YieldMax MSTR Option Income Strategy ETF (NYSEARCA:MSTY): A High-Yield Income Play on Volatility

The YieldMax MSTR Option Income Strategy ETF (NYSEARCA:MSTY) has gained attention in the market for its extraordinary dividend yield of over 100%. This fund is particularly appealing to income-focused investors due to its innovative approach to capitalizing on volatility in MicroStrategy (MSTR), a stock intrinsically tied to Bitcoin (BTC-USD). By utilizing a covered call strategy on MSTR, MSTY offers investors exposure to Bitcoin’s potential upside, reduced risk compared to directly holding MSTR, and substantial income potential through option premiums.

Understanding the Core of MSTY

MSTY derives its performance from selling out-of-the-money (OTM) call options on MicroStrategy (MSTR). As of now, MSTR acts as a highly leveraged proxy for Bitcoin, given that the company holds over 461,000 Bitcoin tokens on its balance sheet, making it the largest corporate holder of the cryptocurrency. MSTR’s performance is therefore heavily influenced by Bitcoin price movements. The leveraged exposure adds volatility to MSTR, which directly translates into higher premiums for the options sold by MSTY.

Since its inception, MSTY has maintained its net asset value (NAV) while paying out substantial distributions. Investors have received nearly $30 in distributions in less than ten months since the fund's launch, a remarkable feat that underscores its ability to generate income from MSTR's volatility.

Volatility as a Driver of Yield

The essence of MSTY’s strategy lies in monetizing volatility. Higher volatility leads to higher option premiums, which the fund collects and distributes to investors. With MSTR’s significant price swings—fueled by Bitcoin's inherent unpredictability and the company’s leveraged structure—the fund can generate substantial income. This makes MSTY particularly attractive to those looking to benefit from Bitcoin’s volatility without directly investing in the cryptocurrency.

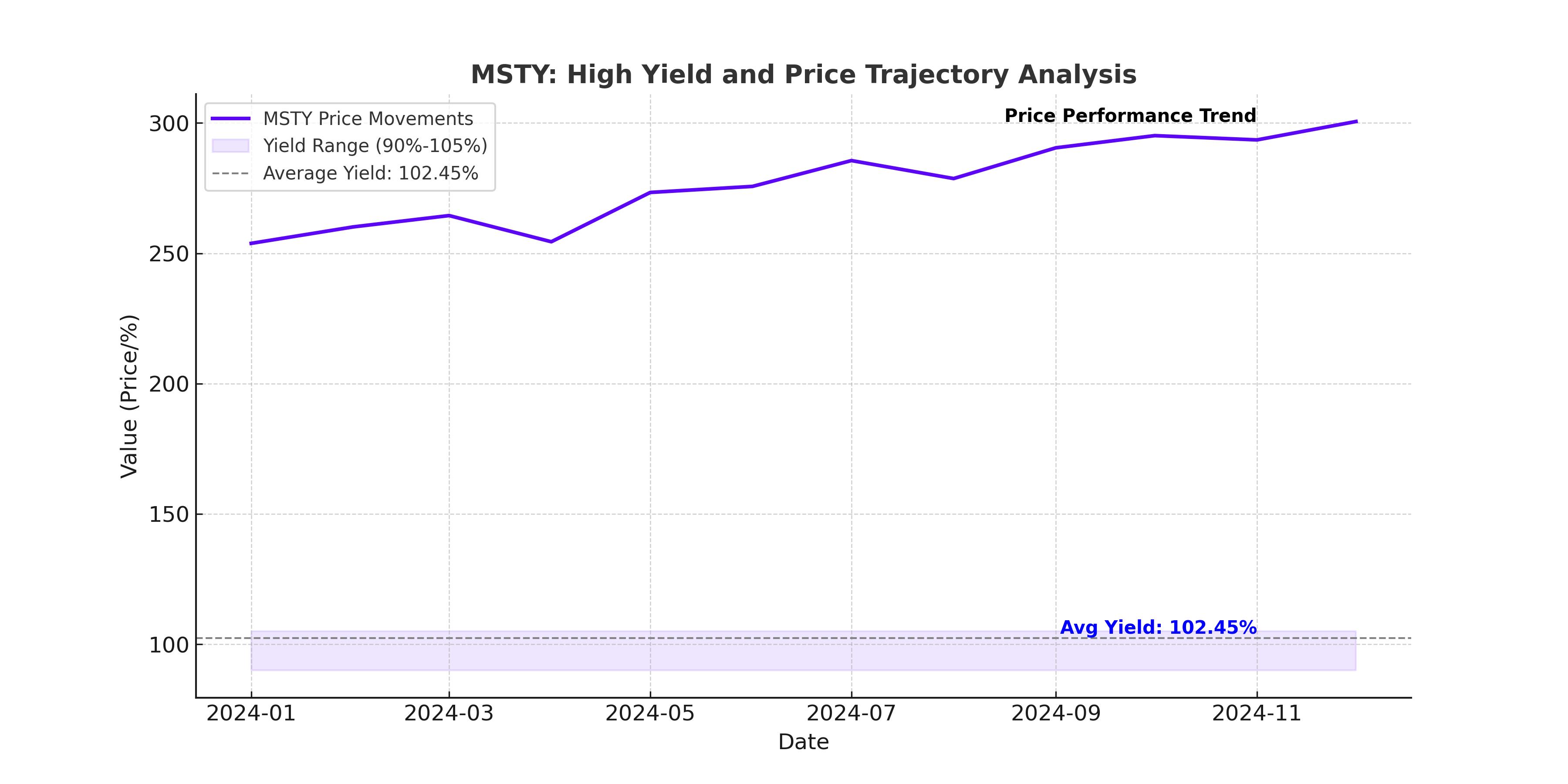

For context, MSTR’s volatility is so pronounced that its options often trade at premiums far higher than those of other Bitcoin-related instruments. For example, YieldMax’s YBIT, which employs a similar covered call strategy on Bitcoin ETFs, offers a lower yield of approximately 81.70% compared to MSTY’s 102.45%. This disparity highlights the elevated income potential that comes with MSTR’s heightened volatility.

Performance and Distribution Analysis

MSTY has shown resilience in maintaining its NAV while delivering outsized returns to investors. Since its inception, the ETF has achieved total returns exceeding 250%, driven by consistent income generation through call option premiums. Its ability to outperform traditional income funds stems from its unique exposure to Bitcoin’s price movements through MSTR.

For instance, during periods of relatively stable Bitcoin prices, MSTY outperforms by capturing high premiums without significant downside risk. In more volatile markets, its income generation remains robust due to the increased value of call options, even when MSTR experiences price corrections.

Potential Risks with MSTY

Investing in MSTY comes with its own set of risks. The primary risk lies in the sustainability of its income stream, which depends on two key factors: MSTR’s solvency and Bitcoin’s volatility.

MSTR’s strategy of issuing debt to buy Bitcoin raises concerns about its financial stability, particularly during prolonged downturns in Bitcoin prices. A collapse in Bitcoin or a significant reduction in MSTR’s market value could result in NAV erosion for MSTY. Additionally, if options trading on MSTR becomes illiquid or restricted, MSTY’s ability to generate income would be severely compromised.

Bitcoin itself remains a polarizing asset, with arguments both for and against its long-term viability. While the approval of Bitcoin spot ETFs and growing institutional adoption have bolstered its legitimacy, questions about its purpose, scalability, and regulatory risks persist. Should Bitcoin’s volatility diminish over time, MSTY’s income-generating potential could decline as well.

Another risk stems from rapid and unpredictable price movements in MSTR. In scenarios where MSTR experiences sharp corrections followed by swift recoveries, the capped upside from call options could limit MSTY’s gains while exposing it to potential losses.

Opportunities for Outperformance

Despite these risks, MSTY offers opportunities for outperformance in several market conditions.

In range-bound markets, MSTY can thrive by repeatedly selling call options near the upper range of MSTR’s price movements. The premiums collected during such periods can lead to returns that surpass those of MSTR itself.

During moderate bullish trends, MSTY can benefit from both premium income and incremental price appreciation. Even if MSTR’s upside is capped due to the nature of call options, MSTY’s high yields can offset the opportunity cost.

In declining Bitcoin markets, MSTY’s income stream provides a cushion against losses, making it a safer alternative to directly holding MSTR. The premiums from options can mitigate the impact of falling prices, offering a degree of downside protection.

Interestingly, even in a strong Bitcoin rally, MSTY can outperform MSTR under specific conditions. If MSTR’s premium to its net asset value (NAV) compresses, the returns from option premiums may exceed the gains from holding the stock outright. This scenario is particularly relevant given MSTR’s historically high valuation relative to its Bitcoin holdings.

Valuation and Outlook

MSTY’s appeal lies in its ability to deliver consistent income regardless of market direction. As long as Bitcoin remains volatile and MSTR retains its leveraged exposure, MSTY is well-positioned to generate substantial returns for income-focused investors. The fund’s active management and ability to capitalize on MSTR’s extreme price swings provide an additional layer of appeal.

Looking ahead, MSTY’s success will depend on Bitcoin’s continued relevance and MSTR’s ability to sustain its current strategy. While the fund is not without risks, its unique structure and high-yield potential make it a compelling option for those seeking exposure to Bitcoin with a focus on income generation.

Conclusion

YieldMax MSTR Option Income Strategy ETF (NYSEARCA:MSTY) represents a powerful income-generating tool for investors willing to navigate the risks associated with Bitcoin and MicroStrategy. By leveraging MSTR’s volatility, MSTY delivers triple-digit yields that can significantly enhance an income-focused portfolio. While it is not without risks, its strategic approach to monetizing market volatility positions it as an attractive investment in the current environment. Investors should consider MSTY as part of a diversified portfolio, maintaining discipline in allocation and risk management to maximize its potential benefits.