NYSE:UAA Strategic Evolution - Market Challenges and Opportunities

A detailed look at Under Armour’s recent performance, financial health, and strategic diversification amid intense market competition and global expansion efforts | That's TradingNEWS

Comprehensive Analysis of Under Armour, Inc. (NYSE:UAA): Navigating Market Dynamics and Strategic Evolution

Market Position and Recent Performance

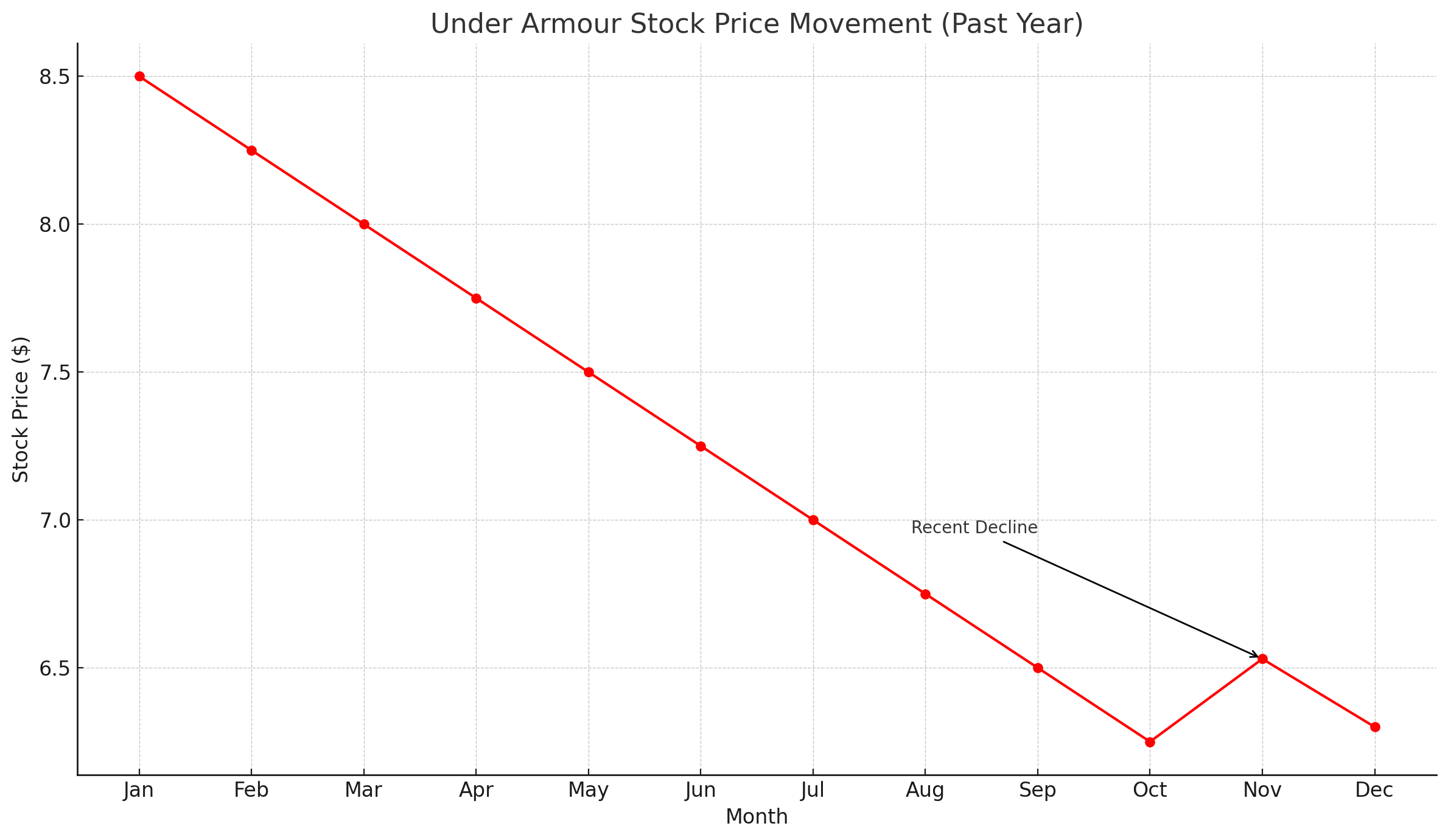

Under Armour, Inc. (NYSE:UAA) currently presents a unique case in the athletic apparel industry, marked by a tumultuous yet promising trajectory. As of the latest trading session, UAA's stock price settled at $6.53, reflecting a decrease of 1.66%. Despite the day-to-day volatility, the broader perspective reveals a company grappling with significant market shifts and internal strategies aimed at revitalization.

Stock Metrics and Valuation Insights

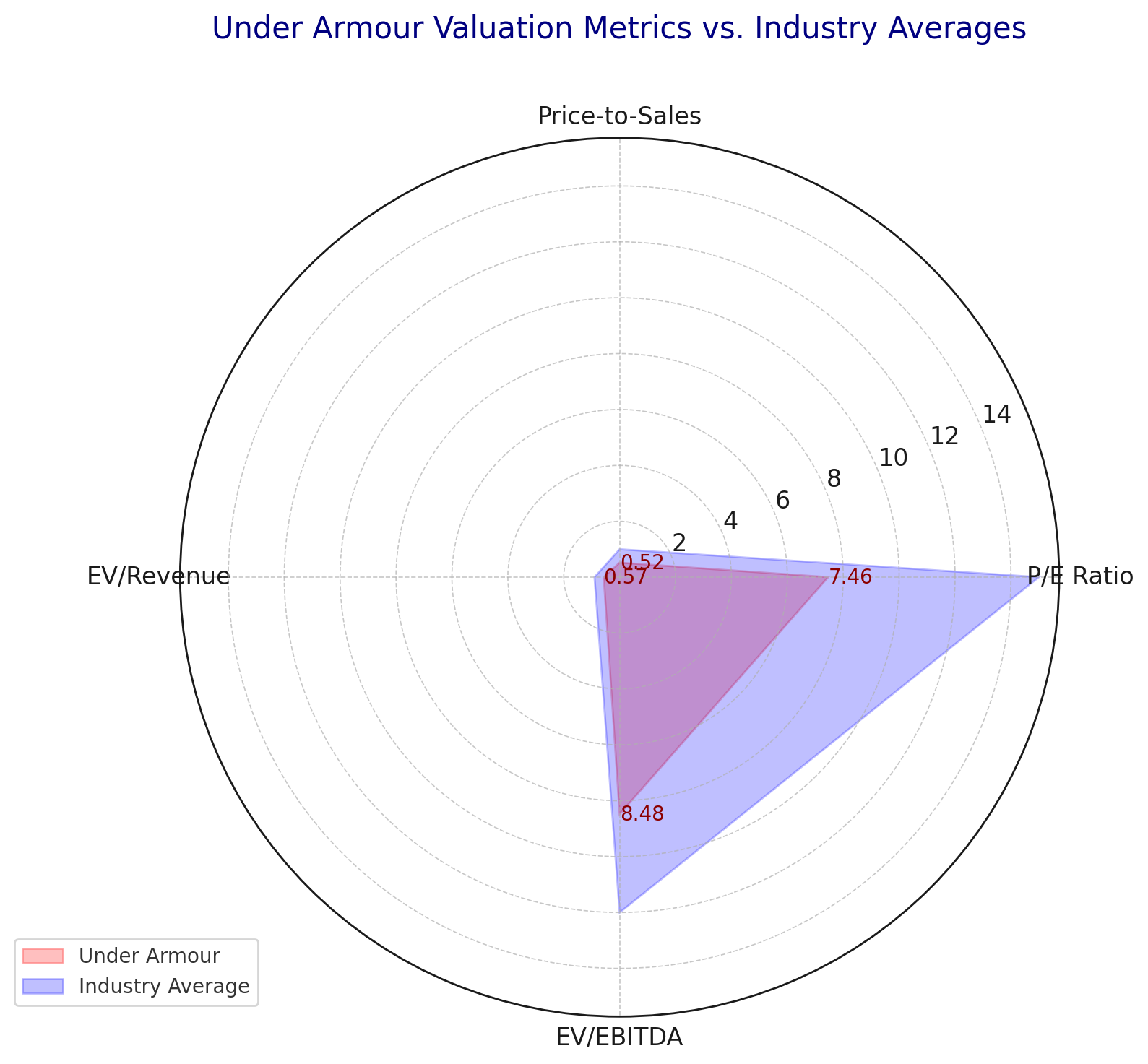

The stock's journey over the past year showcases a decrease of 27.75%, underperforming the S&P 500's rise of 25.65%. With a market capitalization of approximately $2.84 billion and an enterprise value of $3.27 billion, Under Armour operates under a trailing Price-to-Earnings (P/E) ratio of 7.46 and a forward P/E of 13.02, suggesting cautious optimism about its future profitability.

Key Financial Ratios:

- Price-to-Sales (TTM): 0.52

- Price-to-Book (MRQ): 1.33

- Enterprise Value-to-Revenue: 0.57

- Enterprise Value-to-EBITDA: 8.48

These ratios indicate a valuation that could be seen as undervalued in the context of its historical performance and industry standards, which is intriguing for potential investors.

Operational Efficiency and Earnings Analysis

Under Armour reported a profit margin of 6.98% with an operating margin of 4.68% over the trailing twelve months. These figures are supported by a solid Return on Equity (ROE) of 20.12%, showcasing efficient management performance relative to shareholder equity.

- Recent Quarterly Revenue Growth (YoY): -6.00%

- Diluted EPS (TTM): $0.89

The decline in year-over-year revenue alongside modest earnings underscores challenges but also points to stabilization efforts in the face of adverse market conditions.

Strategic Initiatives and Market Expansion

Under Armour's strategic focus has been finely tuned to address both geographic and product line diversification. The company has successfully marked its presence across various global markets, enhancing its brand reach and mitigating risks associated with market volatility.

Geographical Segmentation Insights:

- Revenue diversification is evident with significant contributions from regions beyond North America, including robust figures from Europe, Asia, and Latin America.

This strategic geographical spread is critical in reducing dependency on any single market and leveraging global growth opportunities, particularly in emerging markets where athletic wear has seen an exponential rise in demand.

Financial Health and Liquidity

A critical analysis of Under Armour’s balance sheet reflects a well-structured financial stature:

- Total Cash (MRQ): $1.04 billion

- Total Debt (MRQ): $1.47 billion

- Current Ratio: 2.13

The company’s liquidity ratios, such as a current ratio exceeding 2, depict a strong ability to cover short-term obligations, which is imperative for maintaining operational fluidity in uncertain economic times.

Challenges and Forward-Looking Statements

Despite the promising aspects of Under Armour's strategy and market positioning, several challenges need to be navigated:

- Market Competition: Intense competition from giants like Nike and Adidas continues to pressure Under Armour to innovate continually.

- Supply Chain Dynamics: Global supply chain issues pose risks that could affect production and distribution, critical areas for a company heavily reliant on overseas manufacturing.

Investment Considerations and Stock Insights

Given the company's solid financial base, strategic market expansions, and the relatively low P/E ratio, Under Armour represents a potentially undervalued opportunity in the athletic apparel sector. However, potential investors should consider the inherent risks associated with its competitive landscape and external economic factors.

For detailed stock analysis and real-time updates, interested investors can visit Under Armour's Stock Profile for deeper insights and Insider Transactions to gauge corporate confidence.

Conclusion and Investment Recommendation

After a thorough analysis of Under Armour, Inc. (NYSE:UAA), we find the company at a significant crossroads. Under Armour's financials, strategic initiatives, and market positioning offer a complex but insightful picture of its potential trajectory in the competitive athletic apparel industry.

Bearish Considerations:

- Intense Competition: Under Armour faces stiff competition from industry leaders like Nike, Adidas, and newer entrants, which could hinder market share growth and put pressure on margins.

- Supply Chain Vulnerabilities: As a company reliant on global manufacturing, particularly in Southeast Asia, Under Armour is susceptible to disruptions in the supply chain, geopolitical tensions, and potential tariff changes, which could increase operational costs and impact profitability.

- Market Performance: The stock's underperformance compared to the broader market and its sector could signal underlying issues not fully captured by public financials, possibly related to brand positioning or product innovation lag.

Bullish Considerations:

- Strong Financial Health: The company's robust balance sheet, characterized by a high current ratio and significant cash reserves, provides it with a cushion to navigate short-term uncertainties and invest in growth opportunities.

- Strategic Geographic Diversification: Expansion into global markets reduces reliance on the North American market and taps into emerging markets' growth potential, where demand for athletic apparel is rising.

- Innovative Direct-to-Consumer Channels: Under Armour's focus on enhancing its direct-to-consumer and e-commerce platforms is timely, aligning with shifting consumer shopping behaviors post-pandemic, which could drive higher margins and deeper market penetration.

Investment Recommendation: Hold with Cautious Optimism

Given the mixed signals from both bearish and bullish perspectives, the recommendation for Under Armour is a Hold. Investors currently holding shares should maintain their position but watch for significant shifts in market dynamics or internal strategy that could impact the company's performance. Potential investors should adopt a wait-and-see approach, looking for improvements in revenue growth and successful execution of strategic initiatives before considering entry.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex