Oil Markets Rocked by Middle East Conflicts, Libyan Shutdown, and China’s Growing Demand

A perfect storm of geopolitical tensions, a looming halt in Libya's oil production, and China's relentless energy appetite sends oil prices soaring to new highs | That's TradingNEWS

Rising Tensions and Supply Disruptions Drive Oil Prices Higher

Middle East Conflict Spurs Oil Market Volatility

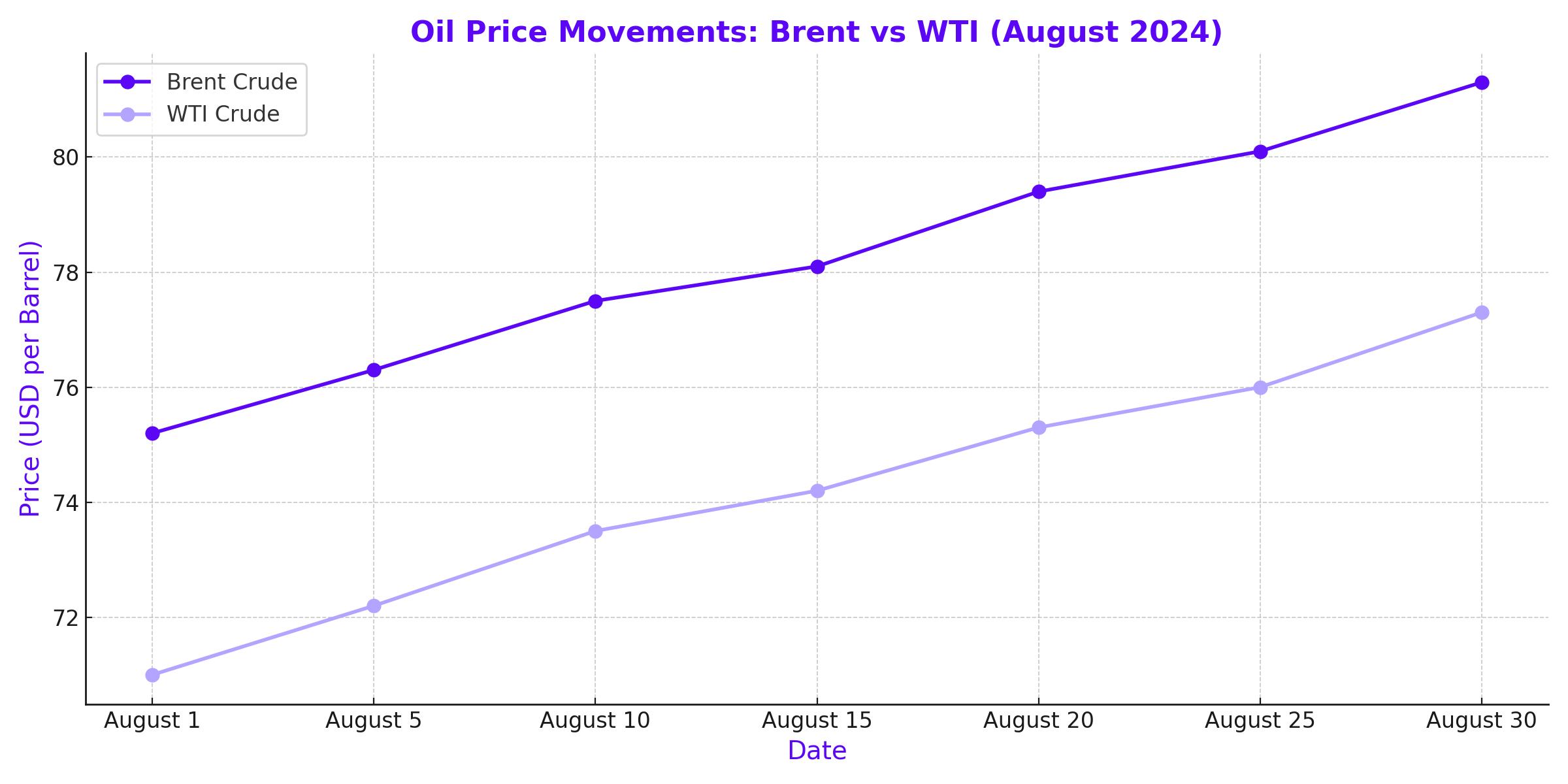

The global oil market has been rattled by escalating tensions in the Middle East, particularly involving the ongoing conflict between Israel and Hezbollah. On Sunday, Hezbollah launched hundreds of rockets and drones into Israel, prompting a swift military response from Israel, which included airstrikes on targets in Lebanon. This surge in violence has stoked fears of a broader conflict in the region, a critical area for global oil production and export. Brent Crude, a global benchmark, saw a sharp rise, climbing 2.89% to $81.30 per barrel by midday trading, reflecting market concerns over potential supply disruptions. Similarly, U.S. West Texas Intermediate (WTI) crude futures surged by 3.3%, reaching $77.30 per barrel, marking the highest levels observed in nearly two weeks.

Libya's Oil Exports Under Threat Amid Political Turmoil

Adding to the geopolitical risks, Libya's eastern-based government, not internationally recognized but controlling most of the country’s oil fields, announced the closure of all oil production and exports. This move comes as part of a power struggle over the leadership of the Central Bank of Libya, which has escalated tensions between the rival governments in the east and west of the country. The National Oil Corporation (NOC) in Tripoli, which is recognized internationally and oversees Libya's oil resources, has yet to confirm this shutdown. However, the announcement has already sent shockwaves through the market, as Libya's output, which stands at around 1 million barrels per day, is now at risk of plummeting to zero, according to analysts from Swiss bank UBS.

PetroChina's Record-Breaking Profits Amid Rising Oil Prices

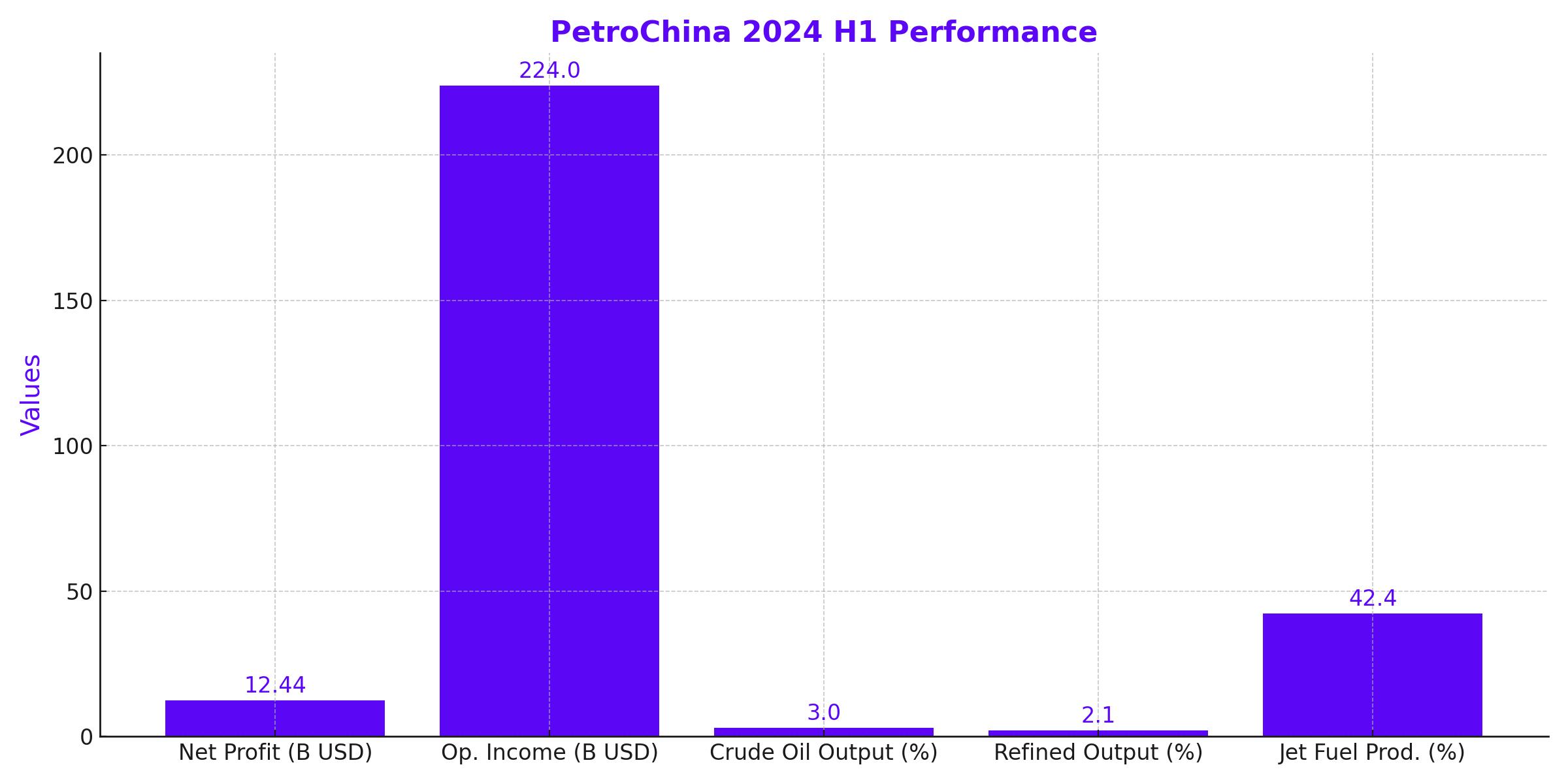

Despite the turbulent global environment, PetroChina (PTR) has emerged as a significant beneficiary of the current oil market dynamics. The company reported a record-high operating profit for the first half of 2024, driven by increased crude oil and natural gas production, which offset weaker domestic fuel demand. PetroChina’s net profit rose by 3.9% year-over-year, reaching $12.44 billion, while its operating income increased by 5% to $224 billion. The company's robust performance is attributed to higher international oil prices and a strategic focus on boosting domestic exploration and production. Notably, PetroChina's output of crude oil and refined products grew by 3% and 2.1%, respectively, despite the fluctuating demand in China. Jet fuel production saw a remarkable increase of 42.4% as air travel rebounded.

Impact of U.S. Economic Data and Interest Rate Expectations

The oil market's recent gains are also linked to broader economic factors, particularly in the United States. The U.S. Federal Reserve's indication of imminent interest rate cuts, likely to begin in September, has bolstered the global economic outlook, which in turn has supported higher fuel demand. Additionally, the release of U.S. Durable Goods Orders data for July, showing a robust increase of 9.9% compared to the expected 4%, has provided further support to the oil market. The anticipation of reduced borrowing costs has led to a weaker U.S. dollar, making oil, which is priced in dollars, more attractive to foreign buyers and driving up prices.

Geopolitical Risks Continue to Loom Over the Oil Market

The combination of geopolitical risks and economic factors has created a volatile environment for the oil market. Analysts at Saxo Bank and OANDA have pointed out that the situation in Libya and the broader Middle East could lead to significant supply disruptions, potentially driving prices even higher. The market is closely watching for any further escalation in conflicts or additional production shutdowns, which could push Brent crude prices above the critical $82 per barrel mark.

Qatar's LNG Strategy: Expanding Influence in a Competitive Market

Meanwhile, in the natural gas sector, QatarEnergy has secured a new 15-year deal to supply 3 million tons of LNG annually to Kuwait, starting in 2025. This agreement is part of Qatar's broader strategy to expand its LNG export capacity by 85% by 2030, solidifying its position as a leading global LNG supplier. The LNG will be shipped to Kuwait's Al Zour port from Qatar’s existing and future production projects, including the planned expansion of the North Field, the world’s largest natural gas field. This move underscores Qatar's efforts to meet growing regional demand, particularly in the hot summer months when electricity demand for air conditioning peaks.

Market Outlook: Navigating a Complex and Volatile Landscape

As the oil market navigates these complex dynamics, investors must weigh the potential risks and rewards. The recent price movements underscore the sensitivity of the market to geopolitical developments and economic indicators. With Brent crude trading near $81 per barrel and WTI close behind, the market remains on high alert for any further disruptions, whether from the Middle East conflict or political instability in key producing regions like Libya. At the same time, companies like PetroChina are poised to continue benefiting from the current high price environment, although challenges remain in the form of fluctuating domestic demand and potential new entrants into the LNG market, such as Qatar. As always, market participants will need to stay vigilant and adapt to the rapidly changing landscape to make informed investment decisions.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex