NYSEARCA:FDVV’s Sector Shake-Up – A Smarter Dividend Play or a Risky Shift?

Can NYSEARCA:FDVV’s New Allocations Deliver Stronger Growth and Yield?

Fidelity High Dividend ETF (NYSEARCA:FDVV) has undergone a substantial portfolio rebalancing, shifting its sector weightings and altering its investment landscape. The question now is whether these changes have positioned FDVV for stronger total returns or introduced new risks that investors need to consider.

With FDVV trading around $42.15, the fund has seen a noticeable shift in its allocation strategy. The most significant change came with a 13.27% increase in financials, now making up 20.98% of the portfolio, up from 7.71%. This shift was funded by a 13% reduction in industrials, bringing FDVV’s composition more in line with peer funds like Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) and iShares Core Dividend ETF (DIVB).

However, FDVV still maintains its high exposure to technology stocks, with Nvidia (NVDA), Apple (AAPL), and Microsoft (MSFT) remaining top holdings, albeit at a slightly reduced weight. The question is whether this shift enhances stability and dividend growth or adds potential downside risk, especially as financials tend to have lower return on assets (ROA) and are sensitive to interest rate movements.

FDVV’s Dividend Yield Boost – A Competitive 3.22% Yield at a Lower Valuation?

One of the most critical factors for dividend investors is yield sustainability. Thanks to its rebalancing, FDVV’s dividend yield has increased to 3.22%, up from 2.96% before the changes. This yield now puts FDVV in a stronger competitive position against SCHD (3.80% yield) and DIVB (2.87%), offering a balance of high yield and capital growth potential.

Additionally, FDVV's valuation improved. Its forward P/E ratio dropped from 18.00x to 16.68x, making it one of the more attractively priced dividend ETFs. Compared to the S&P 500 ETF (SPY), which trades at 21.5x forward earnings, FDVV now trades at a 27% discount to the broader market while still maintaining a high single-digit expected earnings growth rate of 8.54%.

But how does this compare to other dividend funds? FDVV still lags SCHD in pure dividend growth. Over the past five years, SCHD’s dividend growth rate was over 11.04%, while FDVV’s five-year dividend growth came in at just 2.87%. This means that while FDVV may offer higher near-term yield, its long-term dividend growth potential is not as strong as SCHD, which consistently focuses on companies with a proven dividend increase history.

The sector realignment also raises questions about dividend sustainability. Financials typically have lower payout ratios than consumer staples and utilities, meaning dividend growth from new financial holdings may not be as strong. However, this increased exposure may also provide more defensive positioning in a rising-rate environment, helping FDVV balance stability and growth.

FDVV’s Sector Shift – Did It Improve or Weaken Portfolio Quality?

While the increase in financials may offer potential benefits, one downside is the decline in overall portfolio quality. FDVV’s return on assets (ROA) fell from 11.31% to 10.79%, and its return on equity (ROE) dropped from 25.07% to 23.61% after the rebalancing. These drops are relatively minor but indicate a slight decline in overall portfolio efficiency.

Margins and debt-to-free cash flow metrics remain strong, meaning FDVV still holds solid balance-sheet stocks compared to peers. But the increased weight in financials means more exposure to interest-rate cycles, adding an element of macroeconomic risk that investors need to monitor.

The biggest winners in the rebalancing were financials (6.84%), consumer staples (5.45%), and energy (3.67%). The question now is whether these sectors will drive future outperformance or if the lack of heavier exposure to high-dividend utilities and staples will hurt FDVV’s long-term stability.

FDVV vs. SCHD – Which ETF Offers the Better Long-Term Opportunity?

Fidelity High Dividend ETF (NYSEARCA:FDVV) and Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) are two of the top choices for dividend investors, but they have different strengths.

SCHD has a proven history of stronger dividend growth, while FDVV offers a better balance of high-yield and growth stocks. FDVV’s exposure to tech and now financials makes it a more dynamic play, but SCHD remains a more defensive option with more consistent dividend growth.

One major advantage FDVV holds is its tech exposure. With artificial intelligence and cloud computing driving tech stock valuations, FDVV’s positions in Microsoft (MSFT), Apple (AAPL), and Nvidia (NVDA) could lead to stronger total returns if these sectors continue to outperform.

However, SCHD has an 11.59% five-year dividend growth rate, compared to FDVV’s 2.87% over the same period. If long-term dividend growth is the primary goal, SCHD is still the better choice.

Final Take – Is NYSEARCA:FDVV a Buy After Its Portfolio Overhaul?

FDVV’s new strategy offers both opportunities and risks. The higher dividend yield at 3.22% is a positive, and the 16.68x forward P/E ratio makes it attractively priced relative to peers and the broader market. However, lower portfolio quality metrics and increased exposure to financials introduce new risks that investors must monitor.

For growth-focused dividend investors, FDVV offers a solid balance between capital appreciation and income, especially with its continued strong exposure to technology stocks. However, for those seeking consistent dividend growth and lower volatility, SCHD remains the better long-term option.

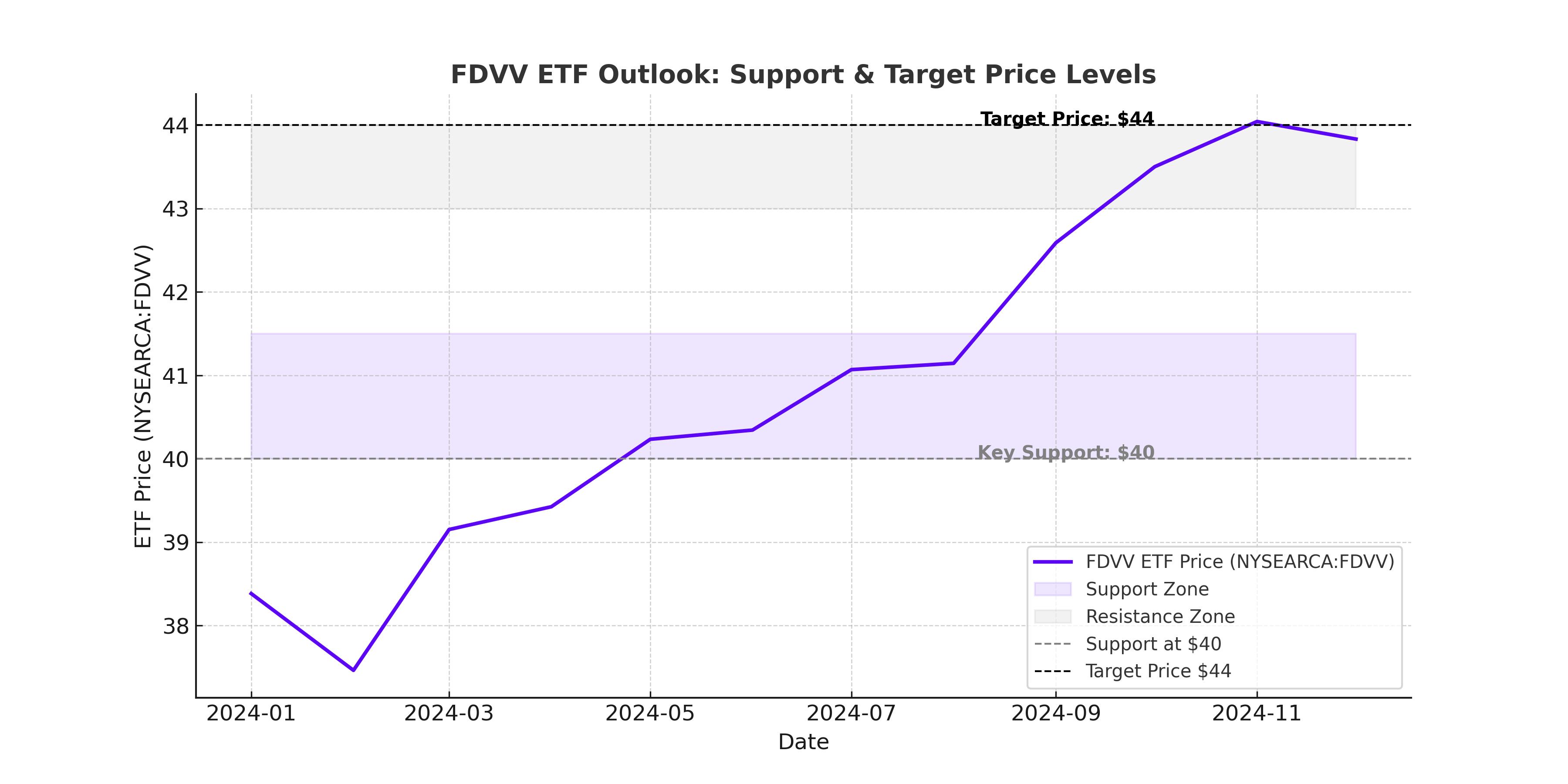

With FDVV currently trading at $42.15, the real question is whether its sector adjustments will drive long-term outperformance or if the increased financials exposure will lead to weaker dividend growth. Investors looking for dividend income with moderate growth exposure may find FDVV an attractive buy, but those prioritizing long-term dividend compounding might still prefer SCHD's proven history of growth.

For a real-time look at FDVV’s stock price and performance, check out FDVV’s Live Chart.