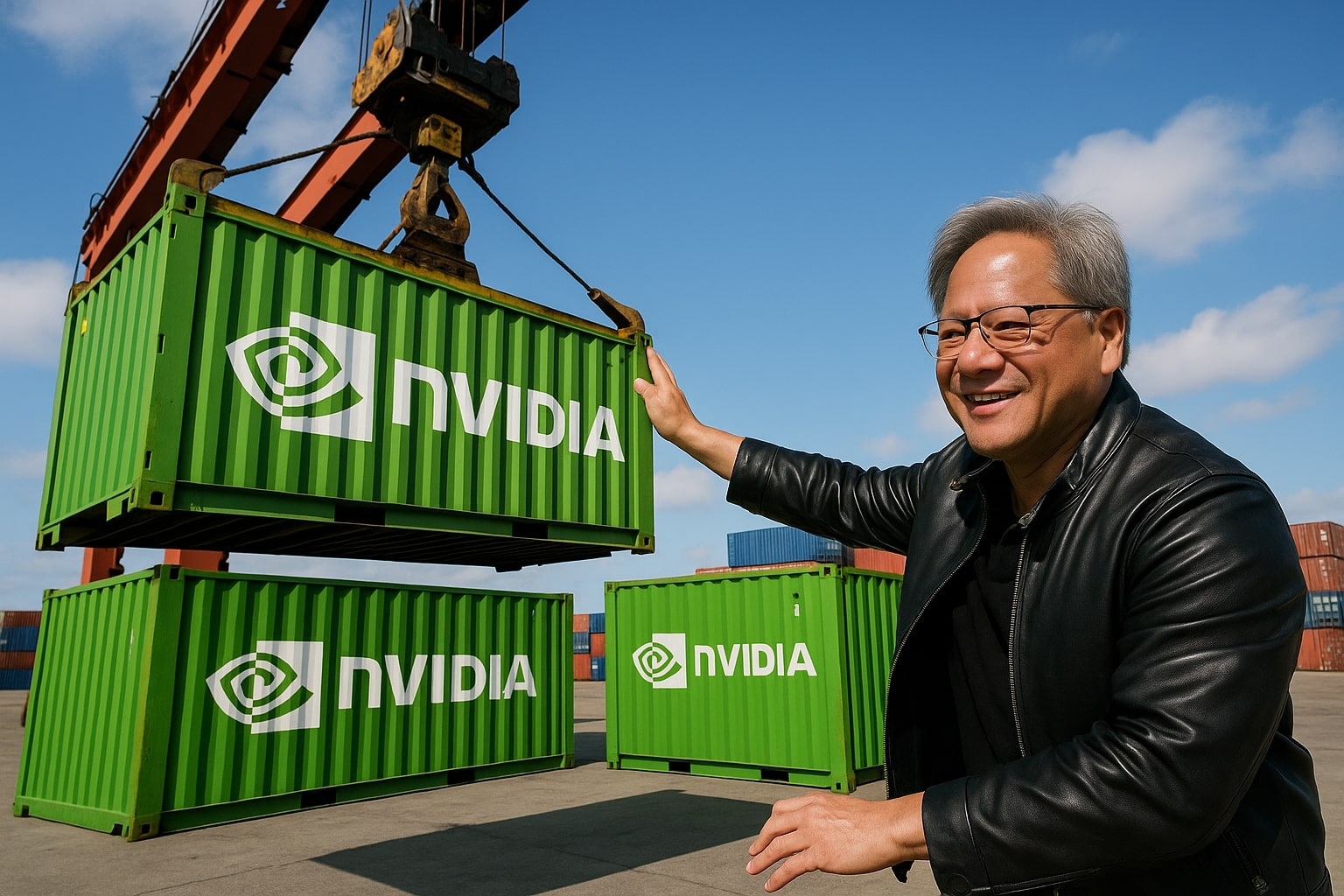

NVIDIA (NASDAQ:NVDA) Stock: Breaking Down the Current Performance Amid Geopolitical Tensions and Innovation Leadership

NVIDIA (NASDAQ:NVDA), the renowned leader in GPUs, has been on a wild ride recently, up nearly 34% since mid-April despite facing headwinds from U.S.-China tensions and the H20 GPU export drama. The company's stock has seen a surge, even in the face of uncertainty brought on by tariffs and trade restrictions. As of now, NVDA is trading around $117 per share, showing some resistance at the 200-day EMA at $117.4, which could either signal a bullish breakout or further consolidation at current levels.

The major catalyst behind NVDA's price action has been the H20 GPU export issues, which resulted in a $5.5 billion hit to Q1 earnings expectations. However, this isn't a new story for NVIDIA, as they faced similar issues with A100/H100 GPUs back in 2022 when the U.S. imposed export restrictions on its top-tier products to China. In those years, NVIDIA quickly adjusted by releasing compliant versions of its chips, allowing the company to recapture market share. This situation has been mirrored with the current H20 GPU challenges, as NVIDIA has managed to mitigate the impact by releasing downgraded versions tailored to Chinese market demands.

Despite the $5.5 billion hit related to the H20 GPUs, there's still significant growth driven by its AI leadership. The company continues to dominate AI chips, with ByteDance, Alibaba, and Tencent placing large orders in Q1 2025, making up for potential losses in other regions. This demand from China’s major tech giants has led to strong orders, valued at $16 billion in Q1 2025 alone, surpassing last year’s total sales for the H20 chips globally.

The key takeaway is that NVIDIA is still positioned well despite these headwinds, and with its market-leading GPUs in AI and gaming, it will likely weather the storm better than competitors like AMD. From a valuation perspective, NVIDIA is still relatively undervalued compared to its historical performance and its competitors in the semiconductor space. NVIDIA's price-to-earnings (P/E) ratio is still below its 10-year historical median, and analysts see this as an attractive buying opportunity.

The Impact of Trade Tensions and AI Chip Exports: Can NVIDIA Handle the Strain?

Since the U.S. government imposed export restrictions on AI chips, there’s been a clear geopolitical struggle for NVIDIA, especially with China. NVIDIA saw tariff issues starting with the A100 and H100 GPUs, leading to a $400 million loss in potential sales. While the company adapted quickly, the recent restrictions on the H20 GPUs signal a much more significant impact, leading to a $5.5 billion loss estimate. The future of AI-driven demand could be dampened if the geopolitical situation worsens.

The U.S.-China trade war is undeniably the biggest risk factor for NVIDIA’s growth, especially as they face strong competition from Chinese rivals like Huawei in the AI space. NVIDIA’s dominance in the GPU sector is still being challenged, as companies like DeepSeek are making rapid strides in competing for market share. The H20 chips, initially priced at a 10% discount compared to competitors, are a clear indication that NVIDIA is struggling to maintain its edge.

Despite these challenges, NVIDIA remains resilient. The recent truce between the U.S. and China where both countries agreed to lower tariffs by 115% for 90 days provides a window of optimism. This is expected to ease some of the trade tensions, benefiting NVIDIA as the company can now reassess its export strategy and continue pushing for market dominance.

Valuation and Growth: A Strong Buy Opportunity or Overpriced Stock?

Despite the ongoing issues with China, NVIDIA is still undervalued relative to its competitors, especially AMD. When looking at price-to-earnings (P/E) and price-to-sales (P/S) ratios, NVIDIA still holds the competitive edge despite challenges such as sectoral tariffs and the H20 export ban. NVIDIA’s forward P/E ratio is sitting at 26.5, which may seem high but is relatively reasonable compared to its past growth rates and market dominance.

The stock's performance over the past few months shows a significant rebound since the 7% dip following the April 15th announcement. The technical charts suggest a bullish momentum starting to take shape, with potential for a price target of $150 by year-end, based on both technical analysis and recovery from external pressures.

The market is also starting to price in the fact that Nvidia's growth is more AI-driven than ever before, and as AI demand continues to increase, NVIDIA will remain the go-to player. The lack of competition in the high-performance GPU market, combined with NVIDIA’s strong position in AI, provides solid grounds for a buy recommendation, especially considering the current stock price around $117.

Insider Transactions and Market Sentiment: Should You Be Concerned?

Despite the export control drama, insider transactions show a confident outlook within NVIDIA. Key executives have made significant buys during market dips, signaling a belief in the company’s long-term growth potential. NVIDIA’s leadership continues to believe in the AI growth trajectory, which remains the company’s main driver in the coming years. For more insights into the latest insider transactions, check out NVIDIA’s profile here.

Moreover, analysts continue to maintain a strong buy rating on the stock, with price targets suggesting substantial upside potential. Despite sector risks, NVIDIA’s market-leading technology, coupled with strong partnerships with key tech companies in both the U.S. and China, keeps the stock a prime candidate for long-term investors.

Conclusion: Is NVIDIA a Buy, Sell, or Hold?

NVIDIA (NASDAQ:NVDA) remains a strong buy in the current market, despite external challenges. The company’s leadership in the AI space, innovative GPU technology, and strategic global partnerships provide strong support for the stock. While tariffs and export restrictions have weighed on the stock price, these issues are already priced in. The market's focus on AI and NVIDIA’s position as a market leader in this field should drive continued growth. With a price target of $150 by year-end, NVIDIA remains an attractive investment at its current price of $117.

For the latest market data and real-time performance, visit the NVIDIA stock chart.