NYSE:CRM Stock Analysis Strategic Initiatives Propel Market Leadership

Unveiling Salesforce's Operational Excellence, Financial Robustness, and Innovative Edge in the SaaS Ecosystem | That's TradingNEWS

Salesforce (NYSE:CRM): A Strategic Financial Overview and Market Position Analysis

Executive Summary

In the fast-paced realm of cloud computing and customer relationship management (CRM), Salesforce has emerged as a formidable titan. With its recent performance showcasing a robust trajectory, Salesforce presents a compelling narrative of growth, innovation, and strategic market positioning. This analysis delves into Salesforce's financial health, market dynamics, competitive landscape, and forward-looking growth prospects, offering insights into its valuation and strategic moves in the evolving SaaS landscape.

Financial Health and Performance Metrics

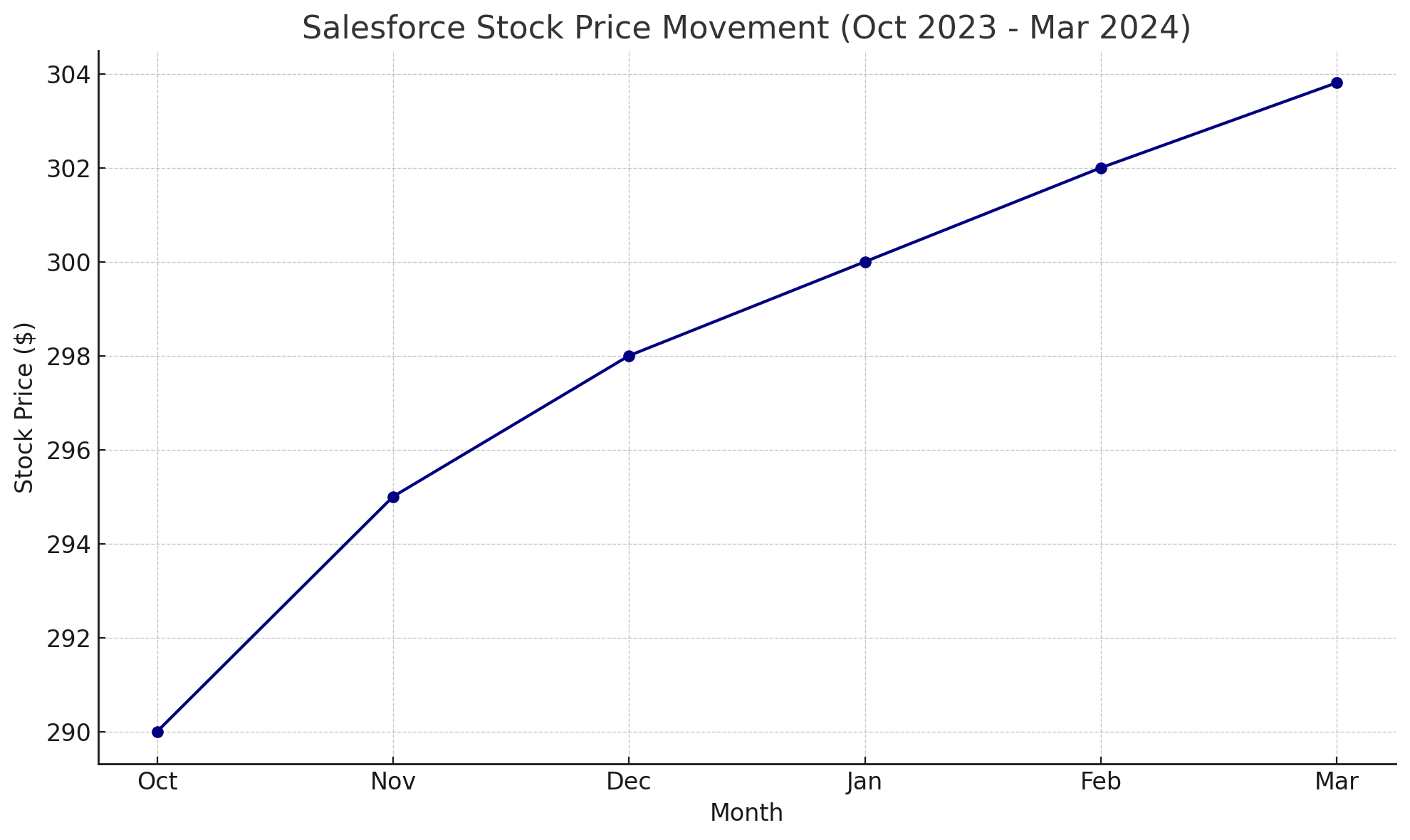

Salesforce has demonstrated impressive financial resilience and growth momentum. As of the latest reporting in March 2024, the company's stock price reflected a modest uptick, trading around $303.81, marking a 0.51% increase. This performance is anchored on a solid foundation with a market capitalization of approximately $294.759 billion and a forward P/E ratio of 31.15, suggesting investors' optimistic outlook on its earnings potential.

A deeper dive into Salesforce's liquidity and profitability ratios unveils a robust financial structure. With a profit margin of 11.87% and an operating margin of 19.33%, Salesforce outpaces industry benchmarks. The company's strategic management has adeptly navigated the market dynamics, accruing a total revenue of $34.86 billion, a testament to its growth and market penetration.

Market Position and Competitive Landscape

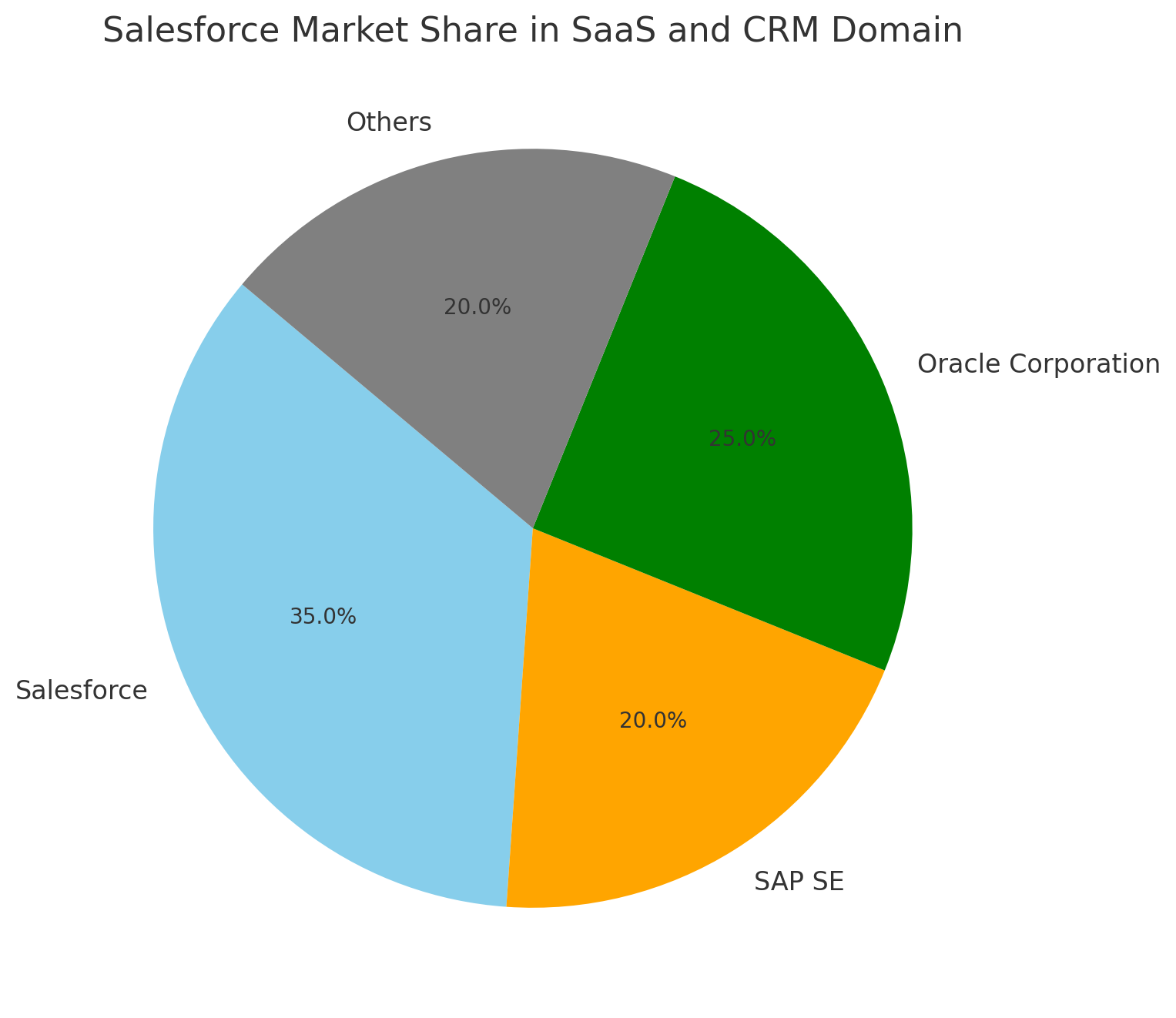

Salesforce's market position is unassailable in the SaaS and CRM domain, holding a significant market share against competitors like SAP SE and Oracle Corporation. The strategic importance of its offerings is magnified in the current digital transformation era, with Salesforce leading the charge in integrating AI and analytics into its solutions. This strategic differentiation not only cements its market leadership but also opens new avenues for growth and expansion.

Forward-Looking Growth Prospects

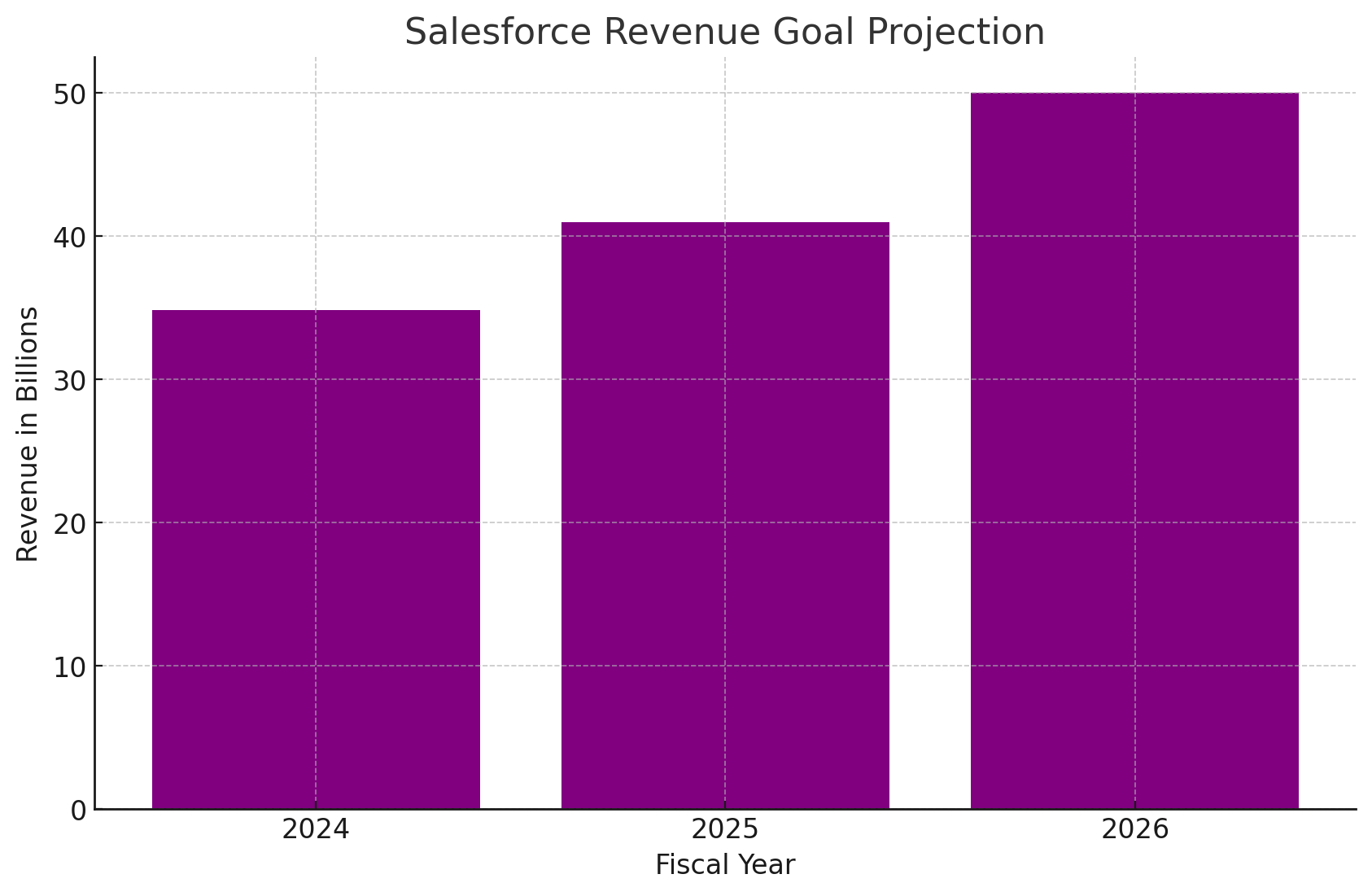

The global SaaS market, poised for exponential growth, sets the stage for Salesforce's ambitious targets. With a revenue goal of $50 billion by 2026, Salesforce's roadmap encompasses aggressive global expansion, deepened customer engagements, and leveraging mergers and acquisitions. This vision is supported by the burgeoning demand in the data analytics market, where Salesforce's Integration and Analytics segment shines, showcasing growth rates surpassing industry averages.

Valuation Insights

Despite the optimistic growth trajectory, a comprehensive discounted cash flow (DCF) analysis presents a nuanced view of Salesforce's valuation. While current market performance indicates slight overvaluation, Salesforce's strategic initiatives, particularly in AI, position it for substantial long-term value creation. However, this analysis underscores the importance of cautious optimism, considering the competitive dynamics and market volatility.

Strategic Recommendations

Based on the analysis, Salesforce stands at a strategic juncture. To navigate future challenges and capitalize on growth opportunities, Salesforce should:

- Deepen AI Integration: Accelerate the deployment of AI across its suite of products to enhance customer value and operational efficiency.

- Global Market Expansion: Focus on untapped markets with tailored solutions to diversify revenue streams.

- Strategic Acquisitions: Identify and acquire niche players that complement its product ecosystem and innovation roadmap.

Operational Excellence and Efficiency Metrics

Salesforce, as of its latest fiscal quarter, exhibited an operational prowess that merits a closer examination. The company reported a Return on Assets (ROA) of 3.77% and a Return on Equity (ROE) of 7.01%, indicators of its efficient use of capital and equity in generating profits. Such metrics underscore Salesforce's operational efficiency, especially when juxtaposed with the broader tech industry benchmarks.

Salesforce in the SaaS Ecosystem: A Comparative Analysis

In the fiercely competitive SaaS landscape, Salesforce's performance can be better understood through direct comparison with its peers:

- Market Capitalization: Salesforce boasts a market cap of approximately $294.759 billion, dwarfing many of its competitors and highlighting its market dominance.

- Revenue Growth: With a year-over-year quarterly revenue growth of 10.80%, Salesforce outpaces industry averages, signaling strong sales and marketing execution.

- P/E Ratio: At a trailing P/E ratio of 71.97 and a forward P/E of 31.15, Salesforce is valued higher than many peers, reflecting high growth expectations from investors.

Strategic Initiatives and Innovation

Salesforce's aggressive push into AI and machine learning through its Einstein platform is pivotal. With AI becoming a cornerstone of digital transformation strategies across industries, Salesforce's early investments position it at the forefront of a major technological shift. This strategic foresight not only enhances its current product offerings but also opens up new revenue channels.

Financial Health Deep Dive

A closer examination of Salesforce's balance sheet reveals:

- Liquidity: Salesforce's current ratio stands at 1.09, indicating adequate liquidity to meet short-term obligations.

- Debt Profile: With total debt at $13.56 billion and a debt-to-equity ratio of 22.74%, Salesforce maintains a manageable debt level, although it warrants close monitoring for future leverage increases.

- Cash Reserves: With $14.19 billion in cash and short-term investments, Salesforce is well-positioned to pursue strategic acquisitions, R&D investments, and weather potential market downturns.

Market and Future Outlook

- Earnings Forecasts: Analyst consensus estimates for the current and next fiscal quarters peg EPS at $2.38 and $2.40, respectively, indicating robust profitability. Salesforce's guidance reflects confidence in sustained growth momentum.

- Revenue Projections: For FY 2025, revenue is projected to hit $37.98 billion, with a trajectory aiming for $41.97 billion in FY 2026, highlighting Salesforce's growth ambition amidst a dynamic market environment.

- Sectorial and Economic Considerations: As global economic uncertainties loom, Salesforce's strategic positioning in cloud-based solutions offers resilience against downturns. Its focus on AI and data analytics aligns with broader digital transformation trends, offering a buffer against cyclical industry pressures.

Risk Factors and Mitigation Strategies

While Salesforce's outlook is broadly positive, potential risks include increased competition from legacy providers and new entrants, market saturation in CRM solutions, and the ongoing global economic volatility affecting IT spending. Strategic diversification, continued innovation, and a keen focus on expanding its global footprint are essential for mitigating these risks.

Investor Considerations

Investors eyeing Salesforce should weigh its growth prospects against valuation metrics and market dynamics. The company's strategic initiatives in AI, robust financial health, and strong market position make it a compelling consideration for those with a long-term investment horizon. However, the high P/E ratio and the ever-evolving SaaS landscape necessitate a careful analysis of potential risks and rewards.

Conclusion

In conclusion, Salesforce's strategic acumen, financial robustness, and market leadership underscore its pivotal role in the SaaS ecosystem. With a clear vision for leveraging AI and data analytics, coupled with a strong balance sheet, Salesforce is poised for future growth. Investors and stakeholders, while mindful of inherent risks, can look forward to Salesforce's continued innovation and market expansion.

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex