NYSE:RBLX Analysis - Roblox's Financial Health and Market Positioning

Exploring Roblox's Revenue Streams, Profitability Challenges, and Competitive Market Dynamics in the Digital Entertainment Industry | That's TradingNEWS

Roblox's Financial Health and Revenue Analysis

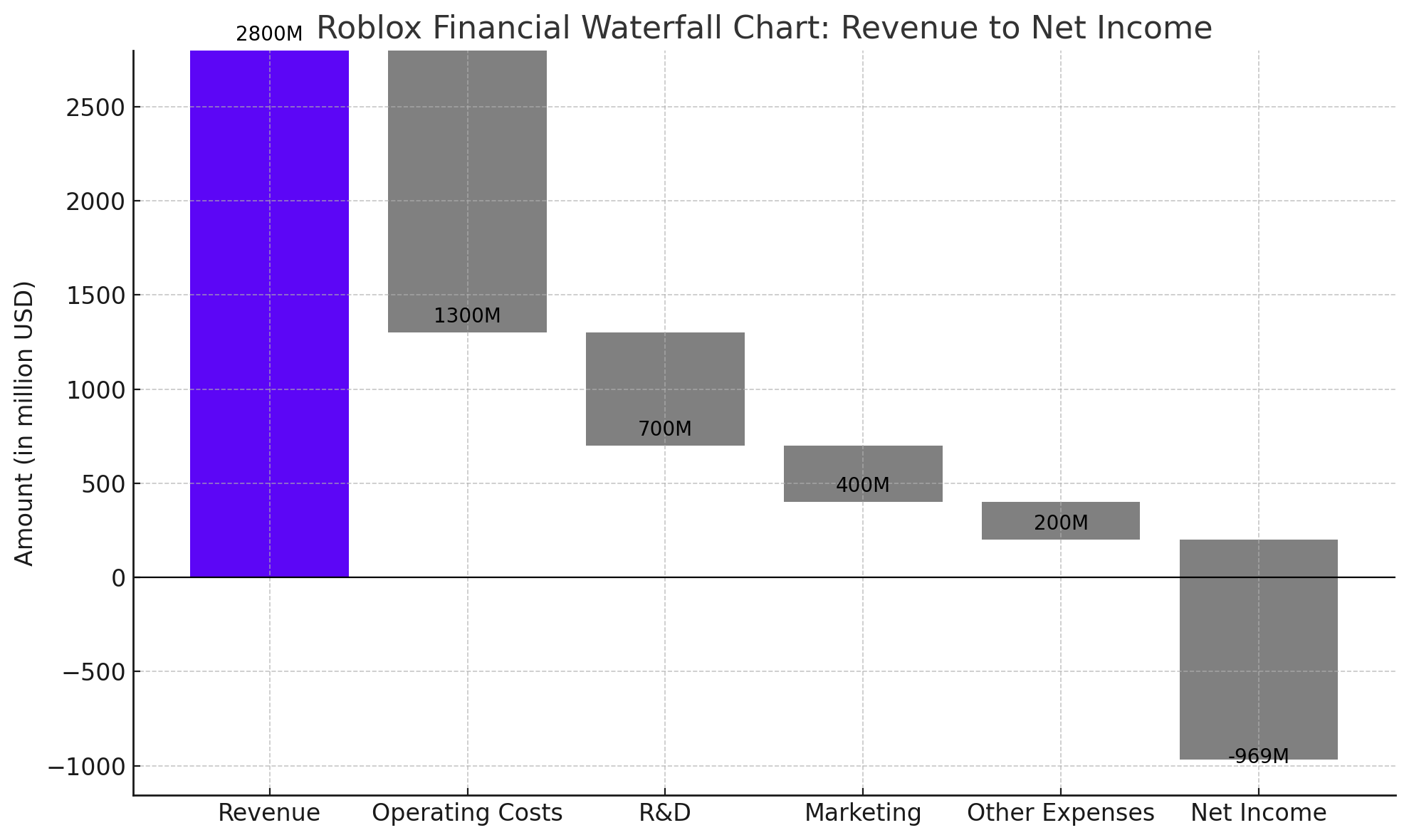

Roblox Corporation (NYSE:RBLX) stands as a unique entity in the realm of digital entertainment with a business model that heavily relies on the sale of its virtual currency, Robux. This currency forms the backbone of Roblox's microtransaction ecosystem, allowing users to purchase enhancements or unique experiences within the platform. As of the last fiscal year, Roblox reported a revenue of approximately $2.8 billion, marking a substantial increase from previous periods.

Revenue Streams and Profitability Challenges

Roblox’s innovative revenue-sharing model with developers, which involves converting the virtual currency Robux back to real-world dollars, is a pivotal growth driver but comes with its complexities. Despite robust top-line growth, Roblox has struggled to reach profitability, with a reported net income margin of -41.15% and an EBIT margin of -44.73%. This significant spend on research, development, and infrastructure reflects a strategic choice to invest in long-term growth over immediate profitability.

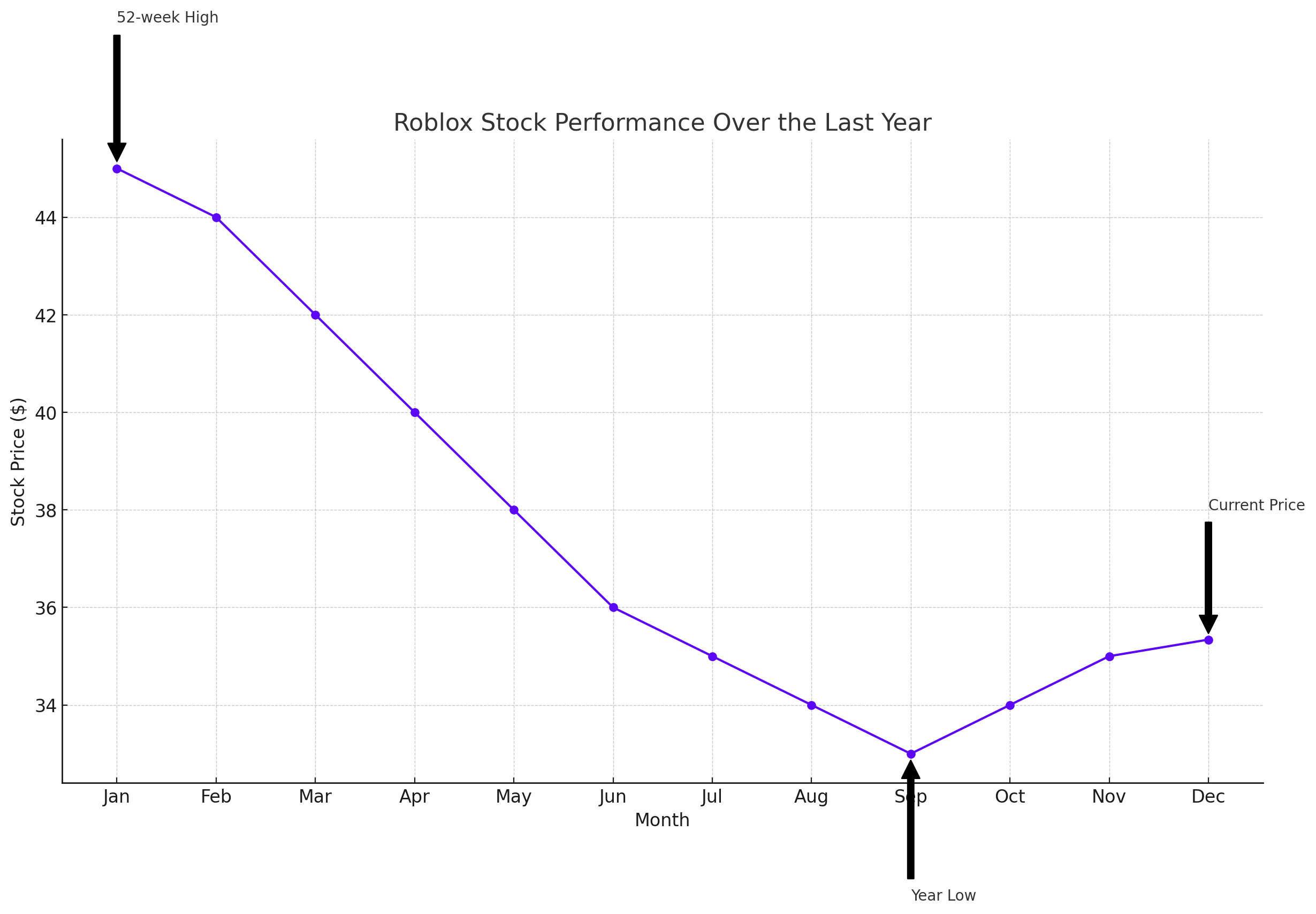

Stock Performance and Market Sentiment

The NYSE:RBLX shares have experienced volatility, currently trading around $35.34, significantly down from a 52-week high of $47.20. This volatility reflects investor sentiment about the challenges Roblox faces in terms of profitability and its heavy reliance on continuous capital expenditures, which in the last term accounted for 11.46% of sales, compared to a sector median of 3.99%.

Strategic AI Integration and Impact on Operations

In March 2024, Roblox introduced several AI-driven tools at the Game Developers Conference, aimed at enhancing the efficiency of 3D content creation. These tools are designed to lower the entry barrier for new developers and streamline existing processes, potentially increasing content output and improving user engagement metrics.

Competitive Landscape and Industry Positioning

Roblox’s main competitors include:

- Epic Games: A powerhouse with extensive resources and popular titles like Fortnite.

- Unity Software: A direct competitor in the real-time 3D content creation space.

- Mojang: Owned by Microsoft, known for the globally popular game Minecraft.

Despite these formidable competitors, Roblox's unique model of user-generated content and its development platform set it apart, offering a different value proposition that is attractive to a young, creative user base.

User Engagement and Market Expansion

Roblox's focus on a predominantly younger demographic has been a double-edged sword, providing a dedicated user base but also limiting its market reach. Efforts to expand its demographic through advanced technology integration, like AI, and broader content offerings are crucial for sustained growth. The platform’s reported daily active users have shown a healthy increase, indicative of strong market engagement and the successful expansion of its user base.

Growth Through Technological Advancements and Content Expansion

Roblox has made significant strides in increasing user engagement through strategic technology integrations and a diverse range of content offerings. The introduction of AI-driven tools has streamlined content creation, making it more accessible to users without advanced technical skills. These advancements not only enhance the platform’s appeal to a broader audience but also improve the quality and diversity of experiences available, fostering a richer ecosystem for both creators and users.

Financial Metrics and User Growth Trends

As of the latest reporting period, Roblox boasts a robust user base, with daily active users (DAUs) reaching approximately 71.5 million, marking a significant year-over-year increase. This growth is not just in numbers but also in user engagement, with metrics showing increased session lengths and more frequent interactions, suggesting a deeper integration of Roblox's platform into users' daily routines.

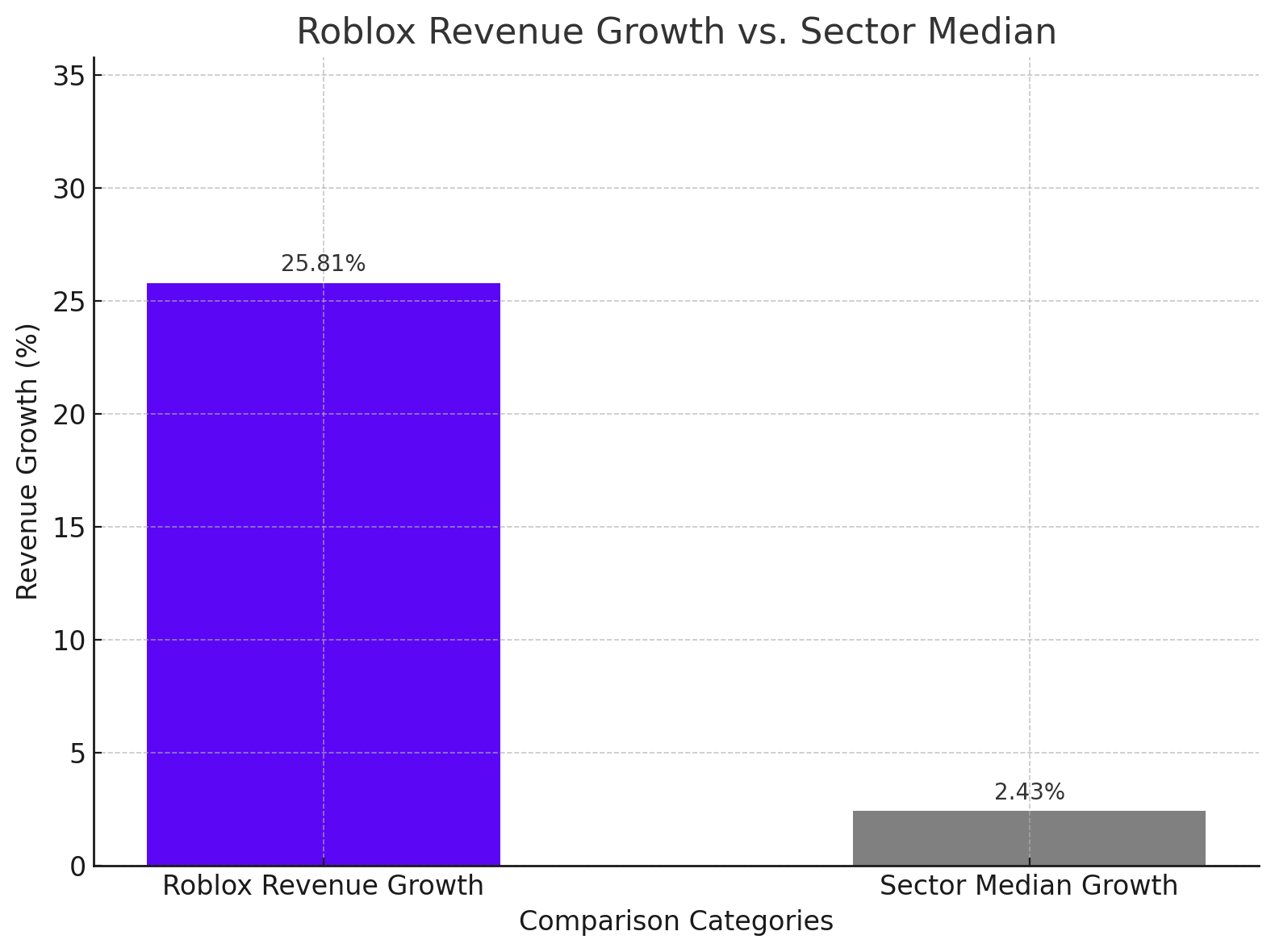

Revenue Growth and Sources

The financial health of Roblox is underscored by its aggressive revenue growth. The last fiscal year saw a revenue increase of 25.81% year-over-year, significantly outpacing the sector median of 2.43%. This growth is primarily driven by the sales of Robux and the uptake of Roblox Premium subscriptions. However, the company is also exploring new revenue streams, such as immersive advertising, which is poised to tap into the burgeoning digital ad market projected to exceed $10 billion by 2025.

Strategic Challenges and Operational Costs

While Roblox has demonstrated potential in revenue growth, the company continues to grapple with high operational costs associated with maintaining and developing its expansive digital platform. These costs have contributed to the company’s current non-profitability status, with significant investments in technology and user acquisition impacting its bottom line.

Financial Performance Indicators

The company’s EBITDA and net income have reflected these challenges, with recent reports indicating an EBIT margin of -44.73% and a net income margin of -41.15%. These figures highlight the financial pressures Roblox faces as it scales up its operations and invests in future growth.

Market Valuation and Stock Performance

Roblox’s market capitalization currently stands at approximately $22.61 billion, reflecting the high expectations investors have for its growth potential. However, the stock has experienced volatility, influenced by broader market conditions and investor sentiment regarding its long-term profitability. Despite this, Roblox remains a notable player in the tech and entertainment industry, with a price-to-sales ratio significantly above the sector median, suggesting investor confidence in its revenue generation capabilities.

Investment Consideration for Roblox Corporation (NYSE:RBLX)

Given the current analysis of Roblox’s financial health, market position, and growth prospects, investors face a complex decision. The company's innovative platform and significant user engagement present compelling growth opportunities, particularly as it continues to integrate advanced technologies like AI and expands its revenue streams through initiatives like immersive advertising.

Bullish Factors:

- User Growth: Continued expansion in daily active users and increased engagement levels indicate a strong market presence and potential for sustained growth.

- Revenue Diversification: Initiatives to diversify revenue, particularly through the introduction of immersive advertising, could significantly boost the company’s financial profile.

- Technological Innovation: Investments in AI and potential ventures into virtual and augmented reality are likely to enhance the user experience and expand market reach.

Bearish Considerations:

- Non-Profitability: Despite impressive top-line growth, Roblox has yet to achieve profitability, with high operational costs and ongoing investments weighing on its financial performance.

- Market Volatility: The stock has shown susceptibility to market fluctuations and sentiment, which could lead to significant price swings.

- Competitive Pressure: The intense competition from larger entities with more resources could impede Roblox’s ability to capture a larger market share.

Investment Outlook: Hold

- The recommendation to hold is based on Roblox’s promising growth trajectory balanced against its current financial challenges and market risks. While the company exhibits potential for substantial long-term growth, the present financial uncertainties and the competitive landscape suggest a cautious approach. Investors currently holding shares should monitor the company's progress toward profitability and the effectiveness of its new revenue channels before increasing their stakes.

Investors are encouraged to stay informed about Roblox’s operational strategies and financial results, particularly how it manages costs and capitalizes on its technological advancements, to make well-informed decisions that align with their investment goals and risk tolerance.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex