Oil Market Volatility: Production Adjustments and Demand Weakness Shape Price Outlook

OPEC+ Delays Production Hike Amidst Weak Global Demand, U.S. Economic Concerns, and Pressure on Oil Prices | That's TradingNEWS

Oil Market Outlook: Key Drivers, Production Dynamics, and Future Trends

Economic Concerns and Impact on Oil Demand

Oil markets have been experiencing heightened volatility, with both demand and supply factors weighing heavily on prices. U.S. employment data for August reflected a smaller-than-expected increase, adding to fears of a recession, while the unemployment rate fell to 4.2%. This suggested an ongoing slowdown in the labor market but not enough to warrant a significant interest rate cut by the Federal Reserve. Economic concerns in China and the U.S., combined with diminished influence from OPEC+, have resulted in increasing pressures on oil demand.

Brent crude, a key global benchmark, settled at its lowest since June 2023, despite a 6.9 million barrel decline in U.S. crude inventories. The inventory drop provided only temporary support, overshadowed by signals from Libya, where rival factions may soon resolve conflicts that have halted the country's oil exports. The Brent contract traded at $72.97 per barrel, down 7.3% for the year, while West Texas Intermediate (WTI) fell 5.5%, closing at $69.43 per barrel, its worst weekly performance since May 2023.

OPEC+ Production Adjustments and Market Implications

OPEC+ delayed its planned production increase of 180,000 barrels per day (bpd), pushing it back to December 2024. This decision followed a steep sell-off in oil, reflecting concerns that supply would outstrip demand. The extended cuts, including a voluntary reduction of 2.2 million bpd until November, are an effort to stabilize the market. However, the delays failed to halt the ongoing downward pressure on prices, as demand weakness, particularly from China, continues to challenge market recovery.

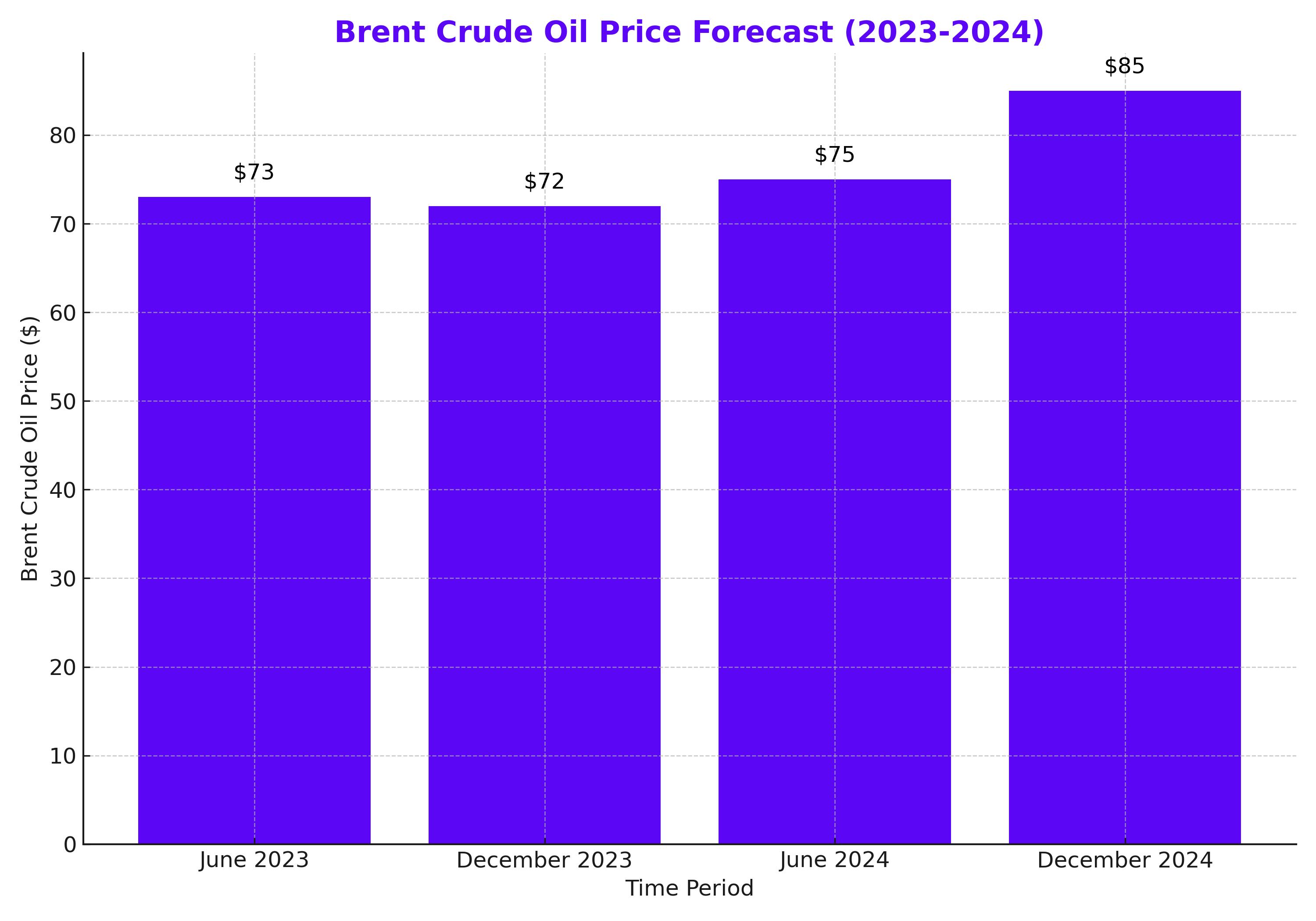

With production expected to rise gradually through 2024, OPEC+ faces a balancing act between maintaining higher prices and supporting global demand. The group's spare capacity and ability to adjust production have provided some flexibility, but persistent economic challenges will test its capacity to stabilize the market. Goldman Sachs projects a potential price range between $70 and $85 per barrel in the near term.

Supply Pressures and Inventory Dynamics

U.S. crude stockpiles declined sharply by 6.9 million barrels, compared with expectations of a smaller drawdown. However, this was not enough to offset the broader market concerns, as oil demand from China, the world’s largest importer, continues to soften due to a rapid transition toward electric vehicles and slower-than-expected economic growth. Bank of America has revised its oil price forecast downward, with Brent expected to average $75 per barrel by the second half of 2024, down from $90 previously.

OPEC+ has been “backed into a corner,” according to Kpler analysts, who highlighted that the group faces significant risks in unwinding production cuts without further pushing prices into the $60 range. The challenge remains in balancing seasonal demand fluctuations, particularly as Libyan oil returns to the market.

Market Drivers and Key Technical Levels

Oil prices have remained under significant pressure, despite a temporary lift following weaker-than-expected U.S. jobs data. The smaller gain in employment has raised expectations for a Federal Reserve rate cut, which could stimulate economic growth and, in turn, bolster oil demand. West Texas Intermediate (WTI) crude for October delivery fell 0.7% to $68.69 per barrel, on track for a weekly decline of 6.5%. Brent, meanwhile, saw a slight increase, up 7 cents to $72.76, but remained poised for a weekly loss of 5.4%.

On the technical side, oil futures breached critical support levels, with WTI falling below $70 per barrel. Analysts now view $63.21 as a potential downside target, as the market struggles to find support amid weak demand signals. Natural gas futures, in contrast, have seen a rise, gaining 6.7% over the week.

Conclusion: Facing Ongoing Challenges

The oil market's trajectory remains uncertain, with weak economic conditions in China and the U.S. creating a challenging environment for sustained price recovery. The delayed OPEC+ production hike has provided only temporary relief, and analysts remain concerned about demand outpacing supply as global inventories build. While the Fed’s potential interest rate cut may offer a short-term boost to oil prices, long-term demand weakness will likely continue to weigh heavily on the market. The next few months will be critical for determining the market’s balance as both economic and geopolitical factors play out.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex