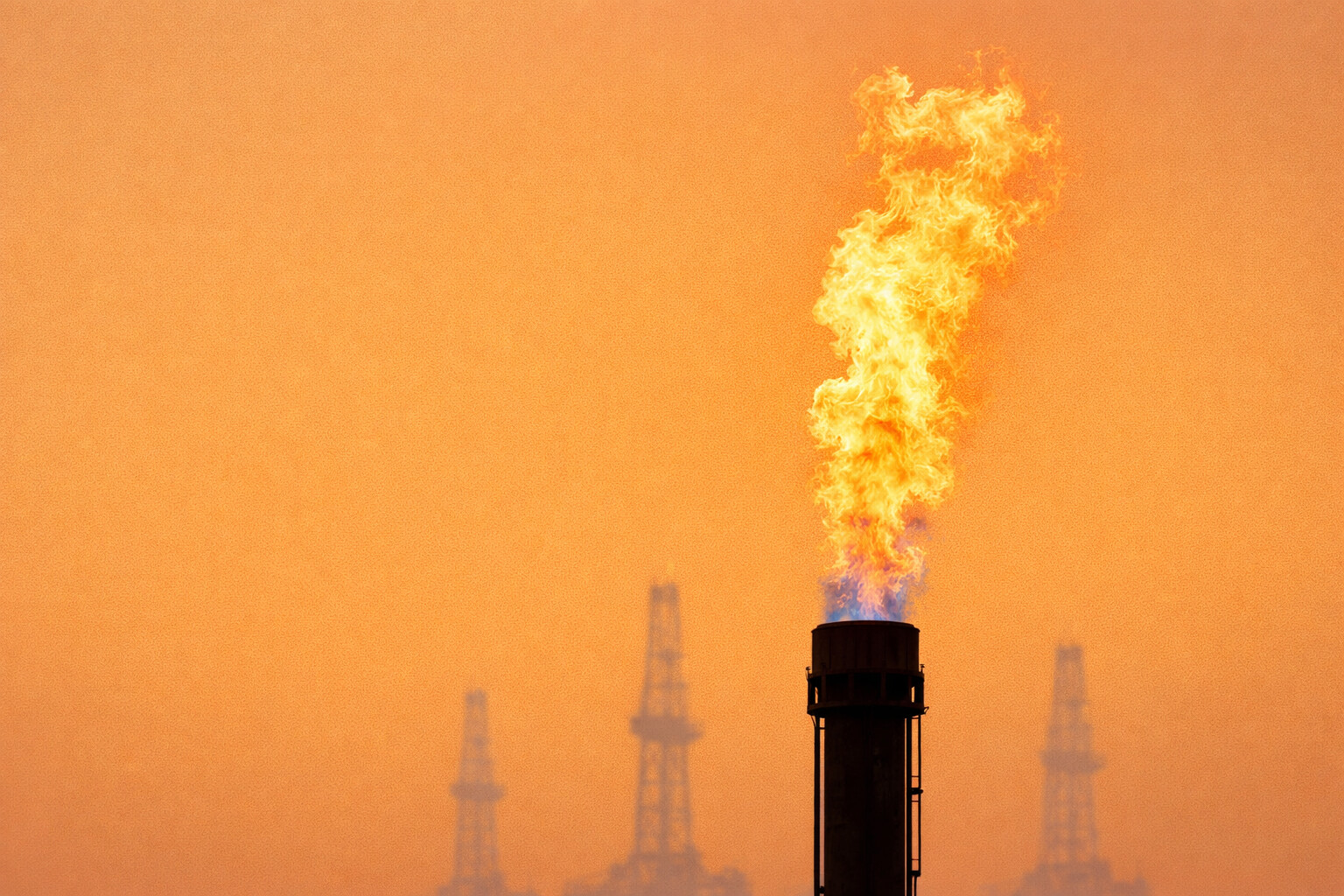

Oil Price Forecast - Oil Price Holds Near Highs: $61 WTI, $66 Brent As Storm Losses Offset Kazakh Restart

WTI CL=F and Brent BZ=F stay firm after a 2.7% weekly jump as US output outages, Trump’s “massive armada” warning on Iran and shrinking Russian fuel flows counter Tengiz and CPC recovery | That's TradingNEWS

Oil (CL=F, BZ=F) Holds Around $61–$66 As Weather Shocks And Geopolitics Tighten The Market

*Short-Term Trading Map For CL=F And BZ=F

WTI CL=F is orbiting the $60–$61 area after a roughly 2.7% weekly gain that pushed prices to the highest levels since mid-January. Front-month Brent BZ=F is pinned in the $65–$66 zone, with March futures quoted around $65.49–$65.91. Both benchmarks are trading in defined ranges: CL=F between a hard ceiling at $62 and support near $59 with a key pivot at $58.80, while BZ=F oscillates between the 50-day EMA around $63.20 and the 200-day EMA in the mid-$66s, with $65 acting as the magnet. The current pricing reflects a combination of U.S. weather-driven supply losses, tightening Russian fuel flows, an elevated Iran risk premium, and still-disciplined OPEC+ supply, all sitting on top of a macro backdrop shaped by a dovish Fed tone and resilient demand for heating and power.

WTI (CL=F) Technical Structure: $58.80 Support Versus $62 Resistance

The CL=F daily chart is locked in a tight but critical band. On the upside, $62 is the dominant resistance zone, reinforced by the 200-day EMA clustering in that area and by repeated intraday failures to hold above it. On the downside, the 50-day EMA near $59 is the short-term floor, and the prior reaction low at $58.80 is the structural support that defines the bull–bear line. Price already bounced sharply from $58.80, confirming it as the level where buyers are willing to take size with stops just below. As long as CL=F trades above $58.80, the tape favors range-trading with a mild bullish skew: dip-buyers step in below $60, profit-taking and fresh shorts emerge into $62. A sustained daily close above $62 opens a path toward $66, while a decisive break below $58.80 would expose the $55 region and flip the structure to “sell the rally” rather than “buy the dip”.

Brent (BZ=F) Technical Structure: $63.20–$66 Band With A $65 Gravity Point

For BZ=F, the price action is slightly firmer but still range-bound. March Brent is holding around $65.5–$66, with the 200-day EMA acting as a clear cap; repeated probes into that moving average have stalled, signalling that longer-term trend followers are still reluctant to chase higher. The 50-day EMA at roughly $63.20 is the main support level and has so far contained any meaningful pullback. The market keeps snapping back to the $65 area as a central pivot. A break and close above the 200-day EMA would unlock $68 and then the psychological $70 handle. Conversely, a close below $63.20 would pull the market back toward $62, indicating that supply disruptions and risk premium are no longer sufficient to hold Brent in the mid-$60s. At this stage, BZ=F is a textbook range around $65 with optionality to the upside if new shocks emerge.

*U.S. Weather Shock: Around 250,000 bpd Of Output Lost Supports CL=F

One of the main pillars under WTI CL=F is the winter storm that has swept key U.S. producing regions. Analysts estimate that roughly 250,000 barrels per day of crude production have been taken offline, with the Bakken, parts of Oklahoma, and regions in Texas all impacted. The storm has also stressed the power grid, compounding operational issues. Weekly data show overall U.S. crude production slipping by about 21,000 bpd to around 13.732 million bpd in the week ending January 16. On its own that decline is modest, but combined with field-level shut-ins it tightens near-term balances and forces refiners and traders to pay more for prompt supply. At the same time, the cold spike lifts heating and power demand, putting additional pressure on refined products and indirectly supporting crude runs. For CL=F, this combination of temporary supply loss and higher seasonal demand is exactly the kind of background that keeps the market anchored above $58–$59 instead of drifting back toward the mid-$50s.

Read More

-

Microsoft Stock Price Forecast - MSFT Slides to $473 After $555 High – AI CAPEX Super-Cycle Sets Up Rebound Toward $575–$624

26.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Below $2.00 With $1.80 Support and Fed Week on the Line

26.01.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast - Gold Smashes $5,100: Why XAU/USD Still Screens as a Buy

26.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones 49,300, S&P 500 6,945, Nasdaq 23,600 as Gold Blasts Above $5,000

26.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound tests 1.37 as Dollar slide, UK data surprise and Fed risk collide

26.01.2026 · TradingNEWS ArchiveForex

Russia’s Fuel Oil Exports: 246,000 bpd To Asia And A Tightening HSFO Market

Russian fuel oil flows are another critical piece of the bullish side of the equation. Exports of fuel oil to Asia so far this month are tracking around 246,000 bpd and are on course for a third consecutive monthly decline. This slump is driven by several overlapping factors. U.S. sanctions on major Russian firms such as Rosneft and Lukoil have increased compliance scrutiny around Russian cargoes, and Asian buyers are more reluctant to load cargoes that might be caught by restrictions or secondary sanctions. At the same time, Russian refinery crude intake fell to about 228.34 million tons in 2025, the lowest level in at least 15 years, with overall processing down around 1.7% on the year. The damage is concentrated in the second half of 2025 and early 2026, when Ukrainian drone attacks on energy infrastructure intensified. Loadings from Black Sea ports have also been disrupted by severe winter weather and drone strikes on export facilities. The result is a tighter market for high-sulfur fuel oil (HSFO) in Asia, which serves both as ship fuel and refinery feedstock. A tighter HSFO balance lifts the value of heavy barrels and, through pricing relationships, adds support under benchmarks such as BZ=F and CL=F. With Russian industry not expecting a quick rebound in runs and with limited economic incentive to push processing higher under these risks, the constraint on product exports is likely to linger through much of 2026.

Middle East Risk Premium: Iran, The “Massive Armada” And BZ=F Floor Support

Geopolitical risk around Iran is injecting a visible risk premium into both CL=F and BZ=F. The U.S. president’s statement that a “massive armada” of American warships is heading toward Iran, coupled with warnings against renewed nuclear activity and crackdowns on protests, immediately shifted the market’s perception of tail risk. Crude prices bounced as traders moved to hedge weekend and headline risk, and that move was amplified by existing short positioning built on weaker macro narratives. From an oil perspective, the concern is straightforward: any escalation that threatens the Strait of Hormuz or regional export routes will be priced well in advance of an actual disruption. Tehran has made it clear that it would view any attack as “all-out war”, reinforcing the probability that any miscalculation could have broad implications for flows. This environment makes it difficult for BZ=F to break convincingly below the low $60s, and it helps explain why CL=F has found strong buying interest around $58.80–$59. As long as the rhetoric and deployments remain in play, that geopolitical floor remains under the forward curve.

*OPEC+, Kazakhstan And Caspian Flows: Supply Cushion Limiting The Upside For CL=F And BZ=F

The bullish forces are moderated by structural and policy-driven supply that continues to act as a ceiling on rallies. In Kazakhstan, the giant Tengiz field is moving toward a resumption of production after recent problems, and the Caspian Pipeline Consortium (CPC) terminal on the Black Sea has returned to full loading capacity after maintenance on one of its moorings. A formal force majeure on some CPC Blend exports remains, and volumes are not at peak yet, but the trend is toward normalization rather than further disruption. At the policy level, OPEC+ delegates are signalling that the group is likely to maintain the current pause on output increases for March. The alliance is already holding back meaningful spare capacity, and with BZ=F trading in the mid-$60s, there is no urgent reason for producers to shift strategy. This coordinated restraint keeps a floor under prices but also caps the upside, because traders know that any aggressive spike toward or above $70 can be met with incremental barrels if needed. For CL=F and BZ=F, this means rallies into the upper end of the current ranges will invite profit-taking as long as there is visible spare capacity in the system.

Macro Backdrop: Fed Dovishness, Heating Demand And Growth Uncertainty

The macro setting is noisy but broadly supportive for oil benchmarks. A more dovish reaction function from the Fed, combined with still-solid U.S. labor data, maintains a constructive environment for risk assets, including energy. The same cold weather that is knocking out some production is boosting demand for heating and power, lifting consumption of distillates and gas-fired electricity and underpinning refinery margins. At the same time, global growth concerns, tariff threats, and political noise keep a lid on expectations for a demand surge. Traders are not pricing a new super-cycle; they are managing volatility and hedging discrete risks. This balance is visible in the broader commodity complex: natural gas is spiking with the cold snap, gold has broken sharply higher as a macro hedge, and CL=F and BZ=F have firmed but stopped well short of panic levels. In this context, oil trades less as a directional macro bet and more as a risk-adjusted instrument reacting to specific supply shocks and regional risks.

*Intraday Momentum: Trendline Support For CL=F And Range Discipline For BZ=F

On shorter time frames, CL=F shows a clear upward sloping trendline on the 1-hour chart originating from the $58.80 low. Buyers are repeatedly defending that line, using it as a reference to scale into long positions with defined risk. As long as intraday candles respect that trendline, the bias is for tests of $62 and, if geopolitical or weather headlines intensify, extension toward $66. For BZ=F, price action is consistent with a mean-reverting range trader’s market around $65: spikes toward the 200-day EMA in the mid-$66s attract selling, while dips toward $63–$64 meet demand. The order book favors fading extremes rather than chasing breakouts unless a clear new catalyst arrives. For both benchmarks, that means risk-reward currently favors buying weakness toward the lower band of the recent ranges rather than initiating new longs into resistance zones already crowded with stops and take-profit orders.

Positioning Verdict: Oil (CL=F, BZ=F) Is A Cautious Buy On Dips, Not A Momentum Chase

Aggregating the technical and fundamental picture, WTI CL=F and Brent BZ=F are in a cautious Buy stance skewed toward dip-buying, not momentum chasing. Support at $58.80 for CL=F and around $63–$64 for BZ=F is backed by tangible factors: roughly 250,000 bpd of U.S. storm-related outages, shrinking Russian fuel oil exports to Asia near 246,000 bpd, lower Russian refinery runs at about 228.34 million tons for 2025, persistent Iran-related risk around the Strait of Hormuz, and disciplined OPEC+ supply management. Offsetting those are the restoration of CPC export capacity, the expected ramp-up at Tengiz, visible spare capacity inside OPEC+, and macro uncertainties that limit the odds of an explosive demand leg higher. In this configuration, sub-$60 levels on CL=F and the low $60s on BZ=F look more like opportunities for tactical longs with tight risk than signs of structural weakness, while chasing breakouts above the 200-day EMA on either benchmark only makes sense if a fresh shock clearly tightens supply or escalates geopolitical risk beyond what is already priced.