Oil Prices Bounce Back as Middle East Tensions and U.S. Inventory Builds Influence Market

Brent and WTI crude prices rise sharply from multi-month lows driven by geopolitical conflicts, unexpected U.S. inventory increases, and strategic moves by OPEC+. Detailed analysis of the market outlook and Tullow Oil's robust financial results | That's TradingNEWS

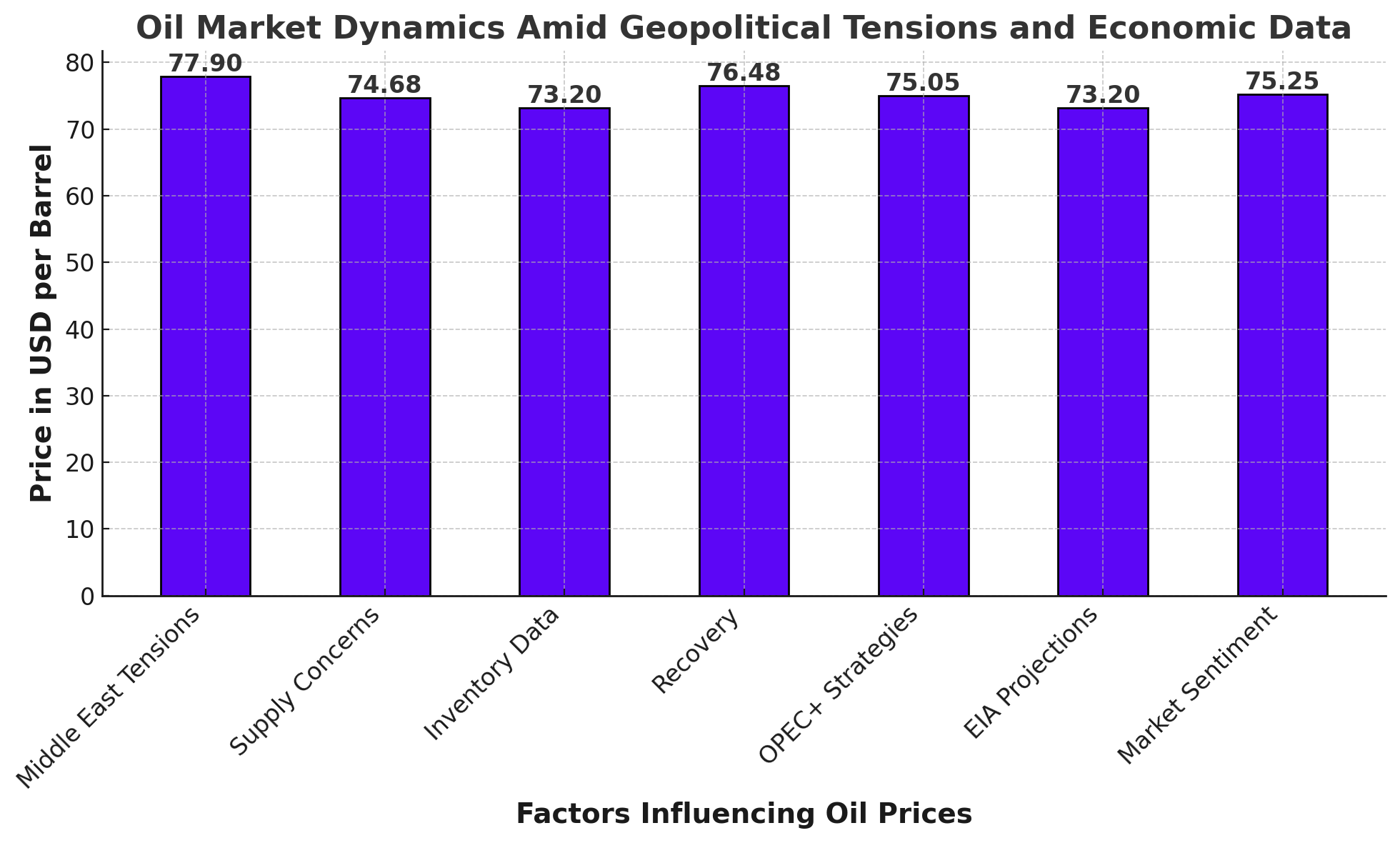

Oil Market Dynamics Amid Geopolitical Tensions and Economic Data

Middle East Tensions Impacting Oil Prices

Oil prices have been highly volatile due to escalating geopolitical tensions in the Middle East, coupled with concerns over global oil demand. On Wednesday, Brent crude futures rose by $1.42, or 1.9%, reaching $77.90 per barrel, while U.S. West Texas Intermediate (WTI) crude increased by $1.48, or 2%, to $74.68 per barrel. These gains followed a significant dip earlier in the week, where Brent futures fell to their lowest levels since January and WTI touched February lows, primarily driven by fears of a potential recession in the U.S. after weak jobs data.

Supply Concerns from the Middle East

The Middle East, a critical region for global oil supply, is bracing for potential new conflicts. The assassination of senior Hamas and Hezbollah leaders has heightened fears of broader regional instability. U.S. Secretary of State Antony Blinken emphasized the need to avoid escalating the situation, yet the risk of supply disruptions remains a significant concern. Analysts, including Daniel Hynes from ANZ, have noted that any escalation could severely impact oil supplies from the region.

Inventory Data and Market Reactions

U.S. crude oil inventories showed an unexpected build, further influencing market sentiment. Data from the American Petroleum Institute indicated an increase in U.S. crude oil and gasoline inventories, reflecting weaker demand. This bearish outlook on demand was compounded by Chinese trade data showing July daily crude oil imports falling to their lowest level since September 2022.

Recovery from Multi-Month Lows

Despite these concerns, oil prices saw a recovery on Tuesday as financial markets stabilized. Brent crude futures closed at $76.48 per barrel, up by 0.2%, and WTI settled at $73.20 per barrel, rising 0.4%. This rebound was partly due to Iran's threats of retaliation against Israel and the U.S., raising fears of further supply disruptions. Additionally, Libya's National Oil Corp announced production cuts at the Sharara oilfield, exacerbating supply worries.

OPEC+ Strategies and Market Supply

OPEC+ faces significant challenges in sustaining oil prices above $75 per barrel. Despite agreements to gradually increase supply, market realities have led to lower prices, with Brent crude recently falling to $75.05 per barrel. Non-OPEC production, especially from the Americas, is rapidly increasing, meeting the growth in global oil consumption. As the Northern Hemisphere's summer ends, oil demand is expected to decline seasonally, potentially leading to oversupply and further price pressure.

EIA Projections and U.S. Market Sentiment

The U.S. Energy Information Administration (EIA) has projected a decrease in global oil inventories by 400,000 barrels per day (bpd) in the first half of 2024 and 800,000 bpd in the second half. Despite these projections, recession fears in the U.S. continue to dampen market sentiment. The American Petroleum Institute reported a 180,000 barrel increase in U.S. crude oil inventories, suggesting cooling demand as the summer travel season ends.

Recent Developments and Future Outlook

U.S. crude oil futures showed a significant rebound on Wednesday, with the Dow Jones Industrial Average rising over 400 points and the S&P 500 gaining 1.5%. West Texas Intermediate for September delivery increased by $2.05, or 2.8%, to $75.25 per barrel, while Brent for October delivery rose by $1.94, or 2.54%, to $78.42 per barrel. These gains reflect a recovery from recent lows, supported by ongoing OPEC+ production cuts and geopolitical tensions.

Tullow Oil's Financial Performance

Independent producer Tullow Oil reported a more than doubled profit after tax for the first half of 2024, reaching $196 million compared to $70 million in the same period of 2023. The company, focused on projects in and offshore Africa, saw a reduction in capital expenditure (capex) to $157 million from $187 million the previous year. Tullow Oil expects significant free cash flow in the second half of 2024, maintaining a full-year guidance of $200 million to $300 million at $80 per barrel oil price.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex