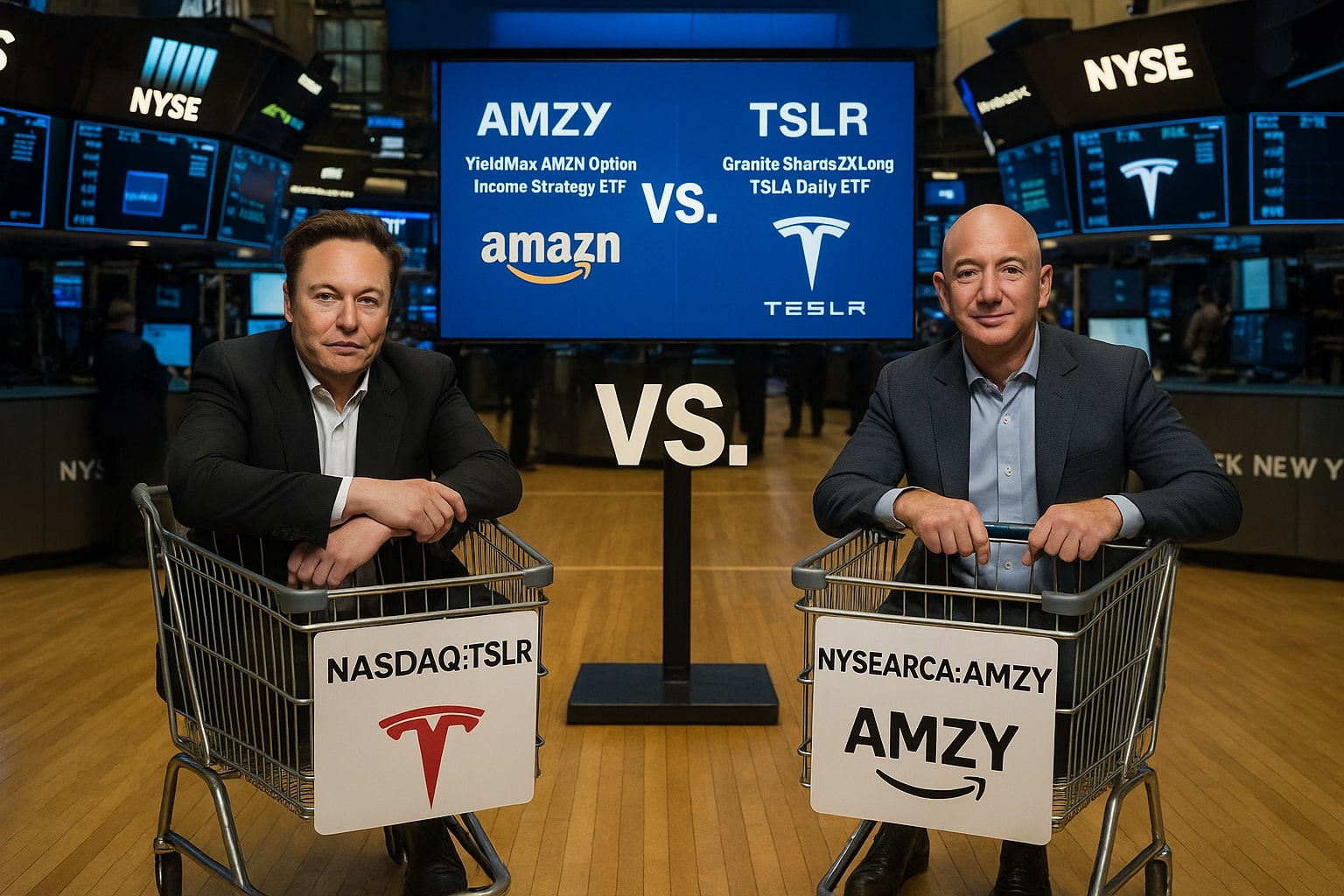

AMZY ETF vs TSLR ETF: High-Yield Amazon Income vs Tesla's Leveraged Power – Which ETF Fits Your Portfolio?

Will you take the guaranteed distributions of AMZY ETF or the explosive leverage of TSLR ETF? | That's TradingNEWS

The Battle of High-Yield ETFs: NYSEARCA:AMZY vs NASDAQ:TSLR

In the world of Exchange Traded Funds (ETFs), the choice between two distinctive approaches can determine both risk and return. Let's compare NYSEARCA:AMZY and NASDAQ:TSLR, two popular leveraged funds that offer divergent strategies aimed at maximizing returns through high-yield and leveraged exposure. Both funds offer unique risks and rewards that any investor needs to carefully consider before taking a position. Let's dive into their strategies, performance, risks, and potential outcomes for investors.

Understanding the Fund Strategies: NYSEARCA:AMZY ETF and NASDAQ:TSLR ETF

NYSEARCA:AMZY takes a more conservative approach by replicating the price movement of Amazon (AMZN) using a synthetic options strategy. AMZY offers a massive distribution yield, paid out through options premiums, but with significant risks that include capped upside potential. It does not own Amazon shares but uses options to replicate its movements. The upside is limited due to the structure of the call and put options, but it provides very attractive distributions—sometimes reaching yields as high as 65%. However, this high yield comes with volatility, as seen in its recent 31.6% price decline, despite its distributions providing a 7.4% total return when considered over the same time frame.

AMZY's approach is designed for high-yield income investors who are willing to take on additional risks. Since AMZY doesn’t directly hold Amazon shares, it often sees price discrepancies when compared with AMZN. The ETF’s synthetic strategy aims to mimic AMZN’s price movement but will cap the upside while amplifying the downside during periods of market turbulence. This makes it a great tool for those seeking income through distributions but not necessarily long-term growth in stock value.

NASDAQ:TSLR, on the other hand, is a 2x leveraged ETF, meaning it seeks to provide 200% of the daily returns of Tesla (TSLA). It’s designed for short-term, risk-tolerant traders looking to amplify their exposure to Tesla stock, which itself is known for its volatility. The major selling point of TSLR is that it offers two times the daily price movement of Tesla, allowing for potentially significant short-term gains. However, this comes with the obvious downside that TSLR is much more volatile than TSLA. A single down day can erase several gains due to the leveraged nature of the fund.

This leveraged ETF is intended for swing traders and short-term traders who are willing to accept substantial risk for amplified returns. Leveraged ETFs like TSLR carry risks in terms of both loss recoupment and volatility, as any movement in Tesla can result in magnified returns or losses. A 10% drop in Tesla stock could lead to a 20% drop in TSLR, and while this provides significant upside in bullish scenarios, it also leads to sharp corrections when the stock moves against the ETF’s position.

Performance Comparison: Risk and Return in Focus

When we look at AMZY’s performance, it’s clear that the high distribution yield is appealing, especially in a market seeking income. AMZY had an excellent 2024 with a 35.39% return, but its performance has suffered recently, with a YTD return of -2.92% as of May 2025. The total returns, including distributions, have helped offset some of these losses. A long-term investor in AMZY could potentially recoup the initial investment through distributions, as the fund nears "house money" status. However, despite the strong yield, AMZY has seen significant price volatility, including a 31.6% decline over the past year, which poses risks for those looking for stability.

In contrast, TSLR provides a different set of risks and rewards. TSLR’s performance is entirely tied to the price movement of Tesla. As of May 2025, TSLR is up 48.21% YTD, with a 1-year return of 75.69%, making it an enticing option for traders who want exposure to Tesla’s high volatility. However, these numbers are amplified by TSLR’s 2x leveraged exposure. Tesla’s inherent volatility makes TSLR a tool best suited for risk-tolerant traders, as it can both over-perform and under-perform TSLA over different timeframes, particularly if Tesla sees a correction or a sharp rise in value.

Key Risks to Consider: Understanding the Downside

Both AMZY and TSLR come with significant risks. AMZY's synthetic option strategy introduces substantial volatility, especially during market downturns. As AMZY only tracks Amazon’s price movements through options, the risk of underperformance during strong bullish rallies or rapid declines can be significant. For instance, the limited upside due to capped call options can result in AMZY failing to participate fully in Amazon’s strong price rallies.

On the other hand, TSLR faces a different type of risk due to its 2x leveraged exposure to Tesla. The most significant downside is the loss recoupment issue, where a 10% loss requires a 20% gain to break even. Furthermore, TSLR’s volatility is amplified, meaning that even if TSLA has strong growth, TSLR’s returns can vary significantly, making it a better option for short-term tactical trades rather than long-term positions. A major down day for Tesla can quickly erode TSLR's performance, and the volatility inherent in Tesla stock means that TSLR will be exposed to even more extreme fluctuations.

Investment Strategy: Which ETF is Right for You?

Both AMZY and TSLR offer distinct strategies suited for different kinds of investors. AMZY is ideal for income-focused investors who are willing to take on higher risk for a massive yield. It’s not designed for growth, but for generating significant distributions. The fund’s synthetic options strategy allows investors to enjoy a strong income stream, but the upside is capped, and the downside risks are substantial during volatile market conditions.

In comparison, TSLR is a high-risk, high-reward ETF, making it more suitable for swing traders looking to capitalize on Tesla’s volatility. With 2x leveraged exposure to Tesla, this fund can provide amplified returns, but it also has the potential to magnify losses, especially if Tesla experiences price swings.

If you are comfortable with short-term volatility and want direct exposure to Tesla, then TSLR could be an attractive option. However, if you are looking for a high-yield income play with risk diversification through Amazon, then AMZY might be the better fit for you. As always, it’s crucial to understand your risk tolerance and investment horizon before committing to either ETF.

For more detailed performance data and real-time charts, check out TSLR ETF chart here and AMZY ETF chart here.

That's TradingNEWS

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex