NYSEARCA:GLD ETF is Soaring – Will Gold Prices Smash $3,100 in 2025?

Is NYSEARCA:GLD ETF a strong buy as gold demand explodes, or is a correction on the horizon? | That's TradingNEWS

NYSEARCA:GLD – Is Gold’s Record-Breaking Surge Just the Beginning?

Why Is Gold (NYSEARCA:GLD) Trading Near All-Time Highs?

Gold has been on an explosive run, with NYSEARCA:GLD surging nearly 12% year-to-date, hitting $271.92 as of the latest trading session. The question now is: can gold keep climbing toward $3,100/oz as some analysts predict, or is this rally at risk of losing steam? The price action is being driven by a perfect storm of macroeconomic factors, from central bank gold hoarding and geopolitical uncertainty to persistent inflation and expectations of Federal Reserve rate cuts.

At a time when equity markets are starting to feel pressure and the U.S. dollar weakens, gold is becoming the go-to safe-haven asset. The SPDR Gold Shares ETF (NYSEARCA:GLD), which tracks physical gold, has seen significant inflows as investors rush to hedge against inflation and financial instability. Meanwhile, global central banks—led by China—are accumulating gold at a record pace, reshaping the market’s long-term outlook.

The real question now is whether NYSEARCA:GLD is still a buy at these levels, or if investors should prepare for a potential pullback.

Gold’s Liquidity Crisis – Why Is Metal Leaving London and Flowing to New York?

A major shift is happening in the global gold market. While London’s gold vaults are running low, inventories in New York’s COMEX exchange are hitting record highs. This unprecedented movement of gold between financial centers suggests that major players—including central banks and institutional investors—are scrambling to secure physical gold.

One theory is that arbitrage opportunities are emerging due to the premium on U.S. gold prices, which has not closed despite billions of dollars of metal flowing across the Atlantic. Some investors believe that fears of U.S. tariffs and economic instability are driving this trend. Others argue that BRICS nations, particularly China and India, are accelerating their gold purchases to reduce dependence on the Western financial system.

Regardless of the cause, the implications are clear: physical gold is in high demand, and supply constraints could push prices even higher.

Central Banks Are Buying Gold at a Record Pace – What Does It Mean for GLD?

In 2023, central banks purchased 1,037 metric tons of gold, with China alone accounting for more than half of these acquisitions. This trend has continued into 2024, with major economies moving away from U.S. Treasuries and shifting reserves into gold.

China has been steadily dumping U.S. debt holdings since 2015, opting instead to build up its gold reserves as a hedge against economic sanctions and currency volatility. With growing geopolitical tensions—including the Taiwan conflict and the Russia-Ukraine war—gold has emerged as the primary store of value for governments seeking protection against potential financial crises.

For GLD investors, this means that demand for gold remains fundamentally strong, regardless of short-term market fluctuations.

Inflation, Interest Rates, and Gold – Where Does GLD Go from Here?

The Federal Reserve's next move on interest rates is a critical factor for gold’s future trajectory. Historically, gold performs best in low-rate environments, as lower yields make non-yielding assets like gold more attractive.

The most recent CPI data suggests that inflation is still sticky, with core inflation hovering around 3.1%. While the Fed is expected to cut rates in 2024, the timeline remains uncertain. If inflation persists, the Fed may delay rate cuts, which could lead to short-term pressure on gold prices. However, if the Fed shifts to an easing cycle, gold could see a massive breakout toward $3,100/oz.

Adding to the bullish case, the U.S. budget deficit is ballooning, increasing concerns over long-term dollar devaluation. This supports a long-term bullish thesis for gold, as investors seek alternatives to fiat currencies.

Technical Analysis – Is NYSEARCA:GLD Overbought or Just Getting Started?

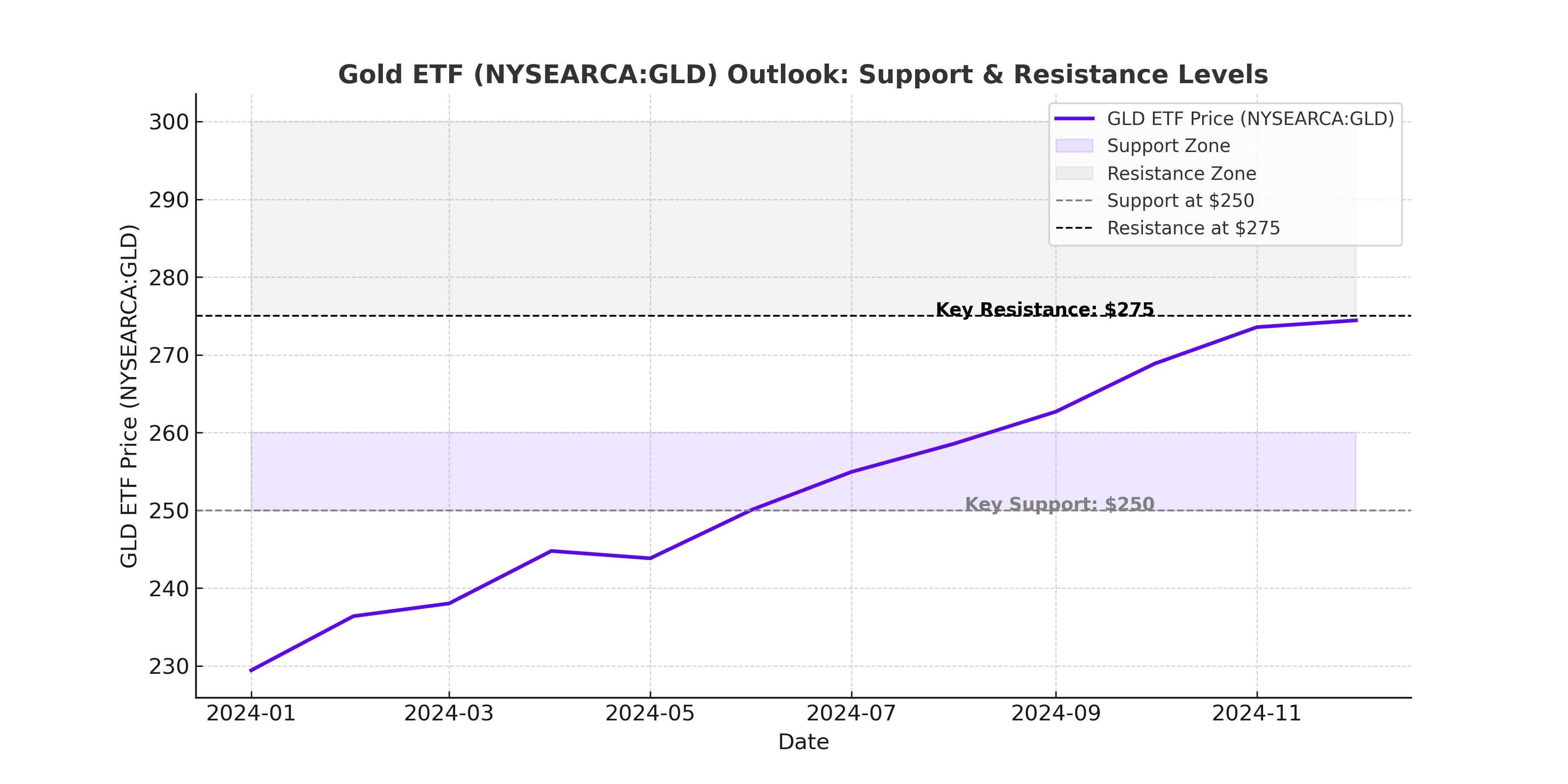

From a technical standpoint, GLD is showing strong bullish signals. The ETF is currently trading well above its 50-day moving average ($253) and 200-day moving average ($237), indicating strong momentum. The Relative Strength Index (RSI) at 71.94 suggests that GLD is entering overbought territory, but this does not necessarily mean a pullback is imminent.

Key technical factors supporting further upside:

- The Bollinger Bands are widening, signaling increased volatility and potential for an extended breakout.

- The 50-day MA is sharply rising, which historically indicates continued bullish momentum.

- Support levels sit around $250, with strong resistance at $275-$280. A breakout above this range could send GLD soaring toward $300+.

Bear Case? A short-term pullback could occur if the Fed delays rate cuts or if inflation cools faster than expected. However, as long as geopolitical uncertainty and central bank gold buying persist, downside risk remains limited.

Geopolitical Risks – Will Gold’s Safe-Haven Demand Continue?

One of the biggest catalysts for GLD’s surge has been global instability. From escalating tensions in the Middle East to ongoing conflicts in Ukraine and Taiwan, investors are looking for hedges against uncertainty.

A potential de-escalation in global conflicts would reduce safe-haven demand for gold, potentially leading to profit-taking and short-term weakness. However, with U.S.-China relations deteriorating and new tariff threats on the horizon, it’s hard to see geopolitical risks disappearing anytime soon.

Key Risks That Could Impact Gold Prices:

- A stronger U.S. dollar – If the dollar rebounds, it could limit gold’s upside potential.

- Faster-than-expected economic recovery – If the global economy strengthens, investors may rotate into riskier assets.

- Central bank policy shifts – If central banks reduce gold purchases, demand could weaken.

Final Verdict – Is NYSEARCA:GLD a Buy, Hold, or Sell?

The fundamental case for gold remains strong, supported by central bank demand, geopolitical risks, and inflation concerns. The technical picture also signals further upside potential, with GLD poised to break out above $275-$280 in the near term.

At $271.92 per share, GLD is not cheap, but it remains an attractive play for investors seeking a hedge against inflation, currency devaluation, and economic instability. Short-term volatility is possible, but long-term investors could see significant gains if gold continues its march toward $3,100/oz by 2025.

Final Call: NYSEARCA:GLD is a BUY, with a potential price target of $300+ in the coming months.

That's TradingNEWS

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex