Ongoing Volatility in the Oil Market: Will OPEC+ React to Tumbling Prices?

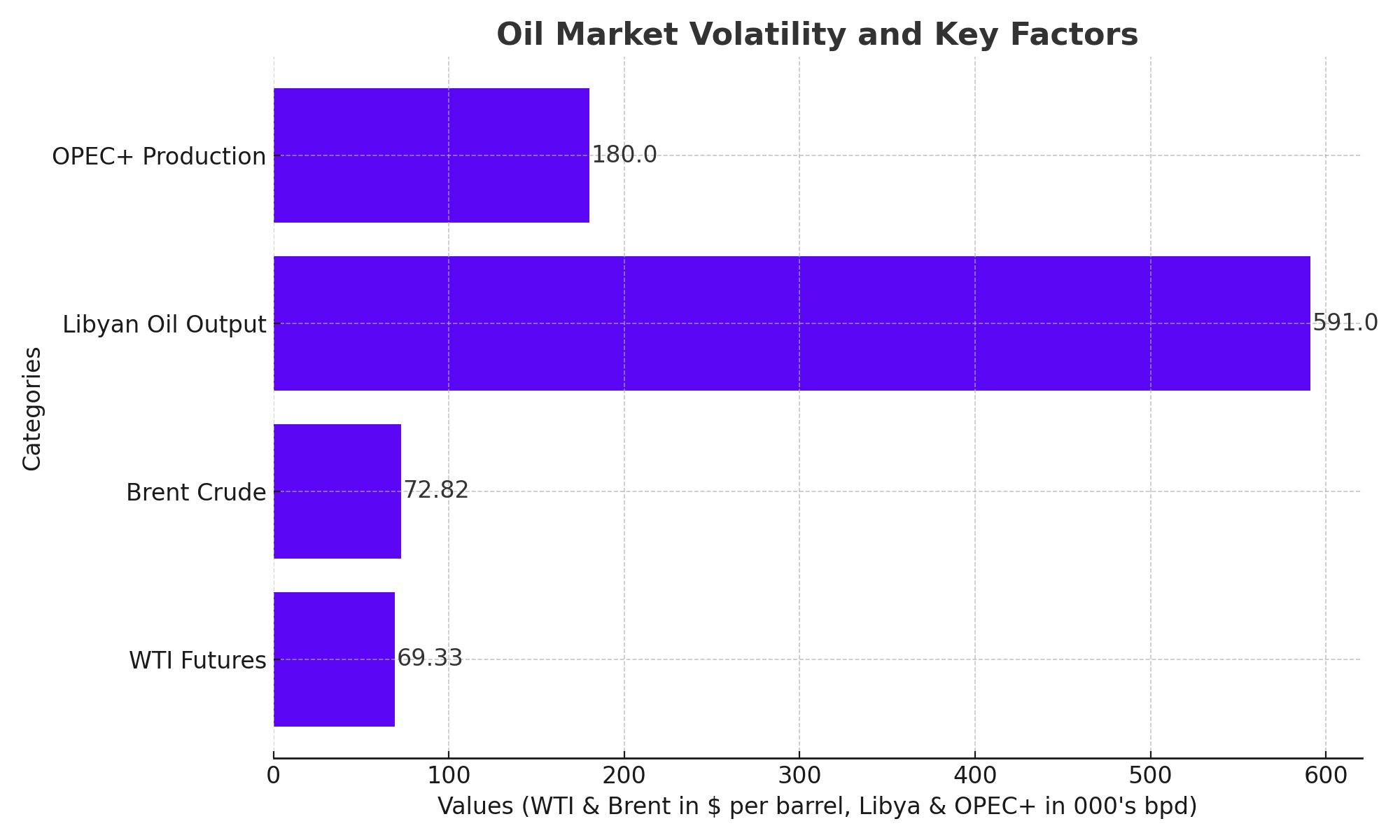

Oil markets have experienced significant volatility this week, with both West Texas Intermediate (WTI) and Brent crude hitting fresh lows. WTI futures dipped below the critical $70 per barrel mark, closing at $69.33 per barrel, while Brent saw a decline to $72.82. The falling prices have raised concerns about OPEC+ production policies, economic slowdowns, and potential recovery scenarios.

Impact of OPEC+ Plans and Libyan Output Uncertainty

As oil prices slide, market attention is turning to OPEC+, which had previously planned to increase output by 180,000 barrels per day (bpd) starting in October. However, the steep decline in prices, coupled with ongoing economic challenges in China and the U.S., has led to speculation that OPEC+ may reconsider this decision.

A potential factor influencing OPEC+ strategies is the expected resolution of Libya's oil production disputes. The North African nation, which saw output plummet from 1.28 million bpd to just over 591,000 bpd in late August, is reportedly nearing an agreement that could restore significant volumes of crude to the market. This resolution would add supply at a time when global demand appears uncertain, particularly given China’s weaker-than-expected manufacturing performance.

UBS strategist Giovanni Staunovo highlighted, “The market reaction to these supply stories shows how weak sentiment in the oil market is currently. There’s a risk that prices could fall further if OPEC+ doesn’t step in to support.”

Weak Global Economic Data Weighing on Oil Demand

Another significant pressure point for oil prices is the slowdown in major economies. Both U.S. and China—the world's largest oil consumers—have reported disappointing economic data. In the U.S., the Institute for Supply Management (ISM) reported that manufacturing activity remained subdued, with the Purchasing Managers' Index (PMI) for August coming in below expectations at 47.2, signaling contraction. Similarly, China’s factory output hit a six-month low in August, reflecting continued weakness in demand.

These economic signals have further fueled fears of a global slowdown, weakening oil demand forecasts. As RBC Capital Markets’ Helima Croft stated, “The China story has been the big headwind for oil this year. Lower Chinese imports and refinery utilization have kept a lid on any price recovery.”

Bearish Momentum Persists as Oil Breaks Key Support Levels

From a technical perspective, oil has broken several key support levels, raising alarms for traders. WTI futures dipped to $69.33, marking a 3.1% decline year-to-date, while Brent dropped to $72.82, down 5.4% for the year. The bearish momentum suggests continued downward pressure unless OPEC+ announces a reversal of its production increase plans or other supply disruptions emerge.

According to Chris Weston, Head of Research at Pepperstone, “Crude literally can’t find a friend in this market. Buyers have simply walked away, and the probability of getting a fill at lower levels is increasing.”

The market remains highly reactive to any signs of further economic deterioration or supply increases. Analysts at Citi warn that if OPEC+ does not reassure the market about extending current output cuts, oil prices could drop even further, risking a break below the $70 per barrel threshold for WTI.

The Role of Geopolitical Factors in Oil’s Future

Adding complexity to the situation are ongoing geopolitical tensions, particularly in the Red Sea region. Yemen’s Houthi rebels recently targeted an oil tanker with drones and missiles, heightening concerns about supply security in a key global shipping route. While the attack did not result in significant damage, it serves as a reminder of the volatility that geopolitics can inject into the oil market.

Furthermore, with the U.S. Federal Reserve expected to announce its interest rate decision later this month, markets remain on edge. A decision to maintain or raise rates could dampen global demand further, as higher borrowing costs would likely slow economic activity.

Market Forecast: Short-Term Pain, Long-Term Recovery?

While the immediate outlook for oil remains bearish, some analysts maintain that prices could recover in the medium term. UBS predicts that Brent could recover to $80 per barrel by the end of the year, driven by tighter supply conditions and an eventual rebound in demand.

“We think the market is overly pessimistic,” said Staunovo. “Inventories have been declining since May, and there’s still a fundamental undersupply in the market that could drive prices higher once demand recovers.”

In the long term, Saudi Arabia’s Vision 2030, which seeks to diversify the country’s economy away from oil, will still depend heavily on oil revenues in the near term. As Croft of RBC noted, “This is not an optimal price for OPEC members. They will likely act to ensure that prices don’t fall much further.”

Conclusion: Uncertainty Dominates the Oil Landscape

As oil prices continue to face pressure, the global market remains in a state of flux. Key factors such as OPEC+ production decisions, potential Libyan output, and global economic trends will play a crucial role in determining the future direction of oil prices. For now, bearish momentum persists, but the possibility of a recovery in the coming months cannot be ruled out.

Investors should closely monitor economic data and OPEC+ announcements, as any shifts could create opportunities or risks in the volatile energy market.