Oil Market Outlook: Rising Prices Amidst Tightening Supplies

An in-depth analysis of current oil price trends, future projections, and the strategic factors influencing global oil dynamics, from supply deficits to Federal Reserve decisions | That's TradingNEWS

Current Trends in Oil Prices

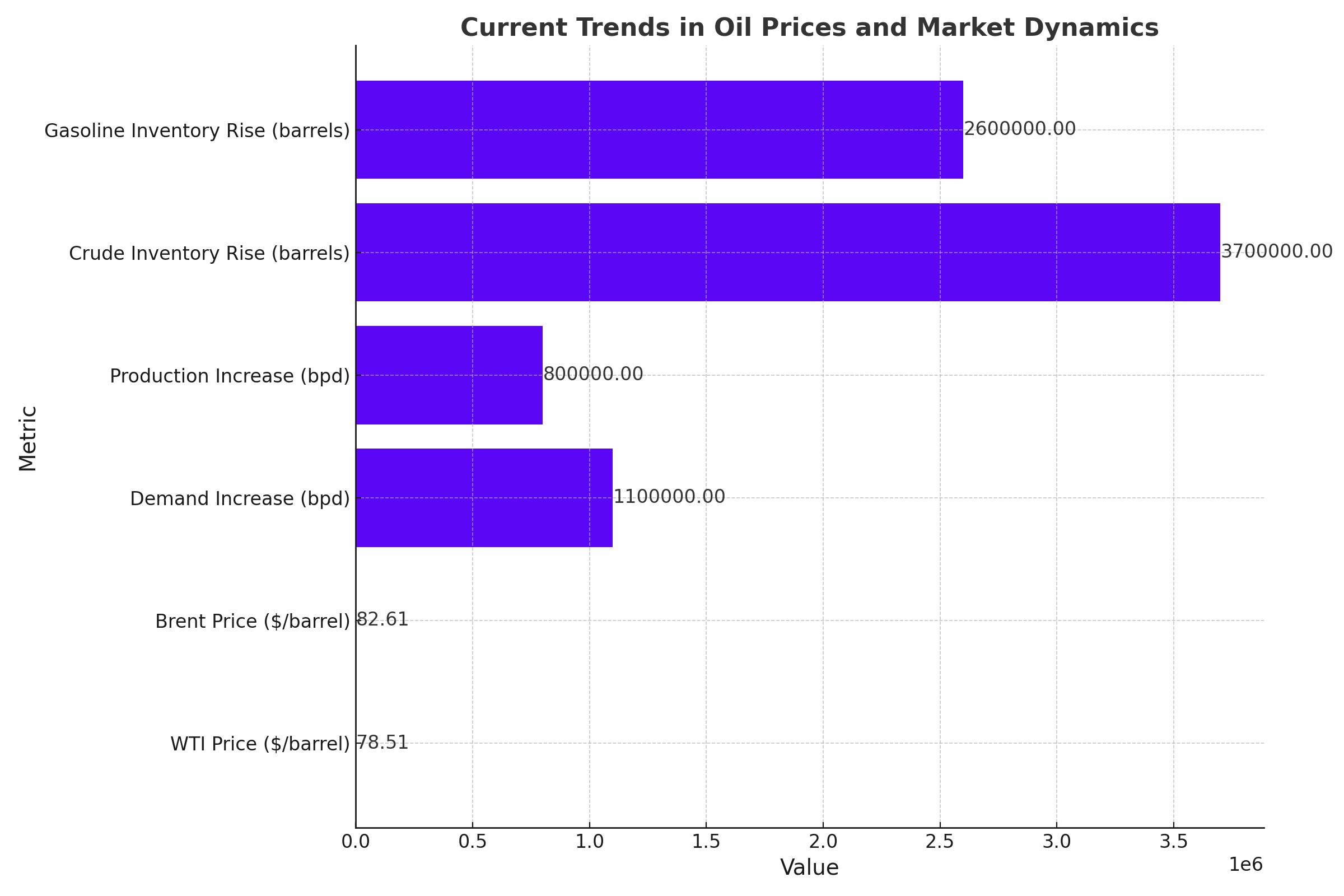

Oil prices have recently shown a notable increase, with West Texas Intermediate (WTI) crude trading at approximately $78.51 per barrel, reflecting a gain of 0.78%. Similarly, Brent crude has followed this upward trend, priced at around $82.61 per barrel, marking an increase of 0.84%. These adjustments are indicative of a broader market sentiment reacting to a mix of geopolitical tensions, supply constraints, and macroeconomic indicators.

Analysis of Supply and Demand Dynamics

The Department of Energy's latest forecast suggests a significant shift in global oil dynamics, predicting a demand increase of 1.1 million barrels per day (bpd) for the current year. This adjustment up from an earlier forecast of 900,000 bpd signals tighter future supplies. Production, however, is only expected to rise by 800,000 bpd, pointing towards a looming supply deficit that could further buoy prices.

Impact of U.S. Inventory and Federal Reserve Policies

Recent U.S. stockpile data introduced some bearish sentiment, revealing a 3.7 million barrel rise in crude inventories, starkly contrasting with the anticipated draw of 1 million barrels. This increase, coupled with a 2.6 million barrel rise in gasoline stockpiles, has temporarily dampened the bullish outlook on oil prices.

Moreover, the Federal Reserve's latest indications of a conservative approach towards interest rate cuts have also influenced market dynamics. The Fed hinted at possibly just one rate cut this year, which has had a mixed impact on commodity prices including oil. This cautious stance by the Fed reflects ongoing concerns about inflation control, which could influence oil market speculations and investments.

Technical Outlook and Price Projections

From a technical standpoint, oil prices are encountering resistance around the $82-$83 per barrel range for Brent and $78-$79 for WTI. These levels are critical to watch in upcoming trading sessions. Morgan Stanley's commodity strategist forecasts a potential rise in Brent prices to $86 per barrel in the third quarter, assuming market conditions continue to tighten.

Geopolitical Influences and Market Speculations

OPEC's steadfast demand growth projection of 2.2 million bpd, supported by a global economic growth forecast of 2.8%, contrasts with more bearish outlooks from other agencies like the International Energy Agency (IEA). The IEA warns of weakening demand and rising supplies, which could challenge OPEC+'s efforts to manage production effectively.

Long-term Projections and Strategic Implications

Looking towards the future, the oil market faces potential volatility driven by geopolitical risks, environmental policies, and technological advancements in energy sectors. The strategic maneuvers by OPEC+ and responses from major oil-producing nations will be crucial in shaping the market landscape. Investors and analysts alike must remain vigilant, considering both short-term data trends and long-term economic indicators to navigate the complex oil market successfully.

This analysis highlights the intricate balance of supply and demand, geopolitical strategies, and economic policies that drive the oil market today. As these factors continue to evolve, they will dictate the trajectory of oil prices and market stability.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex