Oil Prices Fall: Strategic Buying Opportunity Amid U.S. Economic Fears

Despite recent drops in oil prices due to U.S. economic concerns, market conditions present a strategic buying opportunity | That's TradingNEWS

U.S. Economic Fears and Oil Market Sentiment

Impact of Weak Payrolls Report on Oil Prices

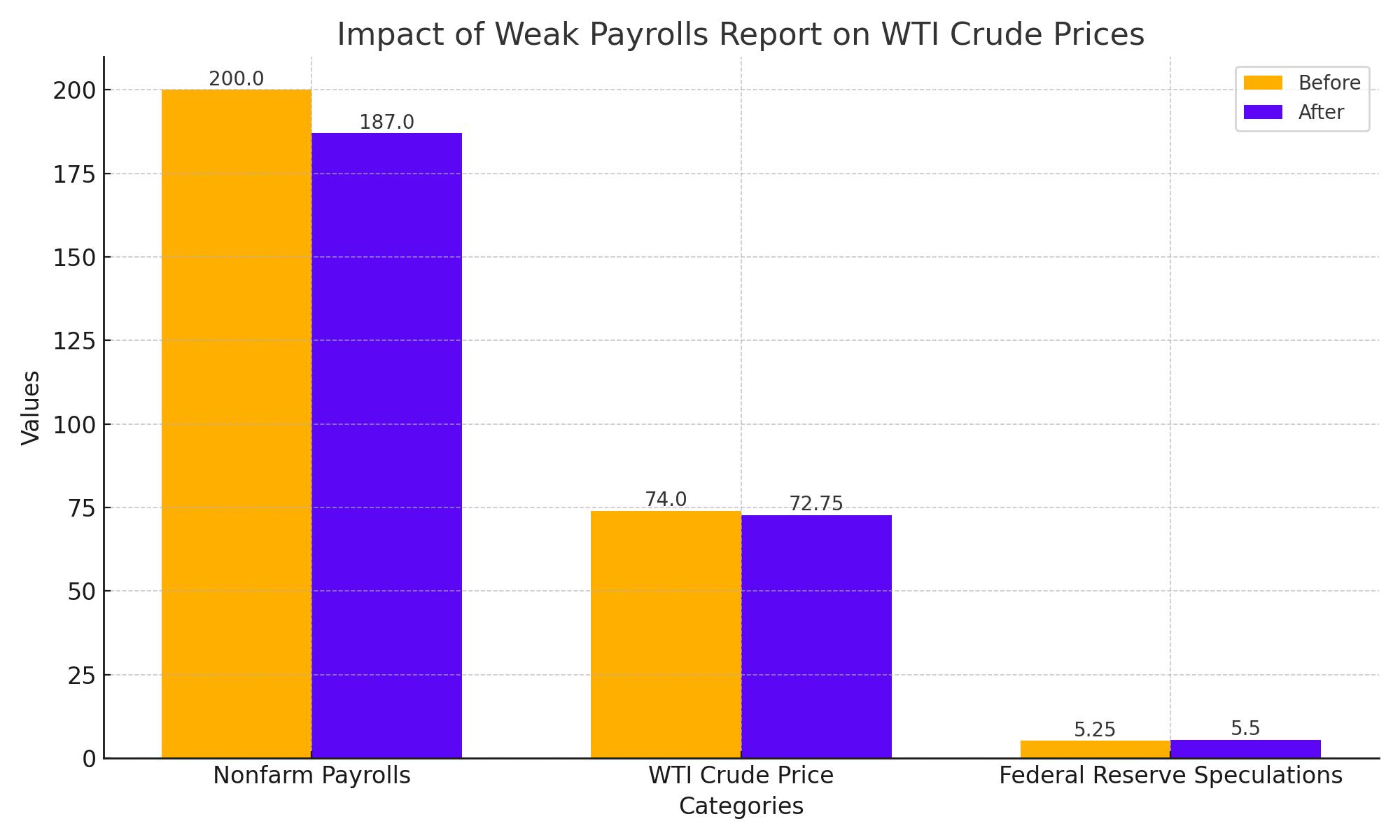

The U.S. economy plays a pivotal role in global oil markets, and recent economic data has added to the volatility. The weak July payrolls report, which showed fewer jobs added than expected, has intensified fears of a looming recession. Nonfarm payrolls increased by just 187,000 jobs in July, significantly below the market forecast of 200,000, indicating a potential slowdown in economic activity. This disappointing jobs data has prompted investors to reassess their positions in risk assets, including oil.

Decline in WTI Crude Prices

As a direct consequence of these economic fears, West Texas Intermediate (WTI) crude prices have plummeted. On Monday, WTI crude fell by 1.1%, reaching $72.75 per barrel, its lowest level since January. This decline is part of a broader trend driven by the market's anxiety over the U.S. economic outlook. The oil market, highly sensitive to economic indicators, has reacted strongly to the possibility of reduced industrial activity and consumer demand, both of which are closely tied to employment rates.

Federal Reserve's Response to Economic Challenges

The broader market sentiment is also influenced by expectations regarding the U.S. Federal Reserve's monetary policy. In response to the weakening economic data, there is growing speculation that the Federal Reserve might need to implement rapid interest rate cuts to stimulate growth. The Fed's recent decision to raise interest rates to a range of 5.25% to 5.50% was intended to combat inflation, but the focus is now shifting towards supporting economic growth. Market participants are increasingly betting on rate cuts as early as the first quarter of 2025, which would be aimed at averting a deeper economic downturn.

Broader Market Impact and Investor Sentiment

The economic uncertainty has had a cascading effect on investor sentiment across various asset classes. Equities have seen significant sell-offs, with major indices reflecting investor trepidation. The S&P 500, for instance, has experienced a decline of over 2% in the past week, mirroring the cautious stance adopted by investors. Similarly, the Dow Jones Industrial Average has dropped by approximately 1.8%, while the tech-heavy Nasdaq Composite has fallen by 2.5%.

Commodity Market Dynamics

The bearish sentiment extends to the commodity markets, where oil, in particular, has been hard hit. The interplay between economic indicators and oil prices is evident, with the demand outlook being a major driver. The U.S., being the world's largest oil consumer, significantly impacts global oil demand. A slowdown in the U.S. economy signals reduced industrial activity and lower fuel consumption, contributing to the downward pressure on oil prices.

Anticipation of Future Market Movements

Looking ahead, the market is keenly watching for further economic indicators that might provide clarity on the trajectory of the U.S. economy. Upcoming data releases, such as consumer spending reports, industrial production figures, and further employment statistics, will be critical in shaping market expectations. Additionally, any statements or policy adjustments from the Federal Reserve will be closely scrutinized.

Why Oil (WTI) Is a Buy Amid U.S. Economic Fears

The recent decline in oil prices, with West Texas Intermediate (WTI) dropping to $72.75 per barrel, reflects heightened fears of a U.S. recession following a weaker-than-expected July payrolls report. This economic uncertainty has led investors to flee risk assets, causing a sharp drop in oil prices. However, this downturn presents a strategic buying opportunity for several reasons.

First, the Federal Reserve's potential rapid interest rate cuts to stimulate economic growth could boost industrial activity and fuel demand. Historically, lower interest rates spur economic activity, leading to increased oil consumption. Furthermore, the U.S. remains the world's largest oil consumer, and any economic recovery will significantly impact global oil demand positively.

Second, despite the current market sentiment, geopolitical risks and supply constraints continue to support oil prices. For example, disruptions in Libya's largest oil field and ongoing tensions in the Middle East can limit oil supply, providing a floor for prices. Investors can capitalize on these dynamics, anticipating a rebound in oil prices as supply issues persist.

Strategic Implications for Investors

For investors, the current economic landscape presents both challenges and opportunities. The sharp decline in oil prices could be seen as a buying opportunity, particularly if they believe that the economic slowdown will be short-lived and that demand will rebound. Conversely, the continued economic uncertainty and potential for further declines might prompt a more cautious approach, emphasizing risk management and portfolio diversification.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex