Oil Prices Plunge to Seven-Month Low as OPEC+ Increases Production and China’s Economy Slows

WTI and Brent crude face significant declines as OPEC+ prepares to boost output, while concerns over China's economic slowdown and global demand weigh on the market | That's TradingNEWS

Oil Market Volatility and Price Dynamics

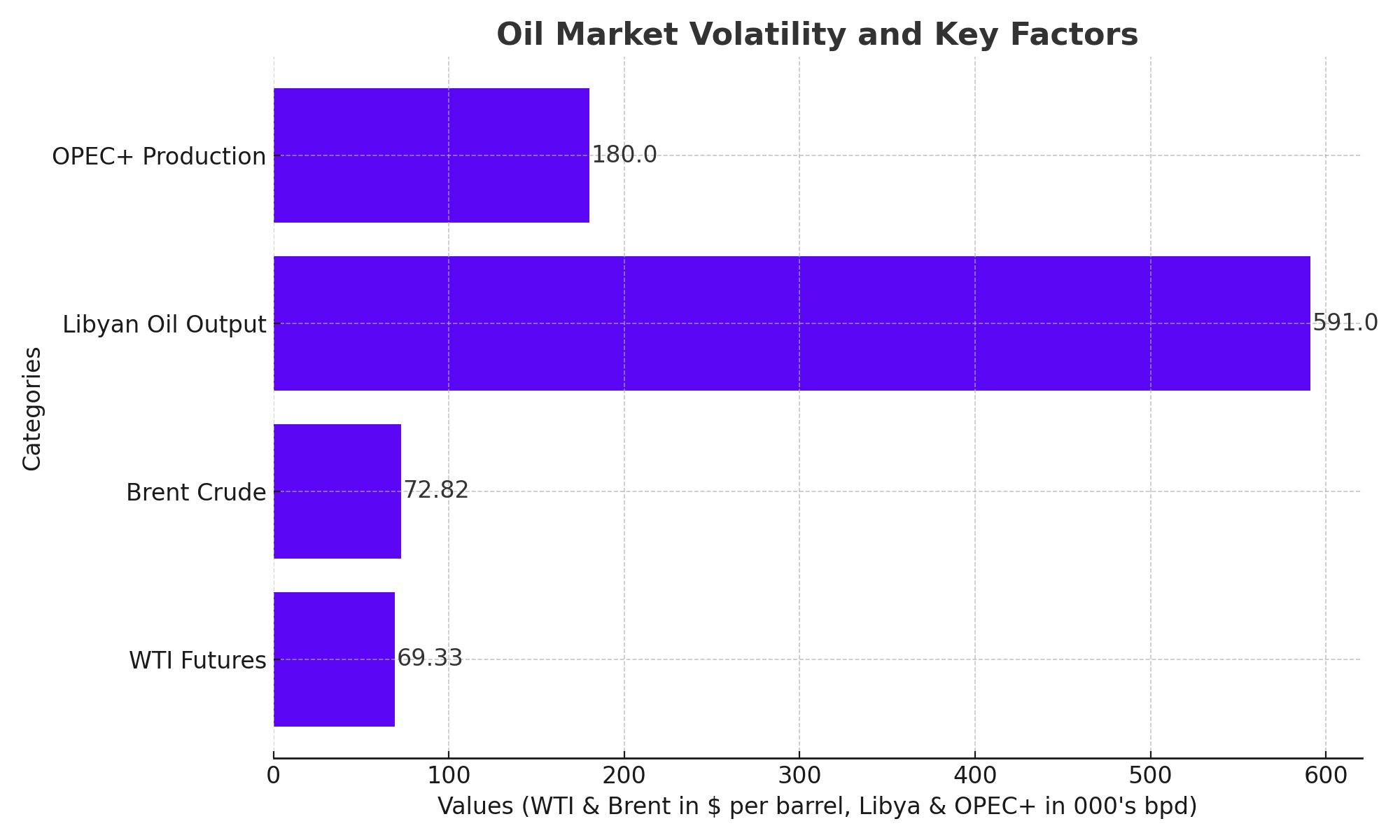

Crude oil prices have recently faced significant volatility, driven by a complex interplay of global economic factors, production adjustments by OPEC+, and geopolitical developments. As of the latest trading sessions, West Texas Intermediate (WTI) for October delivery settled at $70.97 per barrel, marking a 3.48% drop, while Brent crude for November delivery fell to $74.42 per barrel, a 4% decline. These price movements have erased year-to-date gains, with WTI and Brent crude down 1% and 3.47%, respectively.

Impact of OPEC+ Production Adjustments

One of the primary drivers of the recent decline in oil prices is the anticipation of increased production from OPEC+ members. The group, which includes some of the world’s largest oil producers, is expected to boost output by 180,000 barrels per day (bpd) in October, despite concerns about weakening demand, particularly from China. This planned increase in production comes at a time when the global oil market is already grappling with oversupply fears, further pressuring prices.

OPEC+ has indicated that it may reverse this decision if market conditions deteriorate further. However, as of now, the plan appears to be moving forward. Analysts, including those from Panmure Liberum, have pointed out that many OPEC+ members require higher oil prices to balance their budgets, making the current price levels unsustainable in the long term without intervention.

China's Economic Slowdown and Global Demand Concerns

China, the world’s largest importer of crude oil, has reported a significant slowdown in its manufacturing sector, which fell to a six-month low in August. This decline has raised alarms about the potential impact on global oil demand. The weak performance of China’s economy has been compounded by a downward revision in its GDP growth forecast by Bank of America, which now expects China's economy to grow by 4.8% in 2024, down from an earlier estimate of 5%.

This slowdown in China, coupled with softer-than-expected manufacturing activity in the United States, has added to the bearish sentiment in the oil market. The U.S. Institute for Supply Management reported weaker-than-expected manufacturing activity in the country, further fueling concerns about global demand for oil.

Geopolitical Tensions and Libyan Production Disruptions

Geopolitical factors have also played a significant role in recent oil price movements. In Libya, ongoing political turmoil has led to significant disruptions in oil production. The National Oil Corporation (NOC) declared force majeure at the El-Feel oil field, reducing the country’s output to just over 591,000 bpd from nearly 1.28 million bpd in July. Despite these disruptions, news reports have suggested that a resolution to the conflict may be imminent, which could lead to a resumption of Libyan oil exports and further weigh on global oil prices.

The market’s response to the potential return of Libyan supply has been swift, with Brent crude futures dropping to their lowest levels since December 2023. Analysts from UBS, including Giovanni Staunovo, have noted that the sell-off was triggered by reports of progress in resolving the Libyan dispute, highlighting the sensitivity of oil prices to geopolitical developments.

Market Sentiment and Technical Analysis

The broader market sentiment around oil remains cautious, with many investors and analysts keeping a close eye on key technical levels. For WTI, the $71.00 per barrel mark is seen as a critical support level, while Brent crude is testing support at $74.44 per barrel. Should these levels fail to hold, further declines could be on the horizon, with potential support seen around $68 for WTI and $70 for Brent.

The recent price movements have also been accompanied by declining volumes, indicating a lack of strong buying interest from institutional investors. This suggests that the market may be waiting for clearer signals before making any decisive moves.

Natural Gas and RBOB Gasoline Trends

In addition to crude oil, other energy commodities have also experienced declines. RBOB Gasoline futures for October fell by 4.21% to $2 per gallon, reflecting broader concerns about fuel demand in light of economic slowdowns in key markets. Meanwhile, Natural Gas futures for October settled at $2.09 per thousand cubic feet, down 1.55%, continuing a broader downward trend that has seen natural gas prices decline by 16.7% year-to-date.

Outlook for the Oil Market

Looking ahead, the oil market faces a challenging environment characterized by a confluence of factors, including the potential for increased OPEC+ supply, economic slowdowns in major markets like China and the U.S., and ongoing geopolitical risks. Analysts will be closely monitoring developments in Libya, the finalization of OPEC+ production plans, and upcoming economic data from the U.S. and China, which could provide further direction for oil prices.

Investors should remain vigilant, as the current market dynamics suggest continued volatility. With WTI and Brent crude trading near critical support levels, any significant shifts in supply or demand could trigger sharp price movements. As always, staying informed and responsive to market developments will be crucial for navigating the complexities of the global oil market.

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex