Oil Prices on Edge: OPEC+ Cuts, Stockpile Surprises, and War Threats

WTI and Brent face turbulence as supply cuts, political turmoil, and U.S. policies spark dramatic market swings | That's TradingNEWS

Crude Oil Prices Under Pressure Amid Mixed Market Forces

The current state of the oil market reflects a volatile mix of geopolitical tensions, shifting OPEC+ strategies, and economic uncertainty. WTI crude (CL=F) hovers around $68.64, while Brent crude (BZ=F) trades at $72.33, both showing signs of indecision among traders. Price movements have been influenced by multiple key developments, including OPEC+ decisions, geopolitical risks in the Middle East, and mixed signals from U.S. economic data.

OPEC+ Strategic Decisions Shape the Supply Outlook

The OPEC+ coalition recently opted for a cautious three-month delay in its production normalization schedule, extending the cut timeline to April 2025. This decision follows internal deliberations and reflects the group’s anticipation of stricter sanctions on Iran and Venezuela under President-elect Donald Trump. While the delay supports tighter supply conditions, the market viewed the decision as underwhelming compared to a more bullish six-month extension previously rumored. The move signals OPEC+’s intention to maintain a balanced market without overly constraining output, yet it lacks the decisiveness to drive a significant price rally.

Geopolitical Tensions Escalate with Middle East Risks

The Middle East remains a focal point of market instability. President-elect Trump’s ultimatum to Hamas to release Israeli hostages or face U.S.-led military action has heightened tensions. Any escalation could disrupt key oil supply routes in the region, particularly through the Strait of Hormuz, which handles nearly 20% of global oil shipments. Traders are pricing in the potential for supply disruptions, yet the lack of immediate action has kept prices from spiking.

U.S. Stockpile Data Confirms Mixed Signals

The U.S. Energy Information Administration (EIA) reported a surprising drawdown of 5.073 million barrels in crude oil stockpiles, contrasting with the 1.232 million-barrel build reported earlier by the American Petroleum Institute (API). This discrepancy underscores the market’s sensitivity to inventory data as a barometer for supply-demand dynamics. Despite the drawdown, oil prices remain under pressure, reflecting broader concerns about demand resilience as global economic growth moderates.

Macroeconomic Factors Influence Oil Market Sentiment

The U.S. Dollar Index (DXY) has remained relatively stable ahead of key economic data, including the December Nonfarm Payrolls report. A stronger dollar, buoyed by hawkish Federal Reserve rhetoric, could dampen oil prices by making crude more expensive for non-dollar holders. Federal Reserve Chair Jerome Powell’s comments on unsustainable U.S. debt levels and the possibility of a December rate hike have added to market caution.

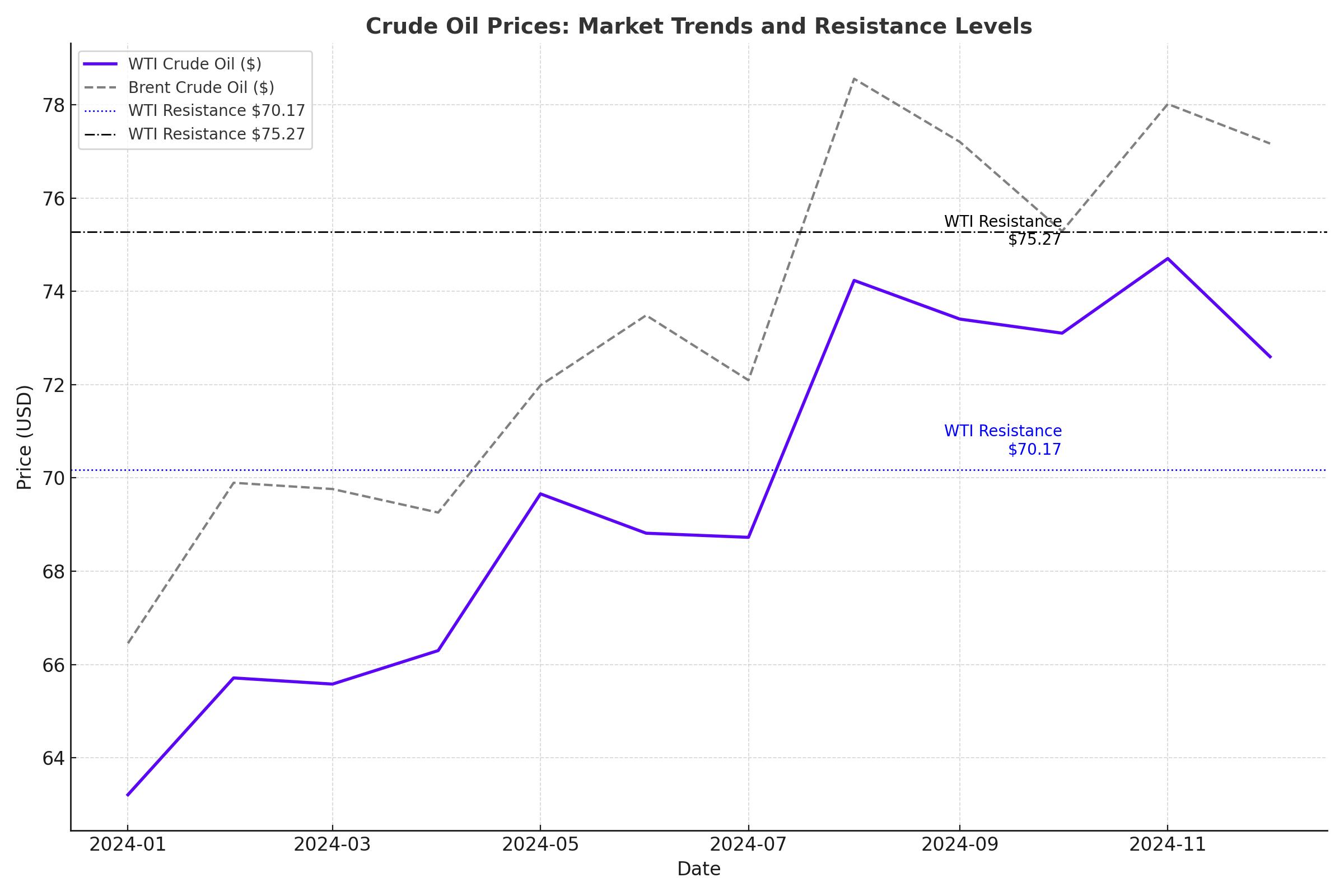

Oil Price Technical Analysis Highlights Key Resistance Levels

From a technical standpoint, WTI crude faces significant resistance near $70.17, the 55-day Simple Moving Average (SMA). Additional barriers exist at $71.65 (100-day SMA) and $75.27, representing pivotal topside levels. On the downside, critical support is seen at $67.12, followed by the 2024 year-to-date low of $64.75. A break below these levels could open the door for further declines, particularly if bearish macroeconomic or geopolitical developments emerge.

Sustainability and Decarbonization Drive Long-Term Industry Shifts

The oil and gas sector is entering a new investment cycle, emphasizing sustainability alongside financial performance. Companies are increasingly integrating decarbonization strategies into their operations, with emissions-reduction targets and carbon pricing becoming standard components of project evaluations. This transition aligns with broader market and regulatory expectations, yet it also adds cost pressures that could influence future production strategies.

Market Dynamics Ahead of Trump Administration Policies

The incoming Trump administration is expected to roll back several regulatory constraints on the U.S. oil and gas industry, potentially accelerating domestic production growth. However, Trump’s aggressive stance on pushing shale producers to ramp up output risks oversaturating the market, particularly if global demand fails to keep pace. Industry leaders like Exxon Mobil have expressed skepticism about the feasibility of such rapid production increases, emphasizing the need for economic viability.

Merger and Acquisition Activity Reflects Industry Resilience

The U.S. oilfield services sector is undergoing significant consolidation, with $19.7 billion in deals recorded in the first nine months of 2024 alone. This trend reflects efforts to streamline operations and achieve economies of scale amid evolving market dynamics. Recent high-profile mergers between Shell and Equinor in the UK North Sea further underscore the industry’s focus on optimizing resources and maintaining energy security.

Price Forecasts Suggest Range-Bound Trading with Upside Risks

Analysts remain divided on the future trajectory of oil prices. A recent survey of bankers anticipates WTI prices could drop to $58.62 per barrel by 2027, driven by moderating demand and rising U.S. production. In contrast, more bullish projections suggest a potential recovery toward $75.27 if geopolitical tensions intensify or OPEC+ adopts a more aggressive supply strategy. Meanwhile, sustained price volatility presents opportunities for strategic investors.

Conclusion

The oil market’s future hinges on a delicate interplay of geopolitical developments, OPEC+ actions, and macroeconomic trends. While near-term prices remain under pressure, structural shifts in the industry and potential policy changes under the Trump administration could reshape the landscape. For now, traders and investors must navigate a volatile environment with equal parts caution and opportunism.

That's TradingNEWS

Read More

-

JEPQ ETF Price: 10% Nasdaq Yield From Volatility – But At What Cost?

15.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF XRPI and XRPR: Pricing the Next Big Move with XRP Around $1.46

15.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: NG=F Tests $3.24 as Tight Storage Clashes With Mild Weather

15.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: From 157 Peak to 152 Support as BoJ Hawk Turn Threatens Carry Trade

15.02.2026 · TradingNEWS ArchiveForex