Geopolitical Tensions and Oil Prices

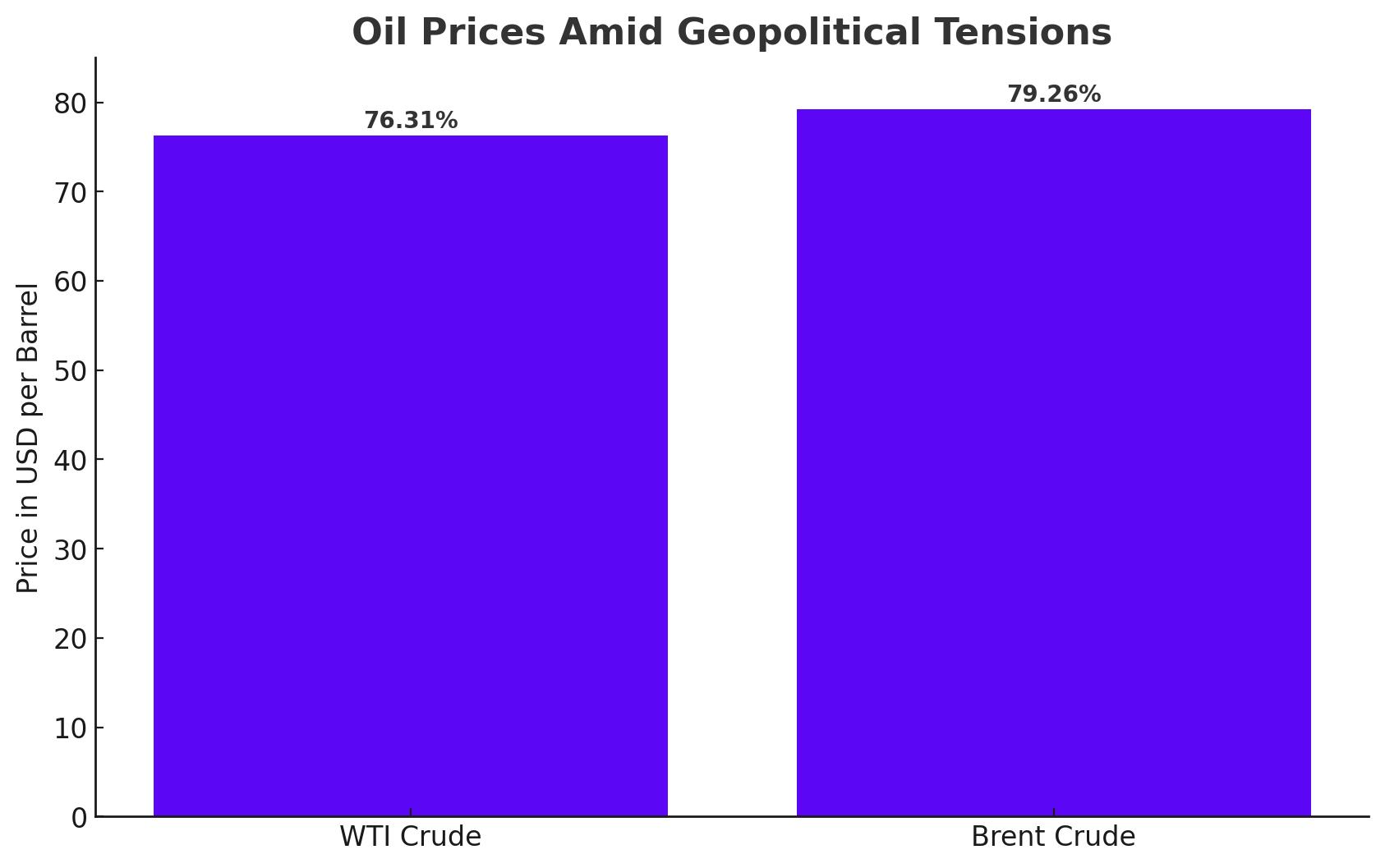

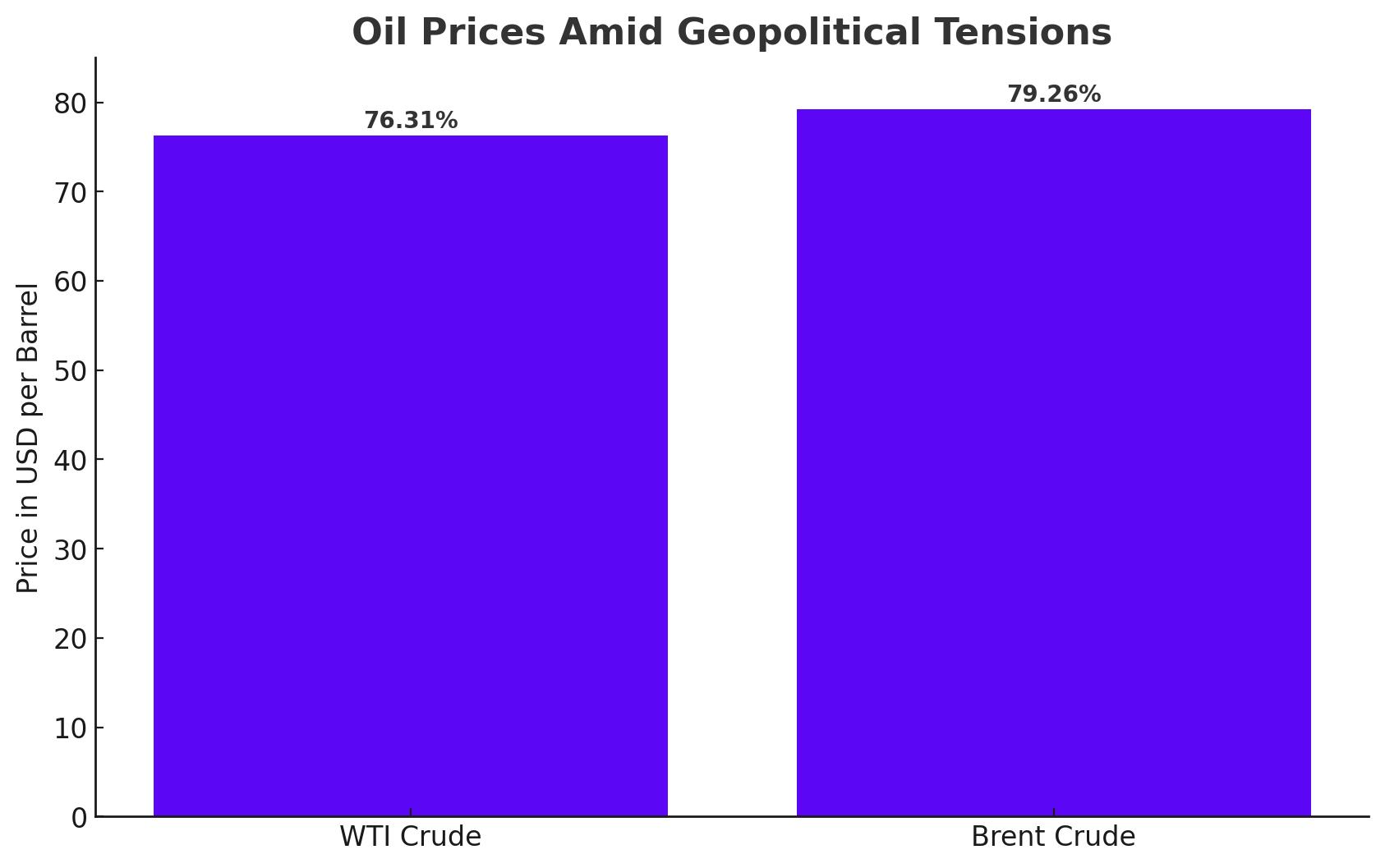

The oil market witnessed significant volatility this week, with prices surging due to escalating geopolitical tensions and tightening supply concerns. West Texas Intermediate (WTI) crude and Brent crude both saw substantial price increases, reflecting the complexities of the current global oil landscape. Specifically, WTI crude prices rose to $76.31 per barrel, up by 0.93%, while Brent crude reached $79.26 per barrel, marking a 0.84% increase. These gains are closely tied to the evolving geopolitical risks and supply disruptions that are reshaping the market dynamics.

Escalation in the Middle East: Impact on Oil Supply

The recent assassination of key figures within Hamas and Hezbollah has sent shockwaves through the Middle East, raising the specter of Iranian retaliation against Israel. This situation has significantly heightened fears of supply disruptions from one of the world’s most critical oil-producing regions. The Middle East, which accounts for a substantial portion of global oil production, is now on high alert, with markets anxiously monitoring the situation. The potential for conflict to escalate further is a key driver behind the recent surge in oil prices, with Brent crude nearing the $80 per barrel mark as traders brace for possible interruptions in the flow of crude oil from the region.

Libya's Sharara Oilfield Shutdown

Adding to the supply-side pressures, Libya’s National Oil Corporation has declared force majeure at its Sharara oilfield, effectively ceasing production. The Sharara oilfield, one of Libya's largest, has a production capacity of 300,000 barrels per day, making it a critical asset not just for Libya but for global oil supplies. The shutdown was triggered by ongoing protests, which have further tightened the supply in an already constrained market. This unexpected halt in production has compounded concerns over global supply, contributing to the upward trajectory of oil prices. The situation in Libya serves as a stark reminder of the vulnerabilities in the global oil supply chain, where local disruptions can have far-reaching impacts.

U.S. Inventory Data: Indicators of Strong Demand

In the United States, the latest data from the Energy Information Administration (EIA) revealed a significant drawdown in crude oil inventories, with stocks falling by 3.7 million barrels. This decline far surpassed market expectations and is a clear signal of strong demand within the U.S. market. The reduction in inventories suggests that, despite broader economic concerns, the demand for oil in the U.S. remains robust, likely driven by resilient consumer activity and industrial use. This strong demand, coupled with the tightening supply from geopolitical tensions and local disruptions like the Libyan oilfield shutdown, is a major factor supporting the recent surge in oil prices. As the U.S. continues to demonstrate economic resilience, the pressure on oil supply chains is likely to keep prices elevated in the near term.

Market Reaction and Price Movements

Market Reaction and Price Movements

In the most recent trading sessions, the oil market has experienced notable price increases, reflecting the complex interplay of geopolitical tensions, supply disruptions, and demand dynamics. West Texas Intermediate (WTI) crude oil prices increased by 0.93%, reaching $76.31 per barrel, while Brent crude oil prices rose by 0.84% to $79.26 per barrel. These price movements underscore the market's heightened sensitivity to ongoing developments, particularly in the Middle East, where the potential for conflict-induced supply disruptions has become a significant concern. The surge in prices is a direct response to these risks, as traders factor in the possibility of constrained supply amidst steady or rising demand.The price gains in both WTI and Brent crude also reflect the broader economic environment, where positive indicators such as lower unemployment claims in the U.S. have provided some relief from recession fears. This economic resilience, coupled with expectations of potential monetary easing by the Federal Reserve, has bolstered market confidence, further supporting the upward trajectory of oil prices. Brent crude’s approach to the $80 per barrel mark is particularly telling of the market’s bullish sentiment, despite underlying risks that could introduce volatility in the near term.

Economic Indicators and Federal Reserve Signals

through the lens of recent U.S. economic data and signals from the Federal Reserve. The latest data revealed a larger-than-expected drop in unemployment claims, which has helped to alleviate some concerns about an impending recession. Specifically, unemployment claims fell by 17,000, bringing the total to 233,000, a figure that suggests a strengthening labor market. This positive economic indicator has, in turn, supported demand for oil, as a more robust economy typically leads to higher energy consumption.

Additionally, growing speculation that the Federal Reserve may soon cut interest rates has added another layer of complexity to the oil market. A rate cut would likely weaken the U.S. dollar, making oil cheaper for foreign buyers and potentially increasing global demand. The correlation between a weaker dollar and higher oil prices is well-documented, and in this context, the U.S. dollar index fell slightly by 0.07% to 103.14, reflecting the market’s anticipation of possible monetary easing. If the Fed does proceed with a rate cut, it could provide further upward momentum for oil prices, particularly as the cost of crude becomes more attractive to international buyers.

Analysis: What Lies Ahead for Oil Prices?

Looking ahead, the oil market is poised at a critical juncture, with several factors likely to influence price movements in the coming weeks. The situation in the Middle East remains the most immediate and unpredictable variable. Any further escalation in the region, particularly if it impacts key oil-producing areas, could trigger a sharp rise in prices. Traders are closely monitoring developments, aware that the geopolitical risks could easily tip the balance towards tighter supply and higher prices.

At the same time, the economic outlook in the U.S. and potential actions by the Federal Reserve will be crucial in shaping demand. If the Fed cuts interest rates, it could stimulate economic activity and energy consumption, thereby sustaining or even increasing the current levels of oil demand. Such a scenario would likely support continued price gains, especially if coupled with ongoing supply constraints from geopolitical events or disruptions like the recent shutdown of Libya's Sharara oilfield.

However, the market is also aware of the potential downside risks. Should economic data begin to falter, or if the Federal Reserve takes a more cautious approach, the momentum behind oil prices could weaken. Moreover, any unexpected resolution or de-escalation of tensions in the Middle East could lead to a rapid decline in prices, as the risk premium currently built into the market would dissipate.

Conclusion

The oil market is navigating a period of significant uncertainty, with prices being driven by a combination of geopolitical tensions, economic indicators, and monetary policy expectations. The recent gains in WTI and Brent crude highlight the market’s current bullish sentiment, but this is tempered by the understanding that volatility remains a real possibility. With Brent crude nearing $80 per barrel and WTI holding above $76 per barrel, the outlook for oil prices in the short term appears positive, though heavily contingent on developments in key areas.

Investors should maintain a close watch on the evolving geopolitical landscape, particularly in the Middle East, as well as on signals from the Federal Reserve regarding interest rate cuts. These factors will be critical in determining whether the current upward trend in oil prices can be sustained or if the market will face renewed pressure. As it stands, the balance of risks and rewards suggests that oil prices may continue to rise, but with significant caution warranted given the potential for rapid changes in the underlying drivers of the market.